Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted General Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

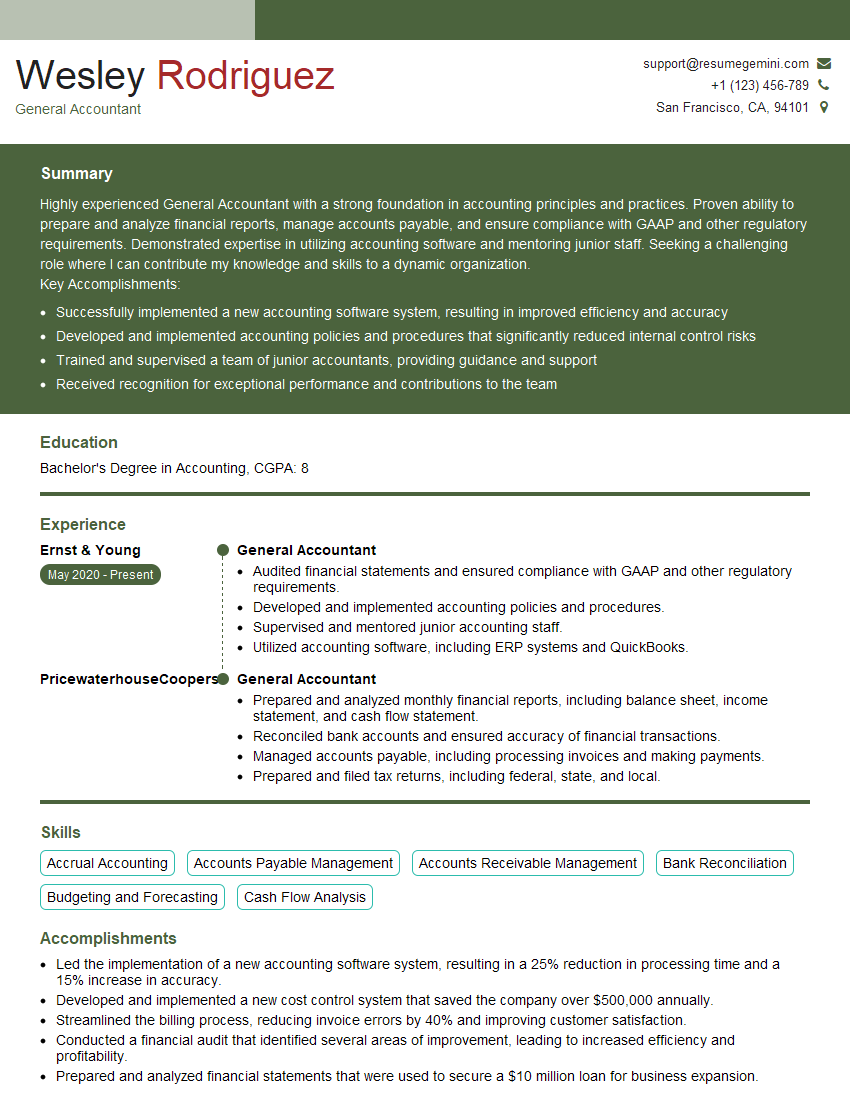

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For General Accountant

1. Explain the concept of accrual accounting and how it differs from cash basis accounting?

- Accrual accounting recognizes revenue when earned and expenses when incurred, regardless of cash flow.

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid.

- Accrual accounting provides a more accurate picture of a company’s financial performance over time.

- Cash basis accounting is simpler and easier to implement than accrual accounting.

2. What are the roles and responsibilities of a General Accountant?

Key Roles:

- Maintain accounting records

- Prepare financial statements

- Analyze financial data

- Prepare tax returns

- Audit financial statements

Key Responsibilities:

- Maintaining accurate and up-to-date financial records

- Preparing financial statements in accordance with GAAP

- Analyzing financial data to identify trends and patterns

- Preparing tax returns to ensure compliance with tax laws

- Auditing financial statements to ensure accuracy and compliance with regulations

3. Describe the different types of financial statements and their purpose?

- Balance Sheet: Provides a snapshot of a company’s financial health at a specific point in time.

- Income Statement: Summarizes a company’s revenues, expenses, and profits over a period of time.

- Statement of Cash Flows: Shows how a company generates and uses cash.

- Statement of Shareholders’ Equity: Tracks changes in a company’s equity over a period of time.

4. Explain the process of reconciling a bank statement?

- Compare bank statement to accounting records: Identify any discrepancies between the two.

- Investigate discrepancies: Determine the cause of any discrepancies and make necessary adjustments.

- Reconcile the accounts: Adjust the accounting records to match the bank statement.

