Are you gearing up for a career in Hedge Fund Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Hedge Fund Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

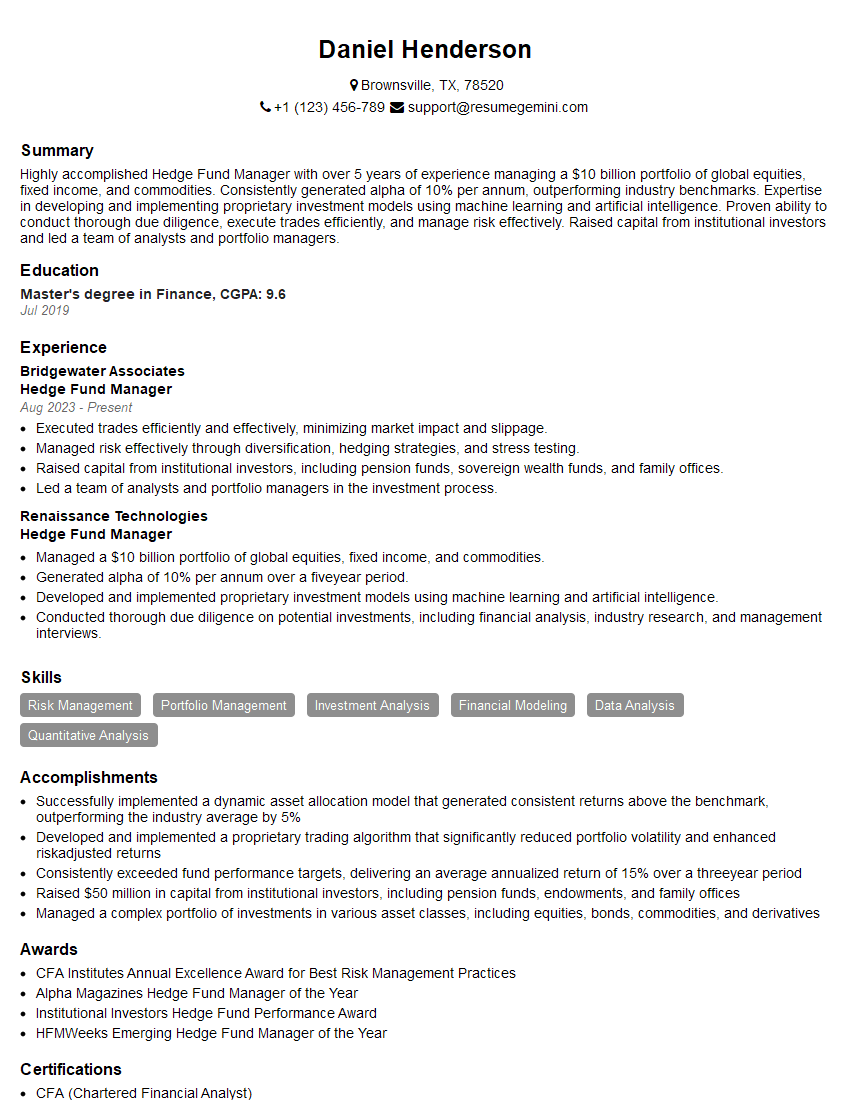

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Hedge Fund Manager

1. Walk me through your investment process from idea generation to execution.

- Begin with identifying potential opportunities through market research, financial analysis, and industry knowledge.

- Conduct thorough due diligence on target companies or assets, assessing financial performance, management team, and competitive landscape.

- Develop an investment thesis that outlines the rationale for the investment, including projected returns and risk assessment.

- Determine the appropriate investment strategy (long/short, fundamental/technical, etc.) and allocate capital accordingly.

- Execute trades efficiently, considering market conditions and liquidity.

- Monitor portfolio performance regularly and make adjustments as needed to maintain risk and return targets.

2. Describe your approach to risk management.

- Quantify risk using quantitative models, such as VaR, stress testing, and scenario analysis.

- Diversify portfolios across different asset classes, industries, and geographies.

- Implement risk limits and closely monitor exposures.

- Conduct regular risk reviews and stress tests to assess potential vulnerabilities.

- Develop contingency plans to mitigate potential risks.

3. How do you evaluate the performance of your investments?

- Compare performance against benchmarks and peer funds.

- Assess risk-adjusted returns, such as Sharpe Ratio, Sortino Ratio, and Calmar Ratio.

- Analyze portfolio attribution to identify sources of alpha and beta.

- Conduct performance reviews on a regular basis to identify areas for improvement.

4. Discuss your experience in managing a team of investment professionals.

- Define clear roles and responsibilities for team members.

- Foster a collaborative and results-oriented work environment.

- Provide mentorship and guidance to junior team members.

- Set performance expectations and provide regular feedback.

- Motivate and inspire team members to achieve their full potential.

5. Explain how you stay up-to-date with industry trends and best practices.

- Attend industry conferences and seminars.

- Read financial publications and research reports.

- Network with other professionals in the industry.

- Participate in continuing education programs.

- Engage in research and development initiatives.

6. Describe your experience in managing investments through different market cycles.

- Navigated through both bull and bear markets, adjusting investment strategies accordingly.

- Protected investor capital during market downturns by implementing defensive strategies.

- Identified and capitalized on opportunities during market rallies.

- Demonstrated resilience and adaptability in challenging market conditions.

7. Discuss your understanding of the regulatory environment for hedge funds.

- Familiar with SEC, FINRA, and CFTC regulations.

- Comply with all reporting and disclosure requirements.

- Maintain high ethical standards and avoid conflicts of interest.

- Stay informed about regulatory changes and adapt accordingly.

8. Explain your investment philosophy and how it has influenced your investment decisions.

- Philosophy is rooted in fundamental analysis and long-term value investing.

- Seek to identify companies with strong fundamentals, competitive advantages, and attractive valuations.

- Invest in businesses with proven management teams and sustainable earnings growth potential.

- Patience and discipline are key principles in the investment approach.

9. Discuss your experience in using quantitative analysis in your investment process.

- Leverage quantitative models to screen for potential opportunities.

- Use statistical techniques to analyze financial data and identify trends.

- Combine quantitative and qualitative analysis to make informed investment decisions.

- Stay current with advancements in quantitative analysis and incorporate them into the investment process.

10. Describe a successful investment you have made and the factors that contributed to its success.

- Invested in a company with strong fundamentals and a unique competitive advantage.

- Conducted thorough due diligence and identified significant growth potential.

- Patiently held the investment through market volatility.

- Realized substantial returns on the investment due to the company’s strong performance.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Hedge Fund Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Hedge Fund Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Hedge Fund Manager is responsible for the overall management of a hedge fund, including investment strategy, portfolio management, and risk management. The key job responsibilities include:

1. Investment Strategy Development

Develop and implement investment strategies that align with the fund’s objectives, risk tolerance, and return targets.

- Conduct thorough market research and analysis to identify investment opportunities.

- Determine the optimal asset allocation and position sizing based on risk-return considerations.

2. Portfolio Management

Monitor and manage the hedge fund’s portfolio, including asset selection, risk management, and trade execution.

- Monitor market conditions and adjust portfolio holdings accordingly.

- Execute trades efficiently to minimize transaction costs and market impact.

- Manage risk exposure through diversification, hedging techniques, and position monitoring.

3. Risk Management

Establish and implement risk management policies and procedures to mitigate investment risks.

- Develop stress tests and scenario analyses to assess portfolio resilience under various market conditions.

- Monitor and control portfolio volatility, correlation, and other risk metrics.

4. Performance Measurement and Analysis

Track and evaluate the fund’s performance against benchmarks and investor expectations.

- Calculate and present performance metrics such as returns, risk-adjusted measures, and Sharpe ratios.

- Analyze performance and identify areas for improvement in investment strategy or risk management.

Interview Tips

Preparing thoroughly for a Hedge Fund Manager interview can significantly increase your chances of success. Here are some key tips:

1. Research the Hedge Fund and Industry

Demonstrate your understanding of the specific hedge fund you’re applying to, its investment strategy, and the broader hedge fund industry.

- Review the fund’s website, SEC filings, and any available marketing materials.

- Read industry publications and research reports to stay informed about market trends and best practices.

2. Practice Behavioral Interview Questions

Hedge fund interviews often include behavioral questions to assess your problem-solving, decision-making, and teamwork skills.

- Prepare for questions about how you handle challenging situations, navigate conflicts, and demonstrate leadership qualities.

- Use the STAR method (Situation, Task, Action, Result) to provide specific examples that highlight your relevant experience.

3. Prepare Technical Questions

Expect to answer technical questions related to investment analysis, portfolio management, and risk management.

- Review fundamental and technical analysis techniques, as well as common hedge fund investment strategies.

- Practice solving case studies that involve analyzing financial data and making investment decisions.

4. Demonstrate Your Passion and Commitment

Hedge fund managers are driven by a passion for investing and a commitment to delivering superior returns.

- Explain why you’re interested in the hedge fund industry and what motivates you to succeed in this role.

- Discuss your investment philosophy and long-term career goals.

Next Step:

Now that you’re armed with the knowledge of Hedge Fund Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Hedge Fund Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini