Are you gearing up for an interview for a Hedge Fund Trader position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Hedge Fund Trader and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

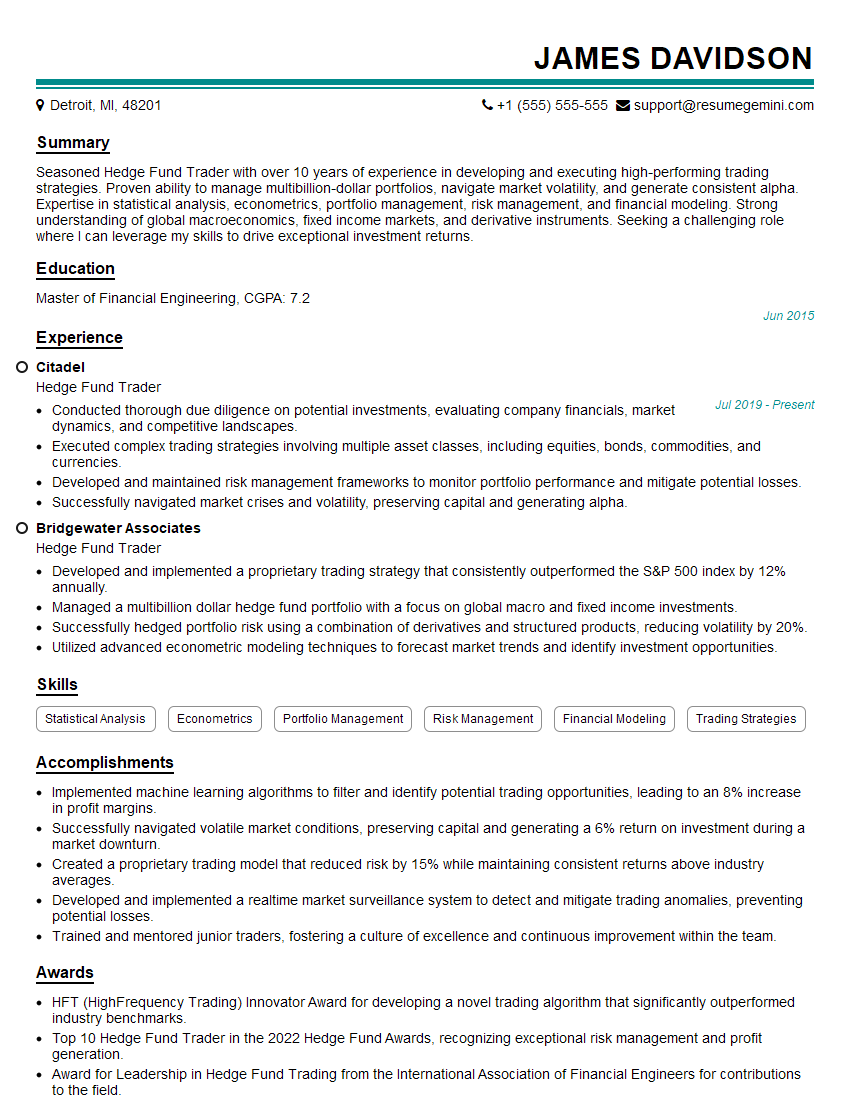

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Hedge Fund Trader

1. Walk me through your process for analyzing a potential investment opportunity, including how you identify and evaluate risks.

- Identify the investment opportunity:

- Review company financials, industry reports, and news articles.

- Attend industry events and conferences to network and gather information.

- Utilize data analytics tools to screen for potential investments.

- Evaluate the investment opportunity:

- Analyze the company’s financial health, management team, and competitive landscape.

- Estimate the potential return and risk of the investment using quantitative and qualitative analysis.

- Conduct due diligence by visiting the company, speaking with management, and reviewing external research.

- Identify and evaluate risks:

- Assess the company’s operational, financial, and regulatory risks.

- Consider market conditions, economic trends, and geopolitical factors that may impact the investment.

- Develop mitigation strategies to address potential risks and enhance the potential return.

2. Describe your experience in using quantitative and qualitative analysis to make investment decisions.

Quantitative analysis

- Proficient in using statistical models, regression analysis, and machine learning algorithms.

- Experienced in building financial models to forecast financial performance, estimate risk, and optimize portfolio allocation.

- Familiar with data visualization tools to present complex data in an easy-to-understand manner.

Qualitative analysis

- Strong ability to read and interpret financial statements, news articles, and industry reports.

- Skilled in conducting company visits, management interviews, and site inspections to gather qualitative information.

- Experienced in conducting due diligence to assess the credibility of investment opportunities.

3. How do you stay up-to-date on market trends and developments?

- Regularly read industry publications, financial news websites, and research reports.

- Attend conferences and webinars hosted by industry experts and thought leaders.

- Network with other investment professionals to exchange insights and ideas.

- Utilize online platforms and databases to access real-time market data and analysis.

- Subscribe to email alerts and newsletters to stay informed about breaking news and market developments.

4. How do you manage the emotional challenges of investing, such as fear and greed?

- Self-awareness and discipline: Recognize personal biases and emotional triggers, and develop strategies to mitigate their impact on investment decisions.

- Risk management: Establish clear investment guidelines, risk limits, and position sizing parameters to avoid excessive risk-taking.

- Emotional detachment: Strive to make investment decisions based on rational analysis rather than emotions, and accept that losses are an inherent part of investing.

- Stress management techniques: Engage in activities such as exercise, meditation, or spending time in nature to reduce stress and maintain focus.

