Are you gearing up for an interview for a Fiscal Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Fiscal Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

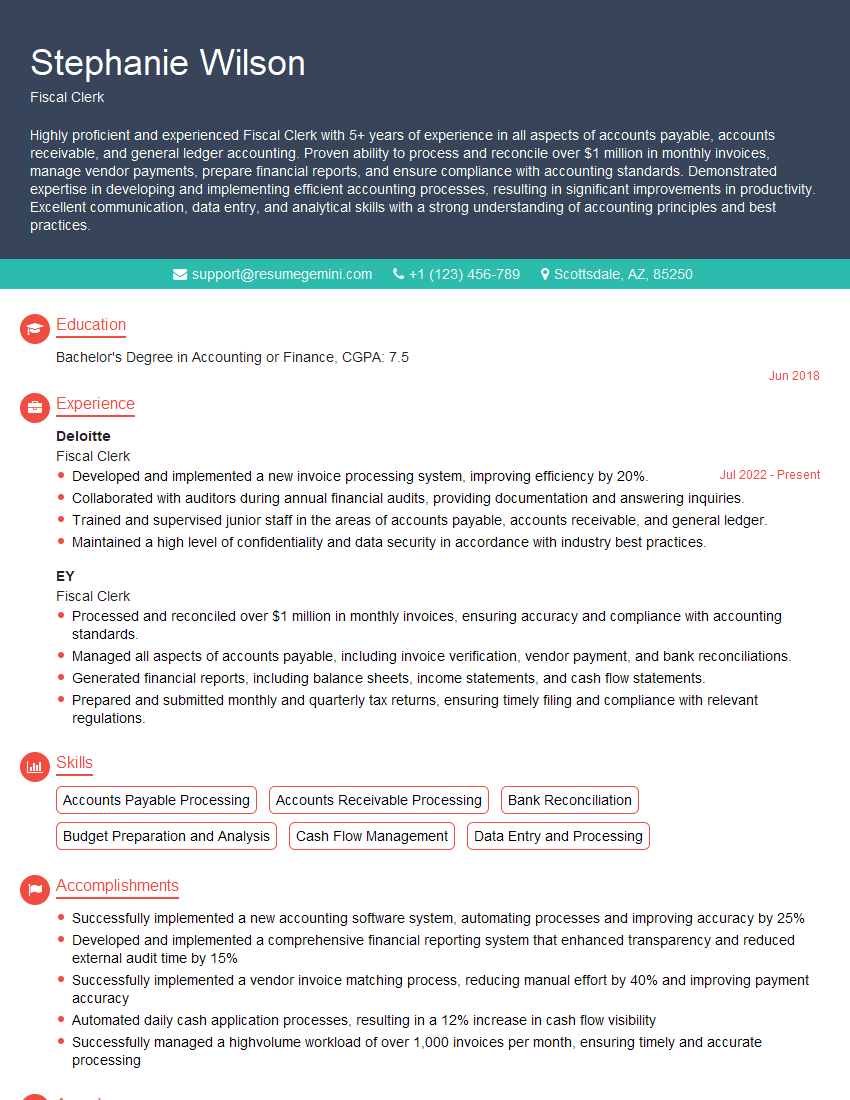

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fiscal Clerk

1. What are the primary duties and responsibilities of a Fiscal Clerk?

As a Fiscal Clerk, my primary responsibilities would involve:

- Processing and reconciling financial transactions, including accounts payable, accounts receivable, and cash management.

- Maintaining accounting records, such as general ledgers, journals, and trial balances.

- Preparing financial reports, including profit and loss statements, balance sheets, and cash flow statements.

- Performing audits and ensuring compliance with financial regulations.

- Providing assistance with budgeting and forecasting.

2. How would you handle a situation where you discover an error in a financial transaction?

Verifying the Error

- Cross-check the transaction against source documents and supporting evidence.

- Review the accounting records for any related errors or inconsistencies.

Reporting and Correcting the Error

- Notify the appropriate supervisor or manager immediately.

- Document the error and the steps taken to verify it.

- Make the necessary corrections to the accounting records and financial transactions.

- Follow up with the relevant parties to ensure the error is resolved.

3. What is your experience with using accounting software, such as QuickBooks or SAP?

I am proficient in using both QuickBooks and SAP. In my previous role, I utilized QuickBooks for accounts payable, accounts receivable, and general ledger management. I am also familiar with SAP’s financial modules, including FI, CO, and MM.

4. How do you ensure the accuracy and integrity of financial data?

- Adhering to established accounting principles and guidelines.

