Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the General Ledger Bookkeeper interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a General Ledger Bookkeeper so you can tailor your answers to impress potential employers.

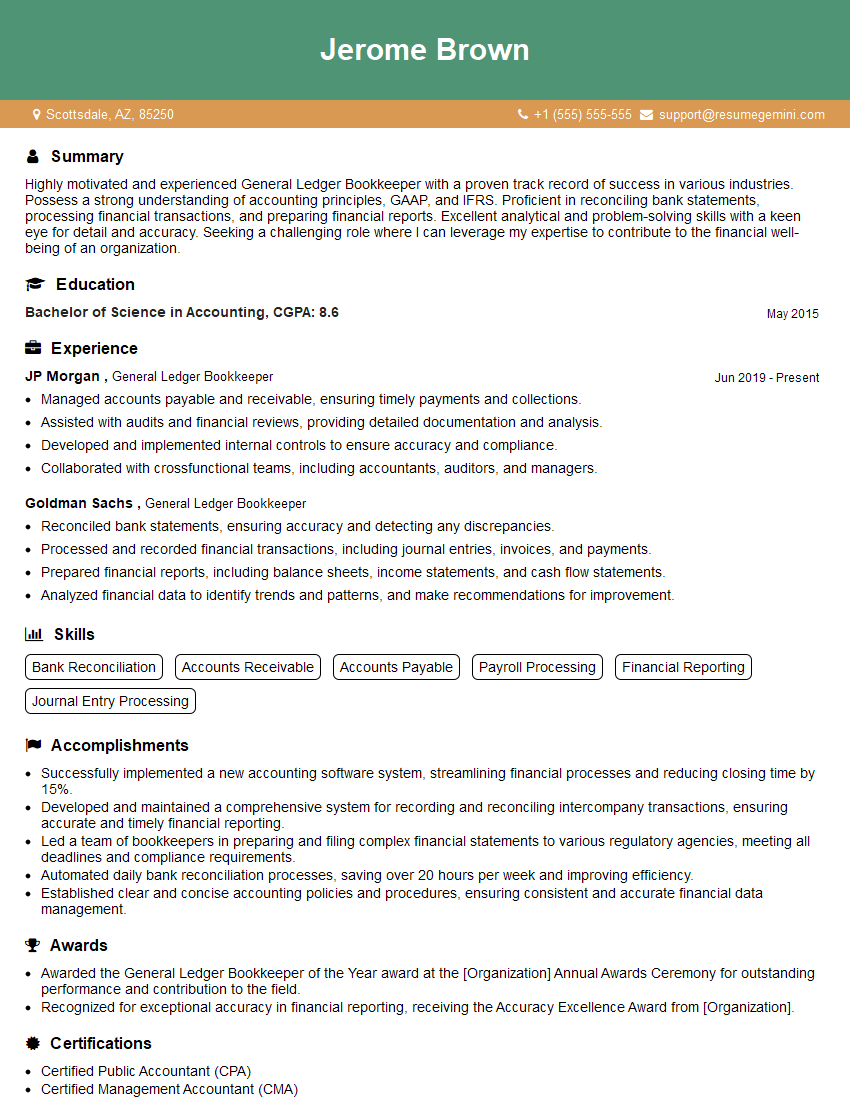

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For General Ledger Bookkeeper

1. How do you ensure the accuracy of your general ledger entries?

- Performing regular reconciliations to match balances with related accounts.

- Scrutinizing entries for completeness, accuracy, and adhering to GAAP.

- Undertaking trial balances to identify and correct any discrepancies.

2. Describe the process you follow for month-end closing.

Closing Entries

- Accrue expenses and defer revenues to recognize expenses and revenues in the correct period.

- Depreciate fixed assets and amortize intangible assets to allocate costs over their useful lives.

Financial Statement Preparation

- Compile financial statements (balance sheet, income statement, statement of cash flows) based on closed ledger balances.

- Review and analyze financial statements for insights and areas of improvement.

3. Explain your understanding of internal controls related to cash handling.

- Maintaining separation of duties among individuals responsible for cash transactions.

- Reconciling bank statements regularly to detect any unauthorized or fraudulent activities.

- Implementing physical safeguards to protect cash on hand, such as secure storage and restricted access.

4. How do you handle complex accounting transactions, such as mergers and acquisitions?

- Reviewing and understanding the terms and conditions of the transaction.

- Preparing necessary journal entries to record the transaction’s financial impact.

