Are you gearing up for a career in Fiscal Analyst? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Fiscal Analyst and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

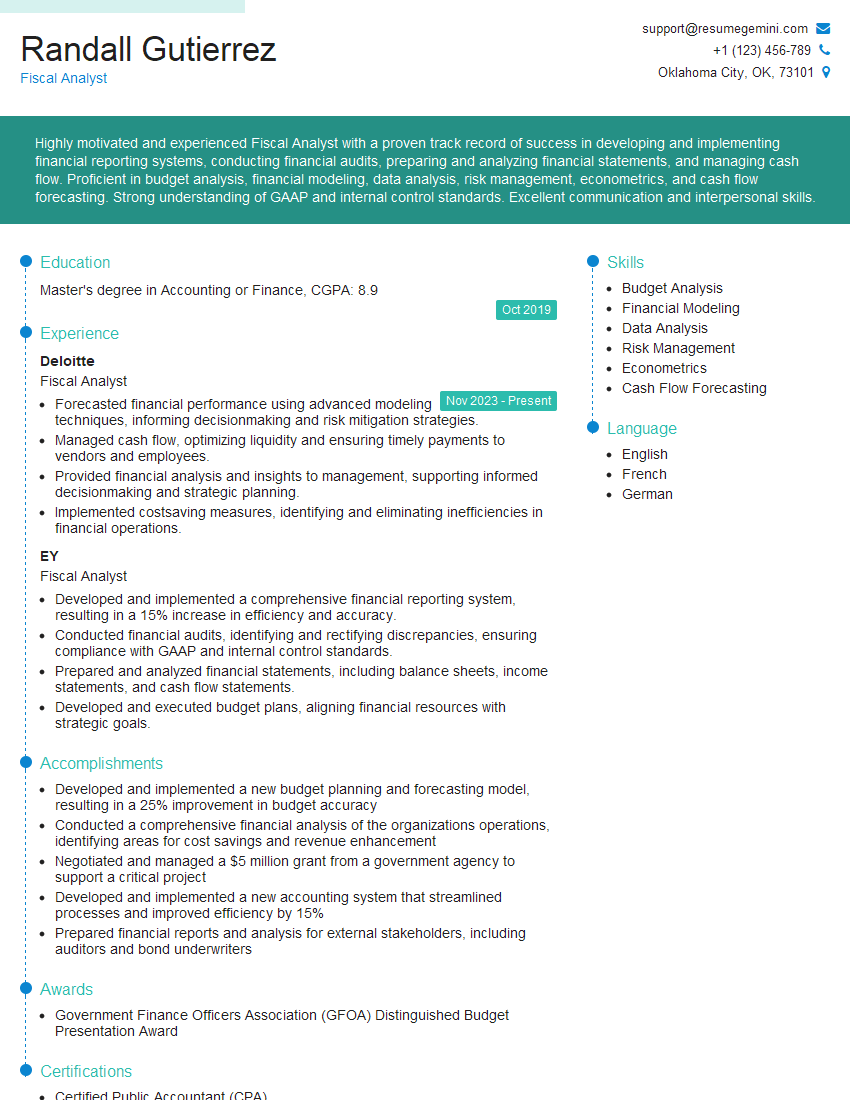

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fiscal Analyst

1. Define cost-benefit analysis, and explain its importance in decision making.

Cost-benefit analysis is a technique used to compare the costs and benefits of alternative courses of action. It is important in decision making because it allows us to objectively evaluate the potential outcomes of different options and make informed decisions.

- To identify the most cost-effective option.

- To justify the costs of a project or investment.

- To compare different projects or investments.

2. Describe the role of a Fiscal Analyst in the budgeting process.

Budget Formulation

- Assist in developing and analyzing budget proposals.

- Conduct cost-benefit analyses of potential budget initiatives.

- Forecast revenue and expenditures.

Budget Execution

- Monitor and track budget performance.

- Identify and resolve budget variances.

- Prepare budget reports and analyses.

3. How do you stay up-to-date on changes in tax laws and regulations?

I stay up-to-date on changes in tax laws and regulations by:

- Reading industry publications and attending conferences

- Taking continuing education courses

- Networking with other professionals in the field

- Monitoring government websites and databases

4. What accounting principles and standards are most relevant to the work of a Fiscal Analyst?

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

- Government Accounting Standards Board (GASB) Statements

5. What are the key differences between accrual and cash basis accounting?

- Accrual basis accounting recognizes revenue when it is earned and expenses when they are incurred, regardless of when cash is received or paid.

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid.

6. What are the implications of using different depreciation methods for a capital asset?

- The choice of depreciation method will affect the pattern of depreciation expenses, which in turn will affect the company’s taxable income and cash flow.

