Feeling lost in a sea of interview questions? Landed that dream interview for Import Customs Clearing Agent but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Import Customs Clearing Agent interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

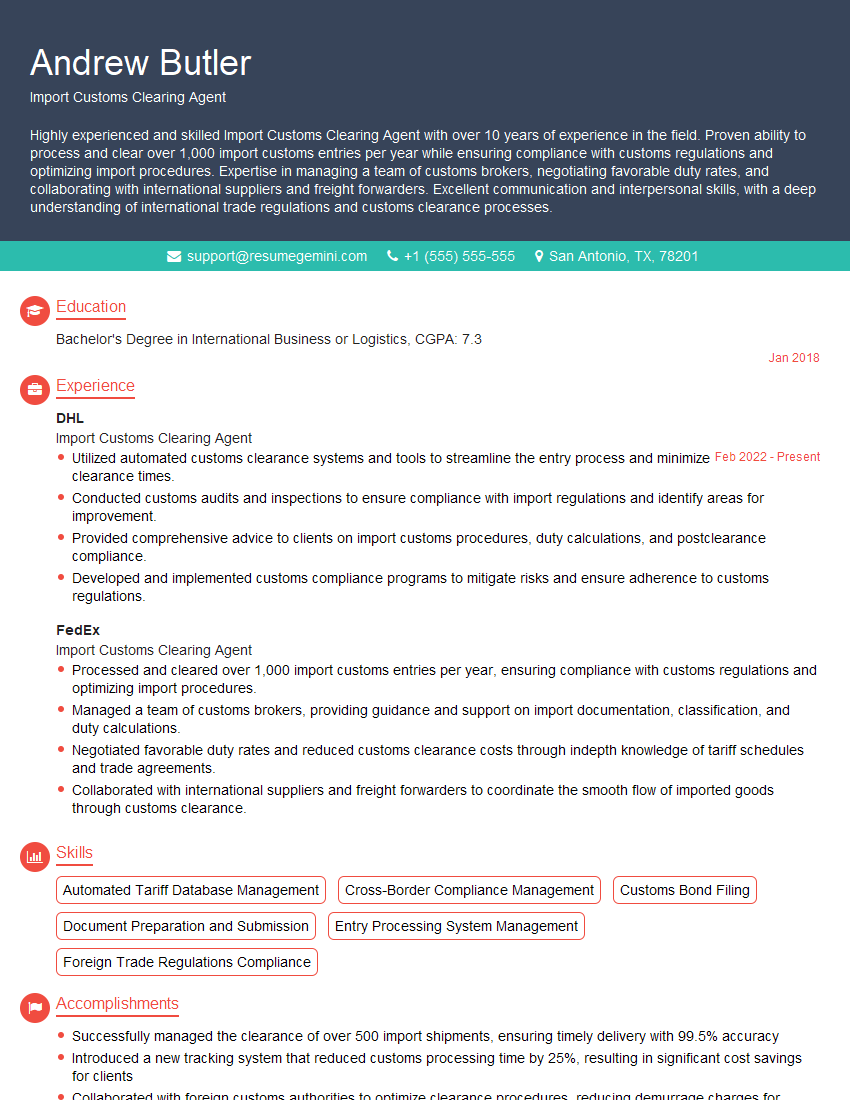

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Import Customs Clearing Agent

1. Describe the key responsibilities of an Import Customs Clearing Agent.

- Preparing and submitting import documentation, including bills of lading, packing lists, and commercial invoices.

- Classifying goods according to the Harmonized System (HS) code.

- Calculating and paying customs duties and taxes.

- Arranging for the release of goods from customs.

- Advising clients on import regulations and procedures.

2. What are the different types of import customs entries?

Informal entries

- For goods valued at $2,500 or less.

- Can be made by the importer or a customs broker.

- Do not require a formal entry bond.

Formal entries

- For goods valued at more than $2,500.

- Must be made by a customs broker.

- Require a formal entry bond.

3. What is the Harmonized System (HS) code?

- An international system for classifying goods.

- Used by customs authorities around the world.

- Based on the World Customs Organization (WCO) Harmonized Commodity Description and Coding System.

4. How do you calculate customs duties and taxes?

- Identify the HS code for the goods.

- Determine the applicable duty rate.

- Calculate the value of the goods.

- Multiply the value of the goods by the duty rate.

- Add any applicable taxes, such as GST or PST.

5. What are the consequences of failing to declare all goods at the border?

- Fines

- Seizure of goods

- Criminal charges

6. What are the different types of customs bonds?

- Single-entry bonds

- Continuous bonds

- Term bonds

7. What is the role of a customs broker?

- Assists importers and exporters with customs clearance.

- Prepares and submits import and export documentation.

- Classifies goods according to the HS code.

- Calculates and pays customs duties and taxes.

- Arranges for the release of goods from customs.

8. What are the benefits of using a customs broker?

- Expertise in customs regulations and procedures.

- Reduced risk of fines and penalties.

- Faster clearance times.

- Improved customer service.

9. What are the challenges facing the import customs clearance industry?

- Increasing volume of trade.

- More complex customs regulations.

- Heightened security concerns.

- Shortage of skilled workers.

10. What is the future of the import customs clearance industry?

- Increased use of technology.

- More collaboration between customs authorities and businesses.

- Continued growth in the volume of trade.

- Greater focus on security and compliance.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Import Customs Clearing Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Import Customs Clearing Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Import Customs Clearing Agent plays a crucial role in facilitating the smooth flow of goods across international borders. They serve as intermediaries between importers and customs authorities, ensuring compliance with import regulations and expediting the clearance process. Key job responsibilities include:

1. Compliance and Documentation Management

Preparing and submitting import documentation, including customs declarations, bills of lading, and invoices.

2. Classification and Valuation

Identifying the correct tariff classification and determining the value of imported goods for customs purposes.

3. Duty and Tax Calculation

Calculating and paying applicable duties and taxes on imported goods, ensuring compliance with customs regulations.

4. Clearance Procedures

Representing importers during customs clearance, verifying documentation, and liaising with customs officials to facilitate the release of goods.

5. Risk Management and Compliance

Identifying and mitigating potential risks associated with import transactions, ensuring compliance with customs regulations and preventing delays or penalties.

6. Communication and Client Support

Providing timely updates to importers on the status of their shipments, addressing queries, and offering guidance on import regulations.

7. Record Keeping and Auditing

Maintaining accurate records of import transactions and supporting documentation for audit purposes.

8. Industry Knowledge and Regulation Monitoring

Staying up-to-date with changes in customs regulations, trade agreements, and industry best practices.

Interview Tips

Preparing thoroughly for an interview as an Import Customs Clearing Agent is essential to showcase your expertise and land the job. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s background, industry, and the specific requirements of the role. This will demonstrate your interest and preparation.

2. Highlight Your Expertise

Emphasize your knowledge of customs regulations, classification and valuation procedures, and risk management strategies. Showcase your ability to navigate complex regulations and ensure compliance.

3. Quantify Your Results

Provide specific examples of how your efforts have contributed to successful import operations. Use metrics and data to quantify your accomplishments, such as reducing clearance times or identifying potential compliance issues.

4. Showcase Your Communication Skills

Demonstrate your ability to effectively communicate with importers, customs officials, and colleagues. Highlight your interpersonal skills and ability to build relationships.

5. Practice Industry Terminology

Be familiar with industry-specific terms and acronyms. Using them correctly will show your confidence and knowledge of the field.

6. Prepare Questions

Preparing thoughtful questions to ask the interviewer shows that you are engaged and interested in the role. Examples include inquiring about the company’s growth plans, industry trends, or specific challenges related to import customs clearing.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Import Customs Clearing Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!