Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Income Tax Expert position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

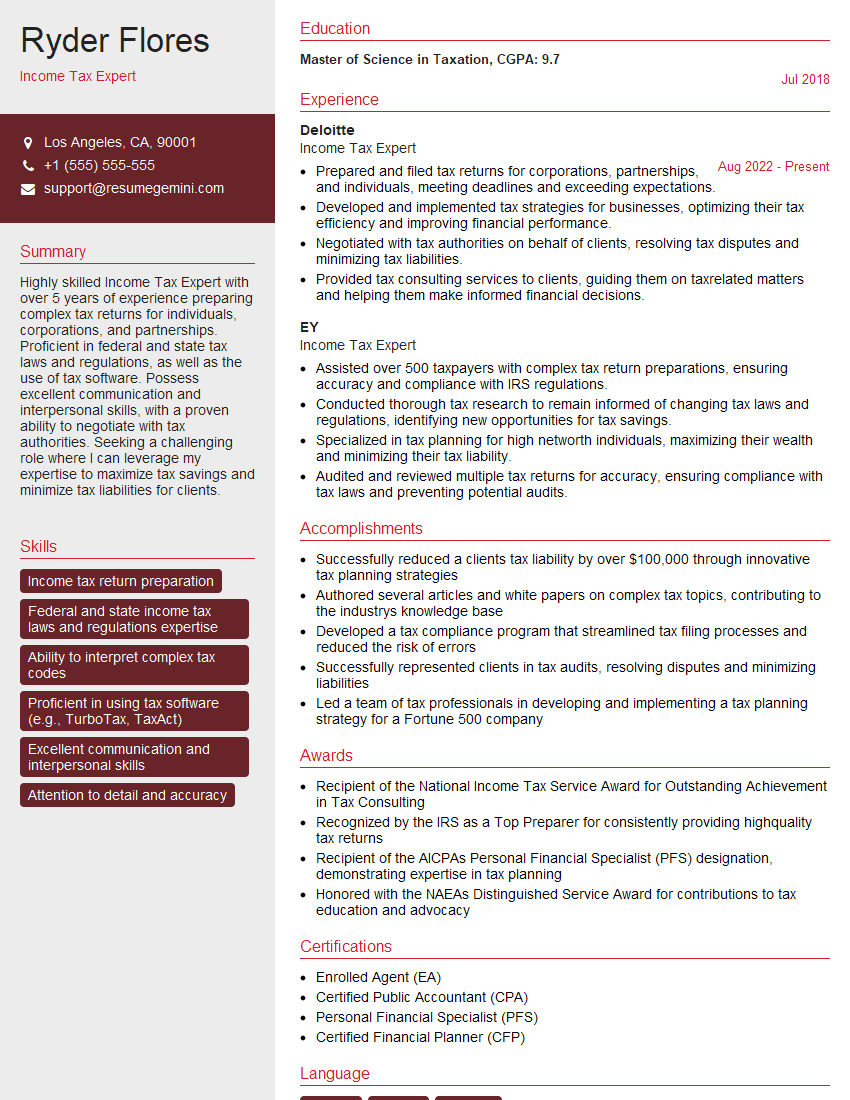

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Income Tax Expert

1. Explain the concept of “Gross Total Income” and its components.

Gross Total Income (GTI) refers to the total income of an individual before any deductions or exemptions. Its components include:

- Income from five specified sources under Section 14: Salaries, house property, business/profession, capital gains, and other sources.

- Income from other sources: Winnings from lotteries, gambling, etc.

- Agricultural Income: As defined under Section 10(1) of the Income Tax Act, 1961.

2. Describe the various methods of computing income under the head “Profits and Gains from Business or Profession.”

a) Regular Method

- Based on actual profits and gains for the financial year.

- Requires proper books of account to be maintained.

b) Presumptive Method

- Applicable to specific professions specified by the government.

- Income is estimated as a percentage of gross receipts.

c) Special Provisions

- For specific industries, alternative methods may be prescribed, such as Rule 8D for real estate developers.

3. Explain the difference between “Exempt Income” and “Deductible Expenses.”

Exempt Income: Income that is not taxable, such as agricultural income up to Rs. 5 lakhs

Deductible Expenses: Expenses that can be subtracted from Gross Total Income to arrive at Total Income, subject to specific conditions and limits set by the Income Tax Act.

4. Describe the procedures for filing Income Tax Returns for individuals and companies.

Individuals:

- File online through the Income Tax e-filing portal using Form ITR-1 to ITR-7, depending on income sources.

- Submit before the due date, typically July 31st for previous financial year.

Companies:

- File online through the e-filing portal using Form ITR-6.

- Due date is October 31st for previous financial year.

5. Explain the concept of “Tax Deducted at Source” (TDS) and its implications.

TDS is a mechanism where certain payments made are subject to deduction of tax at source by the payer. It is applicable to various types of income, including salaries, interest, rent, etc.

