Are you gearing up for a career in Installment Loan Collector? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Installment Loan Collector and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

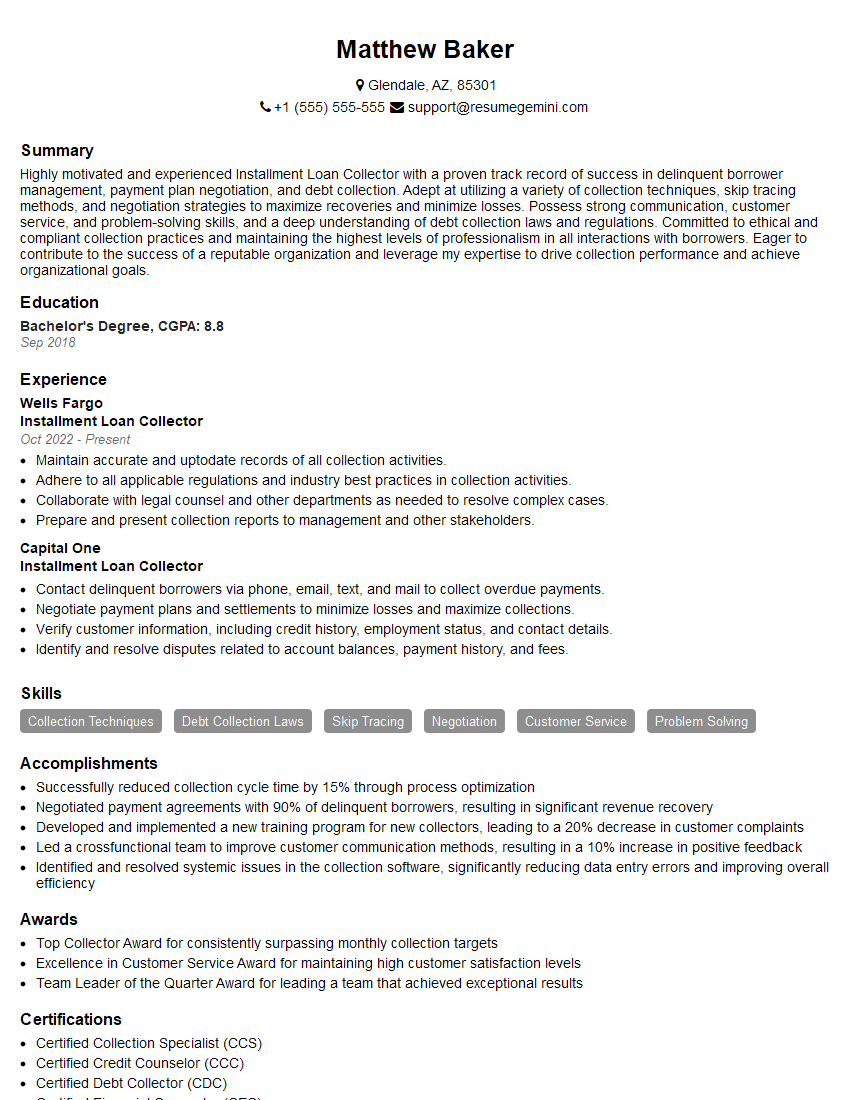

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Installment Loan Collector

1. What are the key responsibilities of an Installment Loan Collector?

As an Installment Loan Collector, my primary responsibilities would include:

- Contacting delinquent borrowers to collect overdue payments

- Negotiating payment arrangements and repayment schedules

- Investigating and validating customer financial situations

- Documenting all collection efforts and customer interactions

- Maintaining accurate records and reporting on collection activities

- Adhering to industry regulations and ethical collection practices

2. What strategies do you employ to effectively collect on delinquent accounts?

Understanding the Borrower’s Situation

- Reviewing customer account history and payment patterns

- Contacting the borrower by phone, email, or mail to discuss their financial situation

- Empathizing with the borrower’s challenges and understanding their reasons for non-payment

Negotiating Payment Arrangements

- Exploring flexible payment options, such as lower monthly installments or extended payment terms

- Working with the borrower to create a realistic repayment schedule

- Documenting all payment arrangements in writing

Following Up and Monitoring

- Regularly contacting the borrower to monitor their progress

- Providing support and encouragement

- Taking appropriate action, such as escalating the account or pursuing legal remedies, if necessary

3. How do you handle difficult or confrontational customers?

When dealing with difficult or confrontational customers, I prioritize the following strategies:

- Staying Calm: Maintaining a professional and composed demeanor, even under pressure.

- Actively Listening: Allowing the customer to fully express their concerns without interrupting.

- Empathizing: Showing understanding for the customer’s frustration while setting clear boundaries.

- Focusing on Solutions: Directing the conversation towards finding a mutually acceptable resolution.

- Documenting Interactions: Accurately recording all customer interactions, including any agreements or commitments made.

4. What techniques do you use to recover collateral in case of default?

- Legal Procedures: Initiating legal proceedings to repossess collateral, such as filing a repossession order or obtaining a judgment.

- Negotiation: Working with the borrower to voluntarily surrender the collateral or make alternative arrangements.

- Collaboration with Law Enforcement: Partnering with law enforcement agencies to locate and seize collateral if necessary.

5. How do you ensure compliance with Fair Debt Collection Practices Act (FDCPA) regulations?

- Training and Education: Regularly attending training programs and staying up-to-date on FDCPA regulations.

- Ethical Conduct: Adhering to ethical collection practices, including refraining from harassment, false or misleading statements, and unfair or deceptive tactics.

- Proper Documentation: Maintaining accurate records of all collection activities, including customer interactions, payment arrangements, and legal proceedings.

- External Audits: Regularly undergoing internal and external audits to ensure compliance with FDCPA regulations.

6. What software and tools are you familiar with in relation to debt collection?

- Collection Management Software: Utilizing software specifically designed for debt collection, such as Firstsource, RevenueMax, or iQor.

- Customer Relationship Management (CRM) Systems: Using CRM systems to manage customer data, track interactions, and automate tasks.

- Dialers and Predictive Analytics: Employing auto-dialers and predictive analytics to streamline outbound calls and prioritize high-value accounts.

7. How do you measure your success as an Installment Loan Collector?

- Collection Rate: Monitoring the percentage of delinquent accounts successfully collected.

- Reduced Delinquency: Tracking the decrease in overall loan delinquency rates.

- Customer Satisfaction: Assessing customer feedback and resolving complaints effectively.

- Regulatory Compliance: Maintaining a clean record of FDCPA compliance and adhering to all applicable regulations.

8. What motivates you to succeed in this role?

I am driven by the challenge of helping individuals resolve their financial difficulties. I find satisfaction in assisting borrowers in finding solutions that work for both them and the lender. Additionally, the opportunity to make a positive impact on people’s lives motivates me to excel in this field.

9. How do you handle the stress and emotional challenges of this job?

- Emotional Regulation: Managing my emotions and staying empathetic while dealing with difficult customers.

- Time Management: Effectively prioritizing tasks and workload to avoid feeling overwhelmed.

- Self-Care: Engaging in stress-reducing activities, such as exercise, meditation, or spending time with loved ones.

10. Why do you believe you are the best candidate for this position?

I am confident that I am well-suited for this position due to my:

- Proven Experience: My track record of successfully collecting delinquent accounts

- Strong Communication Skills: My ability to effectively communicate with customers, negotiate payment arrangements, and build rapport

- In-Depth Knowledge: My thorough understanding of FDCPA regulations and collection best practices

- Empathy and Resilience: My ability to connect with customers, understand their challenges, and remain persistent in the face of adversity

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Installment Loan Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Installment Loan Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Installment Loan Collector is responsible for collecting past-due installment loans. They work with customers to establish payment plans and resolve disputes. The collector must be able to communicate effectively, negotiate, and maintain a professional demeanor.

1. Identify and Contact Delinquent Borrowers

The collector begins by identifying borrowers who are behind on their payments. They may use a variety of methods to do this, such as reviewing account records, calling customers, or sending letters.

2. Develop and Implement Collection Strategies

Once the collector has identified delinquent borrowers, they will develop and implement a collection strategy. This strategy may include contacting the borrower by phone, email, or mail. The collector will also try to negotiate a payment plan with the borrower.

3. Resolve Disputes and Complaints

The collector may also be responsible for resolving disputes and complaints from borrowers. This may involve investigating the complaint, negotiating a resolution, or referring the complaint to a supervisor.

4. Maintain Accurate Records

The collector must maintain accurate records of all collection activities. This may include keeping track of payments, correspondence, and other interactions with borrowers.

Interview Tips

Preparing for an interview for an Installment Loan Collector position can help you make a good impression on the hiring manager and increase your chances of getting the job. Here are a few tips to help you prepare:

1. Research the Company and Position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you to understand the company’s culture and the requirements of the job.

- Visit the company’s website to learn about their mission, values, and products or services.

- Read online reviews of the company to get a sense of the work environment and culture.

- Review the job description carefully and make note of the key qualifications and responsibilities.

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as:

- Tell me about your experience in collection.

- How do you handle difficult customers?

- What are your strengths and weaknesses?

- Why are you interested in this position?

It is helpful to practice your answers to these questions ahead of time so that you can deliver them confidently and concisely during the interview.

Example Outline:

- Introduce yourself and briefly state your qualifications.

- Explain how your experience aligns with the job requirements.

- Provide specific examples of your skills and abilities.

- Conclude by expressing your interest in the position.

3. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time to show that you are respectful of the interviewer’s time.

4. Be Enthusiastic and Positive

The hiring manager will be looking for someone who is enthusiastic and positive about the position. Be sure to convey your interest in the job and your excitement about the opportunity to work for the company.

5. Follow Up After the Interview

After the interview, it is important to send a thank-you note to the hiring manager. This is a great way to reiterate your interest in the position and thank the hiring manager for their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Installment Loan Collector interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!