Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Fraud Prevention Analyst interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Fraud Prevention Analyst so you can tailor your answers to impress potential employers.

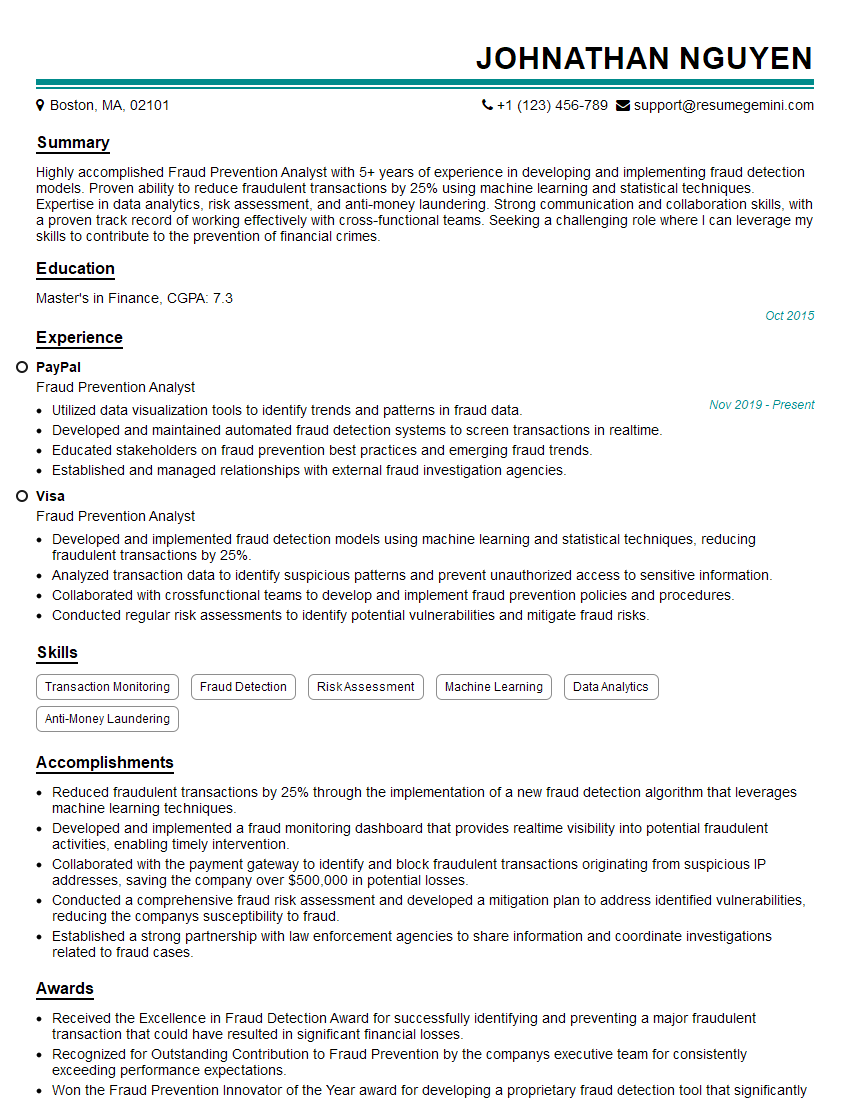

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fraud Prevention Analyst

1. What are the key elements you consider while developing a fraud detection model?

- Historical fraud data

- Business rules and heuristics

- Machine learning algorithms

- Model validation and monitoring

2. Describe the different types of fraud detection techniques and their applications

Supervised Learning

- Logistic Regression

- Decision Trees

- Support Vector Machines

Unsupervised Learning

- Clustering

- Anomaly Detection

3. How do you handle concept drift in fraud detection models?

- Retrain the model periodically

- Use adaptive learning algorithms

- Monitor model performance and adjust thresholds as needed

4. Explain the role of data visualization in fraud detection

- Identify patterns and anomalies

- Communicate findings to stakeholders

- Monitor model performance

5. What are the challenges in implementing a fraud detection system?

- Data quality and availability

- False positives and false negatives

- Model interpretability and explainability

6. How do you evaluate the effectiveness of a fraud detection system?

- Fraud detection rate

- False positive rate

- Return on investment (ROI)

7. Discuss the different types of fraud schemes and how you would detect them

- Identity theft

- Payment fraud

- Account takeover

8. How do you stay up-to-date on the latest fraud trends and techniques?

- Attend industry conferences and webinars

- Read trade publications and journals

- Network with other fraud professionals

9. What is your experience with using machine learning for fraud detection?

- Developed and implemented ML models

- Evaluated model performance and made improvements

- Collaborated with data scientists and engineers

10. What are your thoughts on the future of fraud detection?

- Increased use of AI and ML

- Focus on predictive analytics

- Collaboration between fraud professionals and other stakeholders

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fraud Prevention Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fraud Prevention Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Fraud Prevention Analysts are responsible for protecting businesses from fraudulent activities. They work to detect, investigate, and prevent fraud by analyzing data, identifying patterns, and developing fraud prevention strategies.

1. Data Analysis and Fraud Detection

Fraud Prevention Analysts use data analysis tools and techniques to identify suspicious patterns and behaviors that may indicate fraud. They analyze transaction data, customer profiles, and other relevant information to detect fraudulent activities.

- Analyze large datasets to identify anomalies and patterns that may indicate fraud.

- Develop and implement fraud detection models and algorithms to detect fraudulent transactions.

2. Fraud Investigation

When fraud is suspected, Fraud Prevention Analysts conduct thorough investigations to gather evidence and determine the extent of the fraud. They interview witnesses, collect documents, and work with law enforcement to apprehend fraudsters.

- Investigate suspicious activities and transactions to determine if fraud has occurred.

- Prepare and present investigation reports summarizing findings and recommendations.

3. Fraud Prevention Strategy Development

Based on their analysis and investigations, Fraud Prevention Analysts develop and implement fraud prevention strategies to mitigate risks and prevent future fraud. They work with stakeholders across the organization to implement effective fraud prevention measures.

- Develop and implement fraud prevention policies and procedures.

- Educate employees on fraud prevention best practices.

4. Reporting and Communication

Fraud Prevention Analysts communicate their findings and recommendations to management and other stakeholders. They prepare reports, present analysis, and participate in meetings to inform decision-making.

- Prepare and present reports on fraud prevention activities and findings.

- Communicate with stakeholders to raise awareness about fraud and preventive measures.

Interview Tips

To prepare for an interview for a Fraud Prevention Analyst position, it’s important to have a strong understanding of the job responsibilities and to practice answering common interview questions. Here are some tips to help you ace your interview:

1. Research the Company and the Role

Before the interview, take the time to research the company and the specific Fraud Prevention Analyst role you are applying for. This will help you understand the company’s business model, fraud prevention goals, and the specific skills and experience they are looking for in a candidate.

- Visit the company’s website to learn about their products or services, industry, and financial performance.

- Read articles and news about the company to stay informed about their recent developments and initiatives.

2. Highlight Your Skills and Experience

In your interview, be sure to highlight your skills and experience that are relevant to the Fraud Prevention Analyst role. Emphasize your data analysis abilities, fraud detection expertise, and experience in developing and implementing fraud prevention strategies.

- Provide specific examples of how you have used data analysis to identify and prevent fraud.

- Describe your experience in investigating and resolving fraud cases, including the steps you took and the outcomes you achieved.

3. Demonstrate Your Knowledge of Fraud Prevention Best Practices

Interviewers will want to know that you are familiar with the latest fraud prevention best practices and strategies. During the interview, be prepared to discuss your knowledge of fraud prevention techniques, such as data analytics, machine learning, and behavioral analytics.

- Discuss your understanding of different types of fraud, such as identity theft, credit card fraud, and check fraud.

- Explain how you stay up-to-date on the latest fraud prevention trends and technologies.

4. Be Prepared to Answer Common Interview Questions

There are a few common interview questions that Fraud Prevention Analysts are often asked. Be prepared to answer these questions in a clear and concise manner.

- Why are you interested in a career in fraud prevention?

- What are your strengths and weaknesses as a fraud prevention analyst?

- What is your experience with fraud detection and investigation?

- How do you stay up-to-date on the latest fraud prevention trends and technologies?

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Fraud Prevention Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.