Are you gearing up for a career in Global Risk Management Director? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Global Risk Management Director and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

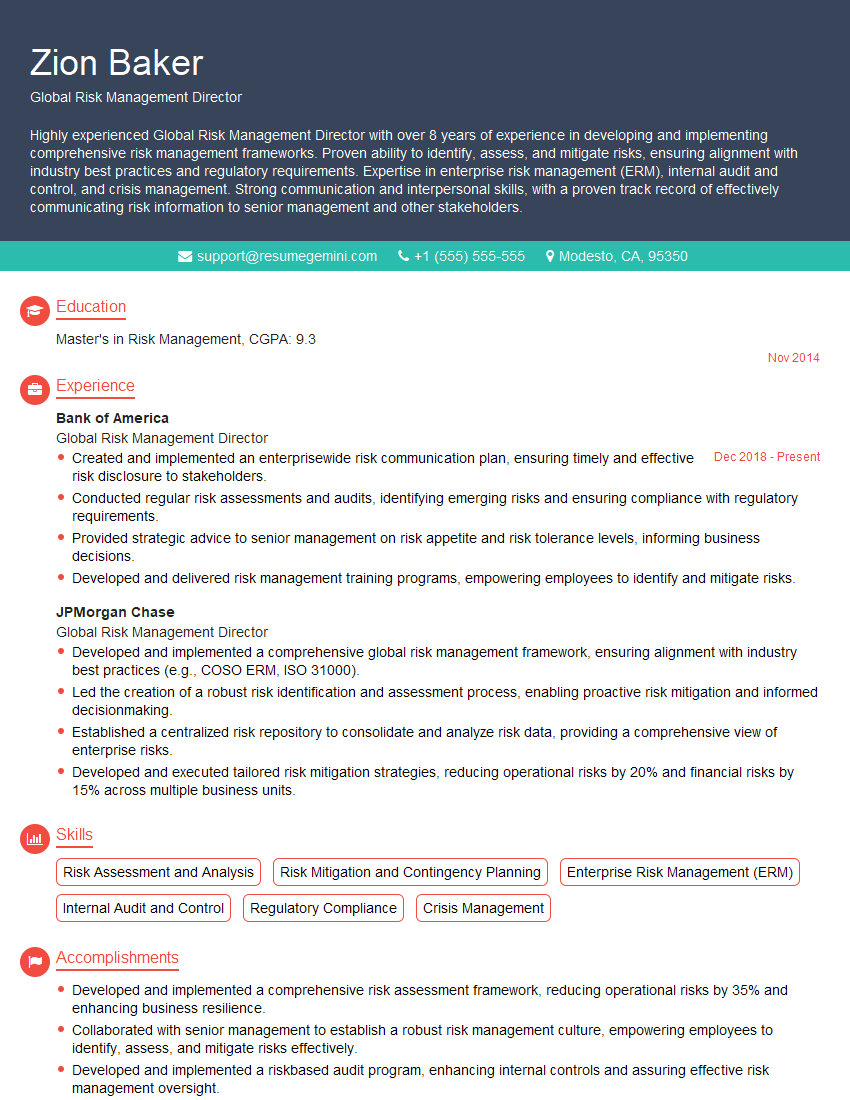

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Global Risk Management Director

1. Describe the key elements of an effective global risk management framework.

An effective global risk management framework typically includes:

- Identification and assessment of risks: Proactively identifying potential risks and assessing their likelihood and impact.

- Risk mitigation and management: Developing and implementing strategies to reduce or eliminate identified risks.

- Risk monitoring and reporting: Continuously monitoring risks and providing regular reports to senior management.

- Governance and oversight: Establishing clear roles and responsibilities for risk management and ensuring board-level oversight.

- Risk culture: Fostering a culture that values risk awareness and encourages responsible risk-taking.

2. How do you prioritize and allocate resources to manage global risks effectively?

Risk assessment and analysis

- Utilize risk assessment tools to quantify and rank risks based on their potential impact and likelihood.

- Conduct thorough scenario analysis to identify potential interdependencies and cascading effects of risks.

Resource allocation

- Align resource allocation with the organization’s risk tolerance and strategic objectives.

- Prioritize risks based on their severity and the availability of resources.

- Consider both internal and external resources, including partnerships with third-party risk management providers.

3. Discuss the role of technology in enhancing global risk management.

- Risk identification and monitoring: Using technology to automate risk identification and continuous risk monitoring.

- Data analytics and reporting: Utilizing data analytics to identify trends, patterns, and correlations in risk data.

- Risk modeling and simulation: Employing risk modeling and simulation tools to assess the impact of different scenarios and make informed decisions.

- Collaboration and communication: Facilitating seamless collaboration and information sharing among risk management professionals.

- Emerging technologies: Exploring the use of emerging technologies such as artificial intelligence (AI) and machine learning (ML) to enhance risk management capabilities.

4. How do you build and maintain strong relationships with key stakeholders, including senior management, regulators, and external partners?

- Effective communication: Establishing clear and regular communication channels with stakeholders.

- Stakeholder engagement: Proactively involving stakeholders in risk management processes and seeking their input.

- Building trust: Demonstrating competence, integrity, and transparency to gain stakeholder trust.

- Understanding stakeholder perspectives: Recognizing and addressing the diverse perspectives and concerns of different stakeholders.

- Collaboration and partnerships: Fostering collaborative relationships with external partners to enhance risk management capabilities.

5. Describe your approach to managing geopolitical risks and their potential impact on global operations.

- Continuous monitoring: Regularly monitoring geopolitical events and analyzing their potential implications.

