Are you gearing up for an interview for a Housing Counselor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Housing Counselor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

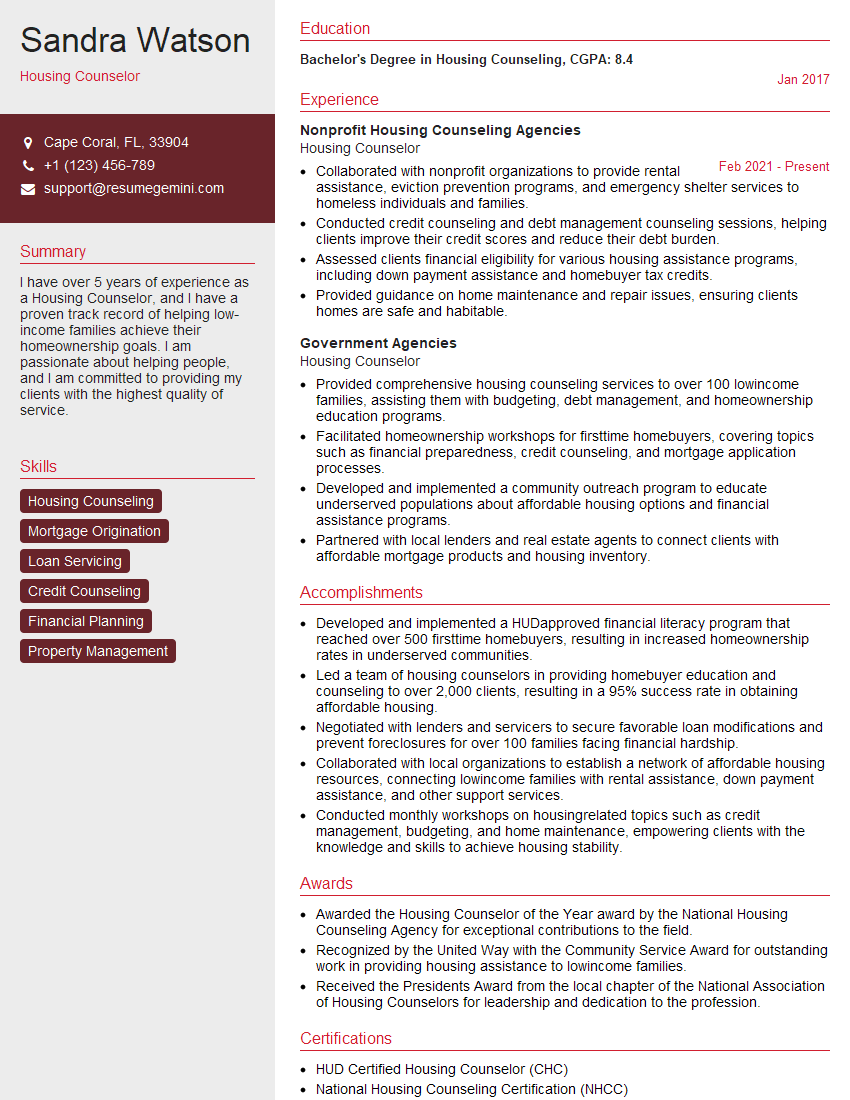

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Housing Counselor

1. What are the key responsibilities of a Housing Counselor?

Here are some of the key responsibilities of a Housing Counselor

- Provide guidance to clients on a variety of housing-related issues, including budgeting, credit management, and foreclosure prevention.

- Educate clients on the homebuying process and help them to prepare for homeownership.

- Develop and implement financial literacy programs and workshops.

- Advocate for clients with lenders, servicers, and other housing providers.

- Stay up-to-date on the latest housing laws and regulations.

2. What is the difference between housing counseling and financial counseling?

Housing Counseling

- Focuses on housing-related issues, such as budgeting for a mortgage, avoiding foreclosure, and improving credit for homeownership.

- Provided by HUD-approved housing counseling agencies.

- Often free or low-cost.

Financial Counseling

- Focuses on broader financial issues, such as budgeting, debt management, and credit counseling.

- Provided by a variety of organizations, including non-profit agencies, credit unions, and banks.

- May have fees associated with the service.

3. What are the qualities of a successful Housing Counselor?

- Strong communication and interpersonal skills.

- Ability to build rapport with clients from diverse backgrounds.

- Excellent listening and problem-solving skills.

- Knowledge of housing laws and regulations.

- Commitment to providing high-quality service.

