Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Fiscal Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

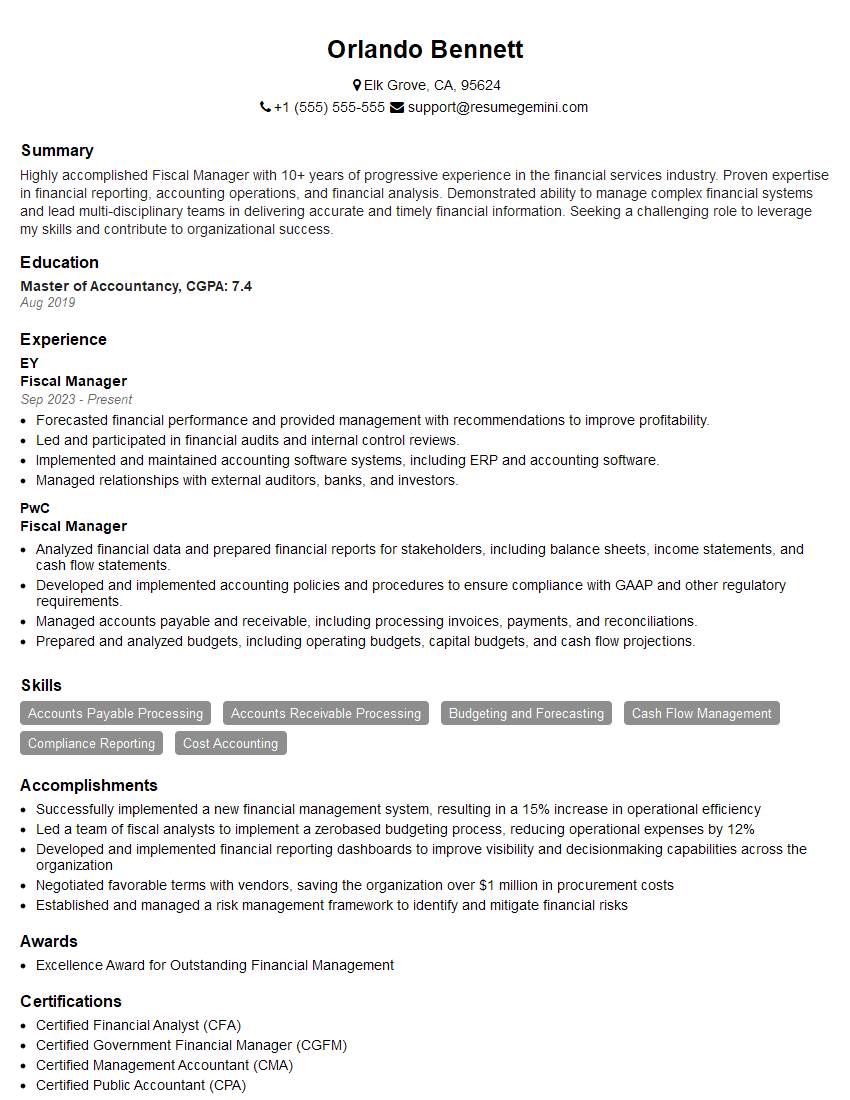

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fiscal Manager

1. Describe the key responsibilities of a fiscal manager in a healthcare organization?

* Overseeing and managing the organization’s financial operations, including budgeting, accounting, and financial reporting. * Developing and implementing financial policies and procedures to ensure compliance with regulatory requirements and internal controls. * Preparing and analyzing financial statements and reports to provide insights into the organization’s financial performance and position. * Forecasting financial trends and developing financial plans to support the organization’s strategic goals. * Managing cash flow and ensuring the organization’s financial stability. * Working closely with other departments to ensure that financial information is integrated into decision-making processes.

2. Explain the importance of financial planning in healthcare management?

Role of Financial Planning

- Ensures the organization meets its financial obligations.

- Allocates resources to meet strategic goals and priorities.

- Helps anticipate and mitigate financial risks.

- Supports informed decision-making by providing financial projections and analysis.

Key Elements of Financial Planning

- Budgeting

- Forecasting

- Risk management

- Investment analysis

3. How do you ensure the accuracy and reliability of financial data in a healthcare setting?

* Establish and enforce strong internal controls and accounting procedures. * Implement a system of checks and balances to verify the accuracy of financial data. * Conduct regular audits and reviews to identify and correct any errors or discrepancies. * Provide ongoing training to staff on financial reporting and accounting principles. * Utilize technology to automate processes and reduce the risk of human error.

