Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Insurance Agents Supervisor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Insurance Agents Supervisor so you can tailor your answers to impress potential employers.

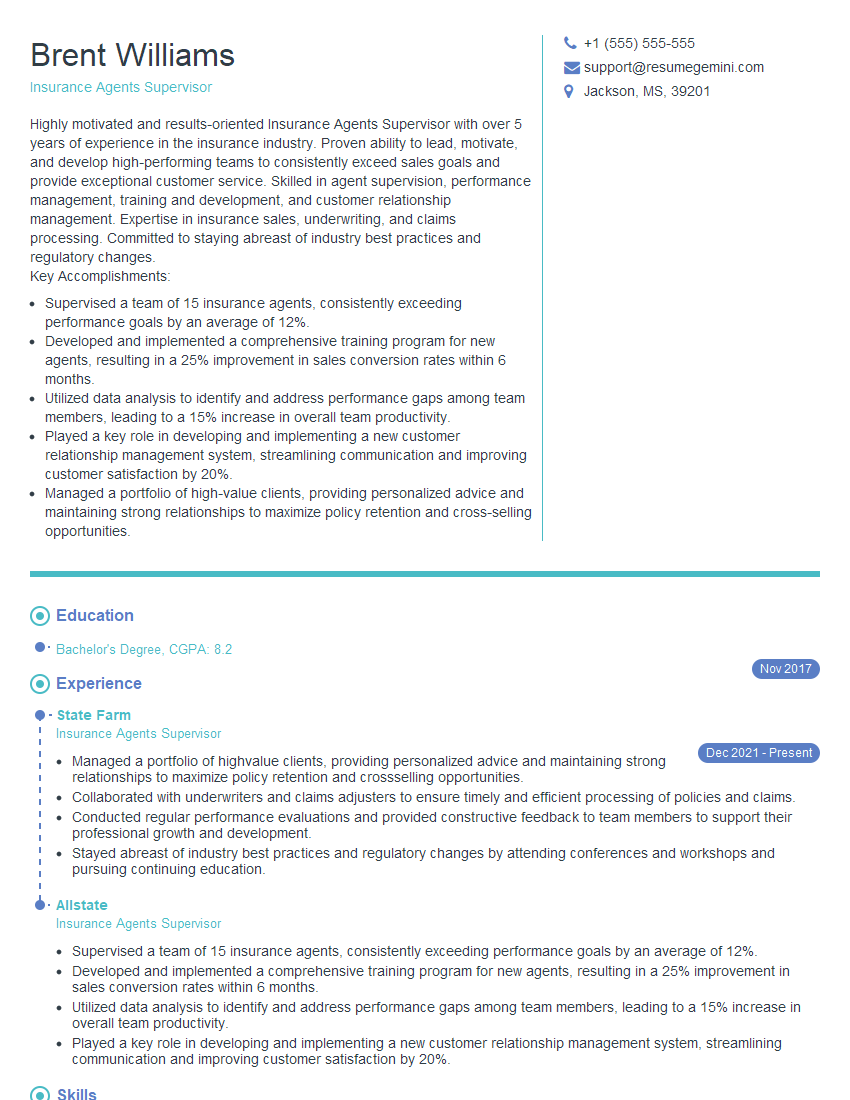

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Agents Supervisor

1. How would you approach the task of training and developing a team of insurance agents?

- Assess the skill gap and current performance levels of the agents.

- Develop a comprehensive training program based on the identified needs.

- Provide personalized coaching and mentorship to support agents’ improvement.

- Establish clear performance expectations and track progress regularly.

- Foster a culture of continuous learning and improvement.

2. What strategies would you implement to enhance the productivity of your team?

Resource Management

- Optimize workload distribution to ensure efficient resource allocation.

- Implement tools and systems to streamline processes and improve workflow.

Team Management

- Set clear goals and expectations to provide direction and motivation.

- Foster a collaborative and supportive team environment.

- Provide regular feedback and recognition to acknowledge achievements.

Technology and Data Analytics

- Leverage technology to automate tasks and improve efficiency.

- Analyze data to identify areas for improvement and inform decision-making.

3. How would you handle underperforming insurance agents?

- Address the issue privately and provide constructive feedback.

- Identify the root cause of underperformance and develop a performance improvement plan.

- Provide additional training and support to bridge skill gaps.

- Set clear expectations and monitor progress closely.

- Consider disciplinary action if performance does not improve despite support.

4. What metrics would you use to evaluate the performance of your team?

- Sales volume and attainment of sales targets.

- Customer satisfaction and retention rates.

- Policy renewal rates and cross-selling ratios.

- Average handling time and resolution rate of customer inquiries.

- Compliance with regulatory requirements and ethical standards.

5. How would you build strong relationships with clients and generate leads?

- Provide exceptional customer service by addressing their needs promptly and effectively.

- Establish personal connections and build trust by understanding their unique requirements.

- Utilize networking opportunities and referrals to expand the client base.

- Conduct market research and stay informed about industry trends to identify potential leads.

- Implement lead generation strategies such as content marketing, webinars, and social media campaigns.

6. How would you stay up-to-date on industry regulations and compliance requirements?

- Attend industry conferences and webinars.

- Subscribe to industry publications and newsletters.

- Participate in continuing education programs.

- Consult with legal professionals and regulatory experts.

- Maintain strong relationships with regulatory agencies.

7. What software tools and technologies are you proficient in that would be beneficial for this role?

- Insurance agency management systems (AMS).

- Customer relationship management (CRM) systems.

- Data analytics and reporting tools.

- Sales forecasting and tracking software.

- Communication and collaboration platforms.

8. How would you prioritize tasks in a high-pressure environment with competing deadlines?

- Use a task management system to organize and track tasks.

- Set priorities based on importance, urgency, and impact.

- Delegate tasks to team members when appropriate.

- Manage workload effectively and avoid procrastination.

- Communicate deadlines and expectations clearly to all stakeholders.

9. What experience do you have in developing and implementing sales strategies?

- Conducted market research to identify target audience and competitive landscape.

- Developed and executed sales strategies to increase market share and revenue.

- Managed sales teams and provided guidance on sales techniques and best practices.

- Utilized data analysis to track sales performance and identify areas for improvement.

- Collaborated with marketing and other departments to align sales efforts.

10. How would you motivate and inspire a team to achieve exceptional results?

- Set clear goals and provide regular feedback on progress.

- Recognize and reward achievements and successes.

- Foster a positive and supportive work environment.

- Provide opportunities for professional development and growth.

- Lead by example and demonstrate a strong work ethic.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Agents Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Agents Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Agents Supervisors are responsible for overseeing the activities of insurance agents and ensuring that they meet company goals and objectives. Their key responsibilities include:

1. Recruiting and hiring agents

Insurance Agents Supervisors are responsible for finding and hiring qualified candidates to fill agent positions. They develop and implement recruiting strategies, conduct interviews, and make hiring decisions.

- Develop and implement recruiting strategies to attract qualified candidates.

- Conduct interviews and make hiring decisions.

2. Training and developing agents

Once agents are hired, Supervisors are responsible for providing them with the training and development they need to be successful. They develop and deliver training programs, coach and mentor agents, and provide ongoing support.

- Develop and deliver training programs to new and existing agents.

- Coach and mentor agents to help them improve their performance.

3. Supervising and managing agents

Supervisors are responsible for supervising and managing the activities of their agents. They set goals and objectives, monitor performance, and provide feedback. They also handle any issues or concerns that arise with agents.

- Set goals and objectives for agents.

- Monitor performance and provide feedback.

4. Measuring and evaluating agent performance

Supervisors are responsible for measuring and evaluating the performance of their agents. They track key metrics, such as sales volume, customer satisfaction, and compliance. They use this data to identify areas for improvement and to make decisions about agent compensation and promotions.

- Track key metrics, such as sales volume, customer satisfaction, and compliance.

- Identify areas for improvement and make decisions about agent compensation and promotions.

Interview Tips

Preparing for an interview for an Insurance Agents Supervisor position can be daunting, but there are some tips that can help you ace the interview and land the job. Here are a few things you can do to prepare:

1. Research the company and the position

Before you go on an interview, it’s important to research the company and the position you’re applying for. This will help you understand the company’s culture, goals, and objectives. It will also help you understand the specific responsibilities of the position and the qualifications that the company is looking for.

- Visit the company’s website to learn about their history, mission, and values.

- Read the job description carefully and make a list of the key responsibilities and qualifications.

2. Practice answering common interview questions

There are some common interview questions that you’re likely to be asked in an interview for an Insurance Agents Supervisor position. It’s a good idea to practice answering these questions in advance so that you can deliver clear and concise answers on the day of your interview.

- Tell me about your experience in managing and supervising others.

- What are your strengths and weaknesses as a supervisor?

- How do you motivate and inspire your team?

3. Be prepared to talk about your experience and skills

In addition to answering common interview questions, you should also be prepared to talk about your experience and skills. This is your chance to sell yourself to the interviewer and show them why you’re the best candidate for the job.

- Highlight your experience in recruiting, training, and developing agents.

- Share examples of your success in managing and motivating teams.

- Quantify your accomplishments whenever possible.

4. Dress professionally and arrive on time

First impressions matter, so it’s important to dress professionally and arrive on time for your interview. This shows the interviewer that you’re serious about the job and that you respect their time.

- Wear a suit or business casual attire.

- Be on time for your interview or even arrive a few minutes early.

5. Be confident and enthusiastic

Confidence is key in an interview. Believe in yourself and your abilities. Be enthusiastic about the job and the company. This will show the interviewer that you’re passionate about the position and that you’re excited about the opportunity to work for the company.

- Make eye contact with the interviewer and speak clearly and confidently.

- Smile and show your enthusiasm for the job and the company.

Next Step:

Now that you’re armed with the knowledge of Insurance Agents Supervisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Insurance Agents Supervisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini