Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the General Claims Agent interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a General Claims Agent so you can tailor your answers to impress potential employers.

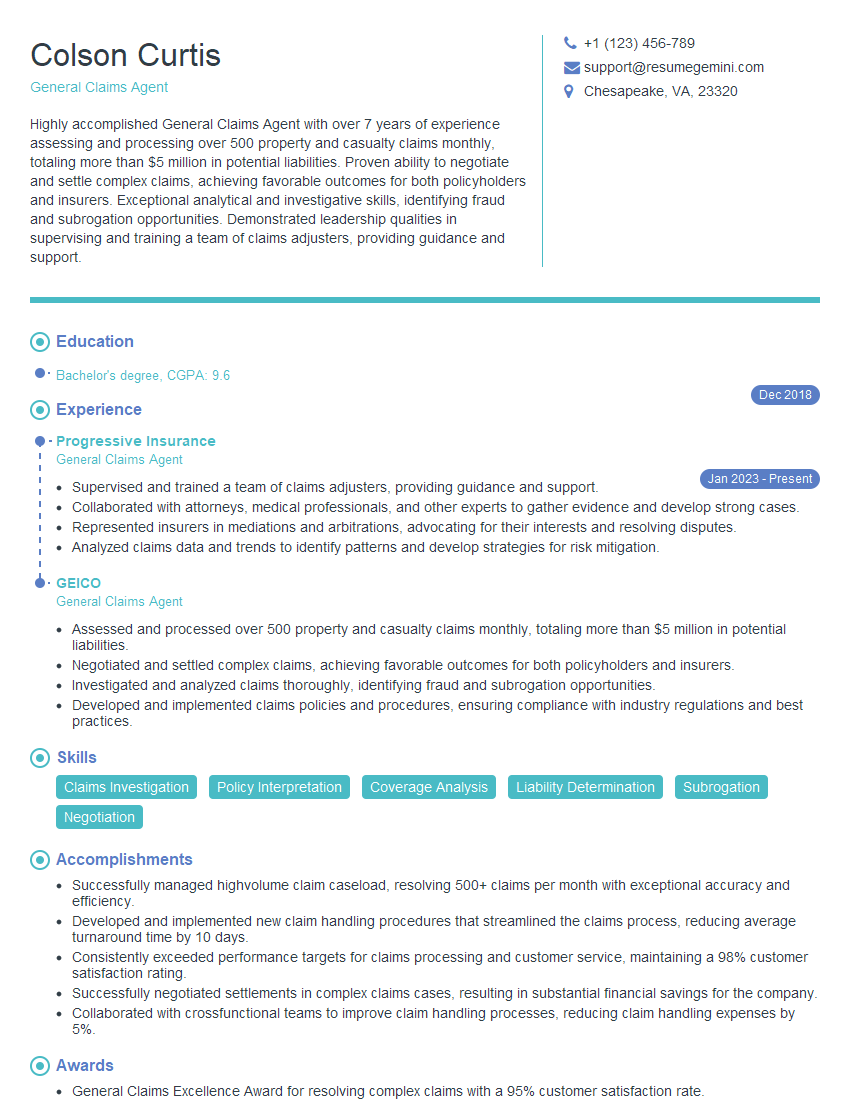

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For General Claims Agent

1. How do you handle challenging or irate customers?

When dealing with challenging or irate customers, I prioritize defusing the situation by remaining calm and empathetic. I actively listen to their concerns, acknowledge their frustration, and validate their feelings. By establishing a rapport, I can work towards addressing their needs effectively.

2. Describe your approach to investigating and evaluating claims.

Gathering Evidence and Information

- Review claim forms, policies, and relevant documentation

- Conduct interviews with the policyholder, witnesses, and experts

- Inspect the damaged property or scene of the incident

Evaluating the Claim

- Assess the validity and coverage of the claim

- Determine the extent of damages and estimate the value of the loss

- Review applicable laws, regulations, and policy provisions

3. How do you stay up-to-date on insurance regulations and industry best practices?

- Attend industry conferences and workshops

- Subscribe to publications and online resources

- Network with other claims professionals and experts

- Pursue continuing education and certifications

4. Describe your experience in managing complex or high-value claims.

- Coordinate with legal counsel and external experts

- Negotiate settlements and resolve disputes

- Oversee the claim process to ensure timely and efficient resolution

5. How do you prioritize and manage your workload effectively?

I utilize a combination of tools and strategies to prioritize and manage my workload effectively. I categorize claims based on urgency and importance, delegate tasks to team members, and implement workflow automation to streamline processes.

6. Describe your experience in utilizing claims management software and technology.

- Proficient in industry-standard claims management systems

- Familiar with claims analytics and reporting tools

- Experience in utilizing technology to improve efficiency and accuracy

7. How do you communicate effectively with different stakeholders, including policyholders, brokers, and legal counsel?

I tailor my communication style to the audience and ensure clarity and transparency at all times. I provide regular updates, proactively address concerns, and seek feedback to foster open and collaborative relationships.

8. Describe your ethical approach to claims handling.

- Adhere to professional codes of conduct

- Maintain confidentiality and respect privacy

- Treat all claimants fairly and without bias

9. How do you handle situations where there is insufficient or conflicting evidence?

- Gather additional information from various sources

- Review similar claims and case law

- Consult with experts and industry professionals

10. What do you consider to be the most important qualities for a successful General Claims Agent?

- Excellent communication and interpersonal skills

- Strong analytical and problem-solving abilities

- Attention to detail and accuracy

- Knowledge of insurance regulations and best practices

- Ethical and professional conduct

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for General Claims Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the General Claims Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

General Claims Agents, also known as Claims Adjusters, are responsible for handling and evaluating insurance claims. They work with policyholders, witnesses, and medical professionals to determine the extent of damages and liability, and decide on the appropriate settlement amount. The key responsibilities of a General Claims Agent include:

1. Investigating and Assessing Claims

Claims Agents investigate claims to determine the cause and extent of damages. They review policy documents and interview policyholders, witnesses, and medical professionals to gather information. They may also visit the site of the incident to inspect damages and take photographs.

2. Evaluating Liability

Claims Agents determine who is liable for the damages or injuries. They review policy documents, state laws, and relevant case law to make this determination. They may also consult with experts such as attorneys or engineers.

3. Negotiating Settlements

Claims Agents negotiate settlements with policyholders or claimants. They use their knowledge of policy coverage, liability, and industry standards to ensure that the settlement is fair and equitable.

4. Managing Litigation

In some cases, claims escalate into litigation. Claims Agents may be responsible for working with attorneys to manage the litigation process, including preparing documents, responding to interrogatories, and attending hearings.

Interview Tips

To ace an interview for a General Claims Agent position, candidates should prepare thoroughly and highlight their relevant skills and experience. Here are some interview preparation tips:

1. Research the Insurance Industry

Familiarize yourself with the insurance industry and the specific lines of coverage you will be handling. Learn about the claims process, common types of claims, and industry trends.

2. Practice Your Investigation and Negotiation Skills

Describe how you would investigate a claim and negotiate a settlement. Use examples from your previous experience to demonstrate your skills in these areas.

3. Prepare Questions for the Interviewer

Ask thoughtful questions about the company and the claims department. This shows that you are engaged and interested in the position.

4. Dress Professionally and Arrive On Time

First impressions matter, so dress professionally and arrive on time for your interview. Be polite and respectful to everyone you meet.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the General Claims Agent role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.