- Support system: Seek support from colleagues, mentors, or therapists to discuss emotional challenges and gain perspective.

5. Give me an example of a successful investment decision you made.

- Identified an undervalued company in the healthcare sector through a combination of quantitative and qualitative analysis.

- Developed a financial model to estimate the company’s potential growth and earnings, identifying a significant upside.

- Conducted due diligence to confirm the company’s financial health and management team, mitigating potential risks.

- Invested in the company’s stock at an attractive price, resulting in a significant return when the company exceeded expectations.

6. Give me an example of a time you had to change your investment strategy due to market conditions.

- Recognized a significant market downturn based on macroeconomic indicators and market sentiment.

- Adjusted portfolio allocation to reduce exposure to risky assets, such as equities, and increase exposure to defensive assets, such as bonds.

- Implemented a hedging strategy to mitigate downside risk and preserve capital during the market decline.

- Monitored market conditions closely and made further adjustments as needed to adapt to the evolving situation.

7. How do you measure and evaluate your investment performance?

- Absolute return: Calculate the total return on investment, including capital appreciation and dividend income.

- Benchmark comparison: Compare investment performance to relevant benchmarks, such as market indices or peer funds, to assess relative performance.

- Risk-adjusted measures: Use metrics such as the Sharpe ratio or Sortino ratio to evaluate risk-adjusted performance.

- Attribution analysis: Identify the sources of investment performance and pinpoint areas for improvement.

- Client satisfaction: Seek feedback from clients to assess their satisfaction with the investment results and overall service.

8. How do you collaborate with the portfolio manager and other members of the investment team?

- Regularly communicate and share insights to enhance decision-making.

- Provide research and analysis to support the portfolio manager’s investment decisions.

- Participate in investment committee meetings to discuss and debate investment strategies.

- Effectively manage and contribute to the team’s workflow and workload.

- Maintain a positive and collaborative work environment to foster open communication and knowledge sharing.

9. How do you stay informed about regulatory and compliance requirements for hedge funds?

- Regularly review industry regulations and compliance guidelines, such as those issued by the SEC and FINRA.

- Attend conferences and webinars to stay abreast of regulatory updates and best practices.

- Consult with legal counsel and compliance professionals to ensure adherence to all applicable regulations.

- Implement and maintain a robust compliance framework within the hedge fund to mitigate legal and reputational risks.

- Stay informed about emerging regulatory trends and developments to proactively address potential compliance challenges.

10. What are your career goals and aspirations?

- Continue to develop my investment skills and expertise to enhance my contribution to the team.

- Advance to a more senior role within the hedge fund, taking on increased responsibilities.

- Gain recognition as a respected and successful hedge fund trader within the industry.

- Contribute to the growth and success of the hedge fund through my investment decisions and contributions.

- Ultimately, aspire to become a portfolio manager with the opportunity to lead and manage my own investment team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Hedge Fund Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Hedge Fund Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Hedge Fund Trader is responsible for managing investment portfolios for hedge funds, making investment decisions based on market research and analysis, and executing trades to achieve specified investment objectives. Key responsibilities include:

1. Investment Research and Analysis

Conduct in-depth research and analysis of various asset classes, including stocks, bonds, currencies, and commodities.

- Identify potential investment opportunities and develop trading strategies.

- Monitor market trends, economic data, and geopolitical events to assess market risks and opportunities.

2. Portfolio Management

Develop and manage investment portfolios that align with the fund’s investment objectives and risk tolerance.

- Allocate funds across different asset classes and investment strategies to optimize returns and manage risk.

- Monitor portfolio performance and make adjustments as needed based on market conditions and investment goals.

3. Trade Execution

Execute trades efficiently and effectively to achieve desired investment outcomes.

- Negotiate with brokers and market makers to obtain favorable trade prices.

- Manage trading risk and ensure compliance with regulatory requirements.

4. Performance Evaluation

Track and evaluate portfolio performance against benchmarks and investment objectives.

- Analyze investment decisions and identify areas for improvement.

- Report to clients and stakeholders on investment performance and market outlook.

Interview Tips

To ace an interview for a Hedge Fund Trader position, follow these tips:

1. Research the Firm and Industry

Thoroughly research the hedge fund, its investment strategy, and the industry as a whole. This demonstrates your interest and knowledge of the role.

- Review the firm’s website, recent news articles, and financial reports.

- Stay up-to-date on current market trends and hedge fund industry best practices.

2. Highlight Your Skills and Experience

Quantify your accomplishments and provide specific examples of your skills and experience in investment research, portfolio management, and trade execution.

- Emphasize your analytical abilities, risk management skills, and ability to make sound investment decisions.

- Use the STAR method (Situation, Task, Action, Result) to describe your experiences.

3. Prepare for Technical Questions

Hedge fund interviews often involve technical questions about investment strategies, portfolio analysis, and risk modeling.

- Review common interview questions and practice answering them in a clear and concise manner.

- Consider using mock interviews with a mentor or career counselor to improve your interview skills.

4. Be Confident and Enthusiastic

Confidence and enthusiasm are crucial in any interview, especially for a demanding role like Hedge Fund Trader.

- Articulate your passion for the financial markets and your drive to succeed.

- Show your confidence in your abilities and willingness to take on challenges.

5. Follow Up and Stay Connected

After the interview, send a thank-you note reiterating your interest in the position and summarizing your qualifications.

- Follow up periodically to show your continued interest and inquire about the status of your application.

- Stay connected with recruiters and industry professionals to expand your network and learn about future opportunities.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Hedge Fund Trader role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.