Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Hospital Insurance Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

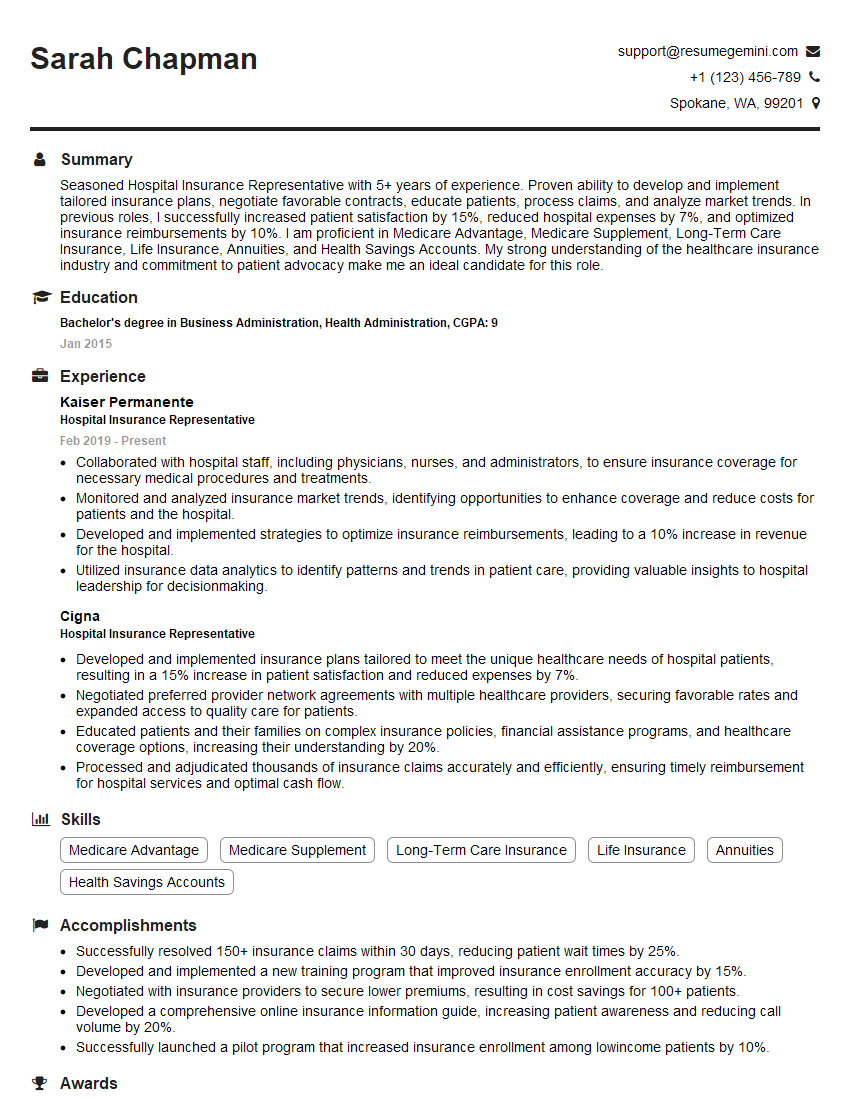

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Hospital Insurance Representative

1. Explain the different types of hospital insurance policies available in the market?

There are several types of hospital insurance policies available in the market, each providing different levels of coverage and benefits. Here are some common types:

- Comprehensive Hospitalization Coverage: Provides coverage for all hospitalization expenses, including room and board, medical fees, surgical costs, and more.

- Specific Disease Coverage: Covers expenses related to treatment of specific diseases or illnesses, such as cancer or heart disease.

- Critical Illness Coverage: Provides a lump sum benefit upon diagnosis of a critical illness, such as cancer, heart attack, or stroke.

- Hospital Cash Coverage: Pays a daily cash benefit for each day spent in the hospital, regardless of expenses incurred.

- Top-Up Hospitalization Coverage: Extends coverage limits beyond those provided by primary insurance, offering additional protection against high medical costs.

