Are you gearing up for a career in Insurance Broker? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Insurance Broker and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Broker

1. What are the key factors to consider when assessing a client’s insurance needs?

- Type of business or organization

- Level of revenue and profitability

- Current insurance coverage and limits

- Risk management strategies in place

- Industry-specific liabilities and exposures

- Client’s risk tolerance and financial capacity

- Potential for future growth or changes

2. Describe the process of developing and presenting an insurance proposal to a client.

Gathering Information

- Meet with the client to understand their needs

- Review the client’s existing policies and financial statements

- Conduct a risk assessment to identify potential exposures

Developing the Proposal

- Select appropriate coverage options based on the client’s needs

- Determine premium rates and deductibles

- Outline the benefits, exclusions, and conditions of the coverage

Presenting the Proposal

- Meet with the client to present the proposal and explain its details

- Address any questions or concerns the client may have

- Negotiate terms and conditions to meet the client’s budget and requirements

3. How do you stay up-to-date on changes in the insurance industry and regulations?

- Attend industry conferences and webinars

- Subscribe to trade publications and online resources

- Network with other insurance professionals and carrier representatives

- Take continuing education courses and maintain professional certifications

- Monitor regulatory updates and legislative changes

4. What are your strategies for building and maintaining strong client relationships?

- Establish clear communication channels and respond promptly to inquiries

- Provide exceptional customer service and personalized attention

- Offer tailored insurance solutions that meet their evolving needs

- Educate clients about insurance concepts and coverage options

- Build trust by being honest, transparent, and responsive

- Regularly check in with clients to ensure their satisfaction

5. Can you describe your experience in underwriting and risk assessment?

- Evaluated financial statements, loss history, and risk factors

- Assessed the likelihood and severity of potential claims

- Determined appropriate coverage limits and premium rates

- Managed a portfolio of clients and mitigated their insurance risks

- Collaborated with underwriters to negotiate terms and conditions

6. How do you handle complex or unusual insurance requests?

- Research and analyze the specific risks involved

- Consult with industry experts and carriers

- Develop tailored solutions that meet the client’s unique needs

- Negotiate coverage terms and conditions to secure the necessary protection

- Communicate clearly with the client throughout the process

7. What are the ethical considerations involved in insurance broking?

- Act in the best interests of the client

- Provide unbiased advice and recommendations

- Maintain confidentiality and protect client information

- Avoid conflicts of interest and disclose any potential biases

- Comply with all applicable laws and regulations

- Uphold the integrity and reputation of the profession

8. How do you measure the success of your work as an insurance broker?

- Client satisfaction and retention

- Placement of coverage that meets the client’s needs

- Reduced insurance premiums and improved risk management

- Positive feedback from clients and carriers

- Contributions to the growth and profitability of the business

9. What are the key challenges facing the insurance industry in the current market?

- Increased frequency and severity of natural disasters

- Technological advancements and cyber risks

- Changing regulatory landscape

- Increased competition and consolidation

- Rising healthcare costs and aging population

10. How do you stay motivated and continue to develop your skills in the insurance field?

- Set personal and professional goals

- Seek opportunities for growth and new challenges

- Attend industry events and training programs

- Collaborate with colleagues and mentors

- Stay informed about industry trends and best practices

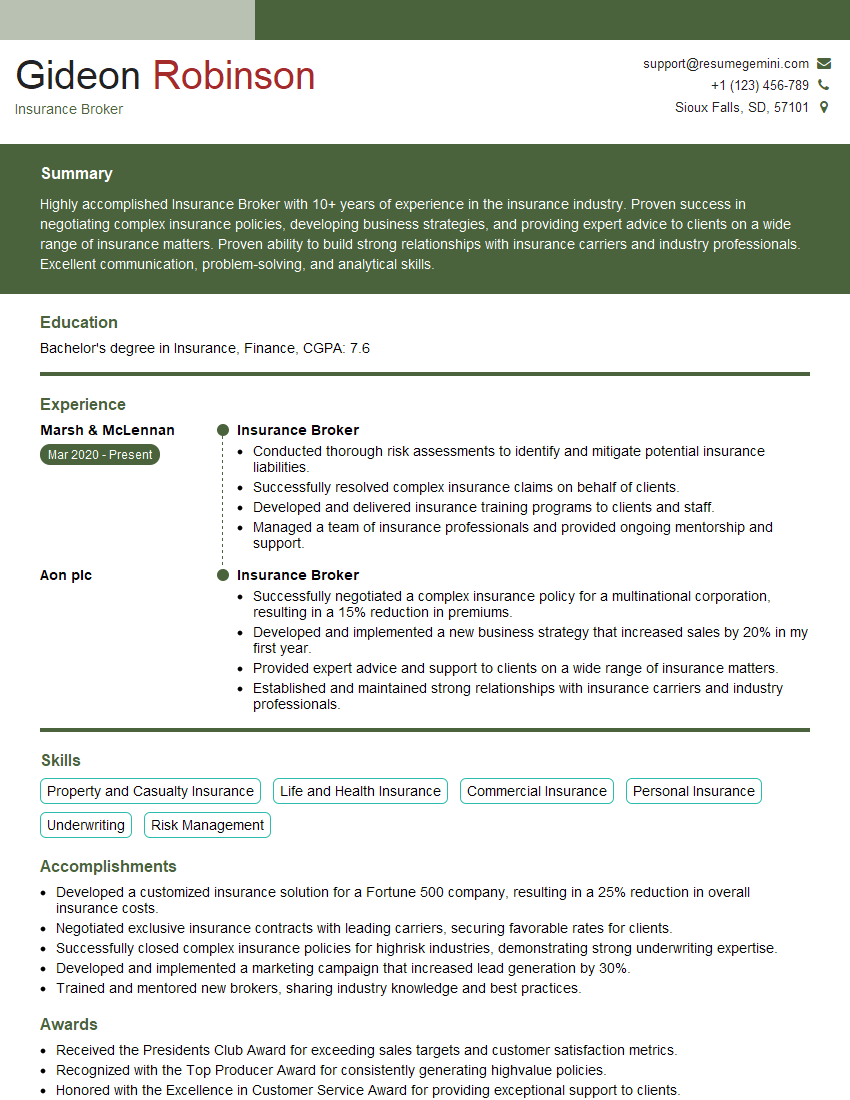

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Insurance Broker is a licensed professional who acts as an intermediary between clients and insurance companies. They play a crucial role in identifying, assessing, and securing insurance coverage for individuals, businesses, and organizations.

Understanding Client Needs

Insurance Brokers spend considerable time understanding their clients’ specific insurance requirements. They analyze the client’s assets, liabilities, and risk profile to determine the appropriate coverage.

Securing Coverage

Based on their understanding of the client’s needs, Insurance Brokers compare and select policies from various insurance providers. They negotiate terms, premiums, and coverage details to secure the most favorable conditions for their clients.

Managing Policies

Insurance Brokers assist clients in managing their insurance policies. They track policy renewals, make adjustments as needed, and handle claims on behalf of their clients.

Providing Expert Advice

Insurance Brokers serve as trusted advisors, providing clients with expert guidance on insurance matters. They explain complex insurance concepts, assist in understanding policy terms, and offer recommendations to minimize risks and maximize coverage.

Interview Tips

Preparing for an Insurance Broker interview requires thorough research and a well-structured approach. Here are some valuable tips to help candidates ace the interview:

Research the Company and Industry

Before the interview, research the insurance brokerage firm and the insurance industry. Understand their areas of expertise, market reputation, and recent developments.

Review Insurance Concepts

Refresh your knowledge of insurance concepts, including types of insurance, underwriting criteria, and policy details. Familiarize yourself with the industry terminology and key players.

Practice Client Communication

Insurance Brokers must be able to effectively communicate with clients. Practice your active listening skills, empathy, and ability to explain complex insurance concepts in a clear and concise manner.

Highlight Your Experience

Tailor your resume and interview answers to showcase your relevant experience as an Insurance Broker. Quantify your accomplishments and provide specific examples of how you have successfully analyzed client needs, secured coverage, and managed policies.

Prepare Questions

Asking thoughtful questions at the end of the interview shows your engagement and interest. Prepare questions that demonstrate your understanding of the company, the insurance industry, and the role of an Insurance Broker.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Insurance Broker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.