Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Indian Trader position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

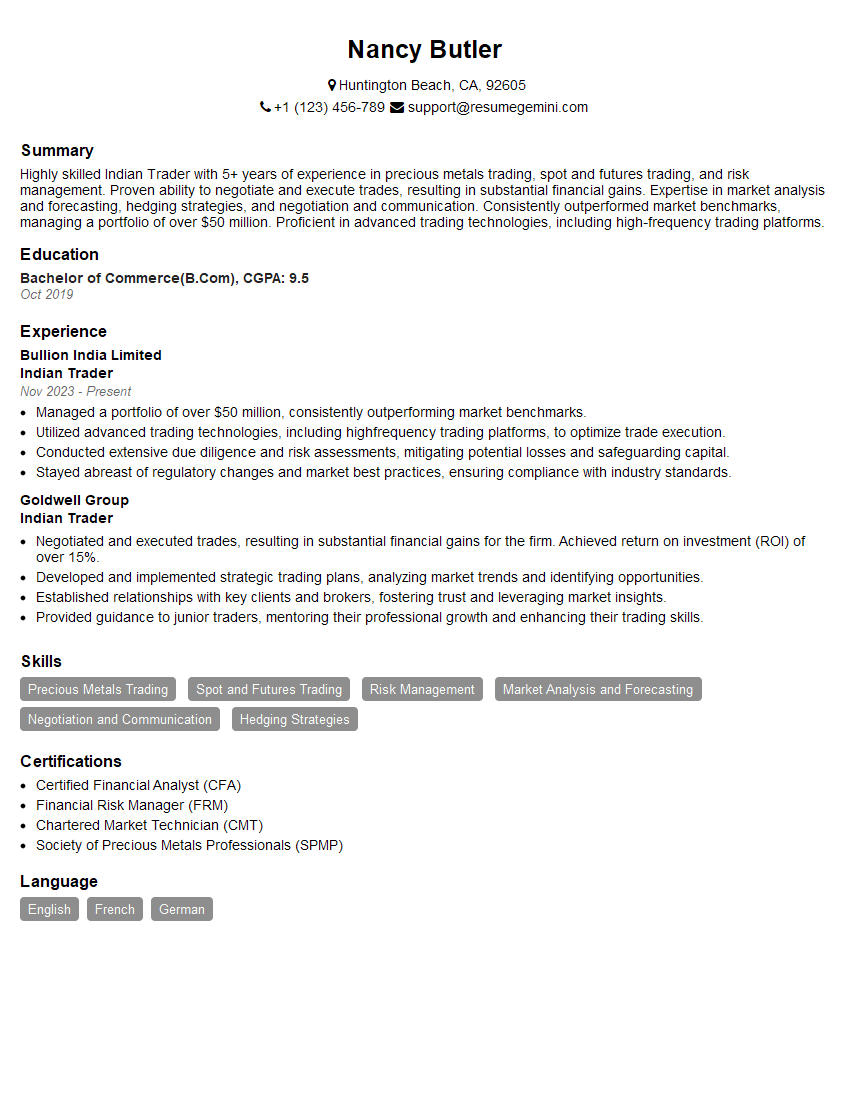

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Indian Trader

1. What are the key technical skills required for an Indian trader?

Here are the key technical skills required for an Indian trader:

- Understanding of the Indian stock market

- Knowledge of financial instruments and trading strategies

- Technical analysis skills

- Experience in using trading software and platforms

- Risk management skills

2. How do you stay updated on the latest market trends and news?

Research and Analysis

- Regularly read financial news and analysis from credible sources

- Attend industry conferences and webinars

- Follow market experts and analysts on social media and online platforms

Technical Indicators

- Use technical indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify trends and patterns in the market

- Monitor market volume and price action for insights into market sentiment

Networking

- Connect with other traders, brokers, and industry professionals to exchange information and gain different perspectives

- Attend industry events to stay informed about the latest trends and developments

3. What is your approach to risk management?

My approach to risk management involves the following:

- Setting clear risk limits: Determine the maximum amount of capital I am willing to risk on any given trade.

- Diversifying my portfolio: Spreading my investments across different asset classes and sectors to reduce overall risk.

- Using stop-loss orders: Setting automatic orders to sell a stock if it falls below a predetermined price, limiting potential losses.

- Monitoring market conditions: Continuously assessing market trends and economic indicators to adjust my risk tolerance and trading strategies accordingly.

4. What are your strengths and weaknesses as a trader?

Here are my strengths and weaknesses as a trader:

Strengths

- Strong understanding of the Indian stock market

- Skilled in technical analysis and trading strategies

- Disciplined and risk-averse approach to trading

- Excellent communication and interpersonal skills

Weaknesses

- Limited experience in international markets

- Can be overly cautious at times, missing potential opportunities

5. How do you handle the emotional challenges of trading?

Here are some strategies I use to manage the emotional challenges of trading:

- Maintain a trading journal: Record trades, emotions, and market conditions to identify patterns and learn from mistakes.

