Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Group Insurance Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

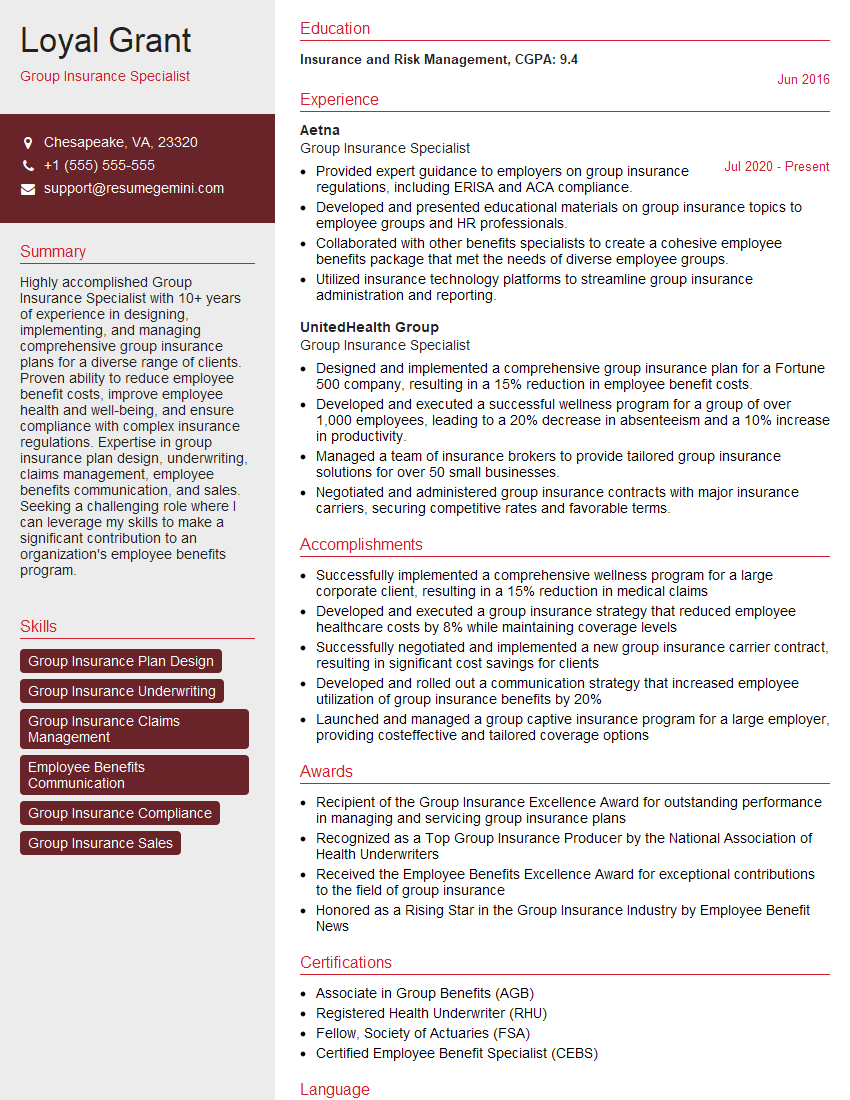

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Group Insurance Specialist

1. Describe the key responsibilities of a Group Insurance Specialist?

As a Group Insurance Specialist, I would be responsible for the following key tasks:

- Designing, implementing, and managing group insurance plans for employers, including health, dental, vision, life, and disability insurance.

- Conducting needs assessments and analyzing employer and employee data to identify and address specific insurance requirements.

- Negotiating with insurance carriers to secure the most competitive rates and coverage terms.

- Providing ongoing support and guidance to employers and employees regarding plan enrollment, benefits, and claims.

- Maintaining compliance with all applicable laws and regulations, including ERISA, HIPAA, and ACA.

2. Explain the differences between fully insured and self-funded group insurance plans?

Fully Insured Plans

- The insurance carrier assumes the financial risk for claims.

- Employers pay premiums to the carrier based on the plan design and employee demographics.

- Premiums are typically higher than self-funded plans.

Self-Funded Plans

- The employer assumes the financial risk for claims.

- Employers pay claims directly or through a third-party administrator.

- Premiums are typically lower than fully insured plans, but employers may be exposed to greater financial risk.

3. Discuss the factors that influence the cost of group insurance plans?

- Number of employees and dependents covered

- Age and health status of employees

- Type of coverage and benefits offered

- Deductibles and co-pays

- Claims experience

- Insurance carrier and plan design

4. Describe the different types of funding arrangements for self-funded group insurance plans?

- Administrative Services Only (ASO): The employer contracts with a third-party administrator to handle claims processing and other administrative tasks.

