Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Installment Dealer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

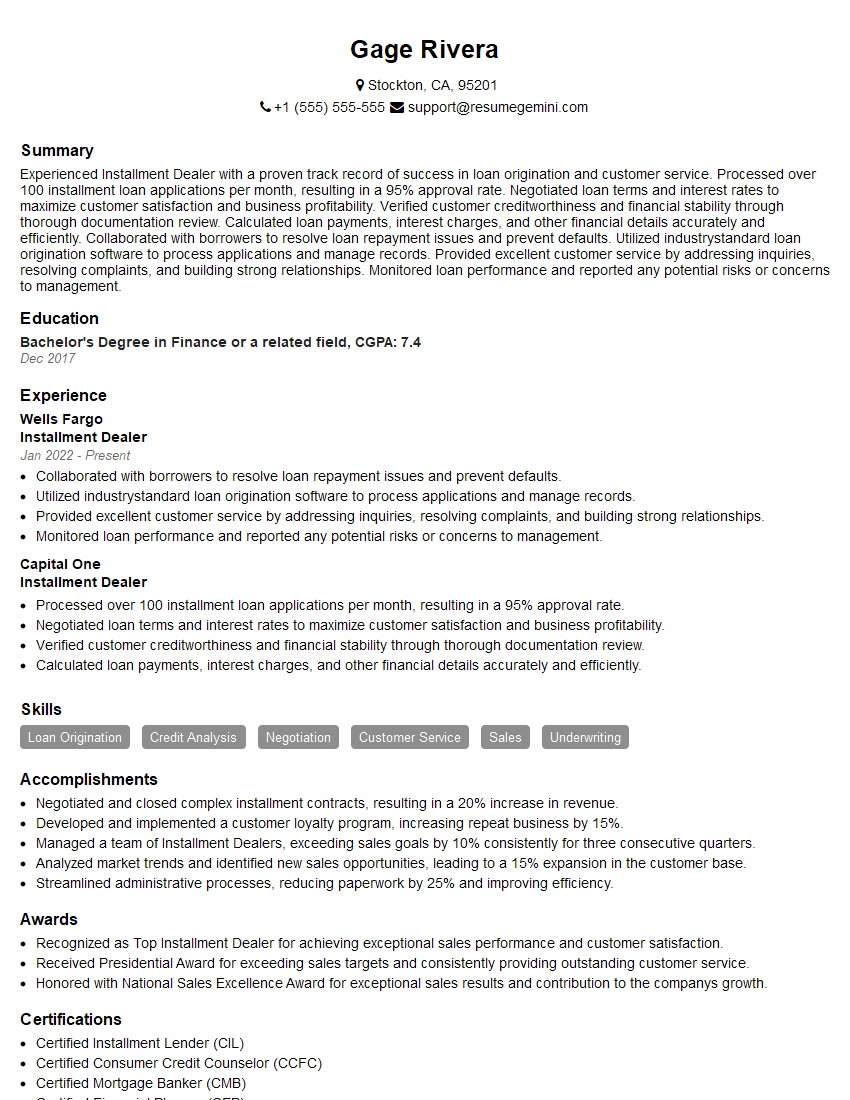

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Installment Dealer

1. Explain the process of finalizing an installment sale.

- Greet the customer and verify their identity.

- Review the terms of the sale with the customer, including the total purchase price, the down payment, the interest rate, and the monthly payment amount.

- Have the customer sign the installment sale contract.

- Set up the customer’s payment schedule.

- Provide the customer with a copy of the installment sale contract and any other relevant documents.

2. What are the different types of installment loans?

Unsecured Installment Loans

- Personal loans

- Credit card debt

- Student loans

Secured Installment Loans

- Auto loans

- Mortgages

- Home equity loans

3. What are the key factors to consider when evaluating an installment loan application?

- The borrower’s credit score

- The borrower’s debt-to-income ratio

- The borrower’s employment history

- The borrower’s income

- The value of the collateral (for secured loans)

4. How do you calculate the monthly payment for an installment loan?

The monthly payment for an installment loan can be calculated using the following formula:

Monthly payment = (Loan amount + Finance charges) / Loan term

5. What are the consequences of defaulting on an installment loan?

- Damage to the borrower’s credit score

- Legal action by the lender

- Repossession of the collateral (for secured loans)

6. What are the different types of insurance that can be purchased with an installment loan?

- Credit life insurance

- Credit disability insurance

- Gap insurance

7. What are the ethical considerations that installment dealers must be aware of?

- The duty to provide customers with clear and accurate information about the terms of the loan.

- The duty to avoid predatory lending practices.

- The duty to respect the privacy of customers.

8. What are the current trends in the installment loan industry?

- The increasing use of online lending platforms.

- The growing popularity of alternative lending products, such as peer-to-peer lending.

- The increasing use of data analytics to assess borrower risk.

9. What are the challenges facing installment dealers in today’s market?

- The increasing competition from online lenders.

- The rising cost of capital.

- The regulatory environment.

10. What are your strengths and weaknesses as an installment dealer?

- My strengths include my extensive knowledge of the installment loan industry, my strong customer service skills, and my ability to build relationships with customers.

- My weaknesses include my lack of experience in online lending and my limited knowledge of alternative lending products.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Installment Dealer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Installment Dealer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Installment Dealer is responsible for selling and financing goods and services through installment plans. They may work in a variety of settings, such as retail stores, car dealerships, and banks.

1. Selling Goods and Services

Installment Dealers typically work with customers who cannot afford to pay for goods or services upfront. They explain the terms of the installment plan to the customer and help them complete the necessary paperwork.

2. Financing Installments

Once the customer has agreed to the terms of the installment plan, the Installment Dealer arranges financing for the purchase. This may involve working with a bank or other financial institution.

3. Collecting Payments

Installment Dealers are responsible for collecting payments from customers on a regular basis. They may also be responsible for taking action against customers who default on their payments.

4. Maintaining Customer Relationships

Installment Dealers need to maintain good relationships with customers in order to keep them coming back. They should be able to answer questions, resolve complaints, and provide support.

Interview Tips

Preparing for an interview for an Installment Dealer position can help you make a good impression and increase your chances of getting the job. Here are a few tips to help you prepare:

1. Research the Company

Before you go to the interview, take some time to research the company. This will help you understand their business, their culture, and their values. You can find information about the company on their website, in their press releases, and in news articles.

2. Practice Answering Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is helpful to practice answering these questions in advance so that you can deliver your answers confidently and concisely.

3. Prepare Questions to Ask the Interviewer

Asking the interviewer questions at the end of the interview shows that you are interested in the position and that you are taking the interview seriously. Prepare a few questions in advance, such as “What are the biggest challenges facing the company right now?” and “What is the company’s culture like?”.

4. Be Yourself

The most important thing is to be yourself during the interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just relax, be confident, and let your personality shine through.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Installment Dealer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!