Are you gearing up for a career in Forex Trader? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Forex Trader and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

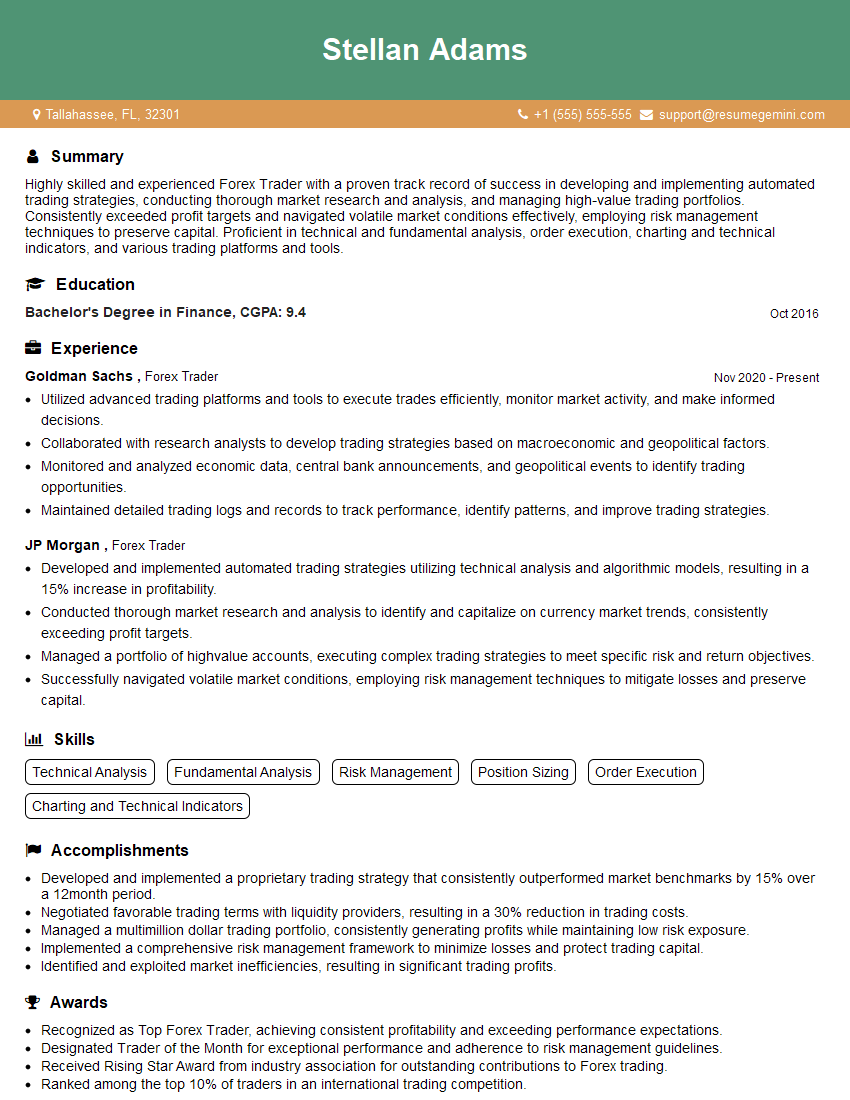

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Forex Trader

1. Explain the concept of pip and how it is used in FX trading?

- Pips (percentage in points) are the smallest unit of price movement in Forex.

- For currency pairs with the US dollar as the quote currency (e.g., EUR/USD), a pip is equal to 0.0001.

- Forex traders use pips to measure profit or loss and to calculate risk-reward ratios.

2. Describe the different types of Forex orders and their uses?

- Market orders: Executed immediately at the current market price. Used for quick entry or exit.

- Limit orders: Executed only when the market price reaches a specified limit price. Used to enter or exit at a desired price level.

- Stop orders: Triggered when the market price reaches a specified stop price, then executed as a market order. Used to protect profits or limit losses.

3. What are the key factors that influence Forex market movements?

- Economic data and news events

- Interest rate decisions

- Political and geopolitical events

- Supply and demand

- Technical analysis indicators

4. Explain the concept of risk management in Forex trading?

- Limiting leverage to avoid excessive risks.

