Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Income Tax Consultant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Income Tax Consultant so you can tailor your answers to impress potential employers.

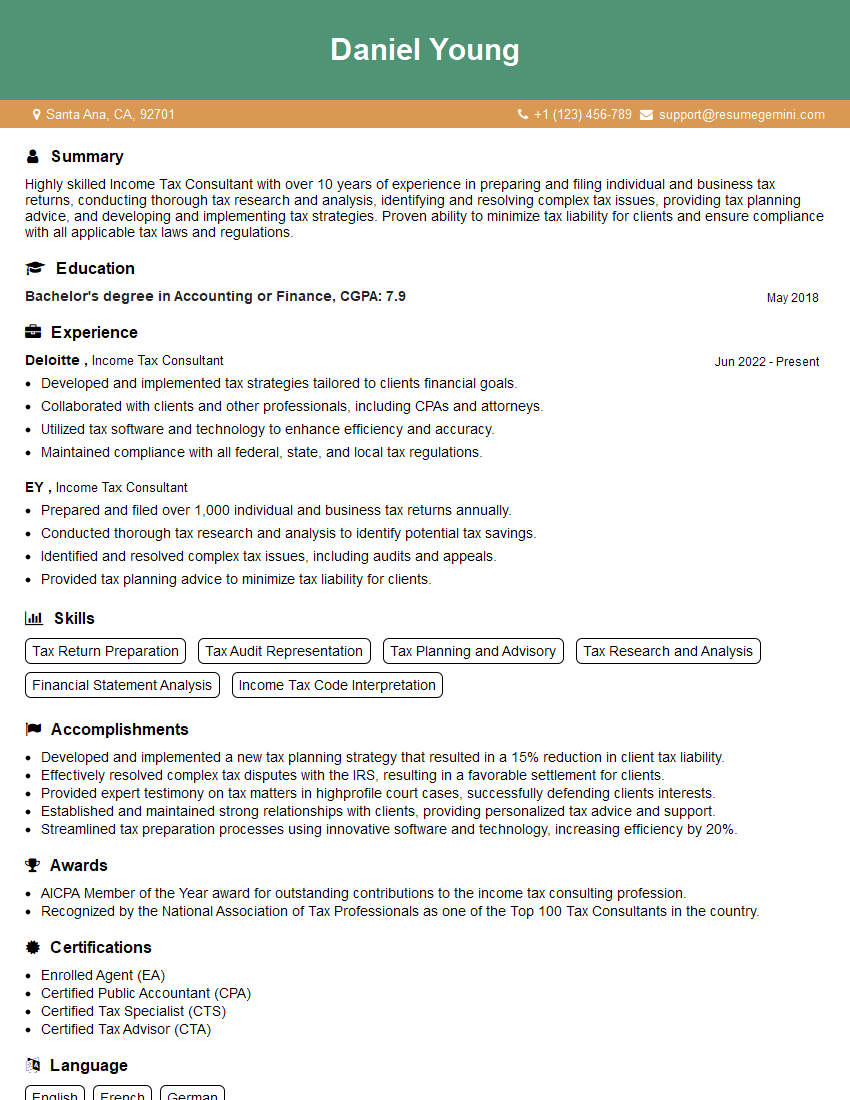

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Income Tax Consultant

1. Explain the concept of permanent account number (PAN)?

The Permanent Account Number (PAN) is a 10-character alphanumeric identifier issued by the Income Tax Department of India to all taxpayers. It is a unique identifier for each taxpayer and is used for tracking all financial transactions and tax-related activities.

- It is used to track all financial transactions and tax-related activities of an individual or entity.

- It is mandatory for individuals and entities to quote their PAN when filing income tax returns, paying taxes, and conducting certain financial transactions.

- It helps prevent tax evasion and promotes transparency in financial transactions.

2. Describe the process of calculating taxable income under the head “Income from House Property”.

Step 1: Determine gross rental income: Add up all the rent received from the property during the financial year.

Step 2: Deduct municipal taxes: Subtract any municipal taxes paid on the property from the gross rental income.

Step 3: Deduct standard deduction: A standard deduction of 30% is allowed on the gross rental income.

Step 4: Calculate net annual value: Subtract the standard deduction from the balance of gross rental income after deducting municipal taxes.

Step 5: Deduct interest on housing loan: Deduct the interest paid on a housing loan taken for the purpose of acquiring or constructing the property.

Step 6: Calculate taxable income: If the net annual value is less than the interest paid on the housing loan, the taxable income is nil. Otherwise, the taxable income is the net annual value minus the interest paid on the housing loan.

3. Explain the provisions of section 80C of the Income Tax Act, 1961.

- Section 80C of the Income Tax Act, 1961 allows for deductions from gross total income for various investments and expenses.

- It incentivizes savings and investments in specific instruments and schemes.

- The overall limit for deduction under Section 80C is Rs. 1,50,000.

- Some eligible investments and expenses under Section 80C include:

- Life insurance premiums

- Provident Fund contributions

- National Savings Certificate (NSC)

- Public Provident Fund (PPF)

- Equity Linked Savings Scheme (ELSS)

4. Discuss the tax implications of capital gains on the sale of shares.

- Capital gains are profits made from the sale of capital assets, such as shares.

