Are you gearing up for a career in Insurance Advisor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Insurance Advisor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

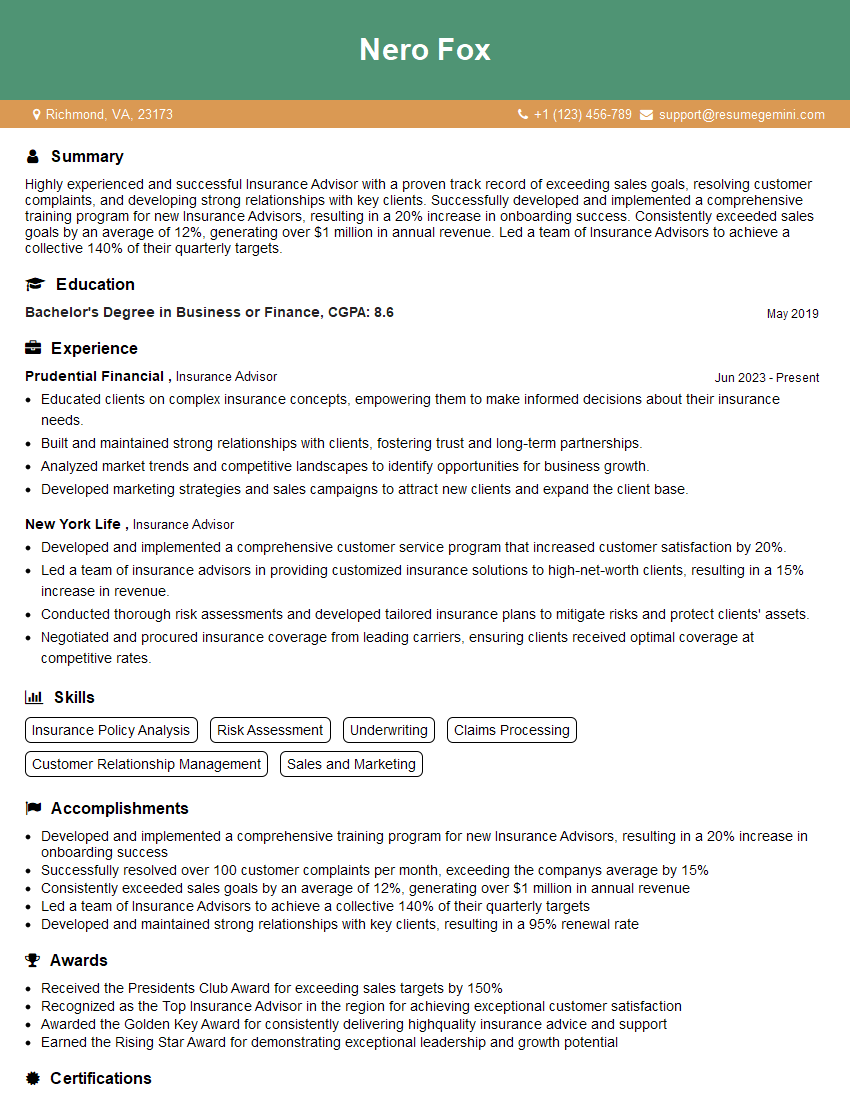

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Advisor

1. What are the key principles of insurance?

The key principles of insurance are:

- Risk sharing: Insurance pools the risks of many individuals or entities to spread the financial burden of loss or damage.

- Indemnity: In the event of a covered loss, insurance aims to restore the insured to their financial position before the loss occurred.

- Utmost good faith: Both the insurer and the insured must act in good faith and disclose all material information.

- Insurable interest: The insured must have a financial interest in the insured property or person.

- Proximate cause: The loss must be directly caused by a covered peril.

2. Explain the different types of insurance policies available.

Individual policies

- Life insurance: Provides financial protection to beneficiaries in the event of the insured’s death.

- Health insurance: Covers medical expenses incurred due to illness, injury, or preventive care.

- Homeowners insurance: Protects the structure of a home and its contents from damage or loss.

- Auto insurance: Covers damage to vehicles, medical expenses, and liability in case of accidents.

Commercial policies

- Commercial property insurance: Protects businesses from damage or loss to their property and assets.

- General liability insurance: Covers businesses for liability claims arising from bodily injury or property damage to third parties.

- Workers’ compensation insurance: Provides medical and income benefits to employees who suffer job-related injuries or illnesses.

3. How do you assess the risk profile of a potential client?

- Gather information: Collect data on the client’s history, property, and financial situation.

- Analyze key factors: Assess factors such as age, health, occupation, location, and safety measures.

- Determine potential hazards: Identify risks that the client may be exposed to based on their profile.

- Calculate premiums: Use the risk assessment to determine appropriate insurance premiums.

4. Describe the claims process for a homeowner’s insurance policy.

- Report the loss: Contact the insurance company promptly to report the damage or loss.

- Submit a claim: Provide detailed documentation, including photos, receipts, and estimates.

- Investigation and settlement: The insurance company will investigate the claim and determine the amount of coverage.

- Payment: The insurance company will issue a settlement check or arrange for repairs.

5. What are the legal and ethical responsibilities of an insurance advisor?

- Legal responsibilities:

- Act in accordance with state insurance laws and regulations.

- Provide accurate and complete information to clients.

- Maintain client confidentiality.

- Ethical responsibilities:

- Put the client’s interests first.

- Provide unbiased advice.

- Avoid conflicts of interest.

6. How do you stay up-to-date on industry trends and best practices?

- Attend industry conferences and seminars: Engage with experts and learn about new developments.

- Read industry publications: Stay informed about regulatory changes and market trends.

- Complete continuing education courses: Enhance knowledge and skills through accredited programs.

- Network with other professionals: Share insights and learn from peers in the field.

7. What are the challenges facing the insurance industry in the current market?

- Technological advancements: Digitalization and automation are disrupting traditional insurance models.

- Changing regulatory landscape: New regulations and compliance requirements can impact business practices.

- Increased competition: The entry of new players into the market intensifies competition.

- Climate change: Extreme weather events and environmental risks pose challenges for insurers.

8. How do you build and maintain strong relationships with clients?

- Communicate effectively: Provide clear and regular communication to keep clients informed.

- Be responsive: Address client inquiries and concerns promptly and thoroughly.

- Personalize interactions: Tailor advice and solutions to meet individual client needs.

- Follow up: Regularly check in with clients to ensure satisfaction and address any changes in their situation.

9. How do you handle objections or concerns raised by potential clients?

- Listen attentively: Understand the client’s concerns and acknowledge their viewpoint.

- Provide clear rationale: Explain the benefits and value of the insurance product or service.

- Offer alternative solutions: Suggest different options that may address the client’s concerns.

- Use data and evidence: Support your advice with statistics, research, or case studies to demonstrate the effectiveness of the solution.

10. Why are you interested in working for our company specifically?

I am eager to join your company because of its reputation as a leader in the insurance industry. I am particularly impressed by your company’s focus on client service and innovation. I believe that my skills and experience in insurance advisory would be a valuable asset to your team. I am confident that I can contribute to the company’s success and provide exceptional outcomes for our clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As an Insurance Advisor, you are the bridge between customers and insurance providers, helping individuals and businesses understand their insurance needs and providing tailored solutions to protect their assets and financial well-being. Your primary responsibilities include:

1. Customer Consultation and Needs Analysis

Conduct thorough needs assessments to identify clients’ insurance requirements, risk tolerance, and financial goals.

- Interview clients to gather information about their personal or business assets, liabilities, and insurance history.

- Analyze clients’ financial statements and risk appetite to develop comprehensive insurance plans.

2. Product Knowledge and Recommendation

Maintain a deep understanding of various insurance products, including life, health, property, and liability insurance.

- Research and compare insurance policies from different providers to find the most suitable options for clients.

- Explain insurance terms and conditions clearly, ensuring clients understand the coverage and exclusions.

3. Policy Underwriting and Administration

Process insurance applications, evaluate risks, and underwrite policies according to company guidelines.

- Collect and review necessary documentation to support insurance applications.

- Calculate premiums and issue insurance policies, ensuring compliance with regulatory requirements.

4. Client Support and Relationship Management

Foster long-term relationships with clients by providing ongoing support and guidance.

- Respond promptly to client inquiries, complaints, and claims.

- Maintain regular communication with clients to review coverage, address changes, and provide updates on the insurance market.

Interview Tips

Preparing for an insurance advisor interview requires a combination of industry knowledge and interpersonal skills. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Thoroughly research the insurance company you’re applying to, their products, and the current insurance market trends.

- Visit the company’s website, read industry news, and attend webinars to gain insights.

- Familiarize yourself with the specific insurance products and services offered by the company.

2. Highlight Your Sales and Customer Service Skills

Insurance advisors are essentially sales professionals who need to effectively communicate with clients and build rapport.

- Showcase your ability to identify customer needs, present solutions, and close deals.

- Emphasize your customer service skills, including empathy, active listening, and problem-solving.

3. Demonstrate Your Insurance Knowledge

Be prepared to discuss your understanding of different insurance products, underwriting processes, and regulatory requirements.

- Study common insurance terms, policy types, and risk assessment techniques.

- If possible, obtain industry certifications or licenses to demonstrate your credibility.

4. Practice Role-Playing Exercises

Many insurance advisor interviews involve role-playing exercises to assess your communication and sales skills.

- Practice role-playing scenarios where you consult with clients, explain insurance products, and handle objections.

- Seek feedback from friends or family members to refine your approach.

5. Prepare Thoughtful Questions

Asking thoughtful questions during the interview shows that you’re engaged and interested in the opportunity.

- Inquire about the company’s sales targets, training programs, and opportunities for professional development.

- Ask about the company’s approach to customer satisfaction and claims handling.

Next Step:

Now that you’re armed with the knowledge of Insurance Advisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Insurance Advisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini