Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Fiscal Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

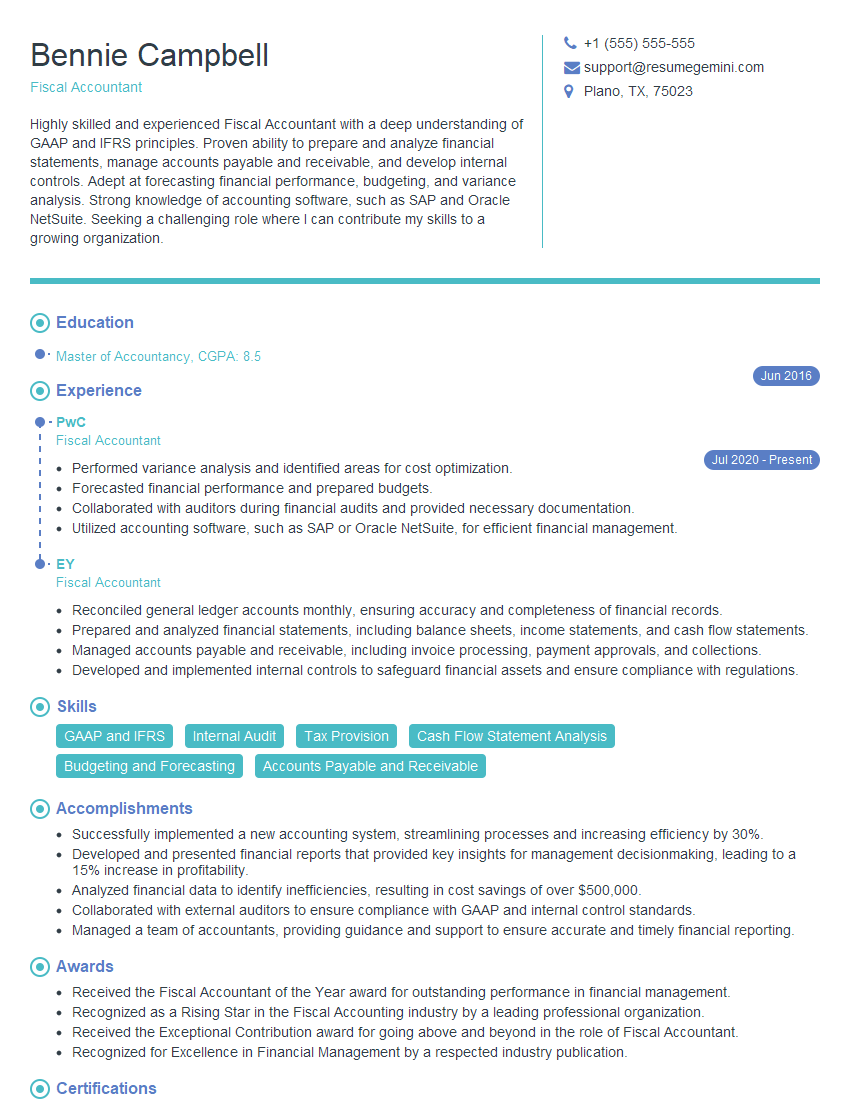

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fiscal Accountant

1. What are your key responsibilities as a Fiscal Accountant?

- Preparing and analyzing financial statements (e.g. balance sheet, income statement, cash flow statement)

- Maintaining accounting records and ledgers

- Ensuring compliance with tax laws and regulations

- Preparing and submitting tax returns

- Managing cash flow and working capital

- Providing financial advice to management

2. Describe your experience in GAAP and/or IFRS compliance.

Technical compliance

- Prepared financial statements in accordance with GAAP and IFRS

- Reviewed and analyzed financial statements for compliance with GAAP and IFRS

- Advised clients on the impact of GAAP and IFRS on their financial reporting

Implementation

- Assisted clients in implementing GAAP and IFRS

- Developed and implemented policies and procedures for GAAP and IFRS compliance

- Trained staff on GAAP and IFRS

3. How do you handle complex accounting transactions, such as mergers and acquisitions?

- Analyze the transaction to determine its accounting impact

- Prepare the necessary journal entries to record the transaction

- Disclose the transaction in the financial statements in accordance with GAAP and IFRS

- Work with other departments, such as legal and tax, to ensure that the transaction is handled properly