- Regularly reconciling accounts and transactions.

- Performing internal audits and reviews.

- Maintaining a system of checks and balances.

- Seeking independent verification of financial data when necessary.

5. What are the key ethical principles that guide your work as a Fiscal Clerk?

- Integrity and honesty in all financial transactions.

- Confidentiality and discretion in handling sensitive financial information.

- Objectivity and impartiality in decision-making.

- Compliance with all applicable laws and regulations.

- Respect for and cooperation with colleagues and clients.

6. How do you stay up-to-date with changes in accounting regulations and best practices?

- Attending industry conferences and webinars.

- Reading professional journals and publications.

- Participating in continuing education courses.

- Actively seeking feedback and guidance from supervisors and peers.

- Utilizing online resources and databases.

7. What is your understanding of internal controls?

Internal controls are a system of policies and procedures designed to prevent fraud, ensure the accuracy of financial data, and promote efficient operations. They include:

- Segregation of duties.

- Establishment of authorization limits.

- Regular audits and reviews.

- Physical security measures.

- Disaster recovery plans.

8. How do you prioritize and manage multiple tasks effectively?

- Using a task management system or to-do list.

- Setting priorities based on urgency and importance.

- Delegating tasks to others when appropriate.

- Breaking down large tasks into smaller, manageable steps.

- Seeking assistance from colleagues or supervisors when needed.

9. What is your experience with preparing financial reports for external stakeholders?

In my previous role, I was responsible for preparing monthly financial statements for submission to our bank and investors. These reports included the balance sheet, income statement, and cash flow statement. I ensured that the reports were accurate, complete, and in compliance with GAAP.

10. How do you handle working in a fast-paced and high-volume environment?

I am comfortable working in fast-paced environments and managing a high volume of transactions. I am organized and efficient, and I can prioritize my tasks effectively. I also have excellent time management skills and am able to meet deadlines under pressure.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fiscal Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fiscal Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Processing Financial Transactions

Fiscal Clerks are responsible for handling various financial transactions, ensuring their accuracy and timely processing:

- Process accounts payable and receivable transactions, including invoices, purchase orders, and credit memos

- Reconcile bank statements, identifying and resolving discrepancies

- Handle petty cash and make necessary disbursements

2. Maintaining Financial Records

Maintaining accurate financial records is crucial to ensure the integrity of the organization’s financial operations:

- Maintain general ledger accounts, recording financial transactions and updating balances

- Prepare and file financial reports, such as balance sheets and income statements

- Prepare and distribute purchase orders and invoices

3. Providing Customer Service

Fiscal Clerks often interact with customers and other stakeholders, providing excellent customer service:

- Answer inquiries related to billing, payments, and other financial matters

- Resolve customer issues related to financial transactions

- Maintain professional and courteous demeanor in all interactions

4. Complying with Regulations

Fiscal Clerks must adhere to various financial regulations and standards:

- Ensure compliance with Generally Accepted Accounting Principles (GAAP)

- Follow established policies and procedures to maintain financial integrity

- Maintain confidentiality and follow data security protocols

Interview Tips

1. Research the Company and Position

Before the interview, thoroughly research the company, its industry, and the specific Fiscal Clerk position. This demonstrates your interest and understanding of the role.

2. Quantify Your Experience

When discussing your experience, quantify your accomplishments whenever possible using specific numbers and metrics. This helps the interviewer understand the impact of your work.

3. Highlight Your Attention to Detail

Fiscal Clerks need to be meticulous and detail-oriented. Emphasize your strong attention to detail and ability to handle complex financial transactions accurately.

4. Show Your Customer Service Skills

Customer service is often an integral part of the Fiscal Clerk role. Describe your experience resolving customer inquiries and providing excellent customer service.

5. Prepare for Common Interview Questions

Preparation is key. Research common interview questions for Fiscal Clerks and practice your answers. This will help you feel more confident and prepared during the interview.

Here are some common questions you may encounter:

- Tell me about your experience in processing financial transactions.

- How do you ensure the accuracy and integrity of financial records?

- Describe a time when you had to resolve a customer issue related to a financial matter.

- Explain how you stay up-to-date with accounting principles and regulations.

- Why are you interested in this Fiscal Clerk position specifically?

6. Ask Thoughtful Questions

At the end of the interview, ask thoughtful questions to show your interest and knowledge of the role. For example, you could ask about the company’s financial strategy or the challenges and opportunities facing the Fiscal Clerk department.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fiscal Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!