Are you gearing up for a career in Foreign Exchange Dealer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Foreign Exchange Dealer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

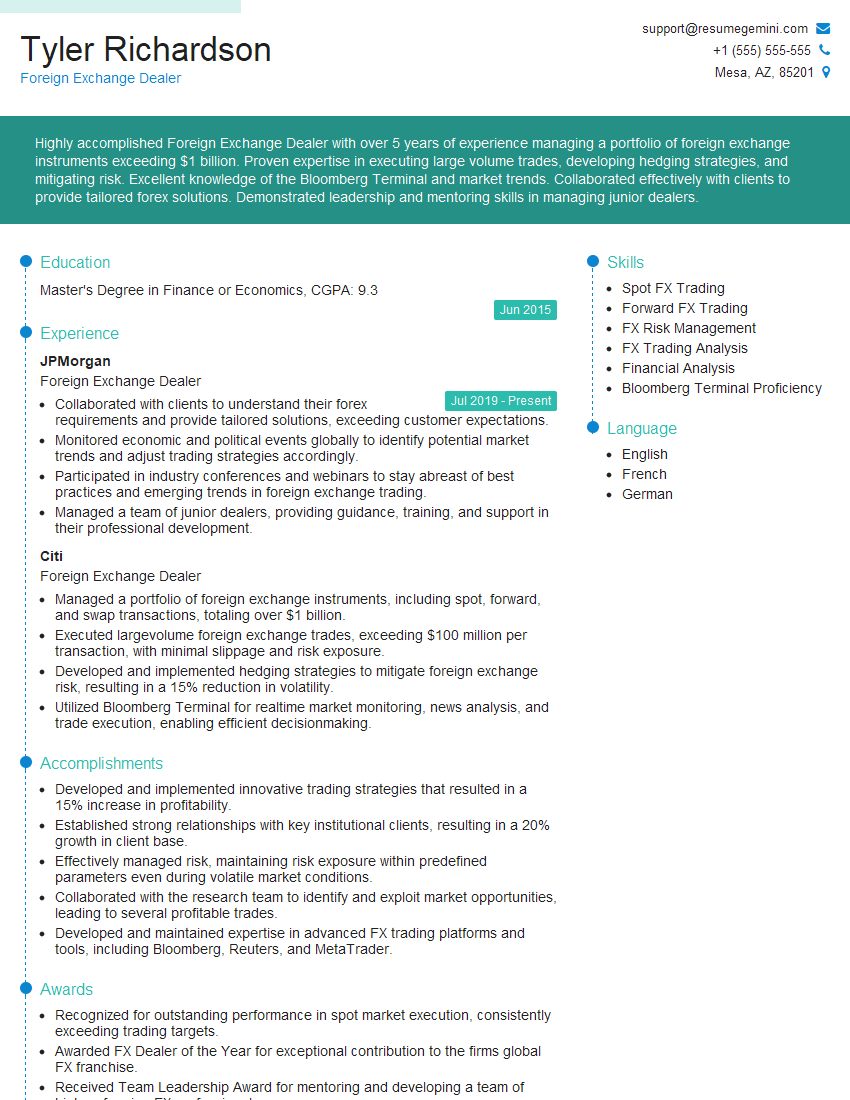

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Foreign Exchange Dealer

1. Explain the concept of “pip” and how it is used in Foreign Exchange trading.

Pip stands for “point in percentage”. It is the smallest unit of price movement in Forex trading, typically representing a change of 0.0001 in the exchange rate. Pips are used to measure the profit or loss on a trade and to calculate the value of a position.

2. Describe the different types of foreign exchange markets.

Spot Market

- Immediate delivery of currencies

- Settlement within two business days

Forward Market

- Contracts for future delivery of currencies

- Used for hedging against exchange rate fluctuations

Swap Market

- Simultaneous buying and selling of currencies with different maturities

- Used for interest rate speculation and currency swaps

3. What are the key economic factors that influence foreign exchange rates?

- Interest rates

- Inflation

- Economic growth

- Political stability

- Current account balance

4. Explain the concept of “carry trade” and its potential risks.

Carry trade involves borrowing in one currency with low interest rates and investing in another currency with higher interest rates. Potential risks include adverse exchange rate movements, interest rate volatility, and political or economic instability.