- Analyzing the impact on financial statements and ensuring compliance with accounting standards.

5. Describe your experience with accounting software and technology.

- Proficient in industry-standard accounting software, such as QuickBooks, NetSuite, or SAP.

- Ability to utilize technology to automate tasks, improve efficiency, and enhance data accuracy.

- Knowledge of data analytics tools for extracting insights from financial data.

6. How do you stay up-to-date with changes in accounting regulations and standards?

- Attending industry conferences and webinars.

- Subscribing to accounting publications and online resources.

- Consulting with professional accountants and auditors.

7. Explain your experience with budgeting and forecasting.

- Participated in developing and monitoring departmental budgets.

- Collaborated with relevant stakeholders to gather input and align budgets with organizational goals.

- Created financial projections and forecasts using historical data and industry trends.

8. Describe your understanding of the double-entry accounting system.

- Every transaction involves at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced.

- Debits increase assets or expenses and decrease liabilities or equity.

- Credits increase liabilities or equity and decrease assets or expenses.

9. How do you prioritize and manage multiple responsibilities within tight deadlines?

- Creating a prioritized to-do list and allocating time effectively.

- Delegating tasks to appropriate team members and providing clear instructions.

- Communicating regularly with supervisors to ensure alignment and adjust priorities as needed.

10. Can you describe a challenging accounting situation you faced and how you resolved it?

- Highlight a specific situation where you encountered an accounting issue.

- Explain the problem, the steps you took to investigate and analyze it.

- Describe the solution you implemented and the positive outcomes it brought.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for General Ledger Bookkeeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the General Ledger Bookkeeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

General Ledger Bookkeepers are responsible for maintaining the accuracy and integrity of a company’s financial records. They ensure that all financial transactions are recorded correctly and in a timely manner. Some of the key job responsibilities include:

1. Recording financial transactions

This involves recording all financial transactions in the general ledger, including cash receipts, cash disbursements, sales, purchases, and expenses.

- Maintaining accurate and up-to-date financial records

- Reconciling bank statements and other financial accounts

- Preparing financial reports and statements

2. Preparing financial reports and statements

Bookkeepers prepare financial reports and statements that summarize the financial activities of the company. These reports are used by management to make informed decisions about the company’s financial health.

- Analyzing financial data to identify trends and patterns

- Developing and implementing financial controls to prevent fraud and error

- Communicating financial information to management and other stakeholders

3. Reconciling bank statements and other financial accounts

Bookkeepers reconcile bank statements and other financial accounts to ensure that the company’s records are accurate. This process involves comparing the company’s records to the records of its banks and other financial institutions.

- Maintaining a system of internal controls to ensure the accuracy and reliability of financial information

- Staying up-to-date on accounting principles and regulations

- Working independently and as part of a team

4. Maintaining a system of internal controls

Bookkeepers are responsible for maintaining a system of internal controls to ensure the accuracy and reliability of financial information. This system of controls includes policies and procedures that are designed to prevent fraud and error.

- Excellent communication and interpersonal skills

- Strong attention to detail and accuracy

- Ability to work independently and as part of a team

Interview Tips

Preparing for an interview for a General Ledger Bookkeeper position can be a daunting task. However, by following these tips, you can increase your chances of success:

1. Research the company and the position

This will help you to understand the company’s culture and the specific requirements of the position. You can research the company’s website, LinkedIn page, and Glassdoor reviews.

- Practice answering common interview questions

- Dress professionally and arrive on time for your interview

2. Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked. You can practice answering these questions by using online resources or by asking a friend or family member to help you.

- Be prepared to talk about your experience and skills

- Be enthusiastic and positive about the position

3. Dress professionally and arrive on time for your interview

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This will show the interviewer that you are serious about the position and that you respect their time.

- Follow up with the interviewer after the interview

- Be patient and don’t give up if you don’t get the job

4. Be enthusiastic and positive about the position

Interviewers are looking for candidates who are enthusiastic and positive about the position. Show the interviewer that you are excited about the opportunity to work for the company and that you are confident in your ability to do the job.

- Research the company and the position

- Practice answering common interview questions

- Dress professionally and arrive on time for your interview

- Be enthusiastic and positive about the position

5. Follow up with the interviewer after the interview

After the interview, it is important to follow up with the interviewer. This shows the interviewer that you are still interested in the position and that you appreciate their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the General Ledger Bookkeeper interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!