4. What is the foreclosure process?

The foreclosure process is a legal proceeding in which a lender takes possession of a property after the borrower has defaulted on their mortgage. The process varies from state to state, but generally involves the following steps:

- The lender sends a notice of default to the borrower.

- The borrower has a period of time to bring the loan current.

- If the borrower does not bring the loan current, the lender will file a foreclosure lawsuit.

- The court will hold a hearing to determine if the foreclosure should be granted.

- If the court grants the foreclosure, the lender will take possession of the property.

5. What are some of the common challenges faced by Housing Counselors?

- Helping clients to overcome financial barriers.

- Keeping up-to-date on the latest housing laws and regulations.

- Working with clients who are facing difficult life circumstances.

- Dealing with clients who are resistant to change.

- Maintaining a positive attitude in the face of challenges.

6. What is your favorite part of being a Housing Counselor?

- Helping clients to achieve their homeownership goals.

- Seeing clients make positive changes in their lives.

- Educating clients on the homebuying process and empowering them to make informed decisions.

- Working with a team of dedicated professionals.

- Making a difference in the community.

7. What is your least favorite part of being a Housing Counselor?

- Dealing with clients who are resistant to change.

- Seeing clients who are facing difficult life circumstances.

- Working with clients who do not follow through on their commitments.

- Dealing with the bureaucracy of the housing industry.

- Not being able to help every client who comes through the door.

8. What are your goals for the future?

- To continue to provide high-quality housing counseling services to the community.

- To develop new programs and initiatives to help more people achieve their homeownership goals.

- To advocate for policies that make homeownership more affordable and accessible.

- To become a leader in the field of housing counseling.

- To make a positive impact on the lives of as many people as possible.

9. What is your experience with counseling clients who are facing foreclosure?

- I have extensive experience counseling clients who are facing foreclosure.

- I have helped clients to develop foreclosure prevention plans.

- I have negotiated with lenders on behalf of clients to help them keep their homes.

- I have represented clients in court in foreclosure proceedings.

- I have a deep understanding of the foreclosure process and the legal rights of homeowners.

10. What is your experience with providing financial literacy education?

- I have extensive experience providing financial literacy education to individuals and families.

- I have developed and implemented financial literacy workshops and programs.

- I have taught clients about budgeting, credit management, and debt reduction.

- I have helped clients to improve their financial literacy skills so that they can make informed financial decisions.

- I am passionate about helping people to improve their financial well-being.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Housing Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Housing Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Provide Homeownership Counseling

- Counsel individuals and families on homeownership options, including pre-purchase, pre-foreclosure, and post-purchase counseling.

- Guide clients through the home buying process, including budgeting, mortgage pre-approval, and house hunting.

- Assist clients in understanding and completing loan applications, mortgage agreements, and other homeownership documents.

Provide Financial Counseling

- Assess clients’ financial situation, including income, expenses, and debt.

- Developing and implementing personalized financial plans to improve clients’ financial stability.

- Educating clients on budgeting, credit management, and other personal finance topics.

Provide Foreclosure Prevention Counseling

- Assist homeowners who are at risk of foreclosure.

- Negotiating with lenders to modify loan terms, reduce interest rates, or postpone foreclosure proceedings.

- Helping homeowners explore alternative options, such as short sales or loan forbearance.

Provide Home Management Counseling

- Assist homeowners with maintaining their homes, including budgeting for repairs and maintenance.

- Educating clients on home energy efficiency, safety, and accessibility.

- Connecting homeowners with resources for home repairs, weatherization, and other home-related services.

Interview Tips

1. Research the Organization

- Learn about the organization’s mission, values, and services.

- Familiarize yourself with the organization’s target population and its approach to housing counseling.

- Research the organization’s financial situation and any recent news or developments.

2. Prepare Questions

- Prepare thoughtful questions to ask the interviewer during the interview.

- This demonstrates your interest in the position and the organization and gives you an opportunity to clarify any areas of uncertainty.

- Sample questions could include: “What are the organization’s goals for the housing counseling program in the next year?” or “How does the organization collaborate with other community partners?”

3. Highlight Your Experience and Skills

- Emphasize your experience in housing counseling, financial counseling, or related fields.

- Quantify your accomplishments and provide specific examples of how you have helped clients achieve their housing goals.

- If you have experience in foreclosure prevention counseling, be sure to highlight your ability to negotiate with lenders and explore alternative options for homeowners.

4. Demonstrate Your Passion and Commitment

- Share your passion for helping people achieve their housing goals.

- Explain why you are interested in working for this particular organization.

- Discuss your commitment to providing high-quality housing counseling services and making a positive impact on the community.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Housing Counselor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.