Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Floor Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Floor Trader so you can tailor your answers to impress potential employers.

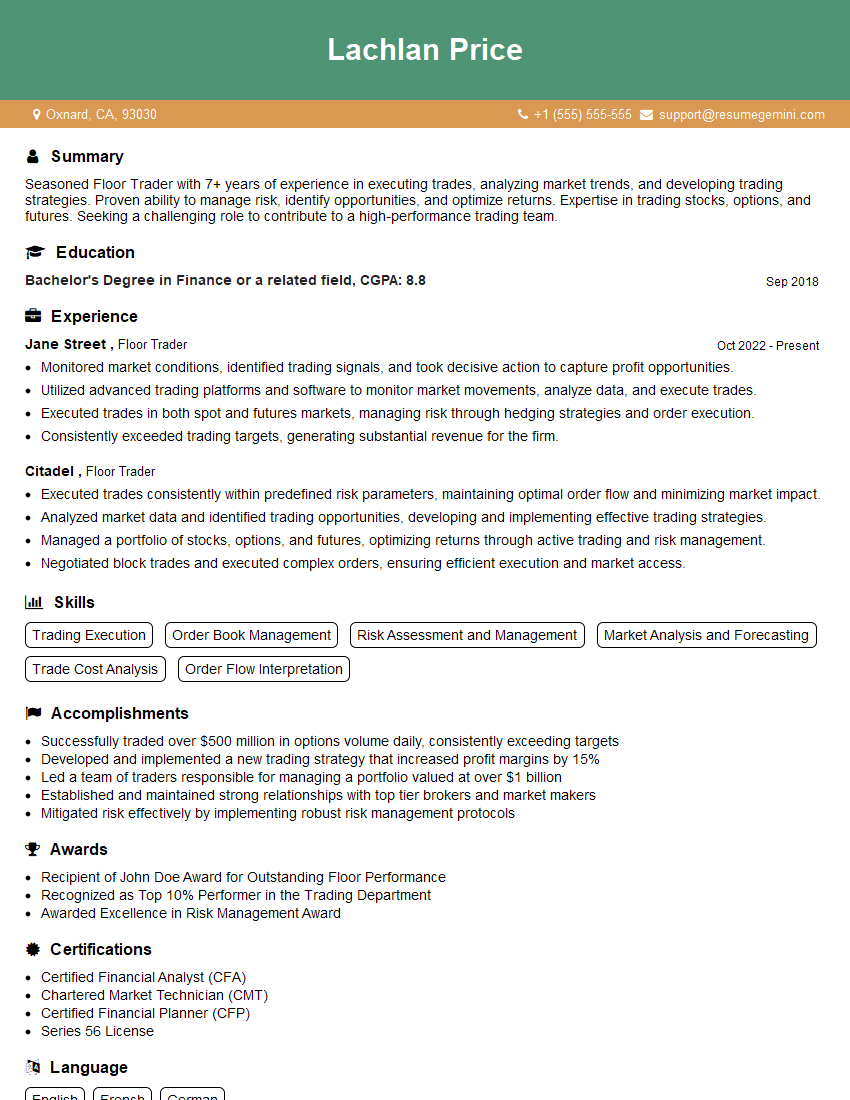

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Floor Trader

1. Explain the concept of market depth and how it affects your trading decisions?

- Market depth, represented by the level II or III quotes, refers to the volume of buy and sell orders at various price levels.

- It provides insights into the overall market sentiment and liquidity.

- By assessing the market depth, a floor trader can make informed decisions on order size, timing, and pricing.

- Thin order books with limited depth increase execution risk, while thick order books with ample depth facilitate smoother executions.

2. Describe the different types of orders used in floor trading and how you prioritize their execution?

Market Orders

- Executed immediately at the best available price.

- Prioritized for urgent executions.

Limit Orders

- Executed only when the specified price or better is reached.

- Used to protect against adverse price movements.

Stop Orders

- Become market orders once a certain price level is triggered.

- Used to exit positions or enter new ones when a price target is reached.

3. How do you manage risk in the fast-paced environment of floor trading?

- Maintain a clear understanding of market conditions and risk-reward ratios.

- Implement stop-loss orders to limit potential losses.

- Diversify portfolio by trading multiple assets to minimize exposure to a single risk factor.

- Stay updated with market news and economic data to anticipate potential volatility.

4. Explain the importance of liquidity in floor trading and how you assess it?

- Liquidity, measured by the ease of buying or selling an asset without significantly impacting its price, is crucial for successful trading.

- Assessed by observing market depth, bid-ask spreads, and historical trading volume.

- High liquidity ensures smooth execution of large orders and reduces slippage.

5. Describe your approach to trading during volatile market conditions?

- Monitor market news and economic indicators to identify potential sources of volatility.

- Reduce position size and increase stop-loss levels to mitigate risk.

- Focus on short-term, opportunistic trades rather than longer-term investments.

- Seek opportunities in both rising and falling markets.

6. How do you collaborate with other traders on the trading floor?

- Communicate with colleagues to share information, identify opportunities, and coordinate strategies.

- Leverage collective knowledge and expertise to make informed decisions.

- Support one another during periods of high stress and market uncertainty.

7. Describe your risk management strategies for handling large-volume orders?

- Execute orders in smaller increments to minimize market impact.

- Monitor the order book closely to anticipate potential price swings.

- Seek liquidity on multiple platforms to distribute order flow.

- Utilize limit orders to control execution price and minimize slippage.

8. How do you stay up-to-date with the latest market trends and events?

- Continuously monitor market news and economic data through various sources.

- Attend industry conferences and seminars.

- Network with other professionals and experts.

- Utilize technical analysis tools and charting platforms.

9. Explain your trading strategy for profiting from market inefficiencies?

- Identify discrepancies between the bid and ask prices.

- Capitalize on price dislocations caused by news or events.

- Utilize algorithmic trading tools to execute trades based on pre-defined criteria.

- Monitor market patterns and trends to predict potential inefficiencies.

10. Describe how you evaluate your own trading performance and identify areas for improvement?

- Track and analyze key performance indicators such as return on investment, profit factor, and risk-reward ratio.

- Review trading logs to identify strengths and weaknesses.

- Seek feedback from experienced traders and mentors.

- Continuously research and stay updated with best practices in trading.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Floor Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Floor Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Floor Traders are responsible for executing trades on the trading floor of an exchange. They work under the supervision of a broker and are responsible for carrying out the orders of their clients.

1. Execute Trades

Floor Traders execute trades by buying and selling securities on the trading floor. They use a variety of trading techniques to get the best possible price for their clients.

- Analyze market data and identify trading opportunities.

- Submit orders to buy or sell securities on the trading floor.

- Monitor the progress of orders and make adjustments as necessary.

2. Manage Risk

Floor Traders are responsible for managing the risk of their trades. They use a variety of risk management techniques to protect their clients’ capital.

- Identify and assess risks associated with trading.

- Develop and implement risk management strategies.

- Monitor risk levels and make adjustments as necessary.

3. Communicate with Clients

Floor Traders communicate with clients to provide them with information about their trades and the market. They also answer client questions and provide advice.

- Provide clients with regular updates on their trades.

- Answer client questions and provide advice.

- Build and maintain relationships with clients.

4. Comply with Regulations

Floor Traders are required to comply with a variety of regulations. They must be familiar with the rules and regulations of the exchange on which they trade, as well as the regulations of the Securities and Exchange Commission (SEC).

- Understand and comply with the rules and regulations of the exchange.

- Understand and comply with the regulations of the SEC.

- Maintain accurate records of all trades.

Interview Tips

To ace a job interview for a Floor Trader position, it is important to be prepared. Here are some tips to help you prepare:

1. Research the Company

Before the interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture and values, as well as the specific responsibilities of the position.

- Visit the company’s website.

- Read news articles and press releases about the company.

- Talk to people who work at the company.

2. Practice your Answers

Take some time to practice answering common interview questions. This will help you feel more confident and prepared during the interview.

- What are your strengths and weaknesses?

- Why are you interested in this position?

- What is your experience in trading?

3. Dress Professionally

First impressions matter, so it is important to dress professionally for the interview. This means wearing a suit or business dress, and making sure your clothes are clean and pressed.

- Wear a suit or business dress.

- Make sure your clothes are clean and pressed.

- Wear appropriate shoes.

4. Be Punctual

It is important to be punctual for the interview. This shows that you are respectful of the interviewer’s time.

- Arrive on time for the interview.

- If you are running late, call or email the interviewer to let them know.

- Be prepared to wait a few minutes if the interviewer is running behind.

5. Be Yourself

The most important thing is to be yourself during the interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not.

- Be yourself.

- Don’t try to be someone you’re not.

- Be honest and genuine.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Floor Trader interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.