4. Describe the key challenges faced by fiscal managers in the healthcare industry?

- Increasing complexity of healthcare regulations and reimbursement models

- Rapidly evolving healthcare technology and its impact on financial operations

- Managing costs while maintaining quality of care

- Ensuring compliance with multiple regulatory agencies

- Adapting to changes in the healthcare market and economy

5. How do you stay up-to-date on the latest financial regulations and trends in healthcare?

* Attend industry conferences and seminars * Read professional journals and publications * Participate in online forums and discussion groups * Network with other fiscal managers and healthcare professionals * Utilize online resources and databases

6. Describe your experience in developing and managing budgets for a healthcare organization?

- Participated in the development of the organization’s annual operating and capital budgets.

- Monitored and analyzed budget performance throughout the year, identifying variances and taking corrective actions.

- Prepared financial reports and presented them to senior management and the board of directors.

- Worked with department heads to ensure that their budgets were aligned with the organization’s strategic goals.

7. How do you evaluate the financial performance of a healthcare organization?

* Analyze financial statements (balance sheet, income statement, cash flow statement) * Calculate and interpret financial ratios (liquidity, profitability, solvency) * Review key financial indicators (revenue growth, expenses, net income) * Compare performance to industry benchmarks and historical data * Identify trends and patterns in financial performance

8. Describe your role in implementing cost-saving initiatives in a healthcare setting?

- Led a team to identify and analyze areas where costs could be reduced.

- Developed and implemented strategies to reduce expenses, such as negotiating with vendors and optimizing supply chain management.

- Monitored the results of cost-saving initiatives and made adjustments as needed.

- Ensured that cost-saving measures did not compromise the quality of care.

9. How do you communicate financial information to non-financial stakeholders, such as physicians and department heads?

* Use clear and concise language * Avoid technical jargon and acronyms * Provide context and explain the significance of financial data * Use visual aids (charts, graphs, tables) to illustrate financial concepts * Tailor the communication to the audience’s level of financial literacy

10. Describe a situation where you demonstrated strong leadership and problem-solving skills in a healthcare financial management setting?

* Faced a significant financial challenge (e.g., budget shortfall, revenue decline) * Took initiative to identify and analyze the root cause of the problem * Developed and implemented a comprehensive plan to address the challenge * Led a team to implement the plan and monitor progress * Achieved a positive outcome (e.g., improved financial performance, resolved financial crisis)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fiscal Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fiscal Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Fiscal Manager serves as a critical member of the financial management team, providing strategic leadership and oversight for all financial activities of the organization. They are responsible for ensuring the accuracy, integrity, and transparency of the organization’s financial reporting, as well as developing and implementing sound fiscal policies and procedures.

1. Financial Reporting and Analysis

Prepares and presents financial statements, including balance sheets, income statements, and cash flow statements, in accordance with generally accepted accounting principles (GAAP) and other regulatory requirements.

- Develops and implements financial reporting processes and procedures to ensure accuracy and compliance.

- Conducts financial analysis to identify trends, strengths, and weaknesses, and provides recommendations for improvement.

2. Budgeting and Forecasting

Prepares and manages the organization’s budget, including revenue and expense projections, and monitors actual performance against budget.

- Collaborates with department heads to develop and align budget goals with the organization’s strategic objectives.

- Performs variance analysis and provides recommendations for corrective action.

3. Cash Management

Manages the organization’s cash flow, including forecasting, investing, and disbursing funds.

- Develops and implements cash flow management strategies to optimize fund availability and minimize risk.

- Negotiates with banks and other financial institutions to secure favorable terms and conditions.

4. Accounting and Compliance

Oversees the accounting function, ensuring compliance with GAAP and other applicable regulations.

- Collaborates with external auditors to ensure the accuracy and integrity of financial statements.

- Develops and implements internal control systems to mitigate financial risks.

Interview Tips

Preparing for a Fiscal Manager interview can be daunting, but with the right strategies and practice, you can increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Take the time to thoroughly research the company and the specific Fiscal Manager position. This will give you a good understanding of the organization’s culture, values, and financial goals.

- Review the company’s website, annual reports, and any other relevant materials.

- Identify the key responsibilities of the Fiscal Manager and how they align with your skills and experience.

2. Practice Your Answers

Once you have a good understanding of the company and position, take the time to practice answering common interview questions.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your skills and experience.

- Focus on highlighting your financial management skills, analytical abilities, and strategic thinking.

3. Be Prepared to Discuss Your Experience

In addition to practicing your answers to specific interview questions, be prepared to discuss your overall experience and qualifications.

- Emphasize your experience in financial reporting, budgeting, cash management, and accounting.

- Highlight any accomplishments or achievements that demonstrate your ability to manage financial operations effectively.

4. Dress Professionally and Arrive on Time

First impressions matter, so make sure you dress professionally and arrive on time for your interview.

- Choose attire that is appropriate for the company culture and industry.

- Allow yourself plenty of time to get to the interview location to avoid any unexpected delays.

Next Step:

Now that you’re armed with the knowledge of Fiscal Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Fiscal Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini