Are you gearing up for an interview for a Insurance Adviser position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Insurance Adviser and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

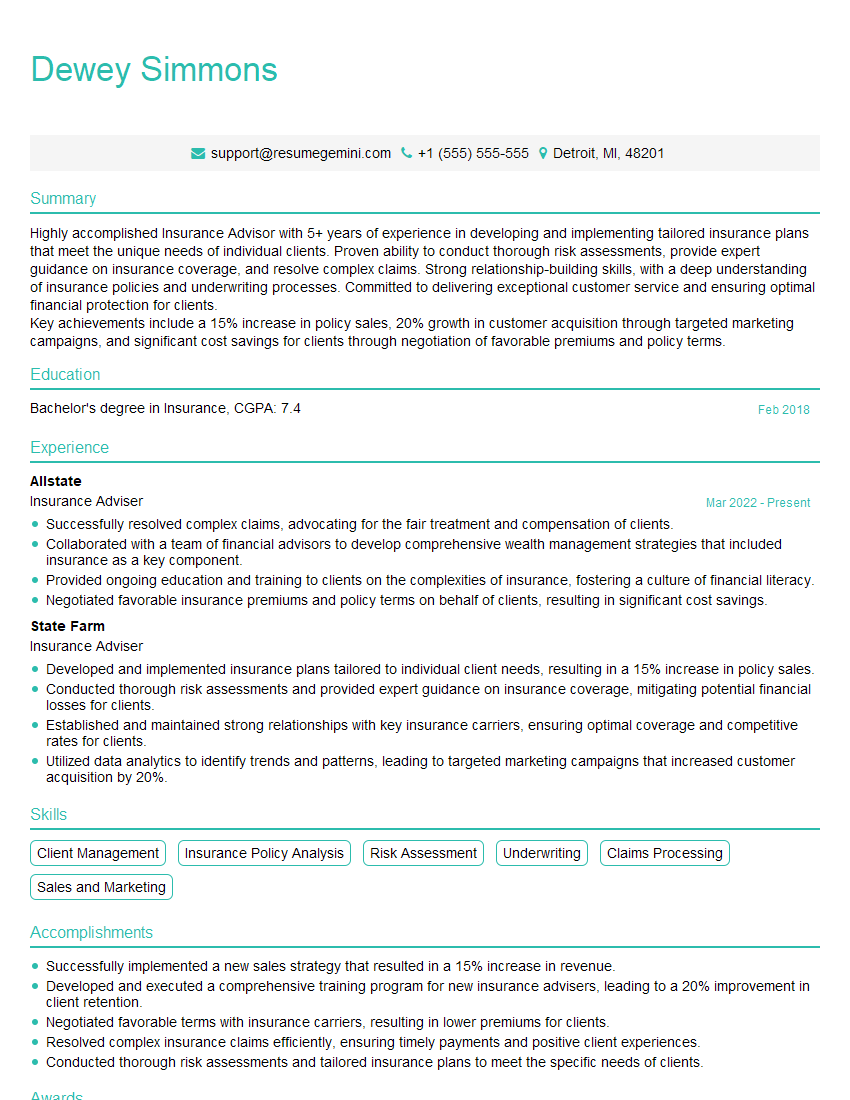

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Adviser

1. How do you approach the underwriting process for complex commercial insurance policies?

- Gather and review all relevant information, including the policy application, financial statements, loss history, and other documentation.

- Identify and assess the risks involved, considering the nature of the business, its operations, and its industry.

- Determine the appropriate coverage and limits of liability based on the risks identified.

- Set the premium rate based on the underwriting analysis and the insurer’s risk appetite.

- Monitor the policy throughout its term to ensure that the risks remain within acceptable parameters.

2. How do you stay up-to-date on the latest insurance regulations and industry best practices?

subheading of the answer

- Attend industry conferences and webinars.

- Read insurance trade publications and journals.

- Take continuing education courses.

- Network with other insurance professionals.

subheading of the answer

- Follow regulatory agencies on social media.

- Set up Google Alerts for relevant keywords.

- Subscribe to industry newsletters and blogs.

3. Can you describe a time when you had to deal with a difficult client? How did you handle the situation?

- Listen to the client’s concerns and try to understand their perspective.

- Explain the insurance policy and coverage in clear and concise terms.

- Work with the client to find a solution that meets their needs.

- Follow up with the client to ensure that they are satisfied.

4. What are the most important qualities of a successful insurance adviser?

- Excellent communication and interpersonal skills.

- Strong knowledge of the insurance industry and products.

- Ability to assess risk and provide sound advice.

- Customer-focused and committed to providing excellent service.

- Professional and ethical.

5. How do you build strong relationships with clients?

- Get to know your clients on a personal level.

- Understand their needs and goals.

- Provide them with excellent service.

- Be honest and transparent.

- Follow up with them regularly.

6. What are the challenges facing the insurance industry today?

- Increased competition.

- Changing regulatory landscape.

- Technological advancements.

- Climate change.

7. How do you see the insurance industry evolving in the future?

- Increased use of technology.

- Greater focus on customer experience.

- New products and services to meet changing needs.

8. Would you recommend any changes at this company, and if so, why, and what would they be?

9. What is your sales strategy?

- Identify potential clients.

- Qualify leads.

- Build relationships with clients.

- Present solutions to clients’ needs.

- Close deals.

10. What are your strengths and weaknesses?

Strengths:

- Excellent communication and interpersonal skills.

- Strong knowledge of the insurance industry and products.

- Ability to assess risk and provide sound advice.

- Customer-focused and committed to providing excellent service.

- Professional and ethical.

Weaknesses:

- I am always looking for ways to improve my knowledge and skills.

- I am sometimes too detail-oriented, which can lead to me overlooking the big picture.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Advisers are responsible for providing guidance and advice to clients on insurance products and services. They assess clients’ needs and risks, and recommend suitable insurance policies to meet their individual requirements. Key responsibilities of an Insurance Adviser include:

1. Client Needs Assessment

Analyzing clients’ financial situation, risk tolerance, and insurance needs through in-depth interviews and research.

- Conducting thorough financial assessments to determine clients’ appropriate levels of coverage.

- Evaluating clients’ risk profiles to identify potential areas of exposure.

2. Insurance Product Recommendation

Recommending tailored insurance policies that align with clients’ specific needs and objectives.

- Providing detailed explanations of different insurance products and their benefits.

- Assisting clients in comparing and selecting the most suitable policies.

3. Policy Management and Support

Managing insurance policies throughout their lifecycle, ensuring clients receive optimal coverage and support.

- Processing and tracking insurance applications and renewals.

- Providing ongoing support and advice to clients on policy changes and updates.

4. Relationship Management

Building long-term relationships with clients based on trust and professionalism.

- Maintaining regular contact with clients to monitor their insurance needs and provide updates.

- Responding promptly to client inquiries and addressing any concerns efficiently.

Interview Tips

Preparing thoroughly for an Insurance Adviser interview is crucial to showcase your skills and knowledge. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s mission, values, and insurance offerings. Research industry trends and regulations to demonstrate your up-to-date knowledge.

- Visit the company’s website and review their annual reports and financial statements.

- Read industry publications and attend webinars to stay informed about market developments.

2. Quantify Your Accomplishments

Use specific metrics and examples to demonstrate your impact in previous roles. Highlight your ability to generate leads, close deals, and provide exceptional customer service.

- Instead of saying “I advised clients,” say “I helped 30% of my clients increase their coverage by an average of 25%.”

- Use numbers to quantify your successes, such as “Reduced claim processing time by 15% through process optimization.”

3. Practice Common Interview Questions

Anticipate common interview questions and prepare your answers in advance. This will help you feel confident and articulate during the interview.

- Prepare for questions about your experience, skills, and qualifications.

- Consider situational questions that ask you to describe how you would handle specific scenarios.

4. Be Professional and Enthusiastic

Dress professionally and arrive on time for your interview. Maintain eye contact, speak clearly, and convey a positive and enthusiastic attitude.

- Show interest in the company and the position by asking thoughtful questions.

- Be prepared to discuss your career goals and how they align with the company’s objectives.

5. Follow Up

After the interview, send a thank-you note to the interviewer within 24 hours. Reiterate your interest in the position and highlight any key points you discussed.

- Personalize your thank-you note by referencing specific aspects of the interview.

- Use the thank-you note as an opportunity to clarify any questions or provide additional information.

Next Step:

Now that you’re armed with the knowledge of Insurance Adviser interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Insurance Adviser positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini