Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Installment Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

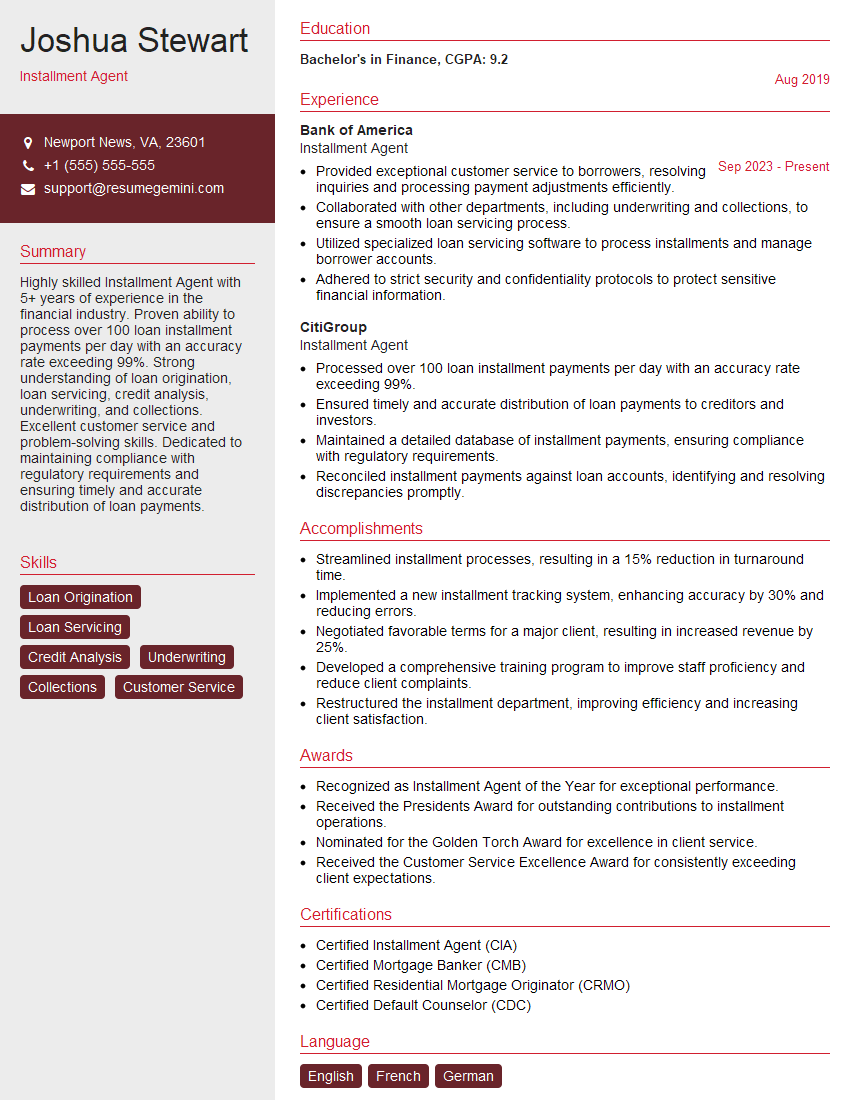

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Installment Agent

1. explain the process of collecting installments from customers?

- Identify customers who have missed payments or are behind on their installment plans.

- Contact customers via phone, email, or in person to remind them of their overdue payments.

- Explain the consequences of not making payments on time, such as late fees, credit score damage, or repossession of property.

- Negotiate payment arrangements with customers who are unable to pay the full amount immediately.

- Process customer payments and update records to reflect the status of their accounts.

2. what are the different types of installment plans that you have experience with?

- Fixed-rate installment plans: The interest rate and monthly payments remain the same throughout the term of the loan.

- Variable-rate installment plans: The interest rate and monthly payments can fluctuate based on market conditions.

- Balloon-payment installment plans: The final payment is significantly larger than the previous payments.

3. what are the common challenges you face as an Installment Agent?

- Dealing with customers who are resistant to paying their bills.

- Helping customers understand the consequences of not making payments on time.

- Negotiating payment arrangements that are both fair to the customer and the company.

- Staying up-to-date on changes in regulations and policies related to installment plans.

4. how do you stay organized and track the progress of your work?

- Maintain a detailed database of customer accounts, including payment history and contact information.

- Set up reminders and follow-up systems to ensure that customers are contacted on a regular basis.

- Prioritize tasks based on the urgency of each customer’s situation.

- Meet with management on a regular basis to discuss progress and identify areas for improvement.

5. what are your strengths and weaknesses as an Installment Agent?

-

Strengths:

- Excellent communication and interpersonal skills.

- Strong negotiation and problem-solving abilities.

- Ability to work independently and as part of a team.