- Set realistic expectations: Understand that losses are part of trading and avoid chasing unrealistic profits.

- Take breaks: Step away from the markets when feeling overwhelmed or emotional to gain perspective.

- Seek support: Connect with fellow traders, mentors, or therapists to discuss challenges and gain support.

6. What is your trading philosophy?

My trading philosophy is based on the following principles:

- Trend following: Identify and trade with the prevailing market trend to increase the probability of success.

- Technical analysis: Use technical indicators and chart patterns to make informed trading decisions.

- Risk management: Prioritize risk management by setting clear limits and using stop-loss orders to protect capital.

- Discipline and patience: Adhere to a disciplined trading plan and avoid impulsive or emotional decisions.

7. How do you evaluate a potential trade?

I evaluate a potential trade by considering the following factors:

- Market trend: Determine the current market trend and identify potential trading opportunities.

- Technical analysis: Use technical indicators such as moving averages, support and resistance levels, and chart patterns to assess the probability of success.

- Risk-to-reward ratio: Calculate the potential reward relative to the risk involved in the trade.

- Market sentiment: Consider market sentiment and news events that may impact the stock’s price.

8. What are some of the common mistakes that traders make?

Here are some common mistakes that traders often make:

- Overtrading: Trading too frequently or with too much capital can increase risk and lead to losses.

- Ignoring risk management: Neglecting to set stop-loss orders or manage risk can result in significant financial losses.

- Chasing losses: Attempting to recoup losses by making impulsive trades often leads to further losses.

- Emotional trading: Making trading decisions based on emotions, such as fear or greed, can cloud judgment and result in poor outcomes.

9. How do you stay motivated and disciplined in your trading?

I stay motivated and disciplined in my trading by:

- Setting realistic goals: Establishing achievable trading goals helps me stay focused and motivated.

- Rewarding successes: Acknowledging and celebrating successful trades helps reinforce positive habits.

- Learning from mistakes: Analyzing unsuccessful trades provides valuable lessons and helps me improve my approach.

- Maintaining a positive mindset: Staying optimistic and resilient in the face of setbacks helps me maintain discipline and focus.

10. What are your career goals as an Indian trader?

My career goals as an Indian trader include:

- Enhance my trading skills and knowledge: Continuously learn and refine my trading strategies to improve performance.

- Build a successful trading career: Achieve financial independence and establish a sustainable income stream through trading.

- Contribute to the Indian financial market: Share my experiences and insights to empower other traders and promote financial literacy.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Indian Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Indian Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Indian Trader is responsible for executing trades on behalf of their clients in the Indian stock market. They must have a deep understanding of the Indian financial markets and be able to make quick and accurate decisions.

1. Execute Trades

Indian Traders are responsible for executing trades on behalf of their clients. This involves buying and selling stocks, bonds, and other financial instruments. They must be able to quickly and accurately execute trades in order to meet their clients’ needs.

- Determine the best time to buy or sell a stock based on market conditions.

- Place orders with brokers to buy or sell stocks.

2. Monitor Market Conditions

Indian Traders must constantly monitor market conditions in order to make informed trading decisions. They must be able to identify trends and patterns in the market and be able to anticipate future price movements.

- Read financial news and reports to stay up-to-date on market trends.

- Use technical analysis to identify trading opportunities.

3. Analyze Financial Data

Indian Traders must be able to analyze financial data in order to make informed trading decisions. They must be able to interpret financial statements and other financial data to identify potential investment opportunities.

- Use financial ratios to evaluate the financial health of companies.

- Use discounted cash flow analysis to value stocks.

4. Manage Risk

Indian Traders must be able to manage risk in order to protect their clients’ investments. They must be able to identify and assess risks and develop strategies to mitigate those risks.

- Set stop-loss orders to limit potential losses.

- Diversify their clients’ portfolios to reduce risk.

Interview Tips

Preparing for an interview can be daunting, but by following these tips, you can increase your chances of success.

1. Research the Company

Before your interview, take some time to research the company you are applying to. This will help you understand their business, culture, and values. You should also be familiar with the specific role you are applying for.

- Visit the company’s website.

- Read news articles and press releases about the company.

2. Practice Your Answers

One of the best ways to prepare for an interview is to practice your answers to common interview questions. This will help you feel more confident and prepared during the actual interview.

- Write down a list of common interview questions.

- Practice answering these questions out loud.

3. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business casual attire.

- Choose clothes that are clean, pressed, and fit well.

- Avoid wearing clothes that are too revealing or too casual.

4. Be on Time

Punctuality is important for any interview, but it is especially important for an Indian Trader interview. This shows that you are respectful of the interviewer’s time.

- Plan your route to the interview in advance.

- If you are running late, call the interviewer to let them know.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Indian Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!