Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Actuary position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

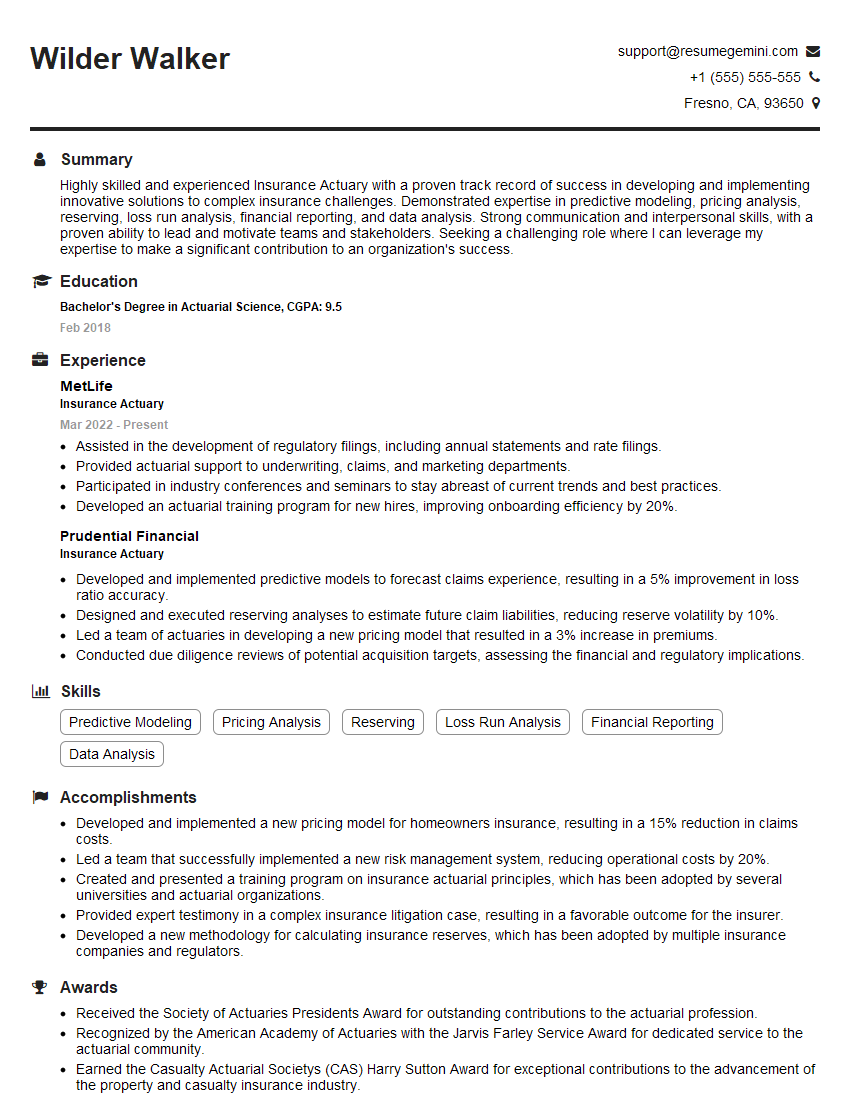

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Actuary

1. Explain the concept of risk assessment in insurance?

Risk assessment in insurance involves evaluating the probability and severity of potential losses or damages. It helps insurers determine the appropriate premium rates and coverage terms for policies.

- Identify hazards: Determine the potential events that could cause losses.

- Analyze frequency and severity: Estimate the likelihood and magnitude of each hazard.

- Mitigate risks: Implement measures to reduce or eliminate hazards and their potential impact.

- Evaluate financial impact: Calculate the potential losses and costs associated with each risk.

2. Describe the different methods used to calculate insurance premiums?

Manual rating

- Based on past claims experience and industry data.

- Uses a fixed rate schedule determined by risk factors.

Experience rating

- Consider the policyholder’s individual claims history.

- Provides a discount or surcharge based on performance.

Schedule rating

- Adjusts premiums based on specific risk characteristics not included in the base rate.

- Used for factors such as location, construction, and safety measures.

3. How do you determine the appropriate level of reserves for an insurance company?

To determine the appropriate level of reserves, actuaries consider:

- Claims incurred but not reported (IBNR): Estimated claims that have occurred but have not yet been reported.

- Loss adjustment expenses (LAE): Costs associated with investigating and settling claims.

- Unearned premium reserve (UPR): Premiums received but not yet earned, as coverage has not expired.

- Catastrophe reserve: Funds set aside to cover potential large-scale events.

4. Explain the role of an actuary in the development of insurance products?

Actuaries play a crucial role in developing insurance products by:

- Pricing and underwriting: Determine the appropriate premiums and risk selection criteria.

- Product design: Assist in creating new products that meet market needs.

- Risk management: Evaluate and mitigate risks associated with new products.

- Regulatory compliance: Ensure products comply with insurance regulations.

5. How do you handle conflicting actuarial advice from different sources?

When faced with conflicting actuarial advice, I take the following steps:

- Review and analyze the underlying assumptions and methodologies: Identify any inconsistencies or biases.

- Consult with other actuaries: Seek input from colleagues or experts in the field.

- Evaluate the potential impact of each recommendation: Consider the financial, reputational, and regulatory implications.

- Make an informed decision: Justify my conclusion and document the rationale behind my choice.

6. Describe your experience in using statistical modeling techniques in insurance?

I have extensive experience in using statistical modeling techniques in insurance, including:

- Generalized linear models (GLMs): Used for modeling claim frequencies and severities.

- Survival analysis: Used for analyzing time-to-event data, such as insurance policy durations.

- Monte Carlo simulations: Used for stochastic modeling and risk assessment.

- Machine learning algorithms: Used for predicting future claims and identifying patterns in data.

7. How do you stay up-to-date with the latest actuarial research and developments?

I stay up-to-date with the latest actuarial research and developments by:

- Attending conferences and seminars: Participate in industry events to learn about new models and best practices.

- Reading actuarial journals and publications: Subscribe to journals and stay informed about current research.

- Collaborating with fellow actuaries: Network with professionals in the field to exchange ideas and insights.

- Continuing education: Pursue additional certifications and training to enhance my knowledge.

8. Describe your experience with regulatory compliance in insurance?

I have a thorough understanding of regulatory compliance in insurance, including:

- Solvency and risk-based capital requirements: Ensure insurers maintain sufficient financial strength.

- Valuation and reporting standards: Adhere to accounting and reporting regulations for insurance companies.

- Consumer protection laws: Protect the rights and interests of policyholders.

- Anti-money laundering and terrorist financing regulations: Combat financial crimes and protect insurance products.

9. How do you prioritize and manage multiple projects and deadlines effectively?

To prioritize and manage multiple projects and deadlines effectively, I use the following strategies:

- Set clear goals and objectives: Define the scope and deliverables of each project.

- Create a detailed project plan: Outline the steps, timelines, and resource allocation.

- Use project management tools: Utilize software to track progress, manage tasks, and collaborate with team members.

- Delegate responsibilities: Assign tasks to team members based on their skills and availability.

- Communicate regularly: Update stakeholders on project status and address any issues promptly.

10. What are your career goals and how do you see this position fitting into them?

My career goal is to become a Chief Actuary, leading an actuarial team and providing strategic guidance to an insurance company. I believe this position is an excellent opportunity for me to:

- Expand my technical skills: Enhance my expertise in various actuarial disciplines.

- Gain leadership experience: Oversee and mentor a team of actuaries.

- Contribute to strategic decision-making: Provide actuarial insights and recommendations to senior management.

- Make a meaningful impact: Utilize my actuarial knowledge to ensure the financial stability and growth of the company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Actuary.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Actuary‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance actuaries are responsible for assessing the financial risks associated with insurance policies and making recommendations on how to mitigate those risks. Their key job responsibilities include:

1. Pricing insurance policies

Actuaries use statistical data to determine the probability of an insured event occurring and to calculate the appropriate premium for an insurance policy.

- Analyzing claims data to identify trends and patterns.

- Developing pricing models that take into account factors such as age, health, occupation, and location.

2. Reserving for future claims

Actuaries estimate the amount of money that an insurance company will need to pay out in claims in the future. This information is used to set aside reserves so that the company can meet its obligations to policyholders.

- Estimating the probability and severity of future claims.

- Developing reserving models that take into account factors such as inflation, medical costs, and legal settlements.

3. Managing investment portfolios

Actuaries help insurance companies manage their investment portfolios to ensure that they have sufficient funds to meet their obligations to policyholders. They make recommendations on asset allocation, diversification, and risk management.

- Analyzing the financial markets to identify investment opportunities.

- Developing investment strategies that meet the company’s risk tolerance and return objectives.

4. Advising on product development

Actuaries work with insurance product development teams to design new products and services. They provide input on the pricing, reserving, and investment implications of new products.

- Evaluating the feasibility of new product ideas.

- Developing pricing and reserving models for new products.

Interview Tips

To prepare for an interview for an insurance actuary position, you should:

1. Research the company and the position

Before you go on an interview, it is important to do your research and learn as much as you can about the company and the position you are applying for. This will help you understand the company’s culture, goals, and needs. You can find information about the company on its website, LinkedIn, and other online resources. You can also learn more about the position by reading the job description and talking to people who work in the industry.

- Visit the company’s website to learn about its history, mission, and products.

- Read the job description carefully and identify the key qualifications and skills that the company is looking for.

- Talk to people who work in the insurance industry to get their insights on the company and the position.

2. Practice your answers to common interview questions

There are a number of common interview questions that you can expect to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Write down your answers to common interview questions and practice saying them out loud.

- Ask a friend or family member to mock interview you and give you feedback on your answers.

- Time yourself to make sure that your answers are concise and within the time limit.

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your work history, education, and any relevant projects or accomplishments. You should also be able to articulate how your skills and experience make you a good fit for the position.

- Highlight your skills and experience that are relevant to the position.

- Use specific examples to demonstrate your skills and abilities.

- Be prepared to talk about your work history and how it has prepared you for the position.

4. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are serious about the position and that you respect their time.

- Dress in business attire that is clean and wrinkle-free.

- Arrive on time for your interview and be prepared to wait a few minutes if necessary.

- Be polite and respectful to everyone you meet, including the receptionist and other employees.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Actuary interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!