- In India, capital gains on shares are taxed differently depending on the holding period.

- Short-term capital gains (STCG):

- STCG arise from the sale of shares held for less than 12 months.

- STCG are taxed at a flat rate of 15%.

- Long-term capital gains (LTCG):

- LTCG arise from the sale of shares held for more than 12 months.

- LTCG up to Rs. 1 lakh are exempt from tax.

- LTCG above Rs. 1 lakh are taxed at a concessional rate of 10%.

5. Explain the concept of tax avoidance and tax evasion.

- Tax avoidance refers to legal methods used to minimize tax liability by taking advantage of tax laws and loopholes.

- Tax evasion, on the other hand, involves illegal means of reducing or avoiding tax payments.

- Tax avoidance is generally considered acceptable, while tax evasion is a serious offense.

6. Describe the role of the Central Board of Direct Taxes (CBDT) in the Indian tax system.

- The Central Board of Direct Taxes (CBDT) is the apex body responsible for administering direct taxes in India.

- It is responsible for framing policies, issuing notifications, and overseeing the implementation of direct tax laws.

- CBDT also plays a vital role in tax collection, revenue administration, and taxpayer services.

7. Explain the process of filing income tax returns using the electronic filing system.

- The electronic filing system allows taxpayers to file their income tax returns online.

- To file returns electronically, taxpayers need to register on the e-filing portal of the Income Tax Department.

- The e-filing portal provides various options for filing returns, including using pre-filled forms or uploading XML files.

- After submitting the return, taxpayers can track its status and receive updates online.

8. Discuss the provisions of the Finance Act, 2020, related to direct taxes.

- The Finance Act, 2020, introduced several changes to direct tax laws, including:

- Increase in basic exemption limit for individual taxpayers

- Revision of tax slabs

- New tax regime with lower tax rates but fewer deductions

- Simplification of TDS provisions

- Measures to promote digital transactions

9. Explain the concept of advance tax and the process of paying it.

- Advance tax is an advance payment of income tax that taxpayers are required to make during the financial year.

- It is based on the estimated tax liability for the year.

- Advance tax is payable in four installments:

- 15% by 15th June

- 45% by 15th September

- 75% by 15th December

- 100% by 15th March

10. Discuss the role of an income tax consultant in tax planning.

- Income tax consultants play a vital role in tax planning by helping individuals and businesses minimize their tax liability.

- They analyze the taxpayer’s financial situation, identify potential tax-saving opportunities, and recommend tax-efficient strategies.

- Income tax consultants can help taxpayers:

- Choose the right tax regime

- Maximize deductions and exemptions

- Plan investments for tax benefits

- Avoid tax penalties

- Resolve tax disputes

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Income Tax Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Income Tax Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Income Tax Consultants provide expert guidance on tax-related matters to individuals and businesses. Their key responsibilities include:

1. Tax Planning and Advisory

Advise clients on tax laws, deductions, and credits to optimize their tax liability.

- Review financial statements and identify tax-saving opportunities.

- Develop tax-efficient investment strategies.

2. Tax Return Preparation and Filing

Prepare and file accurate and timely tax returns for clients, ensuring compliance with tax regulations.

- Gather and analyze financial information.

- Calculate tax liability and prepare supporting documentation.

3. Audit Representation

Represent clients during tax audits, presenting evidence and negotiating with tax authorities.

- Analyze audit notices and prepare defense strategies.

- Accompany clients to audit hearings and meetings.

4. Tax Law Research and Analysis

Stay updated on tax laws and regulations to provide informed advice to clients.

- Monitor changes in tax codes and case law.

- Conduct research to resolve complex tax issues.

5. Client Relationship Management

Build and maintain strong relationships with clients, understanding their financial and tax needs.

- Communicate effectively and provide personalized advice.

- Respond promptly to client inquiries and concerns.

Interview Tips

To ace the interview for an Income Tax Consultant position, consider the following tips:

1. Preparation

Thoroughly research the company, the role, and the industry. Be prepared to discuss your understanding of tax laws and regulations.

- Study the latest tax codes and case law.

- Familiarize yourself with the company’s tax compliance policies and procedures.

2. Communication Skills

Income Tax Consultants must have exceptional communication skills. Be able to clearly explain complex tax concepts to clients.

- Practice presenting your expertise in a concise and engaging manner.

- Demonstrate active listening skills and ask clarifying questions.

3. Problem-Solving Abilities

Tax Consulting involves solving complex tax issues. Showcase your analytical and problem-solving abilities.

- Prepare examples of complex tax scenarios you have solved.

- Be able to articulate your thought process and justify your solutions.

4. Attention to Detail

Accuracy and attention to detail are crucial for Income Tax Consultants. Emphasize your strong attention to detail.

- Highlight your experience with meticulous tax preparation and filing.

- Provide examples of your ability to identify and correct errors.

5. Professionalism and Ethics

Income Tax Consultants must maintain the highest levels of professionalism and ethics.

- Demonstrate your commitment to confidentiality and client discretion.

- Discuss your adherence to professional standards and ethical guidelines.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Income Tax Consultant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.