Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Fixed Income Trading Vice President interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Fixed Income Trading Vice President so you can tailor your answers to impress potential employers.

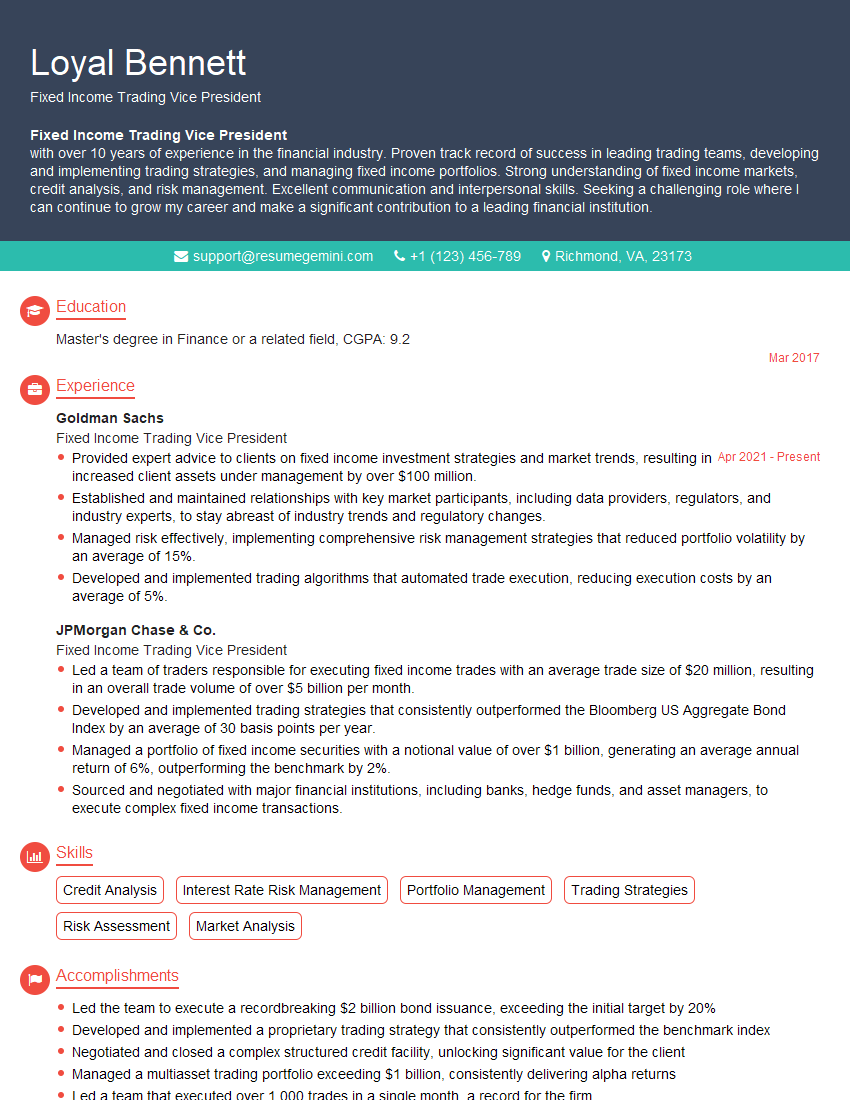

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fixed Income Trading Vice President

1. Can you explain the concept of curve trading and provide an example of a trade you have executed?

- Curve trading involves taking advantage of differences in yields or spreads between different fixed income securities.

- For example, you could buy a longer-term bond that is trading at a higher yield than a shorter-term bond with similar credit risk.

- As the shorter-term bond matures, you can sell it and reinvest the proceeds in the longer-term bond, locking in a higher yield over the life of the investment.

2. What are some of the key factors to consider when evaluating a fixed income portfolio?

Risk Factors

- Interest rate risk: Changes in interest rates can affect the value of fixed income securities.

- Credit risk: The risk that an issuer may default on its obligations.

- Inflation risk: The risk that inflation will erode the value of fixed income payments.

Return Factors

- Yield to maturity: The expected return on a fixed income security if it is held until maturity.

- Coupon rate: The fixed interest rate that is paid on a fixed income security.

- Maturity date: The date on which a fixed income security matures and the principal is repaid.

3. How do you stay up-to-date on the latest developments in the fixed income market?

- Read industry publications and research reports.

- Attend conferences and webinars.

- Network with other professionals in the field.

- Follow market news and data sources.

4. What are some of the challenges you have faced in your previous fixed income trading roles, and how did you overcome them?

- Developing and implementing trading strategies in a volatile market environment.

- Managing risk and ensuring compliance with regulatory requirements.

- Building and maintaining relationships with clients and counterparties.

5. What are your thoughts on the current state of the fixed income market, and what do you expect to happen in the next 12 months?

- Discuss current market conditions and trends.

- Provide an outlook for the next 12 months, considering economic and financial factors.

- Identify potential opportunities and challenges for investors.

6. How do you assess the creditworthiness of a fixed income issuer?

- Review financial statements and credit ratings.

- Analyze industry trends and competitive landscape.

- Conduct due diligence and site visits.

- Consider macroeconomic factors and the issuer’s overall business strategy.

7. What are some of the most important risk management techniques for fixed income traders?

- Diversification: Spreading investments across different sectors, maturities, and credit ratings.

- Hedging: Using financial instruments to offset risk exposure.

- Stress testing: Simulating market scenarios to assess potential losses.

- Limit setting: Establishing clear limits on trading activities and risk exposure.

- Scenario analysis: Identifying and assessing potential risks and their potential impact.

8. What are some of the key performance indicators (KPIs) you use to measure your success as a fixed income trader?

- Return on investment (ROI)

- Sharpe ratio: A measure of risk-adjusted return

- Value at risk (VaR): A measure of potential loss

- Hit ratio: The percentage of trades that are profitable

- Compliance with regulatory requirements and internal policies

9. What are your career goals, and how do you see this role contributing to your professional development?

- Discuss short-term and long-term career aspirations.

- Explain how the role aligns with your goals and provides opportunities for growth.

- Highlight your commitment to continuous learning and professional development.

10. Why are you interested in this role at our company specifically?

- Research the company’s reputation, financial performance, and industry standing.

- Discuss how your skills and experience align with the company’s needs.

- Express enthusiasm for the company’s mission and values.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fixed Income Trading Vice President.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fixed Income Trading Vice President‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Fixed Income Trading Vice President is a crucial role within the financial institution, tasked with overseeing fixed income trading operations. Their responsibilities encompass a wide range of activities, including:

1. Trading Execution

Responsible for executing trades in various fixed income instruments, including bonds, notes, and other debt securities.

- Developing and implementing trading strategies to maximize profit.

- Managing risk by monitoring market conditions and adjusting positions accordingly.

2. Portfolio Management

Managing fixed income portfolios to achieve targeted returns and risk parameters.

- Conducting thorough credit analysis and due diligence on potential investments.

- Diversifying portfolios and managing asset allocation.

3. Market Analysis

Analyzing market trends, economic indicators, and geopolitical events to identify trading opportunities.

- Staying up-to-date with fixed income markets and regulatory developments.

- Providing insights to clients and internal stakeholders on market conditions.

4. Team Management

Leading and managing a team of fixed income traders and analysts.

- Providing mentorship and guidance to team members.

- Setting performance targets and evaluating team results.

Interview Tips

To ace an interview for the Fixed Income Trading Vice President role, meticulous preparation is essential. Here are some interview tips and hacks:

1. Research the Company and Role

Thoroughly research the company’s fixed income trading operations and the specific responsibilities of the Vice President role. Understanding the company’s culture and values will also demonstrate your genuine interest and enthusiasm for the opportunity.

- Read the company’s financial statements, press releases, and industry news articles.

- Connect with current or former employees on LinkedIn to gain insights into the company culture.

2. Highlight Your Experience and Skills

During the interview, emphasize your relevant experience and skills that align with the job requirements. Quantify your accomplishments whenever possible to showcase your impact.

- Provide specific examples of successful trades you executed and the strategies you employed.

- Discuss your portfolio management experience and how you achieved your targeted returns.

3. Demonstrate Your Market Knowledge

The interviewer will assess your understanding of fixed income markets. Be prepared to discuss current market trends, economic indicators, and geopolitical events that impact trading.

- Follow industry publications and attend conferences to stay up-to-date on the latest developments.

- Develop your own insights and opinions on market conditions and be ready to share them.

4. Ask Thoughtful Questions

Asking thoughtful questions during the interview demonstrates your engagement and interest in the role. It also allows you to gather valuable information about the company and the position.

- Inquire about the company’s long-term fixed income trading strategy.

- Ask about the team structure and reporting lines.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fixed Income Trading Vice President interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.