Implications:

- TDS reduces the tax liability of the recipient.

- The payer becomes responsible for deducting and depositing TDS with the government.

- TDS certificate (Form 16/16A) must be issued to the recipient.

6. Describe the process of tax assessment and the role of the Assessing Officer (AO).

Tax Assessment:

- Involves verifying the Income Tax Return and supporting documents.

- AO may issue a notice if there are any discrepancies or additional information required.

- Assessment can lead to refund, additional tax payable, or penalty.

Role of AO:

- To ensure correct computation of income and tax liability.

- To provide an opportunity for explanation and rectification.

7. Explain the concept of “Capital Gains” and the different types of assets subject to capital gains tax.

Capital Gains are profits or gains arising from the sale or transfer of capital assets.

Types of Assets:

- Immovable property

- Shares and securities

- Jewellery

- Business assets

8. Describe the criteria for determining the “Residential Status” of an individual for income tax purposes.

Residential Status determines the taxability of income earned in India.

Criteria:

- Resident:

- Ordinarily resident: Residing in India for 182 days or more in a financial year.

- Not ordinarily resident: Residing in India for less than 182 days in a financial year but has been an Indian citizen for at least 120 days in the last 7 financial years.

- Resident but not ordinarily resident: Residing in India for 182 days or more in a financial year but has been an Indian citizen for less than 120 days in the last 7 financial years.

- Non-Resident:

- Indian citizen residing outside India for more than 182 days in a financial year.

- Foreign citizen who is not an Indian citizen.

9. Explain the concept of “Tax Refund” and the process for claiming it.

Tax Refund occurs when an individual has paid more tax than their actual liability.

Process:

- File Income Tax Return.

- Claim the refund in the return.

- Refund will be processed by the Income Tax Department and credited to the taxpayer’s bank account.

10. Describe the various ways in which income tax can be evaded and the consequences of such evasion.

Income Tax Evasion:

- Hiding income or assets

- Manipulating accounts

- False deductions or exemptions

Consequences:

- Additional tax liability

- Interest and penalties

- Prosecution and imprisonment

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Income Tax Expert.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Income Tax Expert‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Income Tax Experts are responsible for providing guidance and advice on income tax matters to individuals and businesses. They ensure that their clients comply with all applicable tax laws and regulations, and they help them minimize their tax liability while maximizing their tax benefits. Some of the key job responsibilities of an Income Tax Expert include:

1. Preparing and filing income tax returns

Income Tax Experts are responsible for preparing and filing income tax returns for their clients. This includes gathering all necessary documentation, calculating the client’s tax liability, and completing the necessary forms. They must be familiar with all applicable tax laws and regulations in order to ensure that their clients’ returns are accurate and complete.

- Gathering all necessary documentation

- Calculating the client’s tax liability

- Completing the necessary forms

- Ensuring that the client’s return is accurate and complete

2. Providing tax planning and advice

Income Tax Experts can provide tax planning and advice to their clients to help them minimize their tax liability and maximize their tax benefits. They can help clients understand the tax implications of different financial decisions, such as investing, saving, and retirement planning. They can also help clients develop tax-saving strategies, such as using tax-deductible accounts and taking advantage of tax credits and deductions.

- Providing tax planning advice to help clients minimize their tax liability

- Maximizing tax benefits by developing tax-saving strategies

3. Representing clients in tax audits

Income Tax Experts may represent their clients in tax audits. This involves responding to the auditor’s questions, providing documentation, and negotiating on behalf of the client. They must be familiar with the tax audit process and have strong communication and negotiation skills.

- Responding to the auditor’s questions

- Providing documentation

- Negotiating on behalf of the client

4. Keeping up with tax laws and regulations

Income Tax Experts must keep up with changing tax laws and regulations in order to provide accurate and up-to-date advice to their clients. They should read tax publications, attend conferences, and take continuing education courses to stay abreast of the latest developments in tax law.

- Reading tax publications

- Attending conferences

- Taking continuing education courses

Interview Tips

Preparing for an interview for an Income Tax Expert position can be daunting, but by following these tips, you can increase your chances of success:

1. Research the company and the position

Before you go on an interview, it is important to research the company and the position you are applying for. This will help you understand the company’s culture, values, and goals, and it will also show the interviewer that you are interested in the position and that you have taken the time to learn about the company.

- Visit the company’s website

- Read articles about the company

- Talk to people who work at the company

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Write down your answers to common interview questions

- Practice saying your answers out loud

- Get feedback from a friend or family member

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your work history, your education, and your certifications. You should also be able to provide examples of your work that demonstrate your skills and abilities.

- Highlight your experience in preparing and filing income tax returns

- Discuss your knowledge of tax planning and advice

- Mention any experience you have in representing clients in tax audits

- Emphasize your ability to keep up with changing tax laws and regulations

4. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you are serious about the position.

- Wear a suit or business casual attire

- Arrive on time for your interview

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Income Tax Expert, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Income Tax Expert positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.