Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Billing Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

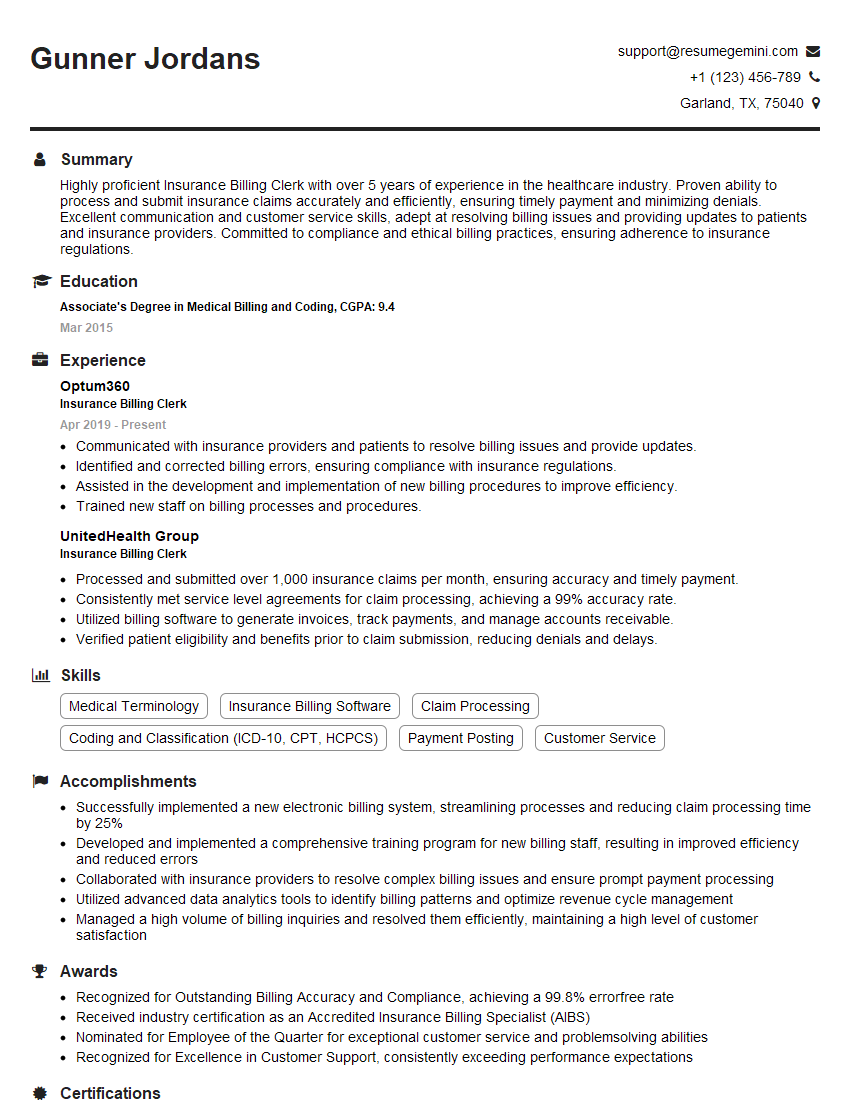

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Billing Clerk

1. What are the key responsibilities of an Insurance Billing Clerk?

- Receive, review, and process insurance claims

- Maintain accurate patient accounts

- Research and resolve billing issues

- Generate invoices and collections statements

- Provide customer service to patients and insurance companies

2. What are the different types of health insurance plans?

- Managed Care Plans: Such as HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point-of-Service) plans

- Fee-for-Service Plans: In which the patient is billed directly for the services they receive

- Medicare and Medicaid: Government-funded health insurance programs for seniors, low-income individuals, and disabled persons

3. What are the most common errors made in medical billing?

- Coding errors

- Missing or incorrect documentation

- Duplicate billing

- Incorrect patient information

- Untimely filing

4. How do you stay up-to-date on changes in medical billing regulations?

- Attend industry conferences and webinars

- Read trade publications and online resources

- Consult with experts in the field

- Stay informed about updates from insurance companies

5. What is the difference between a primary and secondary insurance plan?

- Primary insurance: This is the plan that provides the most coverage

- Secondary insurance: This is a plan that provides additional coverage after the primary plan has been exhausted

6. What are the steps involved in processing an insurance claim?

- Receive and review the claim

- Verify patient information and eligibility

- Code the claim using the appropriate medical codes

- Submit the claim to the insurance company

- Monitor the claim status and follow up as needed

7. How do you handle denied claims?

- Review the denial notice to determine the reason for denial

- Correct any errors on the claim

- Resubmit the claim or appeal the denial

8. What is your experience with medical billing software?

9. What is your experience with insurance follow-up and collections?

- Following up with insurance companies on the status of claims

- Collecting outstanding patient balances

10. How do you prioritize your workload and manage multiple tasks?

- Using time management techniques

- Setting priorities and delegating tasks

- Maintaining a positive and proactive attitude

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Billing Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Billing Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Insurance Billing Clerk is responsible for ensuring accurate and timely billing of insurance claims. Their key responsibilities include:

1. Processing Insurance Claims

Processing insurance claims involves:

- Verifying patient eligibility and coverage

- Preparing and submitting claims to insurance companies

- Following up on claim status and resolving any issues

2. Maintaining Patient Accounts

Maintaining patient accounts includes:

- Creating and updating patient records

- Posting payments and adjusting accounts

- Billing patients for any outstanding balances

3. Communicating with Patients and Insurance Companies

Communicating with patients and insurance companies involves:

- Answering patient inquiries about billing

- Negotiating with insurance companies to ensure proper reimbursement

- Providing updates on claim status to patients and providers

4. Staying Up-to-Date on Insurance Regulations

Staying up-to-date on insurance regulations involves:

- Monitoring changes in insurance laws and regulations

- Attending industry events and training programs

- Reading industry publications and staying informed about best practices

Interview Tips

To ace an interview for an Insurance Billing Clerk position, candidates should:

1. Research the Company and Position

Researching the company and the specific position will help you understand their needs and tailor your answers accordingly. This includes:

- Reviewing the company website and social media pages

- Reading industry news and articles about the company

- Searching for information about the specific position you’re applying for

2. Practice Your Answers to Common Interview Questions

Practicing your answers to common interview questions will help you feel more confident and prepared. Some common questions you may be asked include:

- Tell me about your experience with insurance billing.

- How do you handle challenging situations with patients or insurance companies?

- What are your strengths and weaknesses as an Insurance Billing Clerk?

3. Highlight Your Skills and Experience

During the interview, be sure to highlight your skills and experience that are relevant to the position. This includes:

- Your ability to process insurance claims accurately and efficiently

- Your experience with medical terminology and coding

- Your ability to communicate effectively with patients and insurance companies

4. Ask Questions

Asking thoughtful questions at the end of the interview shows that you’re interested in the position and the company. It also gives you an opportunity to learn more about the company and the position.

- What are the company’s goals for the next year?

- What are the biggest challenges facing the Insurance Billing department?

- What are the opportunities for professional development within the company?

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Billing Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Billing Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.