Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Fiscal Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

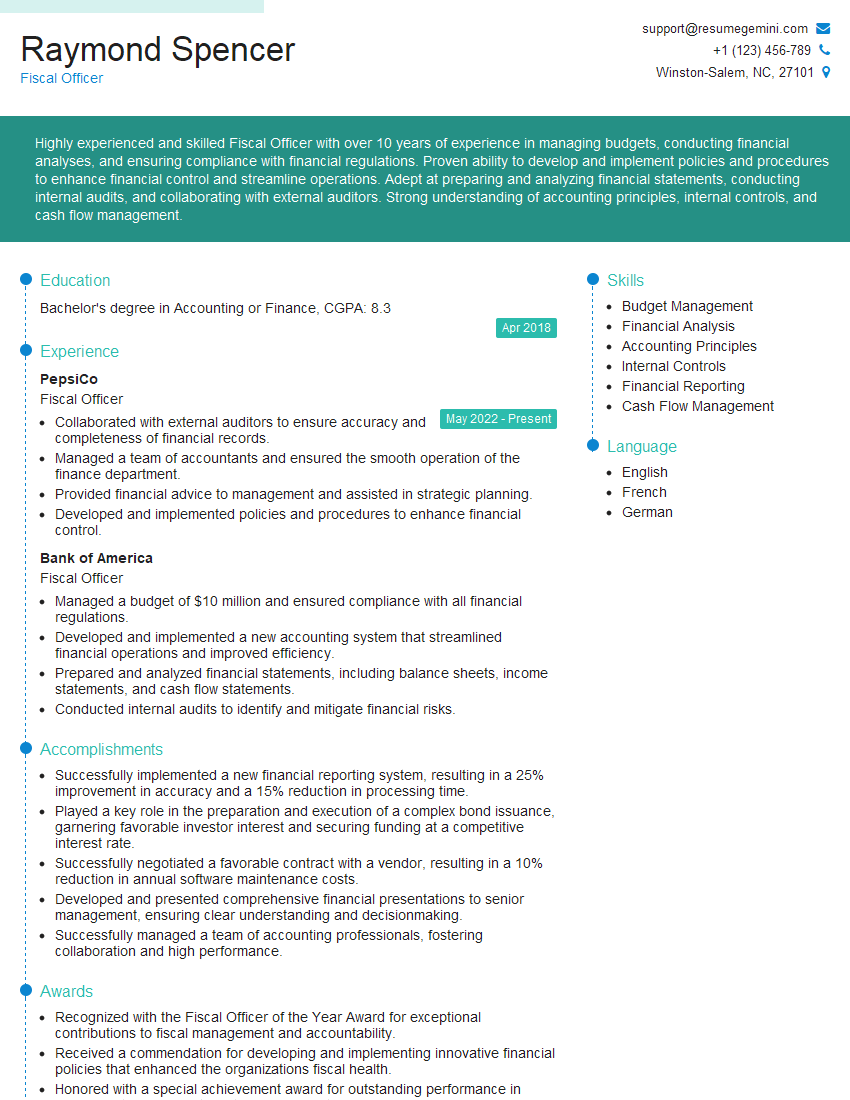

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fiscal Officer

1. What is the purpose of a reconciliation statement and how do you prepare one?

A reconciliation statement is a document that compares two sets of accounts or financial statements to identify any discrepancies or errors. It is used to ensure that the balances in the two sets of accounts match. To prepare a reconciliation statement, you start by comparing the beginning balances of the two sets of accounts. Then, you analyze each transaction that occurred during the period and determine how it affects the balances in the two sets of accounts. Finally, you calculate the ending balances of the two sets of accounts and compare them to each other. If the ending balances do not match, then you must investigate to determine the source of the discrepancy.

2. What is the difference between an accrual basis and a cash basis accounting system?

Accrual Basis

- Recognizes revenues when earned and expenses when incurred, regardless of when cash is received or paid.

- Provides a more accurate picture of a company’s financial performance.

- Is required by Generally Accepted Accounting Principles (GAAP).

Cash Basis

- Recognizes revenues when cash is received and expenses when cash is paid.

- Simpler to implement and maintain.

- Not as accurate as accrual basis accounting.