- Some common depreciation methods include the straight-line method, the double-declining balance method, and the sum-of-the-years’-digits method.

7. What are the main types of financial ratios?

- Liquidity ratios measure a company’s ability to meet its short-term obligations.

- Solvency ratios measure a company’s ability to meet its long-term obligations.

- Profitability ratios measure a company’s overall profitability.

- Efficiency ratios measure a company’s efficiency in using its assets.

8. How do you use financial models to forecast and analyze financial performance?

- Financial models are used to forecast and analyze financial performance by using mathematical and statistical techniques to simulate the behavior of a company’s financial statements.

- Financial models can be used to evaluate the impact of different scenarios on a company’s financial performance, such as changes in revenue, expenses, or tax rates.

9. What are some of the ethical challenges that Fiscal Analysts may face?

- Maintaining confidentiality of sensitive financial information.

- Avoiding conflicts of interest.

- Acting with integrity and objectivity.

10. How do you stay organized and manage your workload as a Fiscal Analyst?

- Use a to-do list or task management system to track your tasks.

- Prioritize your tasks based on their importance and urgency.

- Delegate tasks to others when possible.

- Take breaks throughout the day to avoid burnout.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fiscal Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fiscal Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Fiscal Analyst plays a crucial role in an organization’s financial management and planning process. Their responsibilities encompass a wide range of tasks that ensure the accuracy and reliability of financial data for decision-making and compliance.

1. Financial Planning and Budgeting

Fiscal Analysts are responsible for developing and monitoring the organization’s financial plans and budgets. They analyze historical data, project future revenues and expenses, and allocate resources accordingly to optimize financial performance.

- Create and update financial models and projections

- Identify and assess potential financial risks and opportunities

2. Financial Reporting and Analysis

Fiscal Analysts prepare and analyze financial statements, including income statements, balance sheets, and cash flow statements. They interpret financial data to provide insights into the organization’s financial health, profitability, and operational efficiency.

- Compile and analyze financial data from various sources

- Identify trends and patterns in financial performance

3. Forecasting and Sensitivity Analysis

Fiscal Analysts conduct forecasting and sensitivity analysis to assess the impact of different scenarios on the organization’s financial position. They use statistical and econometric models to predict future financial outcomes and develop contingency plans.

- Prepare financial projections based on assumptions and historical data

- Evaluate the impact of external factors on financial performance

4. Compliance and Risk Management

Fiscal Analysts ensure that the organization’s financial operations comply with legal and regulatory requirements. They identify and mitigate financial risks, such as fraud, embezzlement, and non-compliance with accounting standards.

- Implement and enforce financial controls

- Conduct internal audits and risk assessments

Interview Tips

Preparing for a Fiscal Analyst interview requires a deep understanding of the job responsibilities and the key skills and qualifications needed to excel in the role. Here are some tips and hacks to help candidates ace their interviews:

1. Research the Organization and Position

Thoroughly research the organization’s financial performance, industry trends, and the specific role you are applying for. This demonstrates your interest and preparedness for the interview.

- Review the company’s financial statements and annual reports

- Identify the organization’s financial strengths and weaknesses

2. Highlight Your Analytical and Modeling Skills

Fiscal Analysts rely heavily on analytical and modeling skills. Showcase your proficiency in financial modeling, data analysis, and forecasting techniques.

- Provide examples of financial models you have developed and used

- Discuss how you have used data analysis to identify financial trends and insights

3. Showcase Your Understanding of Financial Reporting and Compliance

Demonstrate your knowledge of GAAP (Generally Accepted Accounting Principles) and other relevant accounting standards. Highlight your experience in preparing and analyzing financial statements.

- Explain your understanding of the key financial statement components

- Discuss your experience with internal control and risk management practices

4. Practice Case Studies and Technical Questions

Interviewers often use case studies and technical questions to assess a candidate’s financial acumen. Prepare for these questions by practicing financial analysis and modeling exercises.

- Solve hypothetical financial case studies that test your analytical skills

- Review common technical questions related to accounting, finance, and financial modeling

5. Prepare Behavioral Interview Questions

Behavioral interview questions focus on your past experiences and how you have applied your skills in real-world situations. Prepare for questions related to teamwork, problem-solving, and ethical decision-making.

- Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions

- Highlight your ability to work independently and as part of a team

6. Be Confident and Enthusiastic

Confidence and enthusiasm are key traits for a successful Fiscal Analyst. Express your passion for finance and your desire to contribute to the organization’s financial success.

- Maintain eye contact and speak with conviction

- Convey your eagerness to learn and grow in the role

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fiscal Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!