5. Describe the role of central banks in the foreign exchange market.

- Set monetary policy and interest rates

- Intervene in the market to stabilize exchange rates

- Provide liquidity and facilitate transactions

6. What are the key differences between market orders and limit orders?

Market Order

- Executed at the current market price

- Guaranteed execution but not at a specific price

Limit Order

- Executed only at a specified price or better

- Not guaranteed execution

7. What are the different types of risk management strategies used in Forex trading?

- Stop-loss orders

- Take-profit orders

- Hedging

- Diversification

8. Describe the different types of trading platforms used in the Forex market.

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- JForex

- Thinkorswim

9. What are the key technical indicators used in Forex trading?

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- Stochastic Oscillator

- Ichimoku Cloud

10. Discuss the importance of risk management in Forex trading.

Risk management is crucial in Forex trading to protect capital, minimize losses, and preserve profits. It involves setting appropriate risk levels, using risk management tools, and adhering to a trading plan.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Foreign Exchange Dealer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Foreign Exchange Dealer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Foreign Exchange Dealer, also known as a Forex Dealer, plays a pivotal role in the dynamic world of currency trading. Their key responsibilities encompass:

1. Execution of Currency Trades

As the heartbeat of the trading floor, Foreign Exchange Dealers buy and sell currencies on behalf of their clients, including banks, corporations, and institutional investors. They execute trades in real-time, ensuring timely and efficient transactions.

- Negotiate exchange rates and trade volumes with clients.

- Monitor market conditions and identify profitable trading opportunities.

2. Risk Management

The world of currency trading is a volatile landscape. Dealers are entrusted with the critical task of managing financial risks associated with currency fluctuations. They employ sophisticated strategies and tools to mitigate exposure to potential losses.

- Monitor market risk and adjust trading strategies accordingly.

- Establish stop-loss orders and other risk-management measures.

3. Client Relationship Management

Building and maintaining strong client relationships is paramount for Foreign Exchange Dealers. They serve as the primary point of contact for clients, providing personalized advice and support.

- Understand client investment objectives and risk tolerances.

- Provide market updates and customized trading solutions.

4. Market Analysis and Research

Staying abreast of global economic and political developments is essential for Foreign Exchange Dealers. They conduct in-depth market research and analysis to stay informed about factors that influence currency prices.

- Monitor macroeconomic data, central bank decisions, and geopolitical events.

- Develop trading strategies based on market insights.

Interview Tips

Preparing for a Foreign Exchange Dealer interview requires a comprehensive approach. Here are some valuable tips to help candidates ace their interview:

1. Research and Preparation

Knowledge is power. Thoroughly research the company, its values, and the specific role you’re applying for. Familiarize yourself with the key responsibilities outlined above, and be prepared to discuss your relevant skills and experience.

- Identify specific examples of your accomplishments that align with the job requirements.

- Practice answering common interview questions to enhance your confidence and articulation.

2. Technical Proficiency

Foreign Exchange Dealers need to be technically proficient. Brush up on your knowledge of financial markets, currency trading strategies, and risk-management techniques. Consider acquiring relevant certifications to demonstrate your expertise.

- Study currency markets, including major currency pairs and their relationships.

- Familiarize yourself with trading platforms and software used in the industry.

3. Market Awareness

Interviewers will assess your understanding of the global economic and political landscape. Read industry publications, follow financial news, and develop informed opinions on market trends. This will demonstrate your ability to analyze market movements and make sound trading decisions.

- Stay updated on current events and their potential impact on currency markets.

- Follow thought leaders and influential analysts in the financial sector.

4. Communication and Teamwork

Foreign Exchange Dealers often work in fast-paced, collaborative environments. Showcase your strong communication skills, both verbal and written, as well as your ability to work effectively in a team setting.

- Emphasize your ability to clearly convey complex financial information.

- Highlight instances where you successfully collaborated with colleagues to achieve common goals.

5. Professional Demeanor and Enthusiasm

First impressions matter. Dress professionally, maintain a positive attitude, and demonstrate a genuine enthusiasm for the role and industry. Your demeanor and passion for currency trading will leave a lasting impression on the interviewers.

- Be respectful and attentive during the interview.

- Ask thoughtful questions that show your interest and engagement.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Foreign Exchange Dealer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!