Feeling lost in a sea of interview questions? Landed that dream interview for Fixed Income Portfolio Manager but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Fixed Income Portfolio Manager interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

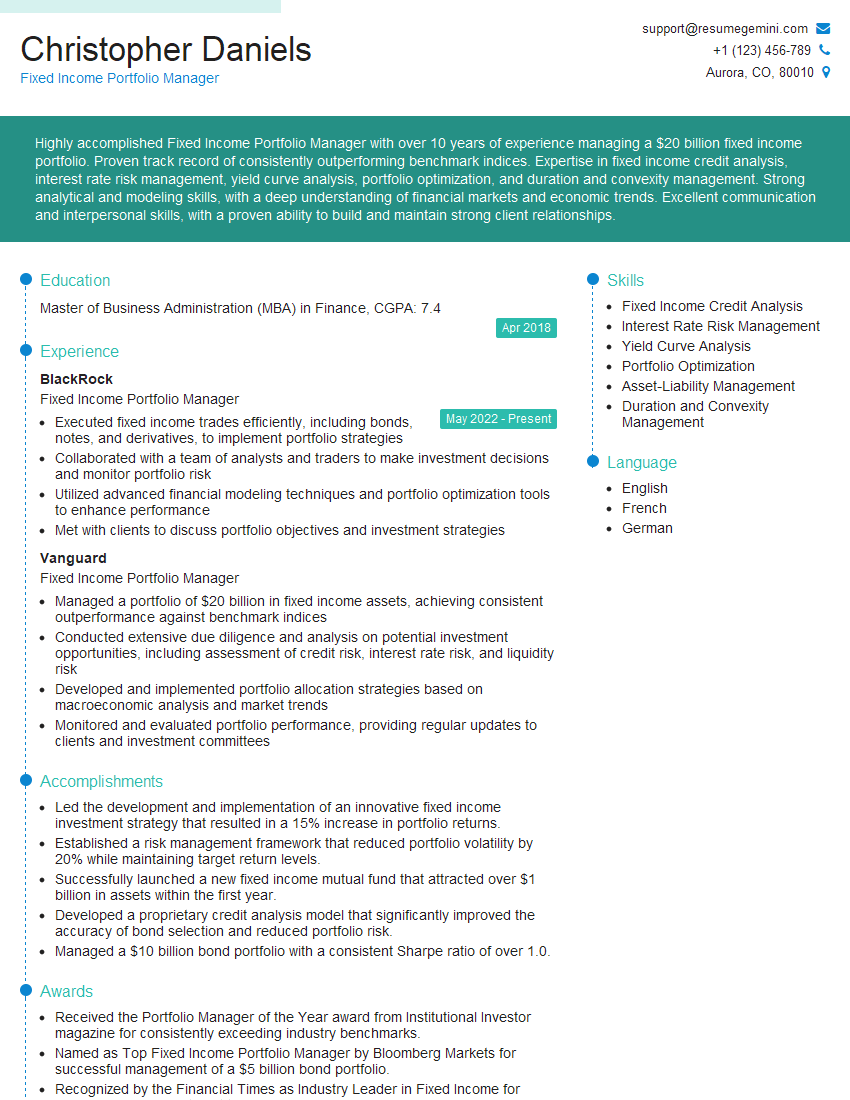

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fixed Income Portfolio Manager

1. Interview Question: Please explain the difference and relation between nominal and real yield of bonds?

- Nominal yield is the coupon rate of a bond, which is the stated interest rate that is paid to bondholders.

- Real yield is the nominal yield adjusted for inflation. inflation erodes the purchasing power of coupon and principal payments, so real yield is a more accurate measure of the return on a bond.

2. Interview Question: How do calculate the yield-to-maturity of a bond and what are the factors that affect it?

i. How do calculate the yield-to-maturity of a bond?

- The yield-to-maturity (YTM) of a bond is the annual rate of return that an investor will receive if they hold the bond until maturity.

- To calculate the YTM, you need to know the bond’s coupon rate, maturity date, and current price.

- You can use a financial calculator or a spreadsheet to calculate the YTM.

ii. What are the factors that affect it?

- The coupon rate: The higher the coupon rate, the higher the YTM.

- The maturity date: The longer the maturity date, the higher the YTM.

- The current price: The lower the current price, the higher the YTM.

3. Interview Question: What is the relationship between interest rates and bond prices? Explain with an example.

Bond prices and interest rates have an inverse relationship. This means that when interest rates rise, bond prices fall, and when interest rates fall, bond prices rise.

Example:

- Suppose you have a bond with a $1,000 face value and a 5% coupon rate.

- If interest rates rise to 6%, the price of your bond will fall because investors can now buy new bonds with a higher coupon rate.

- If interest rates fall to 4%, the price of your bond will rise because investors are now willing to pay a premium for the higher yield.

4. Interview Question: How do you analyze the creditworthiness of a bond issuer?

To analyze the creditworthiness of a bond issuer, you need to look at a number of factors, including:

- The issuer’s financial statements

- The issuer’s credit ratings

- The issuer’s industry and competitive landscape

5. Interview Question: What are the different types of fixed income securities?

There are many different types of fixed income securities, including:

- Government bonds

- Corporate bonds

- Municipal bonds

- Agency bonds

- Mortgage-backed securities

- Asset-backed securities

6. Interview Question: What are the risks associated with investing in fixed income securities?

There are a number of risks associated with investing in fixed income securities, including:

- Interest rate risk: The risk that interest rates will rise, causing the value of your bonds to fall.

- Credit risk: The risk that the issuer of your bonds will default on their payments.

- Inflation risk: The risk that inflation will erode the purchasing power of your returns.

- Liquidity risk: The risk that you will not be able to sell your bonds when you need to.

7. Interview Question: How do you manage a portfolio of fixed income securities?

To manage a portfolio of fixed income securities, you need to:

- Set investment objectives

- Determine your risk tolerance

- Diversify your portfolio

- Monitor your portfolio’s performance

8. Interview Question: How do you use financial modeling to make investment decisions?

- Financial modeling is a powerful tool that can help you make better investment decisions.

- By creating a financial model, you can simulate different scenarios and see how they would affect your investment portfolio.

- This can help you identify risks and opportunities, and make more informed decisions about your investments.

9. Interview Question: What are some of the ethical challenges that fixed income portfolio managers face?

Fixed income portfolio managers face a number of ethical challenges, including:

- The temptation to take on too much risk

- The temptation to favor certain clients or investments

- The temptation to engage in insider trading

10. Interview Question: What are your career goals?

My career goal is to become a successful fixed income portfolio manager. I am passionate about fixed income investing and I believe that I have the skills and experience to be successful in this field.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fixed Income Portfolio Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fixed Income Portfolio Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Fixed Income Portfolio Manager is responsible for the day-to-day management of fixed income portfolios. This involves making investment decisions, managing risk, and communicating with clients.

1. Investment Decisions

Fixed Income Portfolio Managers are responsible for making investment decisions for their portfolios. This includes deciding which bonds to buy and sell, as well as when to buy and sell them. Portfolio Managers must have a deep understanding of the fixed income market and be able to make sound investment decisions based on their research and analysis.

2. Risk Management

In addition to making investment decisions, Fixed Income Portfolio Managers are also responsible for managing risk. This involves identifying and mitigating potential risks to their portfolios. Portfolio Managers must have a strong understanding of risk management techniques and be able to implement them effectively.

3. Client Communications

Fixed Income Portfolio Managers are responsible for communicating with clients about their portfolios. This includes providing clients with regular updates on the performance of their portfolios, as well as answering any questions or concerns that clients may have.

4. Other Responsibilities

In addition to the core responsibilities listed above, Fixed Income Portfolio Managers may also be responsible for other tasks, such as:

- Conducting research on fixed income markets

- Developing investment strategies

- Creating marketing materials

- Attending industry events

Interview Tips

Preparing for an interview for a Fixed Income Portfolio Manager position can be a daunting task. However, by following these tips, you can increase your chances of success.

1. Research the Company and the Position

Before you go on an interview, it is important to research the company and the position you are applying for. This will help you to understand the company’s culture and values, as well as the specific requirements of the position. You can research the company’s website, read news articles about the company, and talk to people who work there.

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you are likely to be asked in an interview for a Fixed Income Portfolio Manager position. It is important to practice answering these questions in advance so that you can deliver clear and concise answers. Some common interview questions include:

- Tell me about your experience in fixed income portfolio management.

- What are your investment strategies?

- How do you manage risk?

- What are your thoughts on the current fixed income market?

3. Be Prepared to Talk About Your Skills and Experience

In addition to answering common interview questions, you should also be prepared to talk about your skills and experience. This is your chance to highlight your qualifications and show the interviewer why you are the best candidate for the job.

4. Ask Questions

Asking questions at the end of an interview shows the interviewer that you are interested in the position and that you are taking the interview seriously. It is also a good way to learn more about the company and the position.

5. Follow Up

After the interview, it is important to follow up with the interviewer. This can be done by sending a thank-you note or email. Following up shows the interviewer that you are still interested in the position and that you are eager to learn more about the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fixed Income Portfolio Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.