Are you gearing up for a career in Insurance Agent? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Insurance Agent and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

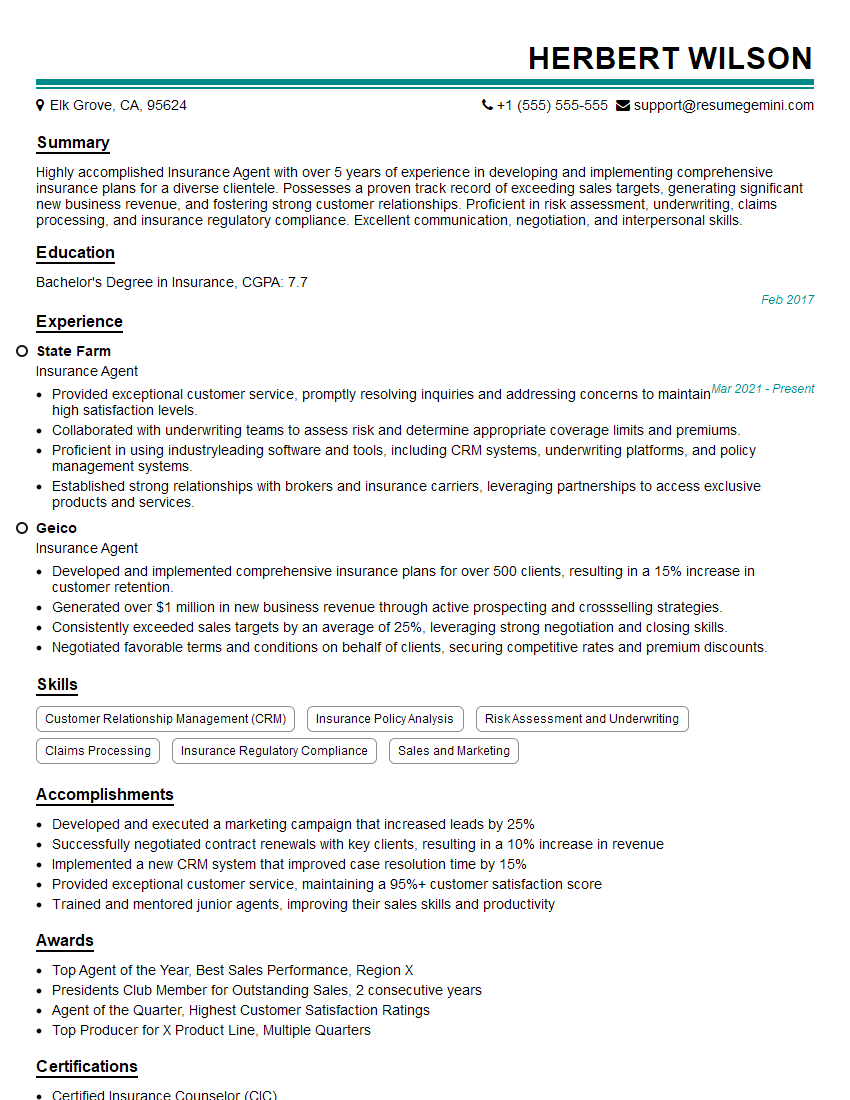

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Agent

1. What are the key principles of insurance?

- Indemnification: Restoring the insured to their financial position prior to the loss.

- Utmost Good Faith: Both parties must disclose all material facts.

- Insurable Interest: The insured must have a financial stake in the insured item.

- Proximate Cause: The insured event must be the direct cause of the loss.

- Subrogation: The insurer’s right to pursue the party responsible for the loss on behalf of the insured.

2. Describe the different types of insurance policies and their coverages.

Property Insurance

- Covers physical assets like buildings, equipment, and inventory against risks such as fire, theft, and natural disasters.

Liability Insurance

- Protects against financial losses arising from legal claims of third parties due to bodily injury, property damage, or financial harm.

Health Insurance

- Covers medical expenses, hospitalization, and other healthcare costs.

Life Insurance

- Provides financial support to beneficiaries in the event of the insured’s death.

3. Explain the underwriting process and the factors that determine insurance premiums.

- Risk Assessment: Evaluating the likelihood and severity of potential losses.

- Loss History: Examining previous claims and losses.

- Risk Mitigation: Assessing measures taken to reduce risks.

- Financial Stability: Verifying the financial health of the insured.

- Industry and Location: Considering factors that may impact the likelihood of losses.

4. Discuss the role of reinsurance in the insurance industry.

- Provides a mechanism for insurers to spread and manage their risks.

- Helps reduce the financial burden of large or catastrophic losses.

- Enhances the capacity of insurers to offer policies with higher coverage limits.

- Supports the stability of the insurance market by diversifying risks.

5. How do you identify and mitigate risks in insurance underwriting?

- Risk Identification: Proactively searching for potential hazards that may lead to losses.

- Risk Assessment: Quantifying the likelihood and impact of potential losses.

- Risk Mitigation: Implementing measures to reduce or eliminate identified risks.

- Monitoring: Continuously reviewing and updating risk assessments to ensure ongoing effectiveness.

6. Describe the claims handling process.

- Notification: Promptly reporting losses to the insurer.

- Investigation: Assessing the cause and extent of the loss.

- Settlement: Negotiating and finalizing the amount of compensation.

- Payment: Issuing payment to the insured in accordance with the policy terms.

7. Explain the ethical responsibilities of an insurance agent.

- Duty of Care: Acting in the best interests of the client.

- Confidentiality: Maintaining the privacy of client information.

- Fair Dealing: Providing honest and accurate advice.

- Compliance: Adhering to all applicable laws and regulations.

- Professional Development: Staying abreast of industry best practices and knowledge.

8. How do you stay updated on changes in insurance laws and regulations?

- Continuing Education: Attending industry seminars and workshops.

- Industry Publications: Subscribing to trade journals and newsletters.

- Regulatory Websites: Monitoring government agencies’ websites for updates.

- Networking: Engaging with other insurance professionals and regulators.

9. Describe your experience in cross-selling insurance products.

- Understanding Client Needs: Identifying potential additional coverage requirements.

- Tailored Recommendations: Proposing suitable products that complement existing policies.

- Value Proposition: Emphasizing the benefits and cost-effectiveness of cross-selling.

- Sales Techniques: Utilizing persuasive communication skills to influence decisions.

10. How do you build and maintain strong relationships with clients?

- Exceptional Service: Providing personalized attention and prompt assistance.

- Communication: Maintaining regular contact and keeping clients informed.

- Trustworthiness: Demonstrating honesty and integrity in all interactions.

- Value-Added Services: Offering additional support beyond policy coverage.

- Referrals: Encouraging clients to refer their friends and family.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

1. Prospecting and Lead Generation

– Identifying potential clients through various channels (e.g., networking, referrals, cold calling). – Building relationships with clients and understanding their unique insurance requirements.2. Policy Analysis and Recommendation

– Evaluating clients’ needs and developing customized insurance policies based on coverage, deductibles, and premiums. – Explaining policy terms, conditions, and exclusions in a clear and concise manner.3. Sales and Policy Issuance

– Presenting insurance products and services to clients and negotiating terms. – Processing and submitting insurance applications and completing policy issuance.4. Customer Service and Claims Management

– Providing ongoing support and guidance to policyholders throughout the policy term. – Handling claims submissions and assisting clients in navigating the claims process.5. Regulatory Compliance and Ethical Standards

– Adhering to all applicable laws, regulations, and ethical guidelines. – Maintaining accurate and confidential client information. ## Interview Tips Ace the Insurance Agent interview with these preparation tips and hacks:1. Research the Company and Position

– Thoroughly research the insurance company, its products, and the specific agent position. – Understand the company’s mission, values, and target market.2. Highlight Relevant Skills and Experience

– Quantify your accomplishments and provide specific examples of your sales, customer service, and communication skills. – Emphasize any relevant industry knowledge or certifications.3. Practice Your Sales Pitch

– Prepare a clear and concise sales pitch that highlights the benefits of the insurance products you offer. – Practice presenting your pitch to a mirror or a friend to build confidence.4. Prepare for Common Interview Questions

– Study common insurance agent interview questions and prepare thoughtful responses. – Be ready to articulate your sales strategies, customer service approach, and ethical standards.5. Dress Professionally and Be Punctual

– First impressions matter. Dress appropriately and arrive for the interview on time. – Your attire and punctuality convey respect for the interviewer and the position.6. Ask Questions

– Ask thoughtful questions about the company, the position, or the industry at the end of the interview. – Asking questions demonstrates your engagement and interest in the opportunity.7. Follow Up

– Send a thank-you note to the interviewer within 24 hours of the interview. – Briefly reiterate your interest in the position and highlight your key qualifications.Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Insurance Agent role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.