Feeling lost in a sea of interview questions? Landed that dream interview for Full Charge Bookkeeper but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Full Charge Bookkeeper interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

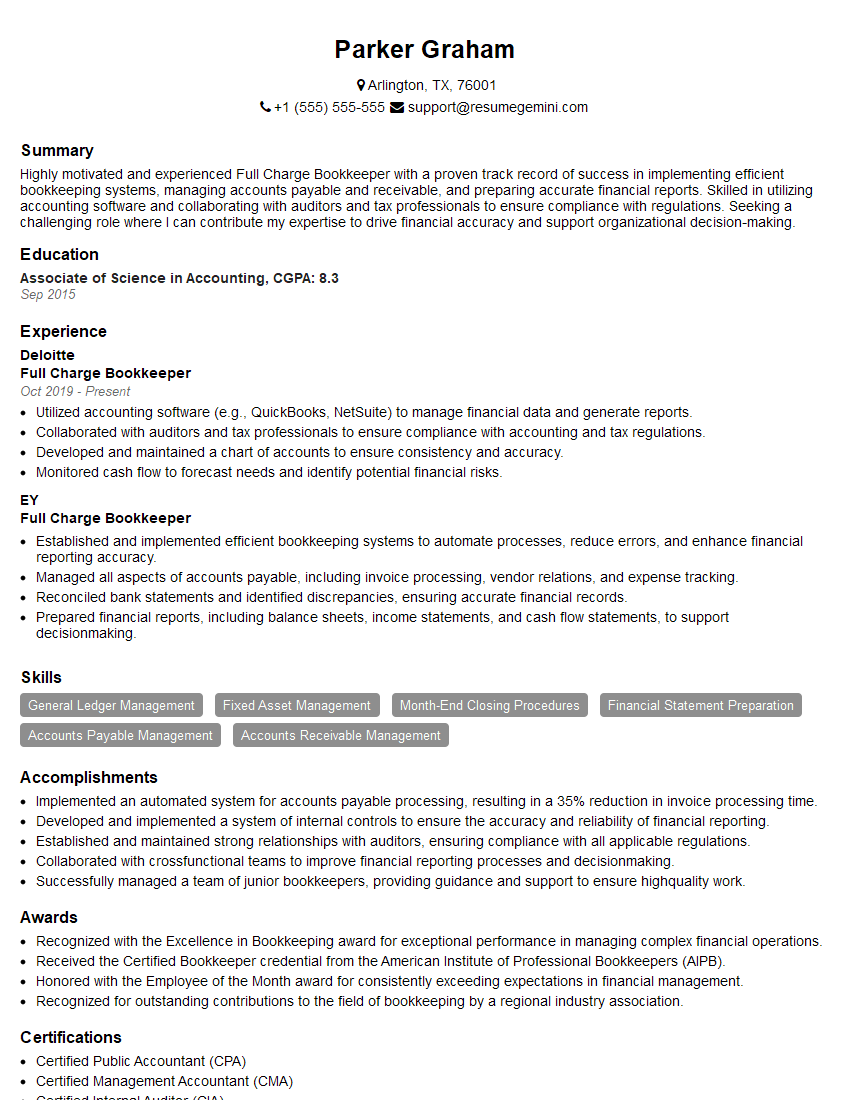

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Full Charge Bookkeeper

1. Explain the steps involved in the monthly bookkeeping cycle?

The monthly bookkeeping cycle typically involves the following steps:

- Record transactions: Journalize all financial transactions that occur during the month.

- Post to the general ledger: Transfer the journal entries to the appropriate accounts in the general ledger.

- Prepare the trial balance: Create a trial balance to ensure that the debits and credits are equal.

- Adjusting entries: Record any adjusting entries that are necessary to reflect the true financial position of the company at the end of the month.

- Prepare the adjusted trial balance: Create an adjusted trial balance to ensure that the debits and credits are equal after the adjusting entries have been recorded.

- Prepare the financial statements: Prepare the income statement, balance sheet, and statement of cash flows.

- Close the books: Transfer the net income or loss to the retained earnings account and close all revenue and expense accounts.

2. What are the different types of adjusting entries?

- Accruals: To record revenue that has been earned but not yet received or expenses that have been incurred but not yet paid.

- Deferrals: To record revenue that has been received but not yet earned or expenses that have been paid but not yet incurred.

- Depreciation: To record the decline in value of fixed assets over time.

- Amortization: To record the decline in value of intangible assets over time.

- Impairments: To record losses on assets that have declined in value.

3. What are the different types of financial statements?

- Income statement: Shows the company’s revenues, expenses, and profits over a period of time.

- Balance sheet: Shows the company’s assets, liabilities, and equity at a specific point in time.

- Statement of cash flows: Shows the company’s cash inflows and outflows over a period of time.

4. What are the key ratios used to analyze the financial health of a company?

- Liquidity ratios: Measure the company’s ability to meet its short-term obligations.

- Solvency ratios: Measure the company’s ability to meet its long-term obligations.

- Profitability ratios: Measure the company’s profitability.

- Efficiency ratios: Measure the company’s efficiency in using its assets.

5. What are the different types of internal controls?

- Preventive controls: Designed to prevent errors and fraud from occurring.

- Detective controls: Designed to detect errors and fraud after they have occurred.

- Corrective controls: Designed to correct errors and fraud after they have been detected.

6. What is the importance of bank reconciliations?

- To ensure that the company’s records of its cash balance agree with the bank’s records.

- To identify any outstanding checks or deposits.

- To detect any errors that may have been made in the recording of cash transactions.

7. What are the different types of payroll taxes?

- Federal income tax: Withheld from employees’ paychecks to cover their federal income tax liability.

- Federal Social Security tax: Withheld from employees’ paychecks to cover their Social Security benefits.

- Federal Medicare tax: Withheld from employees’ paychecks to cover their Medicare benefits.

- State income tax: Withheld from employees’ paychecks to cover their state income tax liability.

- Local income tax: Withheld from employees’ paychecks to cover their local income tax liability.

8. What are the different types of payroll reports?

- Payroll register: Lists all of the employees who were paid during a pay period, along with their pay rates, hours worked, and gross and net pay.

- Check register: Lists all of the checks that were issued during a pay period, along with the check number, date, payee, and amount.

- Earnings and deductions report: Summarizes the earnings and deductions for all of the employees who were paid during a pay period.

- Payroll tax report: Summarizes the payroll taxes that were withheld from the employees’ paychecks during a pay period.

9. What are the different methods of depreciation?

- Straight-line method: The most common method of depreciation, which allocates the cost of an asset evenly over its useful life.

- Declining-balance method: Allocates more of the cost of an asset to the early years of its useful life.

- Units-of-production method: Allocates the cost of an asset based on the number of units produced during its useful life.

- Sum-of-the-years’-digits method: Allocates more of the cost of an asset to the early years of its useful life than the straight-line method.

10. What are the different types of inventory costing methods?

- First-in, first-out (FIFO): Assumes that the first inventory purchased is the first inventory sold.

- Last-in, first-out (LIFO): Assumes that the last inventory purchased is the first inventory sold.

- Weighted average: Calculates the average cost of inventory on hand by dividing the total cost of inventory by the total number of units on hand.

- Specific identification: Assigns a specific cost to each unit of inventory.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Full Charge Bookkeeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Full Charge Bookkeeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Full Charge Bookkeeper is responsible for managing the day-to-day financial operations of an organization. The primary focus of this role includes accounting, bookkeeping, and financial reporting.

1. Accounting and Bookkeeping

Handle all accounting transactions, including recording, classifying, and reconciling financial data

- Maintain accurate financial records, including general ledger, accounts payable, and accounts receivable

- Prepare and analyze financial statements, such as balance sheets, income statements, and cash flow statements

2. Payroll Processing

Process employee payroll, including calculating wages, deductions, and taxes

- File payroll tax returns and make payroll deposits

- Maintain employee payroll records

3. Financial Reporting

Prepare and submit financial reports to management and external stakeholders

- Monitor financial performance and identify areas for improvement

- Prepare and analyze budgets

4. Other Related Responsibilities

Perform other related duties as assigned, such as:

- Assist with audits and reviews

- Maintain internal controls

- Provide customer service related to financial matters

Interview Tips

Here are a few tips to help you ace your interview for a Full Charge Bookkeeper position:

1. Research the Company and Position

Take the time to learn about the company and the specific position you are applying for. This will help you understand the company’s culture and the role’s responsibilities.

- Visit the company’s website and social media pages.

- Read articles and news about the company.

- Contact the hiring manager or recruiter to ask questions about the position.

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” Practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer behavioral interview questions.

- Quantify your accomplishments whenever possible.

- Tailor your answers to the specific position and company you are applying for.

3. Be Prepared to Discuss Your Experience and Skills

The interviewer will want to know about your experience and skills as a bookkeeper. Be prepared to discuss your experience in the following areas:

- Accounting and bookkeeping principles

- Payroll processing

- Financial reporting

- Software proficiency

4. Ask Questions

Asking questions at the end of the interview shows that you are interested in the position and the company. Prepare a few questions to ask the interviewer, such as:

- What are the biggest challenges facing the company right now?

- What are the opportunities for advancement within the company?

- What is the company culture like?

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Full Charge Bookkeeper, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Full Charge Bookkeeper positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.