Are you gearing up for a career in Institutional Commodity Analyst? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Institutional Commodity Analyst and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

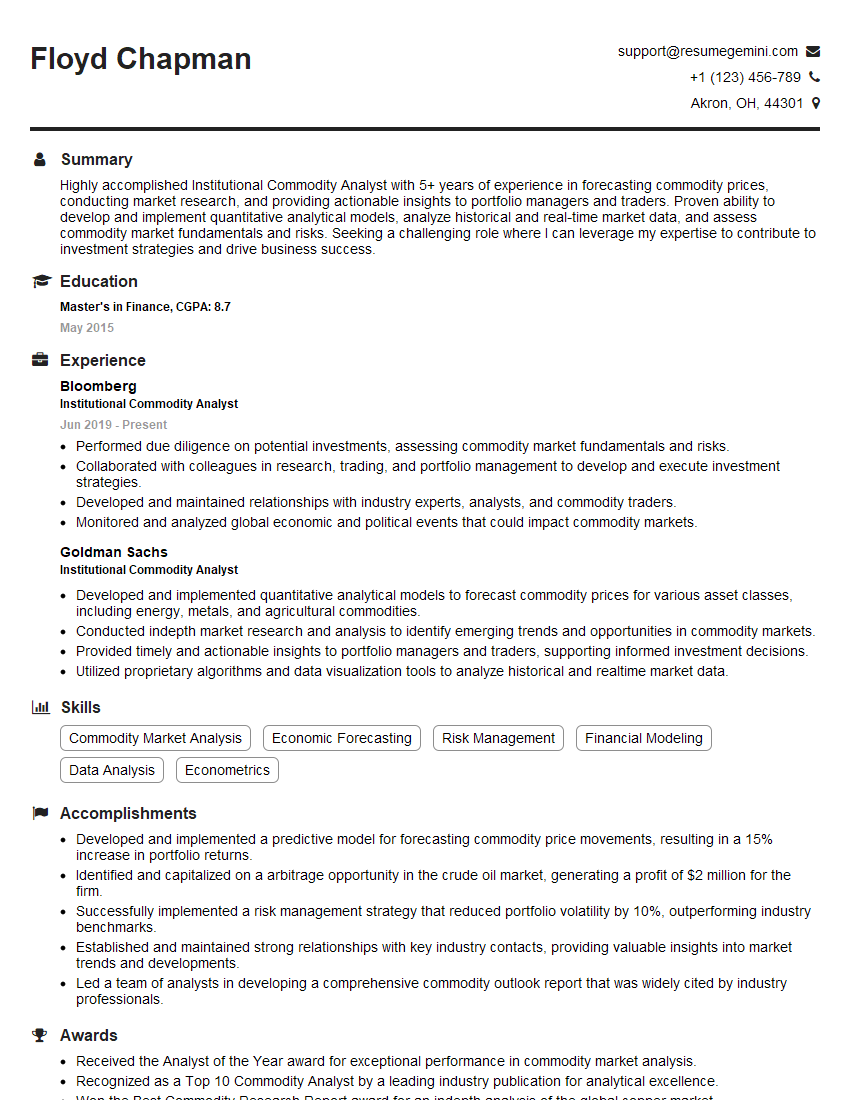

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Institutional Commodity Analyst

1. What are the key factors to consider when analyzing the supply and demand dynamics of a commodity?

In analyzing supply and demand dynamics of a commodity, I would consider the following key factors:

- Production levels and capacities

- Consumption patterns and trends

- Inventory levels and changes

- Trade flows and logistics

- Government policies and regulations

- Weather and natural events

- Economic conditions and market sentiment

2. Explain the concept of contango and backwardation in commodity futures markets. How do they impact trading strategies?

Contango

- Contango occurs when the futures price of a commodity is higher than the spot price.

- This indicates expectations of higher prices in the future.

- Traders may engage in contango trading by buying futures contracts and selling them later.

Backwardation

- Backwardation occurs when the futures price is lower than the spot price.

- This indicates expectations of lower prices in the future.

- Traders may engage in backwardation trading by selling futures contracts and buying them later.

3. Describe your approach to valuing a commodity using different valuation methodologies.

My approach to valuing a commodity involves employing a combination of valuation methodologies to capture different aspects of its value:

- Cost-based valuation: This method considers the costs associated with producing or acquiring the commodity.

- Income-based valuation: This method considers the future cash flows that the commodity is expected to generate.

- Market-based valuation: This method relies on comparable market transactions or publicly available data on commodity prices.

4. How do you assess the impact of geopolitical events on commodity prices? Provide an example.

I assess the impact of geopolitical events on commodity prices by considering the following factors:

- Type and location of the event: Conflicts, political instability, and natural disasters can disrupt production and supply chains.

- Commodities affected: Certain commodities, such as oil or wheat, may be particularly vulnerable to geopolitical events.

- Market sentiment and speculation: Geopolitical risks can trigger market volatility and influence investor sentiment.

5. Explain how you would analyze the impact of climate change on a specific commodity market.

To analyze the impact of climate change on a commodity market, I would consider the following factors:

- Vulnerability of production: The sensitivity of commodity production to changes in temperature, precipitation, or extreme weather events.

- Demand shifts: Potential changes in demand for commodities due to climate-related factors, such as altered energy consumption or food security.

- Regulatory and policy implications: Policies and regulations aimed at mitigating climate change may influence commodity markets.

6. Discuss the role of financial instruments, such as futures and options, in managing commodity price risk.

- Futures contracts: Allow for locking in prices and managing price volatility.

- Options contracts: Provide flexibility to manage risk and speculate on price movements.

- Hedging: Using futures or options to offset potential losses from price fluctuations.

- Speculation: Using financial instruments to capitalize on market fluctuations.

7. Describe your experience in utilizing technical analysis tools to identify trading opportunities in commodity markets.

- Chart patterns: Identifying historical patterns to predict future price movements.

- Technical indicators: Using statistical and mathematical tools to analyze price trends and identify trading signals.

- Candlestick analysis: Interpreting price patterns based on candlestick formations.

- Risk management: Applying technical analysis to determine stop-loss and take-profit levels.

8. Explain the concept of basis in commodity markets and its significance in trading strategies.

Basis refers to the difference between the spot price and the futures price of a commodity. It is significant because:

- Storage and carrying costs: Basis reflects the costs of storing and financing the commodity until its futures contract expires.

- Supply and demand conditions: Changes in basis can indicate shifts in supply and demand, influencing trading strategies.

- Trading opportunities: Traders can capitalize on basis movements by executing spread trades or engaging in basis arbitrage.

9. Discuss the factors that influence the liquidity of commodity markets and the implications for trading.

- Market depth: The number of buyers and sellers available to trade.

- Trading volume: The amount of commodity traded within a given period.

- Market volatility: High volatility can reduce liquidity as participants may be hesitant to engage in transactions.

- Regulatory factors: Regulations and reporting requirements can influence market liquidity.

10. Describe your approach to staying up-to-date on the latest developments and trends in the commodity markets.

- Industry publications and reports: Regularly reading industry publications and research reports.

- Market news and data: Monitoring real-time market data, news, and analysis.

- Conferences and webinars: Attending industry conferences and online webinars to connect with experts and gain insights.

- Networking: Establishing relationships with industry professionals and attending market events.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Institutional Commodity Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Institutional Commodity Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Institutional Commodity Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.