Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Health Underwriter position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

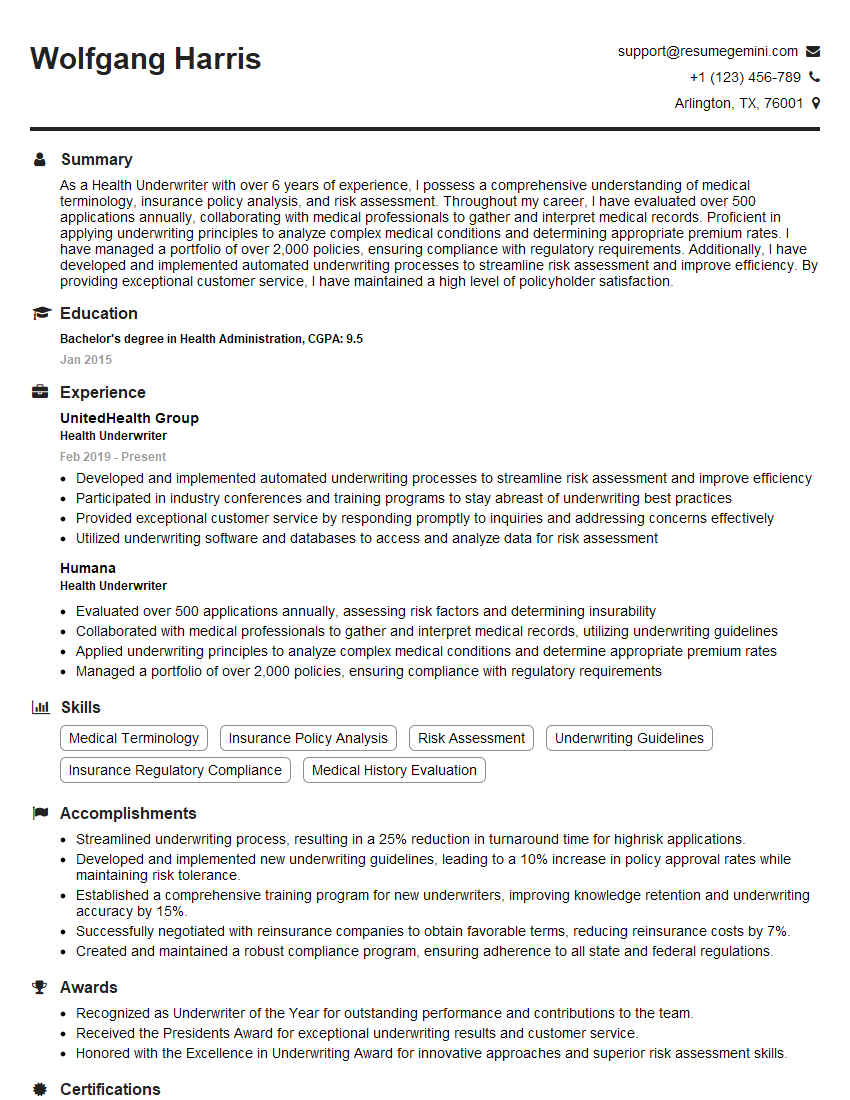

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Health Underwriter

1. Explain the process of underwriting a health insurance policy?

The underwriting process involves assessing an individual’s risk profile and determining the appropriate premium. It includes the following steps:

- Collecting and reviewing medical history, lifestyle habits, and occupation

- Evaluating family health history and genetic predispositions

- Performing medical exams or lab tests if necessary

- Consulting with medical experts and specialists

- Determining the level of risk and assigning a premium that reflects the individual’s health status

2. What are the key factors that influence the underwriting decision?

Medical History

- Chronic conditions

- Past surgeries

- Hospitalizations

Lifestyle Habits

- Smoking

- Alcohol consumption

- Exercise and diet

Occupation

- Potential hazards

- Physical demands

- Travel requirements

Family Health History

- Genetic disorders

- Premature deaths

- Chronic diseases

3. Describe the different types of underwriting models used in health insurance?

- Manual Underwriting: Involves a detailed review of each application by an underwriter

- Automated Underwriting: Uses software to analyze application data and make risk assessments

