Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Fund Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

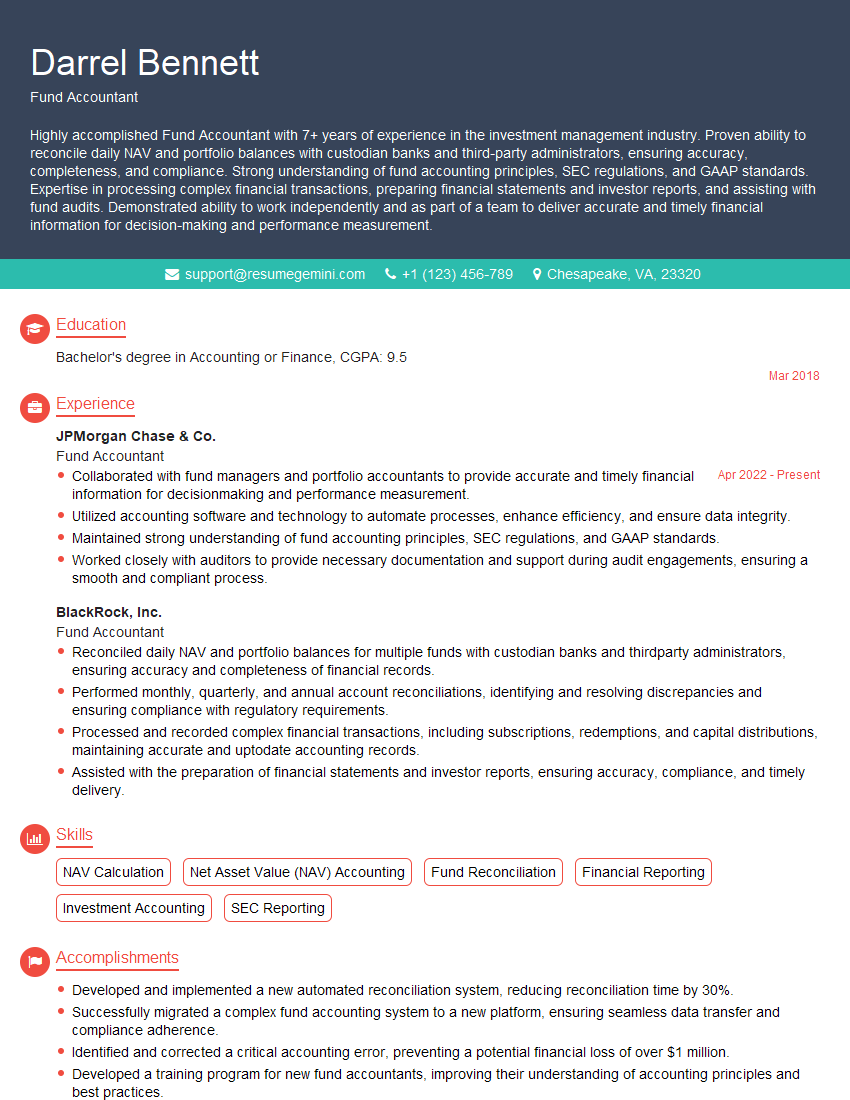

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fund Accountant

1. Explain the process of reconciling bank statements in a fund accounting environment.

When reconciling bank statements, I first compare the bank statement to the general ledger to identify any outstanding deposits or withdrawals. I then review the items that are not reconciled to determine if they are legitimate transactions or errors. If there are any errors, I make the necessary corrections to the general ledger. I also note any unusual activity on the bank statement and investigate to determine the cause. Once all of the items have been reconciled, I prepare a reconciliation report that summarizes the differences between the bank statement and the general ledger.

2. Describe the different types of financial instruments that are commonly used in fund accounting.

Fixed income securities

- Bonds

- Certificates of deposit

- Money market accounts

Equity securities

- Stocks

- Mutual funds

- Exchange-traded funds

Derivative securities

- Options

- Futures

- Swaps

3. What are the key differences between GAAP and GASB accounting standards?

GAAP is a set of accounting standards that are used by publicly traded companies in the United States. GASB is a set of accounting standards that are used by state and local governments in the United States. The key differences between GAAP and GASB accounting standards include:

- GAAP is based on the principle of accrual accounting, while GASB is based on the principle of modified accrual accounting.

- GAAP requires companies to report all of their assets and liabilities on their balance sheet, while GASB only requires governments to report their assets and liabilities that are related to their governmental activities.

- GAAP allows companies to use a variety of accounting methods, while GASB requires governments to use specific accounting methods that are prescribed by the GASB.

4. How do you account for investments in a fund accounting environment?

Investments are accounted for in a fund accounting environment using the fair value method. This means that the investments are reported on the balance sheet at their current market value. The change in the fair value of the investments is reported on the income statement as a gain or loss.

5. What are the different types of audits that are performed in a fund accounting environment?

- Financial statement audits

- Compliance audits

- Performance audits

- Internal audits

6. What are the key internal controls that should be in place for a fund accounting system?

- Segregation of duties

- Authorization of transactions

- Reconciliation of bank statements

- Review of financial statements by management

- Independent audits

7. What are the most common challenges that you have faced in your previous fund accounting roles?

The most common challenges that I have faced in my previous fund accounting roles include:

- Keeping up with the changing accounting standards

- Ensuring that the financial statements are accurate and complete

- Managing the risk of fraud

- Meeting the deadlines for filing financial reports

- Training new staff members

8. What are your strengths and weaknesses as a fund accountant?

My strengths as a fund accountant include:

- Strong knowledge of GAAP and GASB accounting standards

- Experience in all aspects of fund accounting, including financial statement preparation, auditing, and internal control

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

My weaknesses include:

- I am not a CPA

- I do not have any experience in the private sector

9. Why are you interested in this fund accountant position?

I am interested in this fund accountant position because it is a great opportunity to use my skills and experience to make a difference in the community. I am passionate about public service and I believe that I can use my skills to help the organization achieve its goals.

10. What are your salary expectations?

My salary expectations are in line with the market rate for fund accountants with my experience and qualifications. I am open to discussing a salary range that is commensurate with the responsibilities of the position.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fund Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fund Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Fund Accountants are responsible for the accurate accounting and reporting of financial transactions within investment funds. Their primary duties include:

1. Fund Accounting

Fund Accountants maintain detailed records of all financial transactions, including cash receipts, disbursements, and investments. They ensure that all transactions are recorded accurately and in accordance with GAAP and other applicable regulations.

2. Financial Reporting

Fund Accountants prepare and distribute financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide investors with a comprehensive overview of the fund’s financial performance and position.

3. Performance Measurement

Fund Accountants calculate and report the performance of the fund’s investments. They analyze market data, track investment returns, and determine the fund’s net asset value (NAV).

4. Client Relations

Fund Accountants often communicate with fund investors and other stakeholders to answer questions and provide financial information. They may also represent the fund at meetings or conferences.

Interview Tips

To prepare for a Fund Accountant interview, candidates should research the company and its funds, as well as the broader investment industry. They should also be well-versed in GAAP and other applicable accounting principles. Here are some additional tips for acing the interview:

1. Showcase Your Technical Skills

Highlight your experience with fund accounting software and your knowledge of GAAP and other accounting standards. Provide specific examples of how you have applied these skills in your previous roles.

2. Emphasize Your Attention to Detail

Fund accounting requires a high level of accuracy and attention to detail. Emphasize your ability to carefully review and analyze financial data to ensure its accuracy.

3. Demonstrate Your Problem-Solving Abilities

Fund Accountants often encounter complex financial issues. Highlight your ability to identify and solve problems, and provide examples of how you have done so in the past.

4. Show Your Communication Skills

Fund Accountants need to be able to communicate effectively with a variety of stakeholders, including investors, auditors, and regulators. Demonstrate your ability to clearly and concisely convey financial information.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fund Accountant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!