- Proficient in the use of customer relationship management (CRM) software. Weaknesses:

- Can be difficult to deal with customers who are upset or angry.

- May struggle to stay motivated when dealing with a high volume of cases.

6. what are your career goals and how does this position align with them?

- Aspire to become a manager in the financial services industry.

- Gain experience in customer service, collections, and account management.

- Develop leadership and communication skills.

- Make a positive impact on the financial well-being of customers.

7. what are your expectations for this role?

- To be responsible for collecting installments from customers in a timely manner.

- To provide excellent customer service and build relationships with customers.

- To be able to work independently and as part of a team.

- To stay up-to-date on changes in regulations and policies related to installment plans.

- To help the company achieve its financial goals.

8. what is your experience with using technology in your work?

- Familiar with Microsoft Office Suite, including Word, Excel, and PowerPoint.

- Experience with customer relationship management (CRM) software.

- Able to use technology to track progress, manage data, and communicate with customers.

9. what is your knowledge of the Fair Debt Collection Practices Act (FDCPA)?

- Prohibits debt collectors from using harassing or abusive tactics.

- Requires debt collectors to provide consumers with certain information, such as the amount of the debt and the name of the creditor.

- Gives consumers the right to dispute the debt and to request validation of the debt.

10. what are your thoughts on the ethics of debt collection?

- Believe that debt collection should be conducted in a fair and ethical manner.

- Respect the privacy of customers and treat them with dignity.

- Avoid using harassing or abusive tactics.

- Work with customers to find solutions that are in their best interests.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Installment Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Installment Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Installment Agents play a crucial role in the financial industry, providing essential services to customers. Their primary responsibilities involve assisting customers with installment payments, ensuring timely collection, and maintaining accurate records.

1. Customer Service Excellence

Installment Agents are the face of the company, interacting with customers throughout the installment payment process. They must possess strong communication and interpersonal skills to build rapport, understand customer needs, and resolve any issues promptly.

- Answer customer inquiries and provide clear and concise information about payment options, installment plans, and account status.

- Handle customer complaints, respond promptly, and work towards resolving issues to maintain customer satisfaction.

2. Installment Payment Collection

Ensuring timely and accurate installment payments is a critical aspect of the role. Installment Agents are responsible for:

- Processing installment payments through various channels, including online, phone, and in-person.

- Sending out payment reminders, tracking payment status, and following up with customers who have missed payments.

- Maintaining accurate records of all installment payments received and managing payment histories for each customer.

3. Compliance and Reporting

Installment Agents are required to adhere to company policies, industry regulations, and legal requirements. They are responsible for:

- Understanding and complying with all applicable laws and regulations related to installment payments.

- Maintaining accurate and up-to-date records of all installment transactions for auditing and reporting purposes.

- Reporting any suspicious or fraudulent activities promptly to ensure compliance and mitigate risk.

4. Data Entry and Record Keeping

Accurate record-keeping is essential for Installment Agents. They are responsible for:

- Entering customer information, payment details, and other relevant data into the company’s systems.

- Maintaining and organizing customer files, ensuring that all information is readily accessible and up-to-date.

- Generating reports and providing data as needed to support the company’s operations and decision-making.

Interview Tips

Preparing for an interview can significantly increase your chances of success. Here are some key tips to help you ace your Installment Agent interview:

1. Research the Company and Position

Before the interview, thoroughly research the company and the specific Installment Agent position you are applying for. This will demonstrate your interest and understanding of the company’s operations and the role’s responsibilities.

- Visit the company’s website to learn about their products, services, and culture.

- Read online reviews and articles to gather insights into the company’s reputation and work environment.

- Review the job description carefully and identify the key skills and qualifications required for the position.

2. Practice Common Interview Questions

Prepare for common interview questions by practicing your answers in advance. This will help you feel more confident and articulate during the interview.

- Prepare answers to questions about your customer service and communication skills.

- Practice explaining your experience in handling payment transactions and resolving customer issues.

- Be ready to discuss your understanding of compliance and data security regulations related to installment payments.

3. Highlight Relevant Skills and Experience

During the interview, emphasize your relevant skills and experience that align with the job requirements. Use specific examples to demonstrate your abilities and how they would benefit the company.

- Highlight your experience in providing excellent customer service and resolving customer complaints.

- Quantify your results whenever possible, for example, providing data on the number of successful payment collections or customer satisfaction ratings.

- Describe your knowledge of installment payment processes, compliance requirements, and data reporting systems.

4. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows your interest and engagement. It also gives you an opportunity to gather additional information about the position and the company.

- Ask about the company’s growth plans and opportunities for professional development.

- Inquire about the company’s approach to customer satisfaction and compliance.

- Ask for clarification on any specific aspects of the role or the company’s operations that you are curious about.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Installment Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!