- Hybrid Underwriting: Combines manual and automated processes

4. Explain the role of reinsurance in health underwriting?

- Transfers a portion of the risk to another insurer

- Provides financial protection against catastrophic claims

- Stabilizes premiums and ensures the long-term solvency of the insurer

5. Discuss the ethical considerations in health underwriting?

- Fairness: Ensuring equitable treatment of all applicants

- Privacy: Maintaining confidentiality of medical information

- Accuracy: Making decisions based on reliable and relevant data

- Transparency: Communicating underwriting decisions and reasons clearly

6. What are the common challenges faced by health underwriters?

- Incomplete or inaccurate applications

- Evolving medical knowledge and technology

- Balancing risk assessment with affordability

- Regulatory changes

7. How do you stay up-to-date with industry trends and best practices in health underwriting?

- Attending conferences and workshops

- Reading trade publications and research papers

- Networking with other underwriters

- Participating in continuing education programs

8. What software or tools do you use in your underwriting process?

- Underwriting software for data entry, risk assessment, and decision-making

- Medical databases for accessing medical records and health information

- Spreadsheets and calculators for financial analysis and premium calculations

9. Describe a situation where you had to make a difficult underwriting decision?

In this response, provide a specific example of a complex case and explain how you gathered information, evaluated risk factors, consulted with experts, and made a final decision.

10. What are your career goals as a Health Underwriter?

In this response, discuss your aspirations for professional growth, areas of specialization you may be interested in, and how you plan to achieve your goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Health Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Health Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Health Underwriters play a crucial role in evaluating and assessing the risk associated with insuring individuals and groups for health coverage. They ensure that the insurance company has a clear understanding of the applicant’s health history and current health status to determine appropriate coverage and premiums.

1. Underwriting Process

Evaluate applications for health insurance coverage and make underwriting decisions based on risk assessment.

- Analyze medical records and health history to identify potential health risks.

- Conduct interviews with applicants and healthcare providers to gather additional information.

- Interpret test results, including blood tests, urinalysis, and medical imaging.

2. Policy Issuance

Issue health insurance policies based on the underwriting decisions made, including coverage limits and premiums.

- Determine appropriate coverage levels and premium rates based on risk assessment.

- Explain policy terms and conditions to policyholders.

- Answer questions and provide guidance on coverage and benefits.

3. Risk Management

Monitor and manage health insurance risks by analyzing claims data and trends.

- Identify trends in health conditions and predict potential financial liabilities.

- Develop strategies to mitigate risks and ensure the financial stability of the insurance company.

- Stay updated on industry best practices and regulatory changes related to health underwriting.

4. Customer Service

Provide excellent customer service to policyholders and other stakeholders.

- Respond to inquiries and resolve complaints promptly and professionally.

- Build strong relationships with customers and medical professionals.

- Maintain confidentiality and protect sensitive health information.

Interview Tips

To ace a health underwriter interview, it is crucial to prepare effectively and showcase your knowledge and skills. Here are some helpful tips:

1. Research the Company and Position

Research the insurance company and the specific health underwriter position you are applying for. This will give you a better understanding of their products, underwriting guidelines, and company culture.

- Visit the company website to learn about their history, mission, and values.

- Read industry articles and news to stay updated on current trends in health underwriting.

- Identify the specific responsibilities and qualifications required for the position.

2. Practice Your Technical Skills

Health underwriters rely on a strong understanding of medical terminology, risk assessment principles, and insurance regulations. Practice answering interview questions that test these skills:

- Explain your process for evaluating medical records and identifying health risks.

- Describe how you determine appropriate coverage limits and premium rates.

- Discuss your knowledge of industry regulations and how they impact health underwriting.

3. Highlight Your Communication and Interpersonal Skills

Health underwriters often interact with customers, medical professionals, and other stakeholders. Emphasize your strong communication and interpersonal skills during the interview:

- Share examples of how you effectively communicate complex medical information to non-medical professionals.

- Describe your experience in building and maintaining positive relationships.

- Highlight your ability to work independently and as part of a team.

4. Showcase Your Commitment to Ethics and Confidentiality

Health underwriters handle sensitive health information and must maintain the utmost ethical standards. Emphasize your commitment to protecting patient confidentiality:

- Explain your understanding of HIPAA regulations and the importance of patient privacy.

- Describe how you maintain confidentiality when discussing medical information with others.

- Demonstrate your commitment to ethical behavior and integrity in all your professional dealings.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Health Underwriter role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.