4. What experience do you have with tax planning and optimization?

- Advised clients on tax planning strategies

- Prepared tax returns for individuals and businesses

- Represented clients in tax audits

- Stayed up-to-date on tax laws and regulations

5. How do you stay up-to-date on the latest accounting and tax regulations?

- Read industry publications and attend conferences

- Take continuing education courses

- Network with other accountants and tax professionals

- Stay informed of changes in tax laws and regulations

6. What is your experience with accounting software?

- Proficient in [specific accounting software]

- Used [specific accounting software] to perform a variety of accounting tasks

- Implemented [specific accounting software] for clients

- Trained staff on [specific accounting software]

7. What is your experience with data analysis and reporting?

- Used data analysis techniques to identify trends and patterns in financial data

- Created reports to communicate financial information to management

- Used data visualization tools to present financial data in a clear and concise manner

8. What is your experience with internal control?

- Assessed the internal control systems of clients

- Made recommendations to clients on how to improve their internal control systems

- Implemented internal control systems for clients

- Trained staff on internal control systems

9. What is your experience with budgeting and forecasting?

- Prepared budgets and forecasts for clients

- Analyzed financial data to identify trends and patterns

- Made recommendations to clients on how to improve their budgeting and forecasting processes

10. What is your experience with financial modeling?

- Developed financial models for clients

- Used financial models to evaluate investment opportunities

- Used financial models to forecast financial performance

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fiscal Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fiscal Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Fiscal Accountant, you will be responsible for maintaining and improving the organization’s fiscal health and financial reporting systems. Your core responsibilities will include:

1. Financial Reporting and Analysis

Prepare and maintain financial statements, including balance sheets, income statements, and cash flow statements.

- Analyze financial data to identify trends, risks, and opportunities.

- Provide insights and recommendations to management based on financial analysis.

2. Tax Compliance

Calculate and file tax returns, including income taxes, sales taxes, and payroll taxes.

- Stay up-to-date on tax laws and regulations.

- Work with external auditors and tax professionals as needed.

3. Budgeting and Forecasting

Develop and implement budgets and forecasts.

- Monitor actual results against budgets and forecasts.

- Make recommendations for budget adjustments as needed.

4. Internal Controls

Develop and implement internal controls to ensure the accuracy and reliability of financial reporting.

- Monitor internal controls and make recommendations for improvements.

- Work with external auditors to ensure compliance with internal controls.

Interview Tips

Preparing for a Fiscal Accountant interview requires thorough knowledge of the role and its responsibilities. Here are some tips to help you ace the interview:

1. Research the Company and the Role

Before the interview, take the time to research the company, its industry, and the specific role you are applying for. This will give you a good understanding of the company’s financial situation, its goals, and the challenges it faces. It will also help you tailor your answers to the interviewer’s questions.

- Visit the company’s website and read its financial statements.

- Look up news articles and press releases about the company.

- Learn about the specific industry in which the company operates.

2. Practice Your Technical Skills

Fiscal Accountants are expected to have strong technical skills in accounting, finance, and taxation. Be prepared to answer questions about your experience with financial reporting, budgeting, forecasting, and tax compliance. You should also be able to discuss your knowledge of accounting software and internal controls.

- Review your accounting and finance textbooks.

- Take online courses or attend workshops to refresh your skills.

- Practice answering common interview questions about your technical skills.

3. Behavioral Interview Questions

In addition to technical questions, you will also be asked behavioral interview questions. These questions are designed to assess your soft skills, such as your communication, teamwork, and problem-solving abilities. When answering behavioral interview questions, use the STAR method to provide specific examples of how you have used these skills in the past.

- Situation: Describe the situation you were in.

- Task: Explain the task you were responsible for.

- Action: Describe the actions you took to complete the task.

- Result: Explain the results of your actions.

4. Be Enthusiastic and Professional

First impressions matter, so be sure to arrive on time for your interview and dress professionally. Be enthusiastic and positive throughout the interview, and maintain eye contact with the interviewer. Thank the interviewer for their time at the end of the interview, and follow up with a thank-you email within 24 hours.

- Prepare questions to ask the interviewer about the company and the role.

- Be prepared to talk about your salary expectations.

- Follow up with the interviewer within 24 hours to thank them for their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fiscal Accountant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!