Feeling lost in a sea of interview questions? Landed that dream interview for Foreclosure Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Foreclosure Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

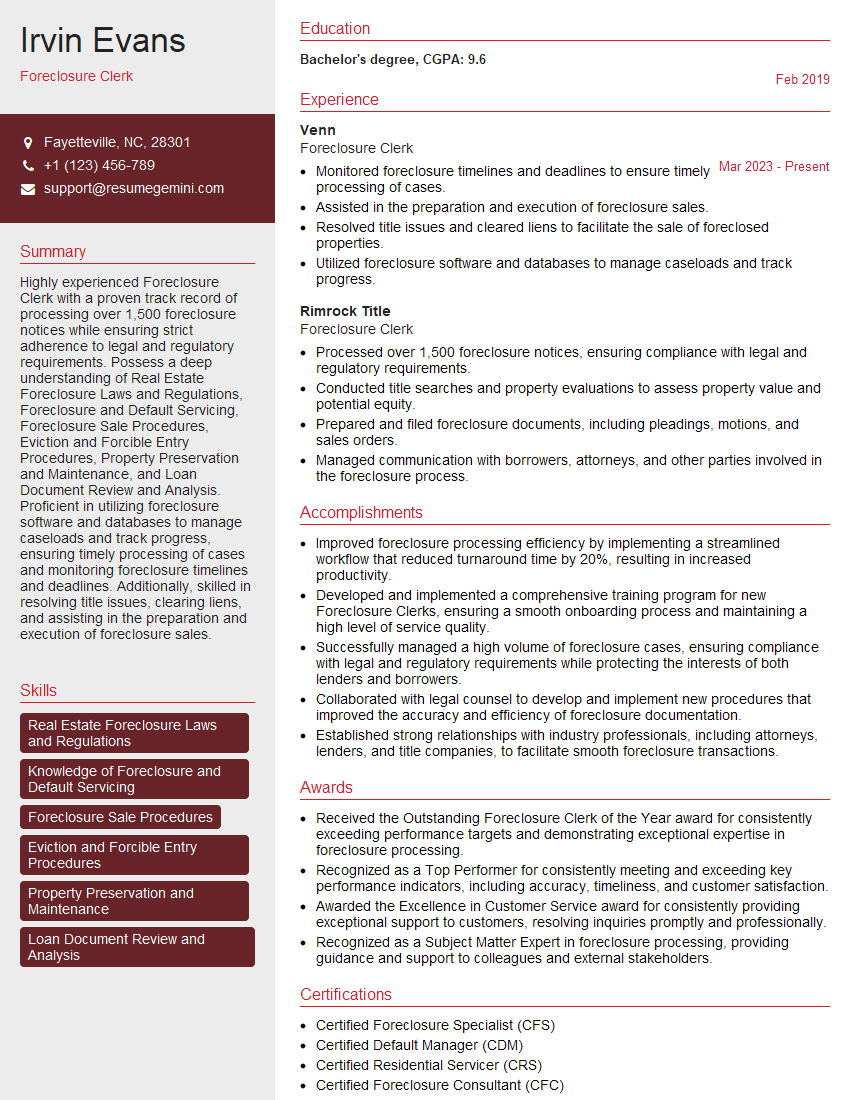

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Foreclosure Clerk

1. How do you initiate a foreclosure process?

To begin a foreclosure process, I first review the loan documents to ensure compliance with all applicable regulations. I then draft and file a complaint with the court, which includes a detailed description of the default and the amount owed. The complaint is then served on the borrower, who has a specific time frame to respond.

2. What are the key steps involved in processing a foreclosure?

Serving the Notice of Default

- Draft and file a Notice of Default with the county recorder’s office.

- Serve the Notice of Default on the borrower and other interested parties.

Filing the Complaint

- Draft and file a Complaint for Foreclosure with the court.

- Serve the Complaint on the borrower and other interested parties.

Scheduling the Foreclosure Sale

- Obtain a judgment of foreclosure from the court.

- Schedule a foreclosure sale with the county sheriff’s office.

- Publish notice of the foreclosure sale in a local newspaper.

Conducting the Foreclosure Sale

- Attend the foreclosure sale and oversee the bidding process.

- Prepare and file the Certificate of Sale with the court.

Finalizing the Foreclosure

- Obtain a Deed of Reconveyance from the county recorder’s office.

- Close the foreclosure file.

3. How do you handle disputes or objections during the foreclosure process?

When a dispute or objection arises during the foreclosure process, I first attempt to resolve it informally with the parties involved. If an informal resolution cannot be reached, I will file a motion with the court for a hearing. At the hearing, I will present evidence and arguments to support the bank’s position. The court will then issue a ruling on the matter.

4. What are the most common challenges you face as a Foreclosure Clerk?

- Dealing with borrowers who are uncooperative or difficult to locate.

- Navigating complex legal and regulatory requirements.

- Managing a high volume of cases.

- Staying up-to-date on changes in foreclosure laws and procedures.

5. How do you stay informed about changes in foreclosure laws and procedures?

- Attend industry conferences and workshops.

- Read legal publications and newsletters.

- Consult with legal counsel.

- Network with other Foreclosure Clerks.

6. What qualities and skills are essential for success as a Foreclosure Clerk?

- Strong attention to detail.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Proficiency in Microsoft Office Suite.

- Knowledge of foreclosure laws and procedures.

7. How do you manage your time and workload effectively?

I use a variety of tools and techniques to manage my time and workload effectively, including:

- Creating a daily to-do list and prioritizing tasks.

- Using a calendar to schedule appointments and deadlines.

- Delegating tasks to other team members when possible.

- Taking breaks throughout the day to avoid burnout.

8. What is your understanding of the ethical responsibilities of a Foreclosure Clerk?

As a Foreclosure Clerk, I have a duty to act ethically and in accordance with all applicable laws and regulations. This includes:

- Maintaining confidentiality of borrower information.

- Avoiding conflicts of interest.

- Treating all parties involved in the foreclosure process with respect and fairness.

9. How do you handle the emotional aspects of working with borrowers who are facing foreclosure?

I understand that foreclosure can be a very stressful and emotional experience for borrowers. I always approach my work with empathy and compassion, and I strive to treat borrowers with respect and dignity. I am also aware of the resources available to assist borrowers who are facing foreclosure, and I am always willing to provide information about these resources.

10. What are your career goals?

My career goal is to become a Manager of Foreclosure Operations. I believe that my skills and experience in foreclosure processing, combined with my leadership abilities, make me well-suited for this role. I am confident that I can lead a team of Foreclosure Clerks to achieve high levels of efficiency and accuracy, while also providing excellent customer service to borrowers.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Foreclosure Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Foreclosure Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Foreclosure clerks are responsible for handling all aspects of the foreclosure process, from the initial filing to the final sale of the property. Their duties include:

1. Preparing and filing foreclosure documents

Foreclosure clerks prepare and file all of the necessary documents to initiate and complete a foreclosure action. This includes the complaint, summons, notice of lis pendens, and other documents required by state law. They also ensure that all documents are properly served on the borrower and other interested parties.

2. Tracking the foreclosure process

Foreclosure clerks track the progress of each foreclosure action and ensure that all deadlines are met. They also keep track of all payments made by the borrower and other interested parties.

3. Communicating with borrowers and other interested parties

Foreclosure clerks communicate with borrowers and other interested parties throughout the foreclosure process. They provide information about the foreclosure process and answer questions. They also negotiate with borrowers to try to avoid foreclosure.

4. Preparing for and attending foreclosure sales

Foreclosure clerks prepare for and attend foreclosure sales. They advertise the sale, collect bids, and conduct the sale. They also prepare the deed and other documents necessary to transfer ownership of the property to the successful bidder.

Interview Tips

Foreclosure clerk jobs can be competitive, so it is important to prepare for your interview. Here are a few tips to help you ace your interview:

1. Research the company and the position

Before your interview, take some time to research the company and the foreclosure clerk position. This will help you understand the company’s culture and the specific requirements of the job. You should also learn about the foreclosure process in your state.

2. Practice your answers to common interview questions

There are a few common interview questions that you are likely to be asked in a foreclosure clerk interview. These questions include:

- Tell me about your experience with the foreclosure process.

- What are your strengths and weaknesses as a foreclosure clerk?

- Why are you interested in working for this company?

It is important to practice your answers to these questions so that you can deliver them confidently and clearly.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time for your interview. This shows that you are respectful of the interviewer’s time and that you are serious about the job.

4. Be positive and enthusiastic

The foreclosure process can be stressful for borrowers, so it is important to be positive and enthusiastic when you are interviewing for a foreclosure clerk position. This will help the interviewer to see that you are genuinely interested in helping people and that you are not afraid of a challenge.

5. Follow up after the interview

After your interview, be sure to send a thank-you note to the interviewer. This is a simple way to show your appreciation for their time and to reiterate your interest in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Foreclosure Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!