2. Describe the underwriting process for hospital insurance policies?

Assessing Risk Factors:

- Medical history

- Age

- Lifestyle factors (such as smoking or alcohol consumption)

- Family medical history

Calculating Premiums:

- Based on risk factors and coverage limits

- Premiums typically increase with age and higher coverage levels

Medical Examination:

- May be required for high-risk applicants or large policy amounts

- Involves physical examination, blood tests, and other medical assessments

Issuance of Policy:

- Underwriter reviews all information and determines insurability

- Policy is issued if the applicant meets underwriting criteria

3. What are the key factors to consider when comparing hospital insurance policies?

- Coverage Limits: The maximum amount of coverage provided for hospitalization expenses.

- Co-payments and Deductibles: The amount the policyholder pays out-of-pocket before coverage begins.

- Network of Hospitals: The list of hospitals and healthcare providers covered by the policy.

- Premium Costs: The amount paid monthly or annually for insurance coverage.

- Benefits and Exclusions: The specific services and treatments covered by the policy and any exclusions.

4. How do you handle objections from potential clients during the sales process?

Handling objections is an essential part of the sales process, particularly in the insurance industry. Here’s how I approach objections:

- Acknowledge and Validate: Recognize the objection and show that you understand their concerns.

- Probe and Clarify: Ask clarifying questions to fully grasp the objection and identify underlying reasons.

- Provide Value-Based Rebuttals: Present factual information, case studies, or testimonials to address the objection and demonstrate the value of your solution.

- Offer Alternatives: If appropriate, suggest alternative solutions or policy options that may meet their concerns.

- Reframe the Objection: Reposition the objection as an opportunity to highlight additional benefits or features of the policy.

5. What techniques do you use to build rapport with potential clients?

- Active Listening: Paying undivided attention to what clients have to say and asking insightful questions.

- Mirroring and Matching: Subtly adjusting body language and tone of voice to create a connection.

- Finding Common Ground: Identifying shared interests or experiences to establish a personal bond.

- Empathy and Understanding: Showing genuine concern for their situation and needs.

- Personalized Communication: Using their preferred name, addressing specific pain points, and tailoring conversations to their circumstances.

6. Describe your experience in assessing clients’ insurance needs?

Assessing client insurance needs requires a comprehensive approach. Here’s my process:

- Gather Information: Conduct thorough interviews and review financial documents to understand their current coverage, income, and lifestyle.

- Identify Gaps and Risks: Analyze their existing coverage and pinpoint areas where additional protection is needed.

- Consider Future Goals: Discuss their financial aspirations and plans to ensure their insurance meets evolving needs.

- Prioritize Needs: Help clients prioritize their insurance needs based on their financial situation and risk tolerance.

- Recommend Tailored Solutions: Present customized insurance solutions that address their unique circumstances and provide comprehensive protection.

7. What is the role of technology in the hospital insurance industry?

Technology is transforming the hospital insurance industry in several ways:

- Online Platforms: Customers can now easily compare policies, purchase coverage, and manage their accounts online.

- Data Analytics: Insurers use data to assess risk, develop personalized products, and improve underwriting processes.

- Telemedicine and Remote Monitoring: Technology enables remote healthcare services, reducing hospitalization time and costs.

- Wearable Devices: Insurers integrate data from wearable devices to reward healthy behaviors and incentivize preventive care.

- Artificial Intelligence: AI chatbots and virtual assistants provide 24/7 support and streamline policy-related tasks.

8. How do you stay updated with industry regulations and best practices?

- Attend Industry Conferences and Webinars: Participate in industry events to gain insights into the latest regulations and trends.

- Read Trade Publications and Journals: Subscribe to industry publications to stay informed about market news, research findings, and regulatory updates.

- Complete Continuing Education Courses: Take specialized courses or certifications to enhance knowledge and skills.

- Connect with Insurance Professionals: Network with other agents, insurers, and industry experts to exchange information and stay abreast of best practices.

- Monitor Regulatory Websites: Regularly check websites of relevant regulatory bodies for updates and changes in regulations.

9. What is your approach to providing exceptional customer service?

- Responsiveness and Availability: I make myself readily available to answer questions, address concerns, and provide support promptly.

- Professionalism and Courtesy: I maintain a high level of professionalism and treat all clients with respect and empathy.

- Clear and Concise Communication: I communicate clearly and effectively, ensuring that clients fully understand their coverage and policy details.

- Personalized Service: I tailor my approach to each client’s individual needs and provide personalized recommendations and guidance.

- Follow-Up and Relationship Building: I regularly check in with clients to ensure satisfaction and build lasting relationships.

10. How do you manage high-value and complex hospital insurance policies?

Managing high-value and complex hospital insurance policies requires a comprehensive and systematic approach:

- Thorough Policy Review: Understand every aspect of the policy, including coverage limits, exclusions, and benefits.

- Risk Assessment: Identify potential risks and develop strategies to mitigate them.

- Tailored Recommendations: Provide clients with customized recommendations that address their specific needs and concerns.

- Claims Assistance: Guide clients through the claims process, ensuring they receive fair and timely settlements.

- Regular Monitoring and Review: Regularly review policies and coverage to ensure they remain aligned with clients’ evolving needs.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Hospital Insurance Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Hospital Insurance Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Hospital Insurance Representative

Hospital Insurance Representatives, also known as health insurance agents, serve as liaisons between insurance companies and hospitals. They play a crucial role in ensuring seamless medical insurance processes for patients and healthcare providers. Here are some key job responsibilities:

1. Patient Education and Sales

Provide comprehensive information about health insurance plans and benefits to patients.

- Educate patients on coverage options, premiums, deductibles, and co-pays.

- Assist patients in comparing and selecting the most suitable plans based on their needs.

- Process enrollment applications and ensure timely coverage for patients.

2. Hospital Collaboration

Collaborate closely with hospitals to streamline insurance processes.

- Establish and maintain strong relationships with hospital staff, including case managers, social workers, and billing departments.

- Provide training and support to hospital staff on insurance coverage and billing procedures.

- Coordinate with hospitals to verify insurance eligibility and coverage for patients.

3. Insurance Processing

Handle various insurance-related tasks to ensure accurate and timely processing.

- Review and process insurance claims, ensuring accuracy and compliance with regulations.

- Resolve discrepancies and issues with insurance companies to facilitate timely payment of claims.

- Maintain accurate records of all insurance transactions and communications.

4. Customer Service

Provide exceptional customer service to patients, hospital staff, and insurance companies.

- Respond promptly to inquiries and resolve issues related to insurance coverage and payment.

- Maintain a professional and empathetic demeanor in all interactions.

- Continuously seek feedback and work towards improving patient and provider satisfaction.

Interview Preparation Tips for Hospital Insurance Representatives

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some effective interview preparation tips:

1. Research the Company

Familiarize yourself with the hospital, its services, and its insurance partners.

- Visit the hospital’s website and social media pages to gather information.

- Research the insurance companies they work with and understand their products and policies.

- Identify any recent news or developments related to the hospital’s insurance operations.

2. Review the Job Description

Carefully analyze the job description and identify the key skills, responsibilities, and requirements.

- Highlight your relevant experience, qualifications, and accomplishments that align with the job requirements.

- Prepare specific examples that demonstrate your abilities in patient education, hospital collaboration, insurance processing, and customer service.

- Practice articulating your skills and experiences in a clear and concise manner.

3. Practice Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses.

- Research typical interview questions for Hospital Insurance Representatives and familiarize yourself with the best practices for answering them.

- Craft STAR (Situation, Task, Action, Result) responses to behavioral questions that highlight your skills and experience.

- Practice answering questions about your motivations, goals, and why you are interested in the role.

4. Prepare Meaningful Questions

Asking thoughtful questions during the interview demonstrates your interest and engagement.

- Prepare questions about the hospital’s insurance operations, their approach to patient care, and their plans for the future.

- Ask questions that show you are interested in the role beyond its responsibilities, such as opportunities for professional development or industry trends.

- By asking meaningful questions, you also show that you have taken the time to research the company and are invested in the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Hospital Insurance Representative role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.