5. How do you handle month-end closing procedures?

- Review and adjust entries: Ensure that all transactions have been properly recorded and adjusted.

- Prepare financial statements: Create the balance sheet, income statement, and statement of cash flows.

- Close the books: Transfer the balances of temporary accounts to permanent accounts.

6. Describe the different types of internal controls that can be implemented to prevent fraud?

- Segregation of duties: Assigning different tasks to different individuals to prevent one person from having complete control over a process.

- Authorization and approval: Requiring multiple levels of approval for significant transactions.

- Reconciliations: Regularly comparing accounting records to supporting documentation.

- Monitoring: Regularly reviewing financial and operational data to identify any anomalies.

7. What are the key accounting principles that must be followed when preparing financial statements?

- Accrual accounting: Recognizing revenue when earned and expenses when incurred.

- Matching principle: Matching expenses with the revenue they generate.

- Going concern: Assuming that the business will continue operating in the foreseeable future.

- Materiality: Only disclosing information that is significant to the financial statements.

8. Explain the concept of depreciation and how it is calculated?

- Depreciation: The systematic allocation of the cost of an asset over its useful life.

- Methods of depreciation: Straight-line, double-declining balance, sum-of-the-years’ digits.

- Formula for straight-line depreciation: (Cost of asset – Residual value) / Useful life in years.

9. What are the different types of auditing procedures that can be performed?

- Financial statement audits: Evaluating the accuracy and completeness of financial statements.

- Operational audits: Reviewing the efficiency and effectiveness of internal controls and processes.

- Compliance audits: Ensuring that a company is adhering to applicable laws and regulations.

- Forensic audits: Investigating financial fraud and other irregularities.

10. What are the key challenges facing General Accountants in today’s business environment?

- Complexity of financial reporting: Increasing complexity of accounting regulations and standards.

- Technology advancements: Keeping up with new technologies and their impact on accounting.

- Data analytics: Using data analytics to improve financial decision-making.

- Globalization: Managing accounting and financial reporting for multinational operations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for General Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the General Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A General Accountant serves as a critical member of the finance team, contributing to the smooth funcionamiento of an organization’s financial operations. The role encompasses a wide range of responsibilities, including:

1. Financial Reporting and Analysis

Preparing and analyzing financial statements, such as balance sheets, income statements, and cash flow statements, to provide insights into the company’s financial health and performance.

- Ensuring the accuracy and compliance of financial reports with accounting standards (GAAP, IFRS).

- Identifying trends and patterns in financial data to support decision-making and forecast future performance.

2. Accounting Operations

Managing day-to-day accounting functions, such as recording transactions, reconciling accounts, and processing invoices and payments.

- Maintaining accurate and up-to-date accounting records.

- Preparing and filing tax returns (e.g., sales tax, payroll tax).

3. Budgeting and Forecasting

Developing and managing the company’s budget, including forecasting revenues and expenses.

- Analyzing historical financial data to estimate future financial performance.

- Monitoring budget performance and making adjustments as needed.

4. Internal Controls

Establishing and maintaining internal controls to ensure the accuracy and reliability of financial information.

- Implementing and evaluating accounting policies and procedures.

- Identifying and mitigating financial risks.

Interview Tips

Preparing thoroughly for an interview is crucial for success. Here are some tips and tricks:

1. Research the Company and Position

Take the time to learn about the company’s industry, products/services, and financial performance. Study the job description carefully and identify the key requirements and responsibilities.

- Visit the company’s website, social media pages, and financial reports.

- Read industry news and research articles to gain insights into the company’s market position.

2. Highlight Relevant Skills and Experience

Tailor your resume and cover letter to the specific job requirements. Quantify your accomplishments and use specific examples to demonstrate your skills.

- Use the STAR method (Situation, Task, Action, Result) to describe your past experiences.

- Emphasize transferable skills that are relevant to the role, even if not directly mentioned in the job description.

3. Practice Common Interview Questions

Prepare for common interview questions by practicing your answers aloud. Anticipate questions about your accounting knowledge, experience, and problem-solving abilities.

- Review accounting principles and concepts to refresh your technical skills.

- Use online resources or mock interview platforms to simulate real-world interview scenarios.

4. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally and arrive on time for your interview. Be polite and respectful to the interviewer and anyone you encounter during your visit.

- Choose business attire that is clean, pressed, and appropriate for the company culture.

- Plan your route and allow extra time for unforeseen delays.

5. Ask Informed Questions

Asking thoughtful questions at the end of the interview demonstrates your interest and engagement. Prepare questions that show you have done your research and are genuinely interested in the position.

- Ask about the company’s growth plans, financial goals, or industry outlook.

- Inquire about the specific responsibilities and expectations of the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the General Accountant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.