Are you gearing up for an interview for a Fixed Capital Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Fixed Capital Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

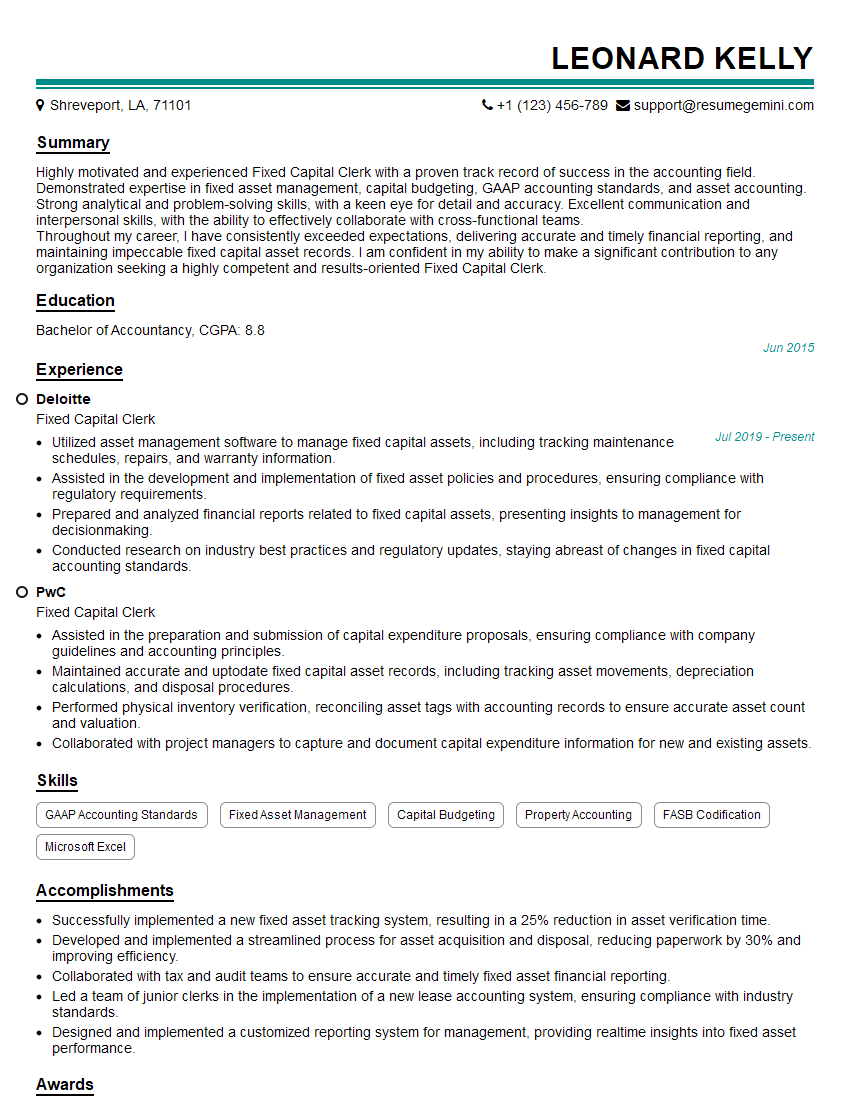

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fixed Capital Clerk

1. What is the main responsibility of a Fixed Capital Clerk?

The primary responsibility of a Fixed Capital Clerk is to assist in the management and accounting of fixed assets within an organization. Key responsibilities include:

- Maintaining fixed asset registers and records

- Preparing and processing capital expenditure requests and authorizations

- Monitoring and tracking the acquisition, disposal, and transfer of fixed assets

- Calculating and recording depreciation expenses

- Conducting physical inventories and reconciling asset records

2. Explain the process of capitalizing an asset.

Definition of Capitalization

- Capitalization is the process of recognizing an expenditure as a fixed asset on the balance sheet rather than an expense on the income statement.

