Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Health Insurance Sales Agent interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Health Insurance Sales Agent so you can tailor your answers to impress potential employers.

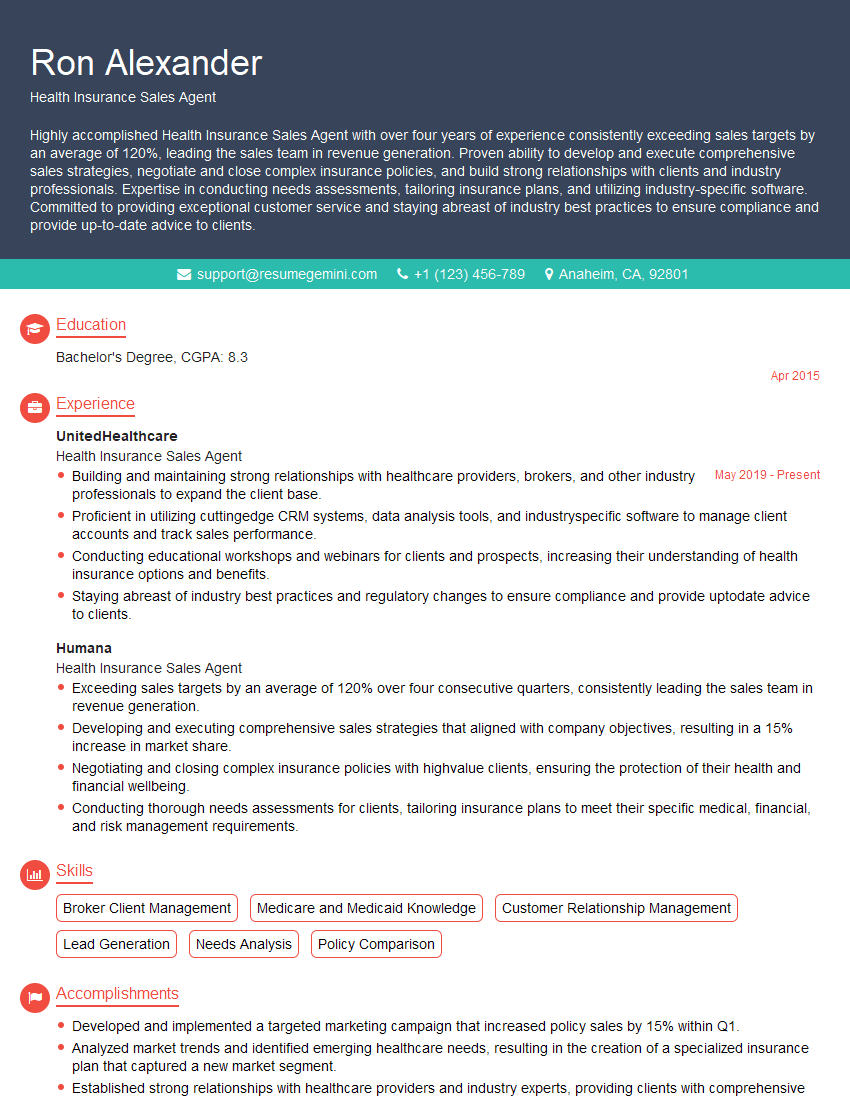

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Health Insurance Sales Agent

1. What are the key benefits of having health insurance?

- Access to affordable healthcare services

- Protection against unexpected medical expenses

- Peace of mind and financial security

2. How do you determine the right health insurance plan for a client?

Needs Assessment

- Gather information on the client’s health history, family size, income, and lifestyle

- Identify their specific healthcare needs and financial constraints

Plan Research and Comparison

- Explore different health insurance plans from reputable providers

- Compare plan offerings, deductibles, co-pays, and premiums

Recommendation and Explanation

- Present the recommended plan with clear explanations of its benefits and coverage

- Discuss the plan’s affordability and how it aligns with the client’s financial situation

3. How do you handle objections from potential clients?

Objection handling is crucial in sales. Here’s how I approach it:

- Listen attentively: Understand the client’s concerns and reasons for hesitation

- Acknowledge and empathize: Show that you understand their perspective and validate their feelings

- Provide factual information: Address misconceptions and provide evidence-based information to counter objections

- Offer solutions: Suggest alternative plans or options that meet their specific needs

- Reassure and build trust: Emphasize the benefits of having health insurance and the reliability of the plan you’re recommending

4. Describe your understanding of the Affordable Care Act (ACA).

The Affordable Care Act, also known as Obamacare, has significantly impacted the healthcare landscape:

- Expanded health insurance coverage: More individuals gained access to affordable health insurance through Medicaid expansion and subsidies

- Established essential health benefits: All health insurance plans must cover a comprehensive range of essential health benefits

- Protected individuals with pre-existing conditions: Insurance companies cannot deny coverage or charge higher premiums based on pre-existing health issues

- Created health insurance exchanges: Online marketplaces where individuals and small businesses can compare and purchase health insurance plans

- Introduced tax credits and subsidies: Financial assistance is available to make health insurance more affordable for low- and middle-income families

5. What are the ethical considerations in selling health insurance?

Ethical conduct is paramount in health insurance sales:

- Put clients’ needs first: Always prioritize the best interests of your clients and recommend plans that genuinely meet their needs

- Provide accurate information: Avoid misleading or exaggerating information about health insurance plans

- Respect client confidentiality: Maintain the privacy of clients’ personal and health information

