Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Group Insurance Special Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

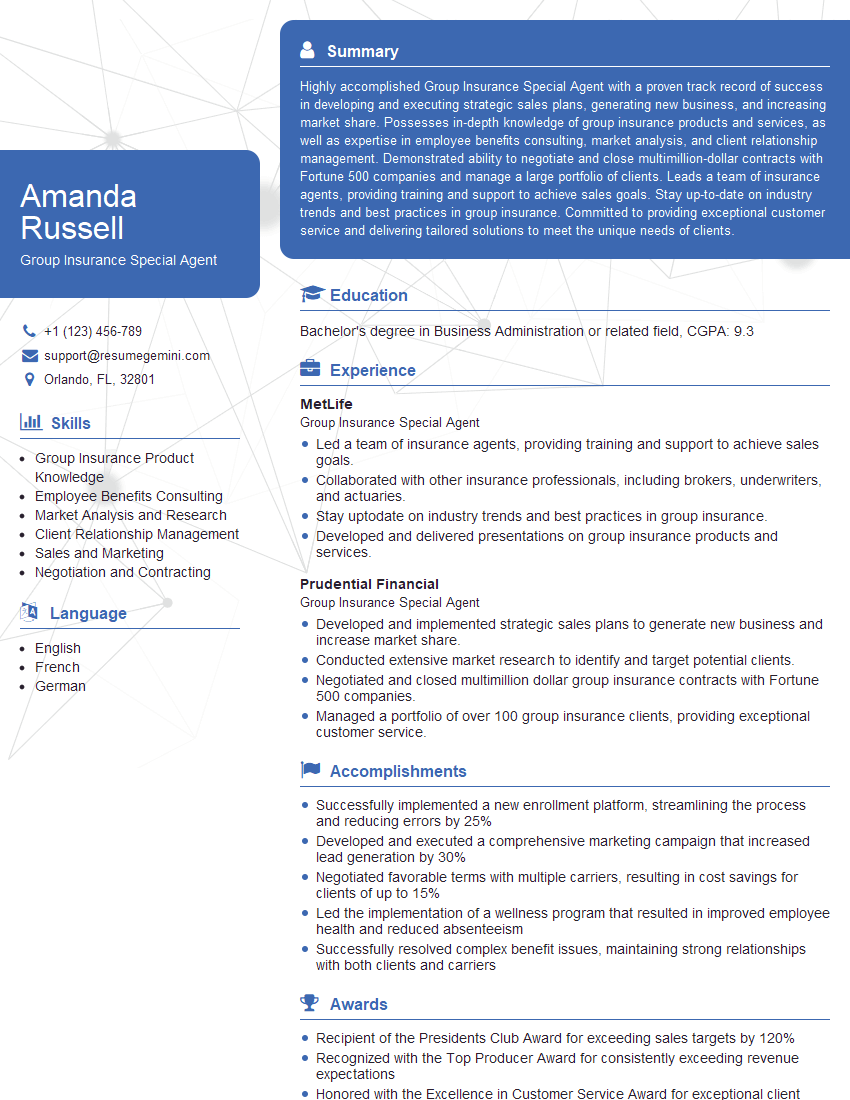

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Group Insurance Special Agent

1. What are the key underwriting considerations for group dental insurance?

- Oral health status of the group

- Dental history of the group

- Age and health status of the group

- Claims experience of the group

- Dental benefit plan design

2. How do you determine the appropriate premium rate for a group life insurance policy?

Factors considered:

- Age and health status of the group

- Occupation and industry of the group

- Size of the group

- Claims experience of the group

- Benefit plan design

Methods used:

- Experience rating

- Community rating

- Blended rating

3. What are the different types of riders available for group health insurance policies?

- Dental rider

- Vision rider

- Accidental death and dismemberment rider

- Cancer rider

- Critical illness rider

4. How do you handle a situation where a group member has a pre-existing condition?

- Review the group’s medical history

- Determine the severity of the pre-existing condition

- Assess the risk of the pre-existing condition

- Determine if the pre-existing condition will be covered under the policy

- Communicate the coverage decision to the group member

5. What are the key differences between a self-funded and a fully-insured group health insurance plan?

Self-funded plan:

- Employer assumes the financial risk

- Employer has more flexibility in plan design

- Potential for lower premiums

- Potential for higher out-of-pocket costs for employees

Fully-insured plan:

- Insurance company assumes the financial risk

- Employer has less flexibility in plan design

- More predictable premiums

- Lower out-of-pocket costs for employees

6. How do you stay up-to-date on changes in the group insurance industry?

- Attend industry conferences and webinars

- Read industry publications

- Network with other group insurance professionals

- Take continuing education courses

7. What are the ethical considerations that you must be aware of when working with group insurance clients?

- Confidentiality of client information

- Duty to provide accurate and unbiased information

- Duty to avoid conflicts of interest

- Duty to act in the best interests of the client

8. What are the key trends that you are seeing in the group insurance industry?

- Increased use of self-funded plans

- Growing popularity of consumer-directed health plans

- Emphasis on wellness and prevention

- Use of technology to improve efficiency and customer service

9. How do you build and maintain strong relationships with group insurance clients?

- Provide excellent customer service

- Be responsive to client needs

- Proactively communicate with clients

- Be a trusted advisor

- Build personal rapport

10. What are your goals for this position?

- To build a strong book of business

- To provide excellent customer service

- To be a trusted advisor to my clients

- To help my clients achieve their financial goals

- To grow my career in the group insurance industry

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Group Insurance Special Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Group Insurance Special Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Group Insurance Special Agent, the key job responsibilities encompass a wide range of functions, including:

1. Client Management

Develop and maintain strong relationships with clients, understanding their insurance needs and objectives.

- Conduct needs assessments and provide customized insurance solutions.

- Negotiate and manage group insurance policies, ensuring optimal coverage and cost-effectiveness.

2. Sales and Marketing

Drive sales and revenue growth by effectively marketing and selling group insurance products.

- Identify and target potential clients within specific industries or markets.

- Create and deliver presentations and proposals, demonstrating the value of insurance solutions.

3. Underwriting and Claims Management

Assess risk and determine insurability for group insurance applications.

- Review and analyze underwriting data, making recommendations on policy terms and conditions.

- Process and manage claims, ensuring prompt and fair settlement.

4. Regulatory Compliance

Ensure compliance with all applicable laws and regulations governing group insurance.

- Stay updated on regulatory changes and industry best practices.

- Maintain accurate records and documentation, adhering to company and regulatory guidelines.

Interview Tips

To ace the interview for a Group Insurance Special Agent position, here are some tips:

1. Research the Company and Industry

Demonstrate your knowledge of the insurance industry, the company’s products and services, and its competitors.

- Review the company’s website, financial statements, and industry news.

- Identify key executives and their roles within the organization.

2. Highlight Your Sales and Underwriting Skills

Emphasize your ability to develop and close sales, as well as your understanding of insurance risk and underwriting principles.

- Provide specific examples of successful sales campaigns or underwriting decisions.

- Quantify your accomplishments whenever possible, such as the number of policies sold or the amount of premium generated.

3. Demonstrate Your Client Management Abilities

Showcase your skills in building and maintaining client relationships.

- Share examples of how you have resolved client issues or exceeded their expectations.

- Explain how you stay organized and manage your time effectively to meet client demands.

4. Prepare for Industry-specific Questions

Be prepared to answer questions about insurance products, market trends, and regulatory compliance.

- Stay up-to-date on current events and legislative changes affecting the insurance industry.

- Review common insurance terms and concepts to ensure a solid understanding.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Group Insurance Special Agent role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.