Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Claims Processor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

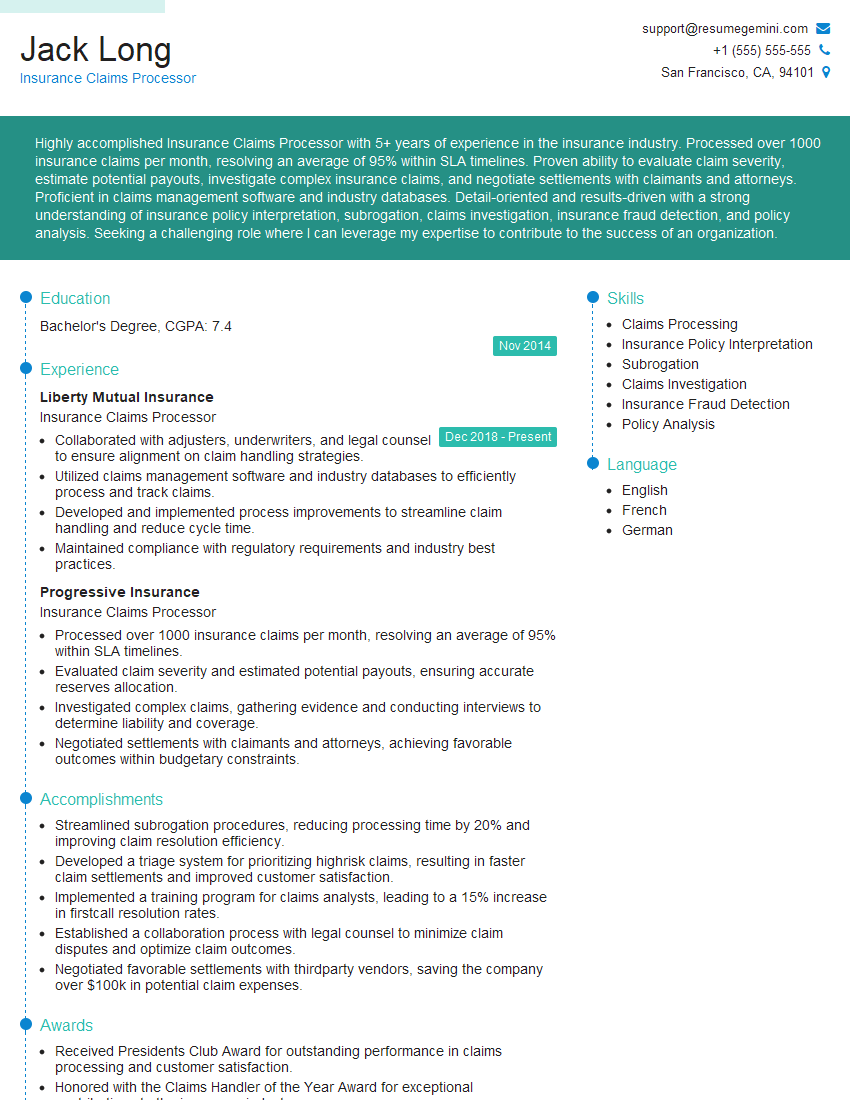

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Claims Processor

1. What are the different types of insurance claims you have processed in the past?

In my previous role, I have processed a wide range of insurance claims, including:

- Property damage claims (e.g., fire, flood, earthquake)

- Vehicle damage claims (e.g., auto accidents, vandalism)

- Liability claims (e.g., personal injury, property damage)

- Health insurance claims (e.g., medical bills, prescription drug claims)

- Disability insurance claims

2. What is your process for investigating and evaluating insurance claims?

Investigating the Claim

- Gather information from the policyholder, witnesses, and other relevant parties.

- Inspect the damaged property or vehicle.

- Review medical records or other documentation to assess the extent of injuries or damages.

Evaluating the Claim

- Determine if the claim is covered under the policy.

- Calculate the amount of the claim based on the policy coverage and damages.

- Negotiate with the policyholder to reach a fair settlement.

3. What are some of the challenges you have faced in processing insurance claims?

Some of the challenges I have faced in processing insurance claims include:

- Dealing with difficult or uncooperative policyholders.

- Investigating complex claims with limited information.

- Negotiating settlements that are fair to both the policyholder and the insurance company.

- Keeping up with changing insurance regulations and laws.

4. What is your experience with using insurance software and technology?

I have extensive experience with using a variety of insurance software and technology, including claims processing systems, policy management systems, and underwriting systems. I am also proficient in using Microsoft Office Suite and other productivity tools.

5. What are your strengths as an insurance claims processor?

My strengths as an insurance claims processor include:

- Strong attention to detail and accuracy.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Knowledge of insurance laws and regulations.

- Commitment to providing excellent customer service.

6. What are your weaknesses as an insurance claims processor?

One area where I could improve as an insurance claims processor is in my ability to work under pressure in fast-paced environments. I am working on developing strategies to manage stress and maintain productivity in these situations.

7. What are your career goals?

My career goal is to become an insurance claims manager. I am confident that my skills and experience in claims processing, along with my strong work ethic and dedication, will enable me to succeed in this role.

8. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to providing excellent customer service and your reputation as a leading provider of insurance products and services. I believe that my skills and experience would be a valuable asset to your team.

9. What are your salary expectations?

My salary expectations are in line with the market rate for insurance claims processors with my experience and qualifications. I am open to discussing a salary range that is fair and commensurate with my contributions to the company.

10. Are there any questions you have for me?

Yes, I have a few questions for you:

- What is the company culture like?

- What are the opportunities for professional development?

- What is the company’s commitment to diversity and inclusion?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Claims Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Claims Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Review and Evaluate Claims

Analyzing insurance claims to determine their validity and coverage.

- Verifying the policyholder’s information and eligibility.

- Assessing damages, expenses, and other costs.

2. Communicate with Policyholders

Interacting with policyholders to gather information, explain coverage, and discuss settlement options.

- Providing clear and concise explanations of the claims process.

- Negotiating settlements and offering support throughout the claims process.

3. Investigate and Document Claims

Investigating cases and gathering evidence to support claim decisions.

- Inspecting damaged property or interviewing witnesses.

- Documenting findings and preparing reports for the claims file.

4. Process and Issue Payments

Reviewing and approving claims for payment.

- Calculating and issuing settlements based on policy terms.

- Monitoring payment status and resolving any issues.

Interview Tips

Preparing for an interview for an Insurance Claims Processor position requires researching the industry, practicing common interview questions, and highlighting relevant skills and experience.

1. Research the Industry

Familiarize yourself with the insurance industry, including different types of insurance policies, claims processes, and regulations.

- Read industry publications and articles.

- Attend webinars or workshops on insurance claims processing.

2. Practice Common Interview Questions

Anticipate and prepare for common interview questions specific to the Insurance Claims Processor role.

- “Tell me about your experience in claims processing.”

- “Describe a challenging claim you handled and how you resolved it.”

3. Highlight Relevant Skills and Experience

Emphasize your skills and experience that are relevant to the role, such as:

- Strong analytical and problem-solving abilities.

- Excellent communication and interpersonal skills.

- Experience using insurance claims software.

4. Prepare Questions for the Interviewer

Show your interest and engagement by preparing insightful questions for the interviewer.

- “What are the key challenges currently facing the insurance claims department?”

- “What opportunities for growth and advancement are there within the organization?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Claims Processor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!