Are you gearing up for a career in Industrial Accountant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Industrial Accountant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

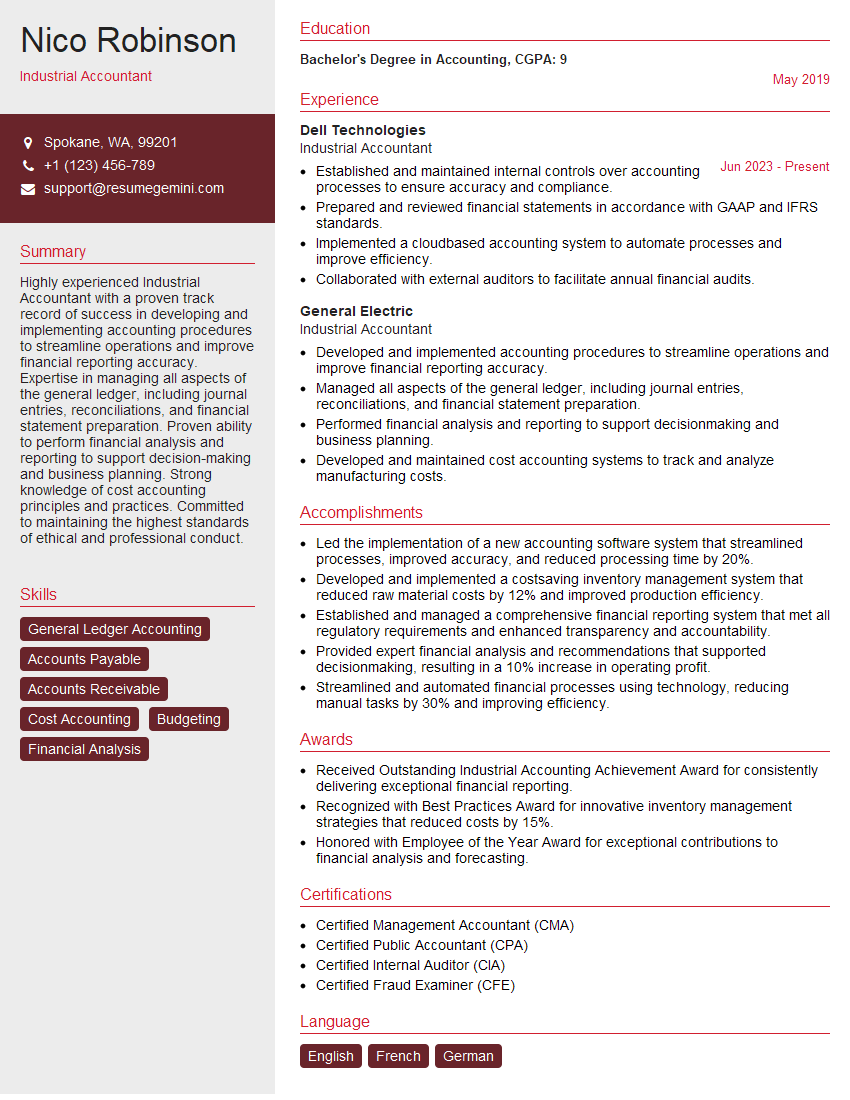

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Industrial Accountant

1. How do you identify and allocate overhead costs in an industrial setting?

- Activity-based costing (ABC) system

- Traditional allocation methods(e.g., direct labor hours, machine hours)

- Consideration of production volume, complexity, and resource consumption

- Using cost drivers to assign overhead costs to products or processes

- Regularly reviewing and adjusting cost allocation methods to ensure accuracy

2. Explain the importance of inventory valuation in industrial accounting.

Cost flow assumptions

- FIFO: Oldest units purchased are sold first

- LIFO: Most recent units purchased are sold first

- Weighted average: Average cost of all units available for sale

Impact on financial statements

- FIFO: Higher cost of goods sold in periods of rising prices

- LIFO: Lower cost of goods sold in periods of rising prices

- Weighted average: Intermediate cost of goods sold

3. How do you handle depreciation of fixed assets in an industrial setting?

- Understanding the different depreciation methods (e.g., straight-line, declining balance)