- Using stop-loss orders to cap potential losses.

- Diversifying trades across different currency pairs.

- Understanding risk-reward ratios.

- Managing emotions during market volatility.

5. Describe your approach to technical analysis and the indicators you use?

- Trend analysis using moving averages, Bollinger Bands, and trendlines.

- Momentum indicators such as RSI and MACD.

- Volume analysis to assess market sentiment.

- Support and resistance levels.

- Candlestick patterns for pattern recognition.

6. How do you stay up-to-date with market news and events?

- Subscribing to financial news sources.

- Monitoring economic calendars.

- Following industry analysts and experts.

- Leveraging social media platforms for market insights.

7. Explain your trading strategy and how you determine entry and exit points?

- Combining technical analysis and fundamental factors to assess market conditions.

- Identifying trading opportunities based on defined entry and exit points.

- Using technical indicators to confirm trade decisions.

- Setting profit targets and stop-loss levels.

8. How do you handle periods of market volatility and unexpected events?

- Adjusting risk management measures.

- Using trailing stops to protect profits.

- Re-evaluate trading strategy and adapt to changing market conditions.

- Remaining calm and disciplined.

9. Describe your experience with currency pairs and cross-currency trading?

- In-depth knowledge of major, minor, and exotic currency pairs.

- Understanding of cross-currency correlations and hedging strategies.

- Skill in identifying trading opportunities in various currency pairs.

10. How do you measure and evaluate your trading performance?

- Tracking key metrics such as profit factor, return on investment, and win rate.

- Regularly reviewing trading logs to identify areas for improvement.

- Using backtesting and simulations to test strategies and optimize parameters.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Forex Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Forex Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Forex Traders are responsible for buying and selling currencies on behalf of their clients or their firm. They analyze economic data and market trends to make informed decisions about when to trade and which currencies to trade. The key job responsibilities of a Forex Trader include:

1. Market Analysis

Forex Traders constantly monitor economic data and market trends to identify opportunities for profitable trades. They use technical analysis, fundamental analysis, and other tools to forecast currency movements.

- Technical analysis involves studying historical price data to identify patterns that can be used to predict future price movements.

- Fundamental analysis involves studying economic data to identify factors that can affect currency values, such as interest rates, inflation, and political events.

2. Trade Execution

Once a Forex Trader has identified a trading opportunity, they will execute the trade. This involves placing an order to buy or sell a currency pair at a specific price. Forex Traders must be able to execute trades quickly and efficiently, as market conditions can change rapidly.

3. Risk Management

Forex trading involves a high degree of risk. Forex Traders must be able to manage their risk effectively by using stop-loss orders and other risk management tools. They must also be able to withstand losses and not let emotions cloud their judgment.

4. Client Relations

Forex Traders who work for a firm may be responsible for managing client relationships. This involves providing clients with information about the market, executing trades on their behalf, and answering their questions. Forex Traders must be able to build strong relationships with clients and earn their trust.

Interview Tips

To ace an interview for a Forex Trader position, candidates should be well-prepared and knowledgeable about the forex market. They should also be able to demonstrate their trading skills and risk management experience. Here are some interview tips for Forex Traders:

1. Research the Company

Before the interview, candidates should research the company they are interviewing with. This will help them understand the company’s culture, values, and trading strategies. Candidates should also be familiar with the company’s financial performance and recent news about the company.

2. Practice Trading

Candidates should practice trading before the interview. This will help them demonstrate their trading skills and knowledge of the forex market. Candidates can practice trading on a demo account or with a small amount of real money.

3. Prepare for Behavioral Questions

Behavioral questions are common in interviews for Forex Trader positions. These questions are designed to assess candidates’ situational judgment, decision-making skills, and teamwork abilities. Candidates should prepare for behavioral questions by thinking about specific examples from their experience that demonstrate their skills and abilities.

4. Be Confident and Enthusiastic

Candidates should be confident and enthusiastic during the interview. They should be able to articulate their trading skills and experience clearly and concisely. Candidates should also be able to answer questions about the market and their trading strategies. Showing genuine interest and excitement about the role and the company can boost your chances.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Forex Trader, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Forex Trader positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.