3. What are the different types of financial statements?

The three main types of financial statements are:

- Income statement

- Balance sheet

- Statement of cash flows

The income statement shows a company’s revenues and expenses over a period of time, and its net income or loss. The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. The statement of cash flows shows a company’s cash inflows and outflows over a period of time.

4. What are the key elements of a budget?

The key elements of a budget are:

- Revenues

- Expenses

- Surplus or deficit

Revenues are the funds that a company expects to receive during a period of time. Expenses are the costs that a company expects to incur during a period of time. The surplus or deficit is the difference between revenues and expenses.

5. What is the difference between a capital expenditure and an operating expense?

A capital expenditure is an expense that is made to acquire an asset that will be used for more than one year. An operating expense is an expense that is incurred in the normal course of business operations.

- Capital expenditures are recorded on the balance sheet as assets.

- Operating expenses are recorded on the income statement as expenses.

6. What are the different types of taxes that a business may be subject to?

The different types of taxes that a business may be subject to include:

- Income tax

- Sales tax

- Property tax

- Payroll tax

7. What are the key skills and qualities that a successful Fiscal Officer should have?

The key skills and qualities that a successful Fiscal Officer should have include:

- Strong understanding of accounting principles and practices

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Strong analytical and problem-solving skills

- Knowledge of financial software and systems

8. What are the key challenges that Fiscal Officers face in today’s business environment?

The key challenges that Fiscal Officers face in today’s business environment include:

- Increasing regulatory complexity

- Rising costs of healthcare and other benefits

- Need to improve operational efficiency

- Managing risk and uncertainty

9. What are the latest trends in fiscal management?

The latest trends in fiscal management include:

- Increased use of data analytics

- Adoption of cloud-based financial management systems

- Focus on improving customer service

- Emphasis on risk management

10. How do you stay up-to-date on the latest developments in fiscal management?

I stay up-to-date on the latest developments in fiscal management by:

- Attending conferences and seminars

- Reading professional journals and articles

- Participating in online forums and discussion groups

- Networking with other fiscal professionals

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fiscal Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fiscal Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Fiscal Officer is accountable for overseeing the financial operations of an organization. The main focus of their role is to ensure the accuracy and integrity of financial records while adhering to established policies and procedures.

1. Budget Management

Establish, manage, and monitor budgets in accordance with organizational objectives. Track and control expenses to ensure efficient resource allocation. Analyze financial data to identify potential cost-saving opportunities.

2. Financial Reporting and Analysis

Prepare and present financial statements, including balance sheets, income statements, and cash flow statements. Analyze financial performance, identify trends, and provide insights to support decision-making.

3. Cash Flow Management

Oversee cash flow operations to ensure timely payments and receipts. Monitor bank accounts, manage investments, and implement strategies to optimize cash availability.

4. Accounts Payable and Receivable

Process and manage accounts payable and receivable. Review and approve invoices, make payments, and collect outstanding receivables. Maintain accurate and detailed records for all financial transactions.

5. Internal Control and Compliance

Establish and implement internal controls to safeguard financial assets and ensure compliance with applicable laws and regulations. Conduct regular audits and reviews to identify any potential risks or irregularities.

Interview Tips

Preparing for an interview can significantly increase your chances of making a positive impression and landing the job. Here are some essential tips to help you ace a Fiscal Officer interview:

1. Research the Organization and Position

Thoroughly research the organization, its mission, values, and industry. Understand the specific requirements and responsibilities of the Fiscal Officer position to tailor your answers accordingly.

2. Highlight Relevant Experience and Skills

Emphasize your experience in financial management, budgeting, accounting, and reporting. Quantify your accomplishments using specific metrics whenever possible. Highlight your knowledge of relevant software and systems.

3. Demonstrate Analytical and Problem-Solving Abilities

Showcase your analytical skills by providing examples of how you’ve identified and resolved financial issues. Explain how you approach problem-solving and decision-making in a logical and data-driven manner.

4. Prepare for Common Interview Questions

Practice answering common interview questions, such as: “Tell me about your experience in budget management,” “How do you ensure accuracy in financial reporting,” and “Describe your approach to internal control and compliance.”

5. Ask Thoughtful Questions

Asking intelligent questions at the end of the interview shows your interest and engagement. Prepare questions about the organization’s financial priorities, growth strategies, or any specific challenges the Fiscal Officer may face.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Fiscal Officer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.