Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Claims Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

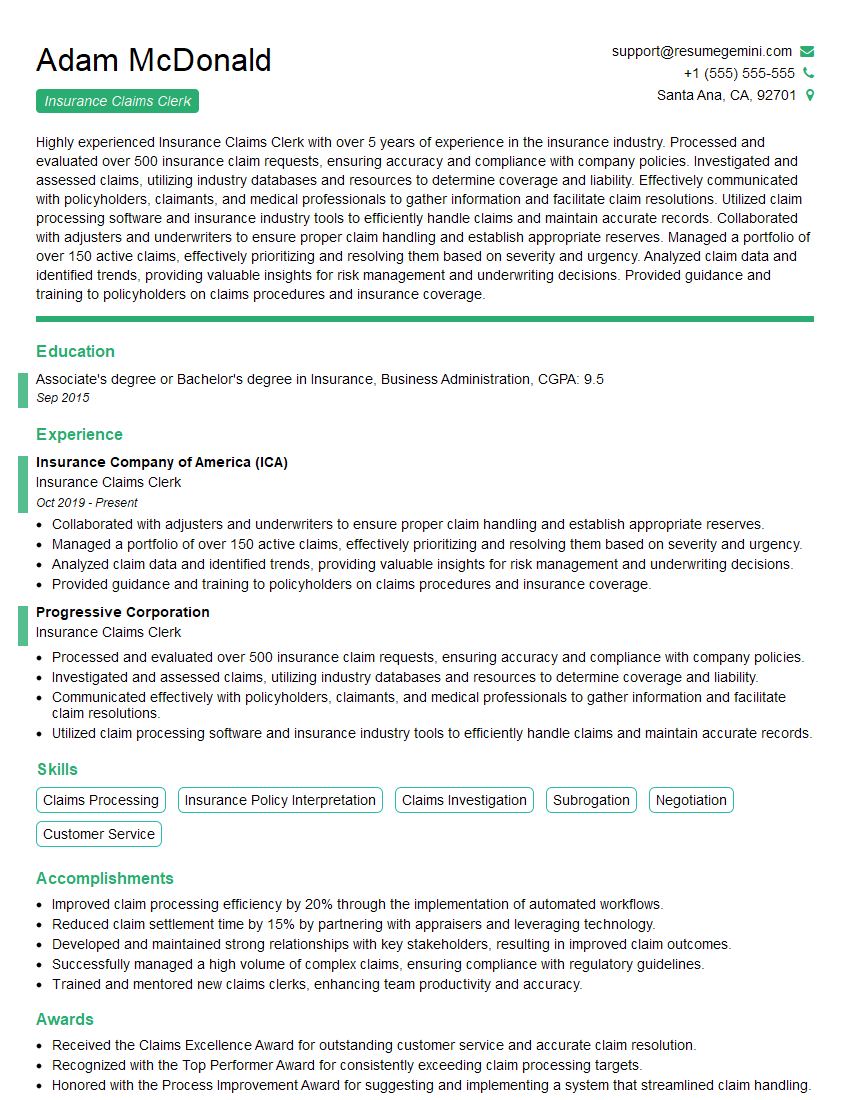

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Claims Clerk

1. How would you prioritize multiple claims with varying severities and deadlines?

- Triage claims based on severity and urgency, giving priority to life-threatening situations and those with imminent deadlines.

- Consider the potential impact of delays on policyholders and stakeholders, prioritizing claims that require immediate attention.

- Communicate with policyholders and keep them informed of their claims status and expected timelines.

2. What is the importance of maintaining accurate and detailed claims records?

: Legal and Regulatory Compliance

- Ensuring adherence to legal and regulatory requirements, which often mandate the maintenance of detailed claims documentation.

- Providing evidence for claims decisions and supporting defenses in case of legal disputes or audits.

Subheading: Smooth Claims Processing

- Facilitating efficient claims processing by providing a clear and comprehensive record of the claim history.

- Reducing the risk of errors and omissions by having all relevant information readily available.

3. Describe your experience in using insurance claims software and technologies.

- Proficient in industry-standard claims management software, such as [Software Name] and [Software Name].

- Experience in utilizing various tools and technologies for claims processing, such as electronic document management systems, loss estimation tools, and communication platforms.

- Ability to leverage technology to streamline processes, improve accuracy, and enhance customer service.

4. How do you handle complex or high-value claims that require specialized expertise?

- Consult with subject matter experts within the organization, such as underwriters, engineers, or medical professionals.

- Collaborate with external resources, such as independent adjusters or attorneys, to obtain specialized knowledge and support.

- Attend industry seminars and workshops to stay updated on best practices and emerging trends in claims handling.

5. What are the ethical considerations you take into account when processing claims?

- Upholding the principles of fairness, objectivity, and integrity in all claims interactions.

- Maintaining confidentiality and protecting sensitive policyholder information.

- Avoiding conflicts of interest and disclosing any potential biases that may affect the claims process.

6. How do you handle challenging policyholders or claimants?

- Approaching interactions with empathy and understanding, acknowledging the policyholder’s perspective.

- Communicating clearly and effectively, providing timely updates and explaining the claims process.

- Remaining professional and maintaining composure, even in difficult situations.

7. What steps do you take to ensure the accuracy of your claims assessments?

- Thoroughly reviewing all relevant documentation, including the insurance policy, claim report, and any supporting evidence.

- Conducting thorough investigations and gathering all necessary information to support the assessment.

- Consulting with experts or seeking external validation when needed to ensure the accuracy of the assessment.

8. How do you stay up-to-date with changes in insurance regulations and industry best practices?

- Regularly attending industry conferences, webinars, and training programs.

- Subscribing to industry publications and staying informed through online resources.

- Participating in professional organizations and connecting with peers to exchange knowledge and insights.

9. Describe your experience in negotiating settlements with claimants or their representatives.

- Understanding the policyholder’s needs and objectives while representing the insurance company’s interests.

- Engaging in respectful and professional negotiations, seeking mutually acceptable outcomes.

- Documenting all agreements clearly and ensuring compliance with contractual obligations.

10. What motivates you to excel in the insurance claims field?

- Passion for helping individuals and businesses navigate challenging situations.

- Driven by a desire to ensure fair and equitable treatment for all policyholders.

- Enjoyment in solving complex problems and finding creative solutions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Claims Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Claims Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Claims Clerks are responsible for a wide range of tasks related to the processing and settlement of insurance claims. Their key responsibilities include:

1. Receiving and reviewing claims

Claims Clerks are responsible for receiving and reviewing claims from policyholders. They must ensure that all necessary information is present and that the claim is valid.

- Gathering information from policyholders about the loss or damage

- Inspecting damaged property and taking photographs

- Assessing the extent of the damage and determining the amount of coverage

2. Investigating claims

Claims Clerks may be required to investigate claims to determine the cause of loss or damage. This may involve interviewing witnesses, reviewing police reports, or obtaining estimates from contractors.

- Contacting witnesses and gathering statements

- Reviewing police reports and other documentation

- Obtaining estimates from contractors or other experts

3. Negotiating settlements

Claims Clerks are responsible for negotiating settlements with policyholders. They must consider the value of the claim, the policyholder’s coverage, and the company’s liability.

- Negotiating with policyholders to settle claims

- Explaining the terms of the settlement to policyholders

- Issuing payment to policyholders

4. Maintaining records

Claims Clerks are responsible for maintaining records of all claims. This includes keeping track of the status of claims, correspondence with policyholders, and other relevant documents.

- Maintaining files on all claims

- Tracking the status of claims

- Corresponding with policyholders and other parties involved in the claim

Interview Tips

To ace an interview for an Insurance Claims Clerk position, it’s important to be prepared and to demonstrate your knowledge of the role. Here are some tips:

1. Research the company and the position

Before the interview, take some time to research the insurance company you’re applying to and the Claims Clerk position. This will help you understand the company’s culture, values, and what they’re looking for in a candidate.

- Visit the company’s website and read about their mission, values, and products

- Read online reviews of the company to get a sense of its culture

- Search for articles or news stories about the company to learn about its recent activities

2. Practice your answers to common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself” or “Why are you interested in this position?” It’s helpful to practice your answers to these questions ahead of time so that you can deliver them confidently and concisely.

- Write down your answers to common interview questions and practice saying them out loud

- Ask a friend or family member to mock interview you

- Record yourself answering interview questions and watch it back to see how you can improve

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills as they relate to the Claims Clerk position. Be prepared to discuss your previous experience with claims processing, customer service, and problem-solving.

- Highlight your experience with claims processing, even if it’s from a different industry

- Emphasize your customer service skills and your ability to build relationships with clients

- Discuss your problem-solving skills and your ability to think critically

4. Dress professionally and arrive on time

First impressions matter, so it’s important to dress professionally for your interview. You should also arrive on time, as being late can reflect poorly on your punctuality and organization skills.

- Wear a suit or business casual attire

- Make sure your clothes are clean and pressed

- Arrive at the interview location 10-15 minutes early

5. Be confident and enthusiastic

Confidence and enthusiasm can go a long way in an interview. Make sure to project a positive attitude and show the interviewer that you’re excited about the opportunity.

- Make eye contact with the interviewer and speak clearly and confidently

- Smile and be enthusiastic about your answers

- Thank the interviewer for their time at the end of the interview

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Claims Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Claims Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.