- Scenario planning and risk assessment: Developing scenarios and conducting risk assessments to identify potential geopolitical risks.

- Contingency planning: Establishing contingency plans to prepare for and respond to geopolitical disruptions.

- Stakeholder engagement: Collaborating with stakeholders to assess and manage geopolitical risks.

- Government relations: Building strong relationships with government agencies to stay informed about geopolitical developments and regulatory changes.

6. How do you measure and report on the effectiveness of global risk management initiatives?

- Key risk indicators (KRIs): Using KRIs to track the performance of risk management initiatives.

- Regular reporting: Providing regular reports to senior management and the board of directors on risk management progress and outcomes.

- Independent assessments: Conducting independent assessments or audits to evaluate the effectiveness of risk management practices.

- Benchmarking: Benchmarking risk management practices against industry standards and best practices.

- Continuous improvement: Using feedback and data to continuously improve risk management processes and initiatives.

7. Describe your experience in managing operational risks, such as supply chain disruptions, cybersecurity breaches, and financial crises.

- Supply chain disruptions: Implementing supplier diversification strategies, establishing contingency plans, and conducting risk assessments to mitigate supply chain disruptions.

- Cybersecurity breaches: Developing and implementing comprehensive cybersecurity frameworks, conducting regular security audits, and training employees on cybersecurity best practices.

- Financial crises: Analyzing financial risks, stress testing scenarios, and developing contingency plans to manage potential financial downturns.

- Business continuity planning: Ensuring business continuity during operational disruptions by developing and exercising business continuity plans.

- Crisis management: Leading or participating in crisis management teams to respond effectively to operational risks and minimize their impact.

8. How do you approach risk management in a global environment where regulations and compliance requirements vary across jurisdictions?

- Regulatory mapping: Mapping regulatory requirements across different jurisdictions to ensure compliance.

- Cross-border collaboration: Collaborating with local teams and external partners to understand and address regulatory nuances.

- Risk assessment and monitoring: Conducting risk assessments and monitoring regulatory changes to identify potential compliance gaps.

- Governance and oversight: Establishing clear governance structures and oversight mechanisms to ensure compliance across global operations.

- Training and awareness: Providing training and raising awareness among employees about regulatory requirements and compliance obligations.

9. Describe your experience in managing environmental, social, and governance (ESG) risks.

- ESG risk identification and assessment: Identifying and assessing ESG risks, such as climate change, labor practices, and stakeholder engagement.

- ESG risk mitigation and management: Developing and implementing strategies to mitigate ESG risks and enhance sustainability.

- ESG reporting and disclosure: Reporting and disclosing ESG performance in accordance with relevant frameworks and standards.

- Stakeholder engagement: Engaging with stakeholders, including investors and regulators, on ESG issues.

- ESG integration: Integrating ESG considerations into business decision-making and long-term planning.

10. How do you stay abreast of emerging risks and trends in global risk management?

- Industry events and conferences: Attending industry events and conferences to stay informed about new risks and trends.

- Professional development: Pursuing professional development opportunities, such as certifications and workshops, to enhance knowledge and skills.

- Research and analysis: Conducting research and analyzing industry reports to identify emerging risks and trends.

- Networking: Building and maintaining professional networks with peers and experts in the field of risk management.

- Thought leadership: Reading industry publications and engaging in thought leadership initiatives to stay abreast of emerging risks and best practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Global Risk Management Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Global Risk Management Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Global Risk Management Director is a senior-level executive charged with the oversight and management of all risk-related matters for a global organization. This individual is responsible for developing and implementing a comprehensive risk management framework, identifying and assessing risks, and developing and executing strategies to mitigate those risks. The Global Risk Management Director must have a deep understanding of risk management principles and practices, as well as a strong understanding of the organization’s business.

1. Develop and implement a comprehensive risk management framework

- Assess the organization’s risk appetite and tolerance levels.

- Identify and assess risks across the organization.

- Develop and implement policies and procedures to manage risks.

2. Identify and assess risks

- Conduct risk assessments to identify potential risks.

- Assess the likelihood and impact of risks.

- Prioritize risks based on their likelihood and impact.

3. Develop and execute strategies to mitigate risks

- Develop and implement risk mitigation strategies.

- Monitor the effectiveness of risk mitigation strategies.

- Communicate risks and mitigation strategies to stakeholders.

4. Report on risk management activities

- Prepare and present risk reports to senior management.

- Provide input to the organization’s strategic planning process.

- Provide risk management training to employees.

Interview Tips

Preparing for an interview for the position of Global Risk Management Director requires thorough research and practice. Here are some tips to help you ace the interview:

1. Research the company and the position

- Visit the company’s website to learn about its business, mission, values, and recent news.

- Read industry publications and articles to gain insights into the company’s industry and competitive landscape.

- Review the job description carefully to understand the key responsibilities and qualifications required for the position.

2. Practice your answers to common interview questions

- Tell me about your experience in risk management.

- What are your key strengths and weaknesses as a risk manager?

- What are your thoughts on the current risk landscape?

- How would you approach developing a risk management framework for a global organization?

- What are your thoughts on the role of technology in risk management?

3. Prepare questions to ask the interviewer

- What are the key risks facing the organization?

- What is the organization’s risk appetite and tolerance levels?

- What are the organization’s strategic priorities?

- How does the organization measure and monitor risk?

- What is the role of the Global Risk Management Director in the organization?

4. Dress professionally and arrive on time for your interview

- First impressions matter, so make sure you dress professionally and arrive on time for your interview.

- Be polite and respectful to everyone you meet, including the receptionist and other employees.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Global Risk Management Director role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.