Steps in Capitalization

- Identify the asset

- Determine the cost of the asset

- Allocate the cost to the appropriate fixed asset account

- Record the depreciation expense over the asset’s useful life

3. What are the different methods of depreciation?

There are several methods of depreciation, each with its own advantages and disadvantages. Common methods used for fixed asset accounting include:

- Straight-line method

- Declining-balance method

- Units-of-production method

4. Describe the role of physical inventories in fixed asset accounting.

Physical inventories involve physically counting and reconciling assets with the records maintained by the Fixed Capital Clerk. They are essential for:

- Identifying missing or obsolete assets

- Adjusting fixed asset records to match actual asset counts

- Supporting the accuracy and reliability of fixed asset accounting

5. What software tools are commonly used in fixed asset management?

Many organizations use software tools to facilitate fixed asset management and accounting. Some common software tools include:

- Enterprise Resource Planning (ERP) systems

- Fixed Asset Management (FAM) systems

- Barcoding and RFID tracking systems

6. What are the key principles of effective fixed asset management?

Effective fixed asset management requires adherence to certain principles:

- Proper documentation and record-keeping

- Accurate and timely capitalization of assets

- Regular reconciliation and physical inventories

- Compliance with accounting standards and regulations

- Collaboration between finance and operations teams

7. What are the challenges associated with fixed asset management?

Some common challenges faced in fixed asset management include:

- Maintaining accurate and up-to-date asset records

- Ensuring compliance with accounting standards and regulations

- Managing the disposal and transfer of fixed assets

- Coordinating with multiple departments and stakeholders

8. How do you stay updated with the latest developments in fixed asset accounting?

To stay updated with the latest developments in fixed asset accounting, I regularly engage in the following practices:

- Attending industry conferences and webinars

- Reading professional publications and online resources

- Participating in online forums and discussions

- Seeking guidance from senior colleagues and professionals

9. What are your strengths and weaknesses as a Fixed Capital Clerk?

My strengths include:

- Strong understanding of fixed asset accounting principles and practices

- Excellent attention to detail and accuracy in record-keeping

- Proficiency in using various software tools for fixed asset management

As for my weaknesses, I am always striving to improve in areas such as:

- Developing a deeper understanding of tax implications related to fixed assets

- Improving my communication and interpersonal skills

10. Why are you interested in this Fixed Capital Clerk position at our company?

I am eager to join your company as a Fixed Capital Clerk because:

- Your company’s reputation for excellence in financial management

- The opportunity to contribute to the growth and success of the organization

- The chance to work with a team of highly skilled and experienced professionals

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fixed Capital Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fixed Capital Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Fixed Capital Clerks are responsible for managing and tracking the fixed assets of a company. Their key responsibilities include:

1. Asset Management

Maintain an accurate and up-to-date inventory of all fixed assets.

- Record and track asset purchases, disposals, and transfers.

- Conduct physical inspections and verify the existence and condition of assets.

2. Depreciation and Amortization

Calculate and record depreciation and amortization expenses in accordance with applicable accounting standards.

- Review and update depreciation schedules to reflect changes in asset values or useful lives.

- Prepare depreciation and amortization reports for internal and external stakeholders.

3. Insurance and Risk Management

Ensure that all fixed assets are adequately insured against loss or damage.

- Review and update insurance policies to cover newly acquired or disposed assets.

- Assist in the preparation of insurance claims in the event of loss or damage.

4. Compliance and Reporting

Maintain compliance with all applicable accounting and regulatory requirements related to fixed assets.

- Prepare financial statements and reports that accurately reflect the value and condition of fixed assets.

- Respond to inquiries from auditors and other stakeholders regarding fixed asset information.

Interview Tips

Preparing for an interview for a Fixed Capital Clerk position requires a combination of knowledge, research, and soft skills. Here are some tips to help you ace the interview:

1. Research the Company and the Role

Take the time to thoroughly research the company you’re applying to and the specific Fixed Capital Clerk role.

- Visit the company’s website to learn about their industry, business model, and recent news.

- Review the job description and identify the key skills and responsibilities required for the position.

2. Highlight Your Relevant Skills and Experience

During the interview, make sure to highlight your relevant skills and experience that match the job requirements.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Prepare examples of projects or tasks that demonstrate your ability to manage fixed assets, calculate depreciation, and maintain compliance.

3. Practice Answering Common Interview Questions

Practice answering common interview questions that may be asked during the interview.

- Tell me about your experience in managing fixed assets.

- How do you calculate depreciation and amortization? What methods are you familiar with?

- What are the key compliance requirements related to fixed asset accounting?

4. Be Enthusiastic and Confident

Throughout the interview, maintain a positive and enthusiastic attitude. Confidence in your abilities and a genuine interest in the role will make a strong impression.

- Make eye contact with the interviewer and speak clearly and confidently.

- Be prepared to ask questions at the end of the interview to show your engagement and interest in the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fixed Capital Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!