Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Foreign Exchange Trader position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

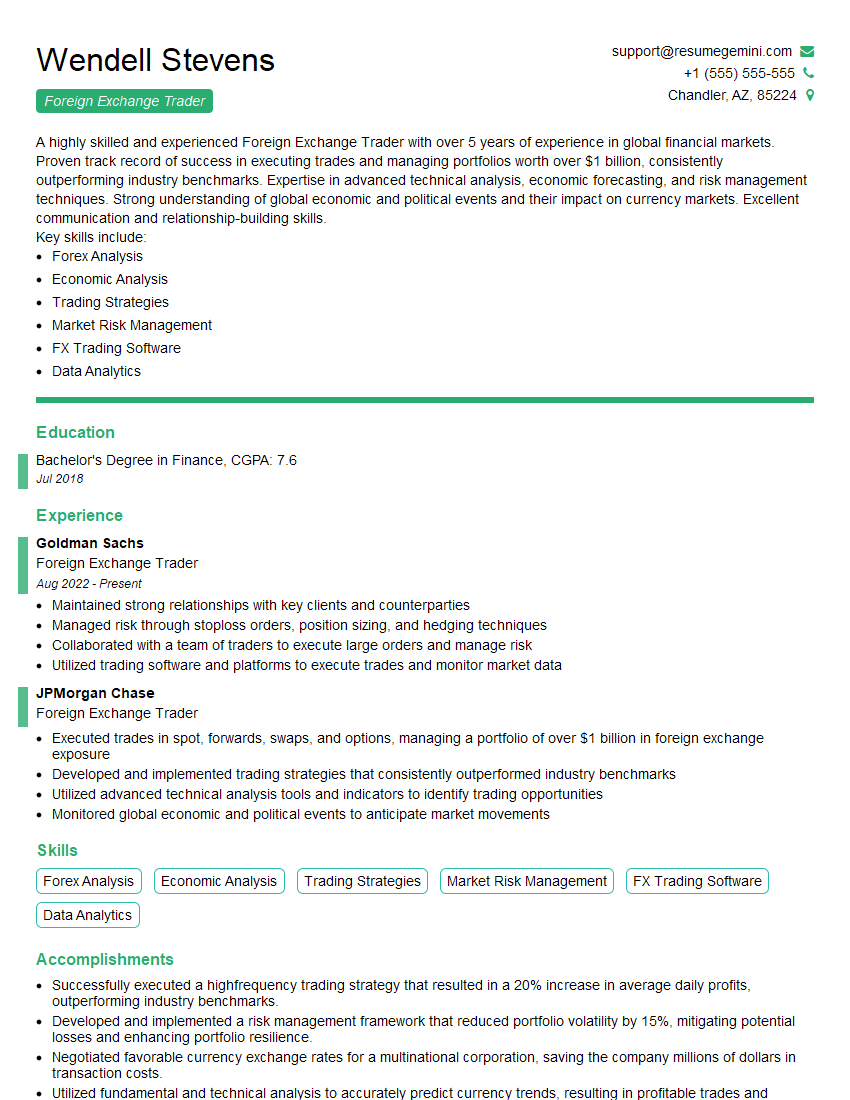

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Foreign Exchange Trader

1. How do you determine the value of a currency?

- I analyze various macroeconomic factors such as economic growth, interest rates, inflation, and political stability.

- I track economic indicators and news events that can impact currency values.

2. What are the different types of foreign exchange transactions?

Spot Transactions

- Immediate settlement (typically within two business days)

- Involve the exchange of currencies at the current market rate

Forward Transactions

- Contracts to exchange currencies at a specified future date and rate

- Used to hedge against exchange rate fluctuations

3. Explain the concept of carry trade.

- Selling a currency with a low interest rate and using the proceeds to invest in a currency with a higher interest rate.