- Estimating the useful life of assets and their salvage value

- Recording depreciation expense and accumulating depreciation

- Considering the impact of depreciation on financial statements and cash flow

- Regularly reviewing and adjusting depreciation estimates

4. How do you ensure the accuracy and integrity of cost accounting data?

- Implementing internal controls over data entry and processing

- Performing regular reconciliations and audits

- Establishing clear policies and procedures for data collection and reporting

- Training staff on proper accounting practices

- Using technology to automate and streamline data management

5. How do you measure and analyze variances in industrial accounting?

- Calculating variances between actual and budgeted costs

- Investigating the causes of variances (e.g., production inefficiencies, material price changes)

- Taking corrective actions to minimize variances and improve profitability

- Using variance analysis as a tool for continuous improvement

- Communicating variance information to management for decision-making

6. How do you handle the allocation of joint costs in an industrial setting?

- Understanding the concept of joint costs and common costs

- Using allocation methods (e.g., physical measures, sales value, estimated market value)

- Considering the impact of cost allocation on product profitability

- Regularly reviewing and adjusting cost allocation methods

- Seeking guidance from industry best practices and accounting standards

7. How do you contribute to the profitability analysis of an industrial operation?

- Analyzing cost-volume-profit relationships

- Calculating break-even points and profit margins

- Identifying areas for cost reduction and profit improvement

- Preparing profitability reports and presenting findings to management

- Using profitability analysis to support strategic decision-making

8. How do you stay updated on the latest developments in industrial accounting?

- Attending industry conferences and workshops

- Reading professional journals and publications

- Participating in continuing education courses

- Networking with other accounting professionals

- Seeking certifications and designations in the field

9. How do you prioritize multiple projects and tasks in a busy industrial accounting environment?

- Understanding the importance and urgency of each project

- Using project management tools and techniques

- Delegating tasks effectively

- Communicating priorities to team members

- Monitoring progress and making adjustments as needed

10. How do you handle ethical dilemmas in industrial accounting?

- Understanding ethical principles and professional standards

- Consulting with supervisors and colleagues

- Documenting ethical concerns and decisions

- Reporting any suspected fraud or misconduct

- Prioritizing the interests of the organization and its stakeholders

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Industrial Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Industrial Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Industrial Accountants are responsible for recording, classifying, and summarizing financial transactions in accordance with Generally Accepted Accounting Principles (GAAP). They also prepare financial statements, such as balance sheets and income statements, and analyze financial data to provide insights to management. Key job responsibilities include:

1. Financial Reporting

Prepare financial statements in accordance with GAAP, including balance sheets, income statements, and cash flow statements.

- Ensure financial statements are accurate and reliable.

- Provide explanations and analysis of financial results to management.

2. Cost Accounting

Develop and implement cost accounting systems to track and analyze costs.

- Identify and allocate costs to products or services.

- Provide cost analysis to management to support decision-making.

3. Budgeting and Forecasting

Develop and manage budgets and financial forecasts.

- Track actual results against budgets and forecasts.

- Provide variance analysis and recommendations to management.

4. Internal Controls

Establish and maintain internal controls to safeguard assets and ensure the accuracy of financial data.

- Review and evaluate internal controls for effectiveness.

- Make recommendations to management for improving internal controls.

5. Other Responsibilities

Perform other accounting-related tasks as assigned, such as:

- Prepare tax returns

- Audit financial records

- Provide consulting services to clients

Interview Tips

Interviews for Industrial Accountant positions can be competitive, but by following these tips you can increase your chances of success.

1. Research the Company

Before the interview, research the company, its industry, and its financial performance. This will help you understand the company’s needs and how your skills and experience can contribute to its success.

2. Practice Answering Common Interview Questions

There are a few common interview questions that you can expect to be asked, such as:

- Tell me about your experience in financial reporting.

- What are your strengths and weaknesses as an accountant?

- Why are you interested in this position?

Practice answering these questions out loud so that you can deliver your answers confidently and concisely.

3. Highlight Your Relevant Skills and Experience

In your interview, be sure to highlight your relevant skills and experience. For example, if you have experience in cost accounting, be sure to mention it and explain how it has helped you to improve efficiency and profitability for your previous employers.

4. Be Prepared to Talk About Your Career Goals

Interviewers often ask candidates about their career goals. This is an opportunity for you to show that you are ambitious and that you are looking for a long-term career with the company. Be prepared to discuss your short-term and long-term goals, and explain how this position fits into your overall career plan.

5. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the company. This shows that you are interested in the opportunity and that you are taking the interview seriously.

6. Follow Up

After the interview, send a thank-you note to the interviewer. This is a simple way to stay on the interviewer’s mind and to show that you are still interested in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Industrial Accountant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.