- Captive Insurance: The employer establishes a separate insurance company to fund employee health benefits.

- Health Reimbursement Arrangement (HRA): The employer funds a reimbursement account that employees can use to pay for qualified medical expenses.

5. Explain the role of a stop-loss insurance policy in a self-funded group insurance plan?

- Stop-loss insurance provides protection against catastrophic claims that exceed a specified threshold.

- It helps to mitigate the financial risk associated with self-funding.

- The premium for stop-loss insurance is based on the plan design and claims experience.

6. Discuss the advantages and disadvantages of using a third-party administrator (TPA) for group insurance plans?

Advantages

- Specialized knowledge and expertise in group insurance administration

- Reduced administrative burden for employers

- Improved efficiency and accuracy in claims processing

Disadvantages

- Additional cost for TPA services

- Potential loss of control over plan administration

- Communication challenges between the employer, TPA, and employees

7. Describe the ethical and legal responsibilities of a Group Insurance Specialist?

- Adhering to all applicable laws and regulations, including ERISA, HIPAA, and ACA

- Maintaining confidentiality of employee health information

- Providing unbiased and accurate information to employers and employees

- Avoiding conflicts of interest

- Acting in the best interests of their clients

8. Explain the importance of maintaining strong relationships with insurance carriers?

- Access to competitive rates and coverage terms

- Support and expertise in plan design and implementation

- Collaboration on innovative solutions to meet client needs

- Early access to new products and services

- Enhanced customer service for employers and employees

9. Describe the role of technology in the group insurance industry?

- Automating administrative tasks, such as enrollment and claims processing

- Providing online access to plan information and resources for employers and employees

- Using data analytics to identify trends and improve plan design

- Developing mobile apps to enhance employee engagement and access to benefits

- Integrating with other HR systems, such as payroll and timekeeping

10. How do you stay up-to-date on the latest developments in the group insurance industry?

- Attending industry conferences and webinars

- Reading trade publications and online resources

- Networking with other professionals in the field

- Participating in continuing education programs

- Consulting with industry experts

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Group Insurance Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Group Insurance Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Group Insurance Specialists are responsible for managing group insurance plans for their employer or clients. They work closely with insurance carriers and plan members to ensure that the plan is meeting the needs of the group.

1. Plan Design and Implementation

Group Insurance Specialists may be involved in the design and implementation of new group insurance plans. They work with employers or clients to determine the coverage needs of the group and then work with insurance carriers to find the best plan for the group’s needs.

- Analyze employer or client needs and objectives

- Research and compare insurance plans from different carriers

- Negotiate plan terms and conditions with carriers

- Implement new plans and communicate changes to plan members

2. Plan Administration

Group Insurance Specialists are responsible for the day-to-day administration of group insurance plans. They work with plan members to answer questions, process claims, and resolve disputes.

- Answer questions from plan members

- Process claims

- Resolve disputes

- Maintain plan records

3. Customer Service

Group Insurance Specialists provide customer service to plan members. They are the first point of contact for members with questions or concerns about their plan.

- Answer questions from plan members

- Resolve complaints

- Provide information about plan benefits

- Assist members with filing claims

4. Regulatory Compliance

Group Insurance Specialists are responsible for ensuring that their employer or client’s group insurance plan is in compliance with all applicable laws and regulations. They work with legal counsel and insurance carriers to ensure that the plan is compliant.

- Stay up-to-date on all applicable laws and regulations

- Review plan documents to ensure compliance

- Work with legal counsel and insurance carriers to ensure compliance

- File required reports with government agencies

Interview Tips

Preparing for your interview is essential to making a good impression and increasing your chances of getting the job. Here are a few tips to help you prepare for your interview for a Group Insurance Specialist position:

1. Research the company and the position

Take some time to learn about the company you’re interviewing with and the specific position you’re applying for. This will help you understand the company’s culture and the specific skills and experience they’re looking for in a candidate.

- Visit the company’s website

- Read the job description carefully

- Talk to people in your network who work for the company

2. Practice answering common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” Practice answering these questions in advance so that you can deliver your answers confidently and concisely.

- Use the STAR method to answer questions

- Be specific and provide examples

- Tailor your answers to the specific position you’re applying for

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills as they relate to the position you’re applying for. Be prepared to talk about your experience in plan design and implementation, plan administration, customer service, and regulatory compliance.

- Highlight your transferable skills

- Quantify your accomplishments

- Be enthusiastic and positive

4. Ask questions

Asking questions at the end of the interview shows that you’re interested in the position and that you’re taking the interview seriously. It also gives you a chance to learn more about the company and the position.

- Ask about the company’s culture

- Ask about the specific responsibilities of the position

- Ask about the company’s plans for the future

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Group Insurance Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!