- Traders aim to profit from the interest rate differential while managing the risk of currency fluctuations

4. Describe the different types of foreign exchange markets.

- Spot Market: Trades for immediate settlement

- Forward Market: Trades for future delivery

- OTC Market: Over-the-counter, non-centralized trading

- Interbank Market: Banks trading with each other

5. How do you manage risk in foreign exchange trading?

- Stop-Loss Orders: Limit potential losses by automatically exiting trades when the price reaches a predetermined level.

- Hedging: Using other financial instruments to offset potential losses from currency fluctuations

6. Describe the factors that influence currency exchange rates.

- Interest rates

- Inflation

- Economic growth

- Political stability

- Supply and demand

7. How do you stay updated on the latest market trends and news?

- Follow financial news websites and blogs.

- Monitor economic calendars and data releases.

- Attend industry conferences and seminars.

8. What are the ethical considerations in foreign exchange trading?

- Avoiding insider trading

- Conducting trades with transparency and integrity

- Adhering to regulatory guidelines

- Managing conflicts of interest

9. How do you evaluate the performance of a foreign exchange strategy?

- Return on Investment (ROI): Measure of profit or loss

- Risk-Adjusted Return: Considers the level of risk taken in achieving returns

- Sharpe Ratio: Measures excess return per unit of risk

10. What are some of the challenges you have faced as a foreign exchange trader?

- Market volatility: Rapid price movements can result in unexpected losses

- Economic uncertainties: Global events and economic crises can disrupt markets

- Technological advancements: Automation and algorithmic trading have increased market complexity

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Foreign Exchange Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Foreign Exchange Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Foreign Exchange Traders are responsible for buying and selling currencies on behalf of their clients. They analyze market conditions, make trading decisions, and execute trades to maximize profits or minimize losses.

1. Market Analysis and Research

Conduct thorough market analysis to identify trading opportunities, anticipate market trends, and make informed trading decisions.

- Monitor global economic and political events that impact currency markets

- Analyze financial data, charts, and market sentiment to identify potential trading opportunities

2. Trade Execution

Execute trades based on market analysis and risk management strategies to maximize profits or minimize losses for clients.

- Place buy or sell orders for currencies in the interbank market

- Monitor open positions and adjust trades as needed based on market conditions

3. Risk Management

Implement and maintain robust risk management strategies to minimize potential losses and protect client portfolios.

- Establish stop-loss orders and position limits to control risk exposure

- Monitor market volatility and adjust trading strategies accordingly

4. Client Relationship Management

Maintain strong relationships with clients and provide them with expert advice and personalized trading solutions.

- Understand clients’ investment objectives and risk tolerance

- Provide regular updates on market conditions and trading performance to clients

Interview Tips

Preparing thoroughly for an interview is crucial to increase your chances of success. Here are some effective tips to help you ace your interview for a Foreign Exchange Trader position:

1. Research the Company and Industry

Demonstrate your interest in the company and the industry by thoroughly researching their history, culture, and recent developments. This will enable you to ask informed questions and engage in meaningful discussions.

- Visit the company’s website and LinkedIn page to gather information about their business, team, and market position

- Read industry news and articles to stay up-to-date on the latest trends and market dynamics

2. Practice Technical and Behavioral Questions

Anticipate common technical and behavioral interview questions and prepare thoughtful responses that showcase your skills and experience.

- Technical questions may cover topics such as currency markets, trading strategies, and risk management techniques

- Behavioral questions may focus on your teamwork, problem-solving abilities, and ethical decision-making

3. Highlight Your Skills and Experience

Tailor your resume and cover letter to emphasize your relevant skills and experience. Quantify your accomplishments whenever possible.

- Showcase your expertise in currency trading, market analysis, and risk management

- Provide specific examples of successful trades or risk mitigation strategies you have implemented

4. Prepare Thoughtful Questions

Asking insightful questions at the end of the interview demonstrates your engagement and interest in the position. Prepare questions that align with the company’s goals or industry trends.

- Inquire about the company’s approach to risk management or their outlook on specific currency pairs

- Ask about opportunities for professional development or training within the organization

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Foreign Exchange Trader interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.