Are you gearing up for a career in Flow Trader? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Flow Trader and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

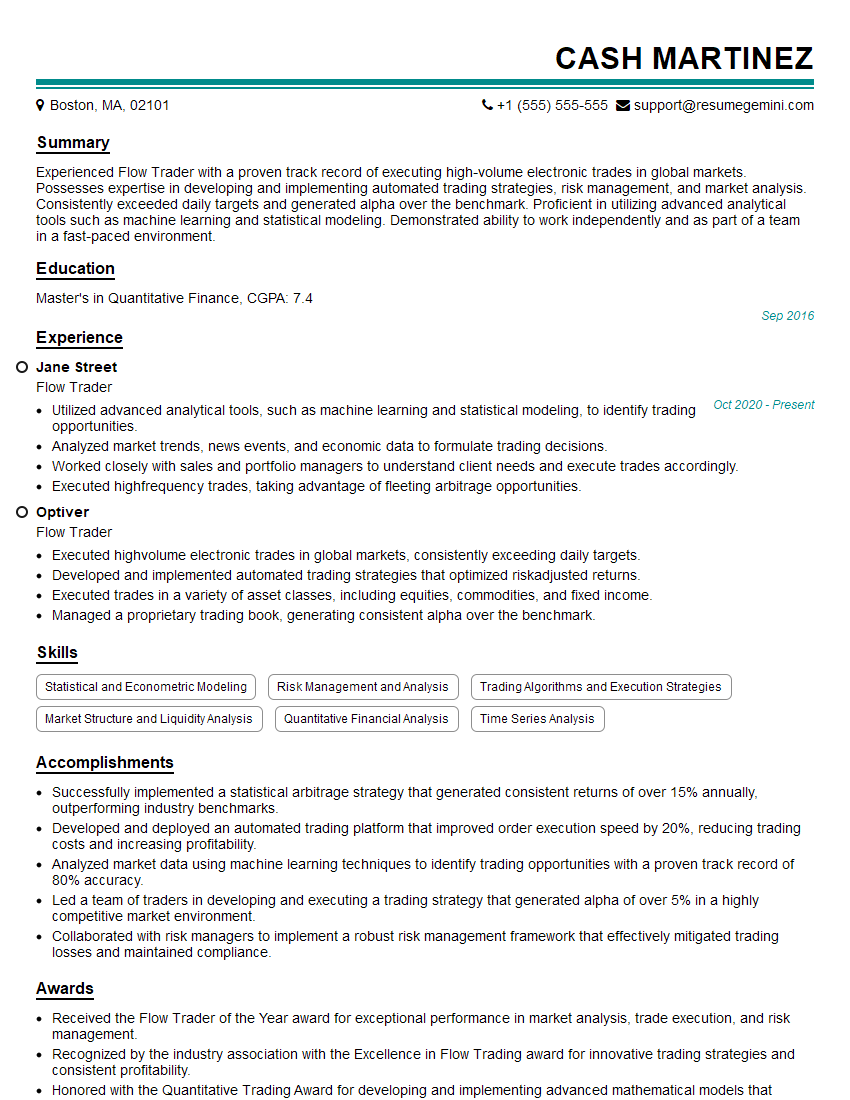

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Flow Trader

1. Describe the process of executing a trade from start to finish, including all the steps involved and the systems you use.

Sample Answer:

- Identify trading opportunity and receive client order.

- Determine optimal execution strategy based on market conditions.

- Select appropriate trading venue and execute trade.

- Monitor trade execution and manage risk.

- Settle trade and provide confirmation to client.

- Systems used: OMS, EMS, risk management software, data analytics tools.

2. What are the key factors that you consider when pricing a trade?

Sample Answer:

Market Liquidity:

- Supply and demand for the asset.

- Bid-ask spread and depth of market.

Market Conditions:

- Market volatility and price trends.

- Macroeconomic factors and news events.

Client Objectives:

- Targeted execution price and timeframe.

- Risk tolerance and constraints.

3. How do you manage risk in your trading operations?

Sample Answer:

- Implement comprehensive risk management framework.

- Monitor market risk, credit risk, and liquidity risk.

- Utilize stress testing and scenario analysis.

- Maintain adequate capital reserves and hedging strategies.

- Regularly review and update risk management policies and procedures.

4. What are the challenges you face in the current market environment and how do you overcome them?

Sample Answer:

- Increased competition and fragmentation in the industry.

- Regulatory and compliance requirements.

- Market volatility and uncertainty.

- Leverage technology and data analytics to gain insights and improve efficiency.

- Collaborate with clients and partners to develop innovative trading strategies.

- Continuously monitor and adapt to changing market conditions.

5. Describe your experience in using data analytics to enhance your trading strategies.

Sample Answer:

- Utilize data analytics to identify trading opportunities and optimize execution.

- Analyze historical data and market trends to predict future price movements.

- Develop quantitative models and machine learning algorithms to support decision-making.

- Implement backtesting and simulation techniques to validate trading strategies.

- Monitor market data in real-time to identify anomalies and potential risks.

6. How do you stay up-to-date on the latest industry trends and developments?

Sample Answer:

- Attend industry conferences and webinars.

- Read industry publications and research reports.

- Network with professionals in the field.

- Engage in ongoing professional development and training.

- Monitor regulatory and market announcements.

7. What are your strengths and weaknesses as a Flow Trader?

Sample Answer:

Strengths:

- Strong understanding of financial markets and trading.

- Excellent analytical and quantitative skills.

- Proven track record of successful trading.

- Ability to work effectively under pressure.

Weaknesses:

- Limited experience in specific asset class.

- Need to improve communication skills.

8. Why are you interested in working at Flow Trader?

Sample Answer:

- Flow Trader’s reputation as a leading global proprietary trading firm.

- Opportunity to work with a team of highly skilled and experienced traders.

- Access to cutting-edge technology and data resources.

- Culture of innovation and continuous learning.

- Commitment to ethical and responsible trading practices.

9. What are your salary expectations?

Sample Answer:

- Research industry benchmarks for similar roles.

- Consider my experience, skills, and performance.

- Be prepared to negotiate based on market conditions and the company’s budget.

10. Do you have any questions for me about the role or Flow Trader?

Sample Answer:

- Ask about the company’s trading philosophy and risk management approach.

- Inquire about career advancement opportunities and professional development programs.

- Request specific details about the role’s responsibilities and performance expectations.

- Ask about the company’s culture and values.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Flow Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Flow Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Flow Trader is responsible for executing large orders without significantly affecting the market price. They must be able to quickly assess the market and make decisions about when and how to execute orders, and they must be able to work independently and as part of a team.

1. Execute large orders

Flow Traders are responsible for executing large orders without significantly affecting the market price. This requires them to have a deep understanding of the market and the order flow, as well as the ability to make quick decisions.

- Monitor the market and identify potential trading opportunities

- Develop and execute trading strategies

- Manage risk and ensure that orders are executed in a timely and efficient manner

2. Manage risk

Flow Traders must be able to manage risk effectively. This includes identifying and mitigating potential risks, as well as developing and implementing risk management strategies.

- Identify and assess potential risks

- Develop and implement risk management strategies

- Monitor risk exposure and take appropriate action to mitigate risks

3. Work independently and as part of a team

Flow Traders must be able to work independently and as part of a team. They must be able to take initiative and make decisions, as well as work effectively with others to achieve common goals.

- Work independently and take initiative

- Work effectively with others to achieve common goals

- Communicate effectively with clients, colleagues, and other stakeholders

4. Develop and maintain knowledge of the market

Flow Traders must have a deep understanding of the market and the order flow. This requires them to stay up-to-date on market news and events, as well as to conduct research and analysis.

- Stay up-to-date on market news and events

- Conduct research and analysis

- Develop and maintain a deep understanding of the market and the order flow

Interview Tips

Preparing for a job interview can be daunting, but there are some simple things you can do to increase your chances of success. Here are a few tips to help you ace your interview for a Flow Trader position:

1. Research the company and the position

Before you go to your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture and values, as well as the specific requirements of the job. You can find information about the company on its website, in news articles, and on social media.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

3. Be prepared to discuss your experience and skills

The interviewer will want to know about your experience and skills, so be prepared to discuss your qualifications in detail. Be sure to highlight your relevant experience and skills, and be able to provide specific examples of your work.

4. Ask questions

Asking questions at the end of the interview shows that you are interested in the position and that you are taking the interview seriously. It also gives you an opportunity to learn more about the company and the position. Some good questions to ask include: “What are the biggest challenges facing the company?” and “What are the opportunities for growth within the company?”

5. Follow up after the interview

After the interview, be sure to follow up with the interviewer. Thank them for their time and express your continued interest in the position. You can also use this opportunity to reiterate your qualifications and why you are the best candidate for the job.

Next Step:

Now that you’re armed with the knowledge of Flow Trader interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Flow Trader positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini