Feeling lost in a sea of interview questions? Landed that dream interview for Insurance Biller but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Insurance Biller interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

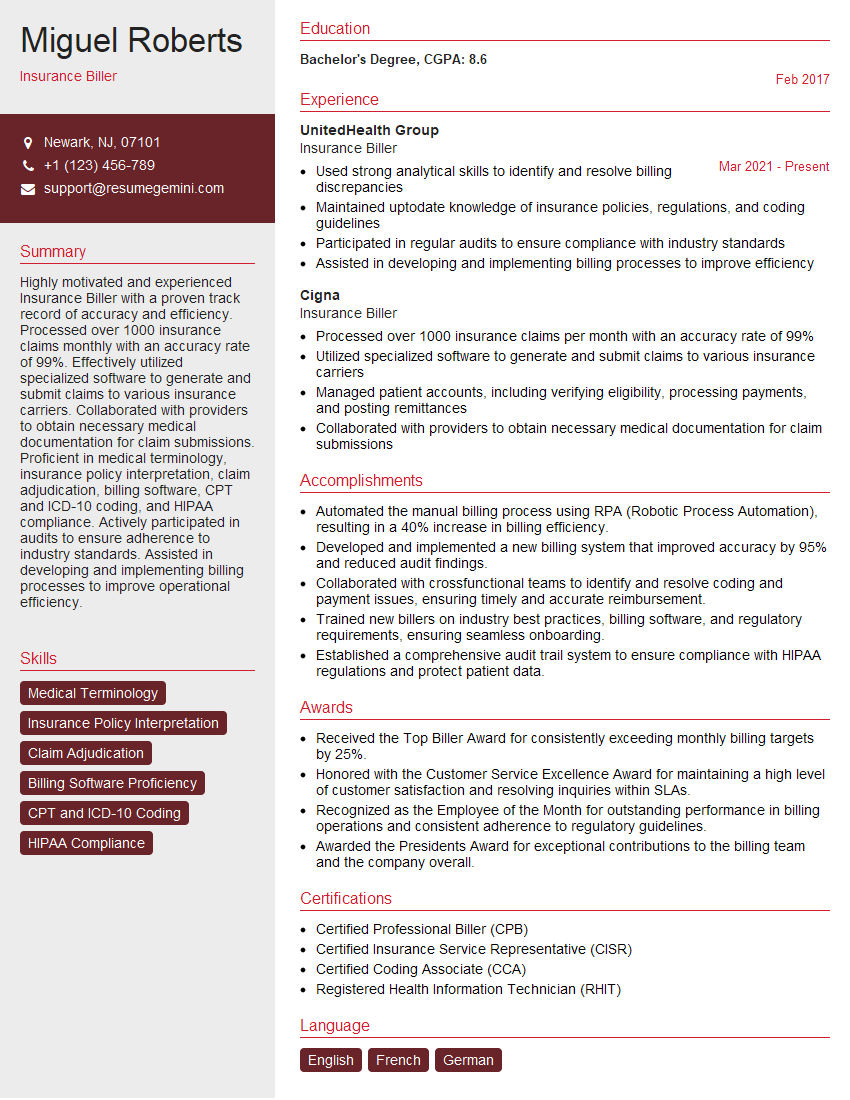

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Biller

1. How would you prioritize and manage a large workload, including multiple claim types, deadlines, and patient inquiries?

I have developed effective time management skills and prioritize tasks based on urgency and importance. I use a task management system or spreadsheet to track progress, set reminders, and delegate tasks when necessary.

- Triage claims based on urgency and complexity, ensuring timely submission to meet deadlines.

- Communicate effectively with patients to address inquiries promptly and professionally.

2. Describe the process you would follow when submitting a claim to an insurance company.

Claim Submission Process

- Verify patient eligibility and benefits.

- Obtain necessary medical documentation and coding.

- Create and submit claim using the appropriate format (electronic or paper).

Follow-Up and Tracking

- Monitor claim status and follow up with insurance carriers as needed.

- Document all interactions, including calls, emails, and correspondence.

- Resolve denied claims by providing additional information or clarifying discrepancies.

3. What strategies would you use to improve the accuracy of claim submissions and reduce denials?

To improve accuracy and reduce denials, I would:

- Thoroughly review medical records: Ensure accurate documentation and coding.

- Verify patient eligibility and benefits: Avoid submission errors and ensure coverage.

- Use automated claim scrubbing software: Identify potential errors and improve accuracy.

- Stay updated on insurance guidelines: Comply with changing regulations and avoid rejections.

- Establish relationships with insurance carriers: Facilitate communication and resolve issues promptly.

4. How do you handle difficult patients or insurance company representatives?

I prioritize empathy and professionalism when interacting with challenging individuals:

- Active listening: Understand their concerns and frustrations.

- Clear communication: Explain processes, policies, and limitations respectfully.

- Problem-solving: Collaborate to find solutions that meet both parties’ needs.

- Documentation: Record all interactions to maintain a clear record.

- Escalation: Involve supervisors or managers when necessary to resolve complex issues.

5. What software and technologies are you proficient in for insurance billing?

I am well-versed in various software and technologies used in insurance billing, including:

- Billing systems: Xactly, Medisoft, and Kareo.

- Claim submission portals: Availity, NaviNet, and EZLynx.

- Electronic health records (EHRs): Epic, Cerner, and Athenahealth.

- Claim scrubbing software: 3M Encoder Pro and NCCI Claim Check.

- Spreadsheets and databases: For data analysis and reporting.

6. How do you stay up-to-date on changes in insurance regulations and coding guidelines?

To stay current on industry changes, I:

- Attend industry conferences and webinars: Engage with experts and learn about latest trends.

- Read industry publications and newsletters: Stay informed on regulatory updates and best practices.

- Utilize online resources: Access databases and websites for coding guidelines and policy changes.

- Collaborate with colleagues: Share knowledge and discuss industry challenges.

7. How do you ensure the privacy and security of patient information?

I adhere to HIPAA regulations and prioritize patient privacy:

- Secure storage: Limit physical and electronic access to patient data.

- Data encryption: Protect sensitive information during transmission and storage.

- Limited access: Grant access only to authorized personnel on a need-to-know basis.

- Staff training: Educate employees on privacy policies and procedures.

- Incident reporting: Report any potential privacy breaches promptly and follow established protocols.

8. Describe your experience with handling patient appeals and denials.

When handling patient appeals and denials:

- Review and understand the reasons for denial: Gather necessary information from insurance carriers and medical records.

- Prepare a clear and concise appeal: Explain the patient’s case, provide additional documentation, and address the denial reason.

- Follow up and negotiate: Contact insurance carriers to discuss the appeal and negotiate a positive outcome.

- Keep patients informed: Communicate the status of the appeal and provide updates on progress.

9. How do you measure and improve your performance as an insurance biller?

I evaluate and improve my performance through:

- Claims accuracy rate: Track the percentage of claims submitted without errors.

- Denial rate: Monitor the number of denied claims and identify areas for improvement.

- Patient satisfaction: Gather feedback from patients to ensure timely and accurate billing.

- Industry benchmarks: Compare my performance to industry standards and best practices.

- Continuing education: Participate in training programs and workshops to enhance my skills and knowledge.

10. What is your understanding of the role of the insurance biller in healthcare?

An insurance biller plays a crucial role in healthcare by:

- Ensuring timely and accurate payment: For healthcare providers to receive reimbursement for services rendered.

- Facilitating patient access to care: By resolving billing issues and minimizing financial barriers.

- Maintaining insurance compliance: Adhering to regulations and guidelines to protect patient privacy and prevent fraud.

- Supporting healthcare operations: Providing data for financial planning and performance analysis.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Biller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Biller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance billers are responsible for submitting claims to insurance companies, processing payments, and resolving any discrepancies. They must have a strong understanding of medical terminology and insurance coding, as well as excellent communication and customer service skills.

1. Submitting Claims

Insurance billers are responsible for submitting claims to insurance companies on behalf of their clients. This involves gathering all of the necessary information, such as the patient’s medical records, insurance information, and treatment details. The biller then enters this information into a claims processing system and submits it to the insurance company.

- Gather patient information, including medical records, insurance information, and treatment details

- Enter information into a claims processing system

- Submit claims to insurance companies

2. Processing Payments

Once the insurance company has processed the claim, the biller is responsible for processing the payment. This involves verifying the amount of the payment, posting it to the patient’s account, and sending a statement to the patient.

- Verify the amount of the payment

- Post payments to patient accounts

- Send statements to patients

3. Resolving Discrepancies

Sometimes, there are discrepancies between the amount of the claim and the amount of the payment. The biller is responsible for resolving these discrepancies. This may involve contacting the insurance company, the patient, or the provider to get the necessary information.

- Contact insurance companies, patients, or providers to resolve discrepancies

- Negotiate with insurance companies to get the best possible reimbursement for patients

- Maintain accurate records of all claims and payments

4. Other Responsibilities

In addition to the above responsibilities, insurance billers may also be responsible for:

- Providing customer service to patients and insurance companies

- Maintaining accurate records of all claims and payments

- Staying up-to-date on changes in medical coding and billing regulations

Interview Tips

Preparing for an interview for an insurance biller position can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips to help you ace your interview:

1. Research the Company

Before you go to your interview, take some time to research the company. This will help you learn about the company’s culture, values, and mission. It will also help you understand the company’s specific needs and how you can contribute to their success.

- Visit the company’s website

- Read the company’s annual report

- Talk to people who work for the company

2. Practice Your Answers

Once you have researched the company, take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during your interview.

- Think about your strengths and weaknesses

- Prepare answers to questions about your experience and skills

- Practice answering questions about your goals and ambitions

3. Dress Professionally

First impressions matter, so make sure you dress professionally for your interview. This means wearing a suit or business dress and making sure your shoes are clean and polished. You should also arrive on time for your interview and be prepared to answer questions about your experience and skills.

- Wear a suit or business dress

- Make sure your shoes are clean and polished

- Arrive on time for your interview

4. Be Enthusiastic and Positive

Employers want to hire people who are enthusiastic and positive about their work. Make sure you show your interviewer that you are excited about the opportunity to work for their company. Be positive and upbeat throughout your interview, and be sure to highlight your strengths and skills.

- Be enthusiastic about the opportunity to work for the company

- Be positive and upbeat throughout your interview

- Highlight your strengths and skills

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Biller interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.