Are you gearing up for a career in Futures Trader? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Futures Trader and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

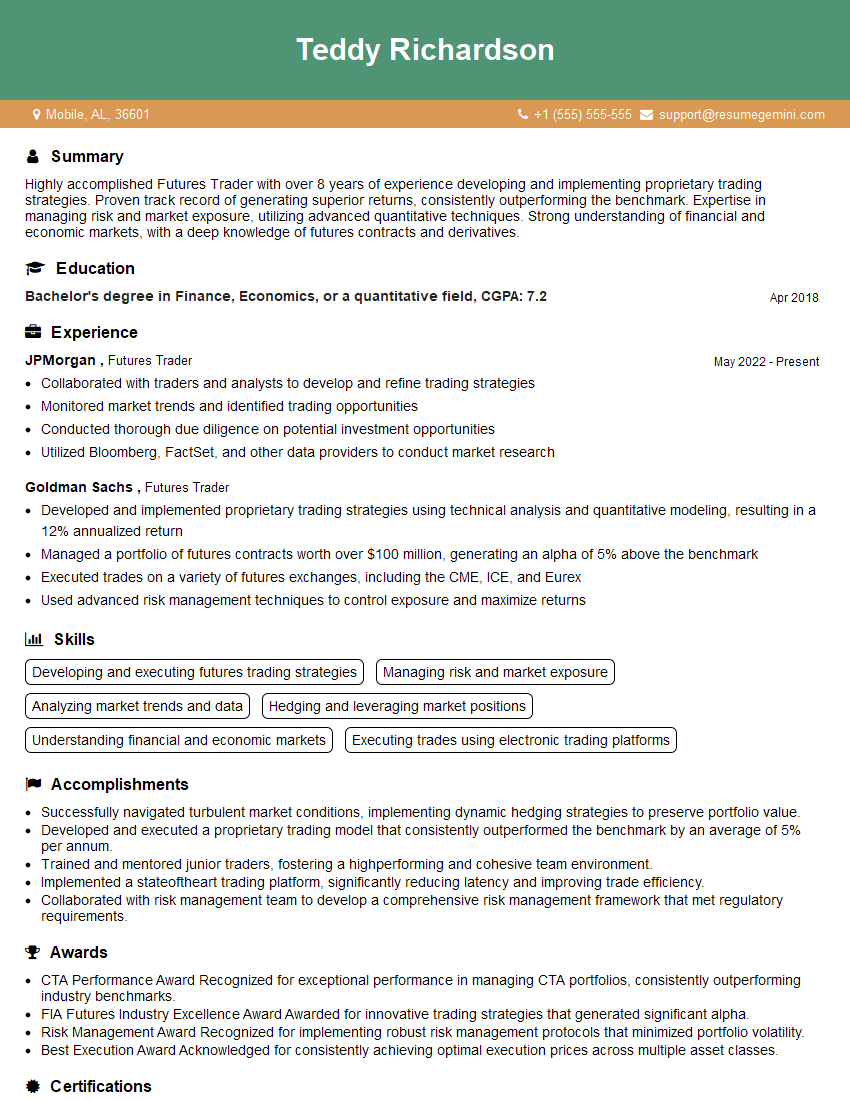

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Futures Trader

1. Describe the process of developing and implementing a futures trading strategy.

- Conduct thorough market research to identify potential trading opportunities.

- Analyze historical data and market trends to develop a comprehensive trading plan with clearly defined entry and exit points.

- Backtest the strategy on historical data or simulation platforms to evaluate its performance and identify areas for improvement.

- Optimize the strategy parameters and risk management measures based on backtesting results.

- Implement the strategy in real-time trading, closely monitoring its performance and making adjustments as needed.

2. Explain the factors that influence the valuation of futures contracts.

Factors affecting spot prices

- Supply and demand dynamics

- Economic indicators and macroeconomic factors

- Weather conditions and natural disasters

Factors specific to futures contracts

- Time value of money (interest rates and dividends)

- Storage and carrying costs

- Basis and seasonality

3. Discuss the different types of futures trading strategies and their respective risk profiles.

- Scalping: High-frequency trading with small profit margins and low risk profile.

- Momentum Trading: Holding positions for short to medium term based on market trends, with moderate risk.

- Trend Following: Identifying and exploiting long-term price trends, with higher risk but potential for significant gains.

- Carry Trade: Buying futures contracts of commodities with low carrying costs and selling contracts with high carrying costs to benefit from interest rate differentials, with low to moderate risk.

- Arbitrage: Exploiting price discrepancies between different markets or contracts, with very low risk but limited profit potential.

4. Explain the concept of margin and its role in futures trading.

- Margin is a deposit required by exchanges as a guarantee against potential losses.

- It represents a percentage of the contract value and serves as collateral.

- Margin requirements vary depending on the contract type, market volatility, and broker policies.

- Proper margin management is crucial to mitigate risks and avoid margin calls.

- Leverage, which is the ratio of contract value to margin, amplifies both profits and losses.

5. Describe the different types of futures markets and their regulatory frameworks.

- Exchange-traded futures: Traded on centralized exchanges with standardized contracts and regulations.

- Over-the-counter (OTC) futures: Traded directly between parties without intermediaries or standardized contracts, with less regulation.

- Commodity futures: Represent physical commodities like agricultural products, metals, and energy.

- Financial futures: Represent financial instruments like currencies, indices, and interest rates.

6. Explain the concept of technical analysis and its application in futures trading.

- Technical analysis involves studying historical price data to identify patterns and trends.

- It uses charts and indicators to analyze price movements, volume, and momentum.

- Traders use technical analysis to make informed decisions about market direction and potential trading opportunities.

- However, technical analysis is not a precise science and should be used in conjunction with other trading strategies.

7. Discuss the ethical considerations and regulatory guidelines that govern futures trading.

- Futures traders must adhere to ethical principles of integrity, transparency, and fair competition.

- Regulatory bodies impose strict rules to prevent market manipulation, insider trading, and other unethical practices.

- Traders should stay informed about relevant regulations and industry best practices.

- Violations of ethical or regulatory guidelines can result in severe penalties, including fines and jail time.

8. Describe the role of fundamental analysis in futures trading.

- Fundamental analysis involves studying economic, political, and industry-specific factors that affect commodity prices.

- It considers supply and demand dynamics, macroeconomic data, and geopolitical events.

- Traders use fundamental analysis to identify long-term trends and potential trading opportunities.

- Combining fundamental and technical analysis provides a more comprehensive understanding of market behavior.

9. Explain the concept of order types and their application in futures trading.

- Market order: Executed immediately at the current market price.

- Limit order: Executed only when the price reaches or surpasses a specified limit.

- Stop order: Triggers an order when the price reaches or surpasses a designated stop price.

- Stop-limit order: Combines a stop order with a limit order to control execution price.

- Traders use different order types to manage risk, target specific prices, and execute trades at advantageous times.

10. Discuss the importance of risk management in futures trading.

- Risk management is crucial to protect capital and prevent catastrophic losses.

- It involves setting stop-loss orders, managing leverage, and diversifying trading strategies.

- Traders should have a clear understanding of their risk tolerance and develop a comprehensive risk management plan.

- Proper risk management enables traders to navigate market volatility and preserve their financial resources.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Futures Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Futures Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Futures Traders are responsible for buying and selling futures contracts on behalf of their clients. They use their knowledge of the futures markets and their trading strategies to make decisions about when to enter and exit trades. Key job responsibilities include:

1. Market Analysis

Futures Traders must have a deep understanding of the futures markets and the factors that affect them. They must be able to identify trading opportunities and develop trading strategies based on their analysis.

- Conduct technical analysis of futures contracts

- Identify trading opportunities based on market trends and patterns

2. Execution

Futures Traders must be able to execute trades quickly and efficiently. They must be able to manage risk and make decisions under pressure.

- Enter and exit trades in futures contracts

- Manage risk by using stop-loss orders and other risk management techniques

3. Portfolio Management

Futures Traders must be able to manage their portfolios effectively. They must be able to track the performance of their trades and make adjustments as needed.

- Monitor the performance of futures contracts

- Make adjustments to trading strategies as needed

4. Client Relations

Futures Traders must be able to communicate effectively with clients. They must be able to explain their trading strategies and the risks involved.

- Communicate with clients about trading strategies and performance

- Provide clients with regular updates on market conditions

Interview Tips

Interviewing for a Futures Trader position can be a challenging experience. However, by following these tips, you can increase your chances of success:

1. Research the Company

Before your interview, take the time to research the company you are applying to. This will help you understand the company’s culture and values, as well as its trading strategies.

- Visit the company’s website

- Read articles about the company in the news

- Talk to people who work at the company

2. Prepare Your Answers

Take some time to prepare your answers to the common interview questions. This will help you sound confident and articulate during your interview.

- Why do you want to work for this company?

- What are your strengths and weaknesses?

- Tell me about your experience in futures trading.

3. Be Enthusiastic

Interviews are a great opportunity to show your enthusiasm for the position. Be positive and upbeat, and let the interviewer know that you are excited about the opportunity to work for the company.

- Smile and make eye contact with the interviewer

- Speak clearly and confidently

- Be passionate about futures trading

4. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the company. This shows that you are interested in the position and that you are taking the interview seriously.

- What are the key responsibilities of the position?

- What is the company’s trading strategy?

- What are the company’s goals for the future?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Futures Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!