- Avoid conflicts of interest: Disclose any potential conflicts of interest and ensure that recommendations are unbiased

- Uphold professional standards: Adhere to industry regulations and ethical guidelines

6. How do you stay up-to-date with changes in the health insurance industry?

- Continuing education: Attend industry conferences, workshops, and webinars to gain knowledge on new regulations, products, and best practices

- Industry publications and journals: Subscribe to trade publications and read news articles to stay informed about industry trends and developments

- Company resources: Utilize training materials, internal updates, and support from senior colleagues within the organization

- Networking: Connect with other professionals in the healthcare and insurance fields to exchange knowledge and insights

- Online research: Regularly explore reputable websites and online resources to stay abreast of the latest industry news and information

7. What is your sales process for health insurance?

1. Lead generation:

- Identify potential clients through networking, referrals, and marketing activities

- Qualify leads to determine their needs and interest in health insurance

2. Needs assessment:

- Gather detailed information about the client’s health history, family size, lifestyle, and financial situation

- Conduct a comprehensive analysis to understand their specific healthcare needs and coverage requirements

3. Plan presentation:

- Based on the needs assessment, present a tailored plan that meets the client’s individual requirements

- Explain the plan’s benefits, coverage, deductibles, and premiums in clear and concise language

4. Objection handling:

- Listen attentively to any objections or concerns raised by the client

- Provide factual information and address misconceptions to resolve their doubts

5. Close the sale:

- Summarize the benefits of the plan and how it aligns with the client’s needs

- Guide the client through the enrollment process and answer any remaining questions

6. Post-sale follow-up:

- Check in with the client after the sale to ensure they are satisfied with the plan

- Provide ongoing support and guidance as needed

8. How do you build and maintain client relationships?

- Exceptional customer service: Provide prompt and personalized responses to client inquiries

- Regular check-ins: Stay in touch with clients to ensure their needs are met and they are satisfied with the insurance plan

- Educational resources: Share valuable health information and insurance updates to empower clients

- Trust and transparency: Foster trust by being honest, transparent, and delivering on promises

- Personal touch: Make genuine connections with clients by listening to their concerns and showing empathy

9. How do you set and achieve sales goals?

- SMART goals: Establish specific, measurable, achievable, relevant, and time-bound sales goals

- Sales pipeline management: Track leads through the sales process and identify opportunities for improvement

- Time management: Prioritize tasks and allocate time effectively to maximize productivity

- Data analysis: Monitor sales performance, identify trends, and make adjustments to strategies as needed

- Continuous improvement: Regularly evaluate and refine sales techniques to enhance effectiveness

10. How do you handle difficult clients?

- Remain calm and professional: Maintain composure and avoid reacting emotionally

- Active listening: Pay attention to the client’s concerns and try to understand their perspective

- Empathy: Show empathy and acknowledge the client’s feelings

- Problem-solving: Work with the client to find a mutually acceptable solution that meets their needs

- Boundary setting: Politely establish boundaries while ensuring the client’s concerns are addressed respectfully

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Health Insurance Sales Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Health Insurance Sales Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Health Insurance Sales Agents play a pivotal role in the healthcare industry by assisting individuals and businesses in securing appropriate health insurance coverage. Their primary responsibilities include:

1. Prospecting and Lead Generation

Identify and reach out to potential clients through networking, cold calling, and referrals.

2. Needs Assessment and Plan Selection

Thoroughly understand clients’ health insurance needs and recommend suitable plans based on their budget, coverage requirements, and lifestyle.

3. Policy Sales and Issuance

Complete sales transactions, process applications, and issue policies in a timely and accurate manner.

4. Customer Relationship Management

Establish and maintain strong relationships with clients, providing ongoing support and addressing any concerns.

Interview Tips

Preparing for a health insurance sales agent interview requires thorough research and practice. Here are some essential tips to help you ace the interview:

1. Research the Company and Role

Familiarize yourself with the company’s culture, products, and services. Understand the specific role you are applying for and its key responsibilities.

- Visit the company website and study its mission statement, values, and history.

- Learn about the company’s health insurance offerings and target market.

- Review the job description to identify essential qualifications and experience.

2. Highlight Your Sales Skills and Experience

Emphasize your ability to identify customer needs, build rapport, and close deals. Quantify your accomplishments using specific examples and metrics.

- Describe successful sales strategies you have implemented.

- Provide statistics on the number of policies sold or clients acquired.

- Showcase your proficiency in lead generation and customer outreach.

3. Demonstrate Your Knowledge of Health Insurance

Display your understanding of health insurance products, regulations, and terminology. This will instill confidence in the interviewer about your ability to effectively advise clients.

- Explain the different types of health insurance plans and their benefits.

- Discuss recent trends in the health insurance industry.

- Stay up-to-date on regulatory changes and compliance requirements.

4. Prepare for Common Interview Questions

Anticipate questions that may be asked and prepare thoughtful answers that align with your qualifications and the company’s needs.

- Why are you interested in a career in health insurance sales?

- What sets you apart from other candidates for this role?

- Provide an example of a time when you successfully overcame a sales challenge.

5. Practice Your Presentation and Communication Skills

Practice presenting your qualifications and delivering clear and concise answers. Dress professionally and arrive on time for the interview.

- Record yourself answering common interview questions.

- Seek feedback from a friend or family member.

- Make a good first impression by being polite and enthusiastic.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Health Insurance Sales Agent role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.