Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

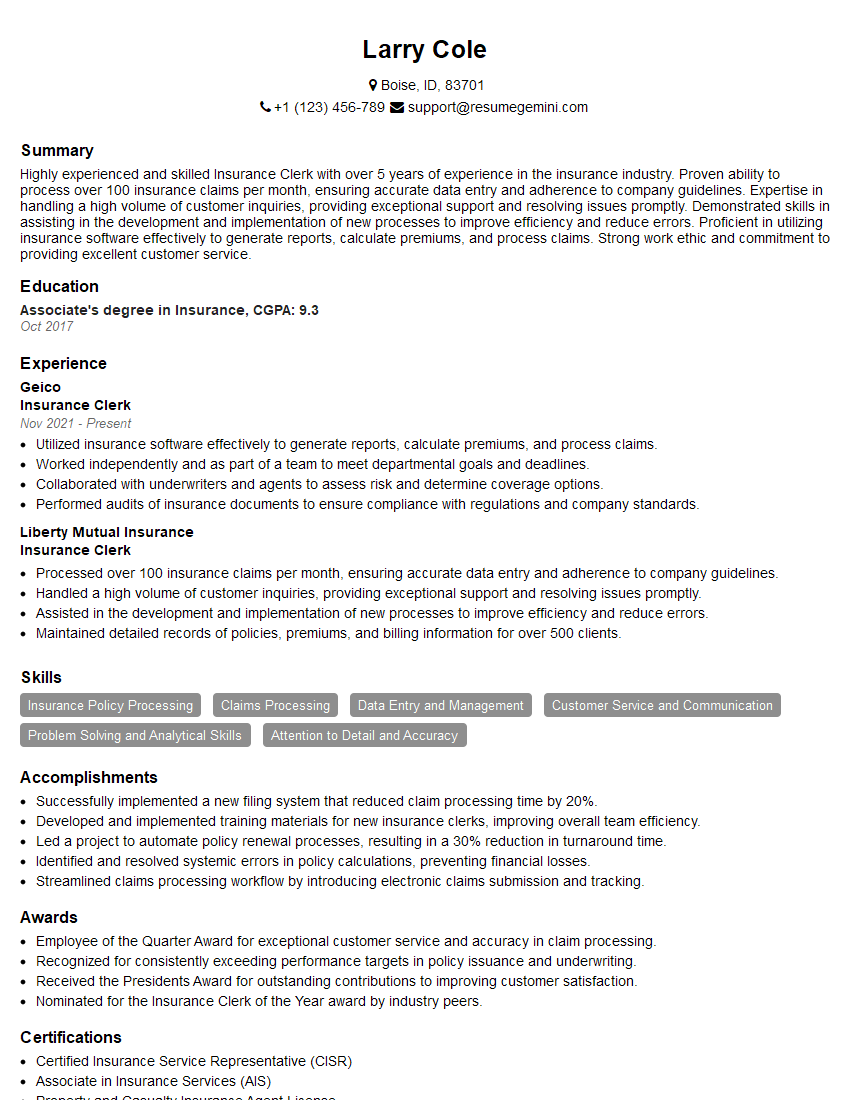

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Clerk

1. Can you explain the roles and responsibilities of an Insurance Clerk?

As an Insurance Clerk, I am responsible for:

- Processing and underwriting insurance policies

- Handling customer inquiries and resolving insurance claims

- Maintaining accurate and up-to-date insurance records

- Complying with all applicable insurance regulations

2. What are the different types of insurance policies that you have experience with?

Personal lines insurance

- Auto insurance

- Homeowners insurance

- Health insurance

- Life insurance

Commercial lines insurance

- Business property insurance

- Liability insurance

- Workers’ compensation insurance

3. What is the claims process and what are the steps involved?

The claims process involves the following steps:

- The insured reports the claim to the insurance company

- The insurance company investigates the claim

- The insurance company determines if the claim is covered

- The insurance company settles the claim

4. What is your experience with using insurance software and technology?

I have experience with a variety of insurance software and technology, including:

- Policy management systems

- Claims management systems

- Rating and underwriting tools

- Customer relationship management (CRM) systems

5. What are your strengths and weaknesses as an Insurance Clerk?

My strengths include:

- Strong attention to detail

- Excellent communication and interpersonal skills

- Proficient in the use of insurance software and technology

- Ability to work independently and as part of a team

My weaknesses include:

- Limited experience with certain types of insurance policies

- Still developing my underwriting skills

6. How do you stay up-to-date on the latest insurance regulations?

I stay up-to-date on the latest insurance regulations by:

- Reading industry publications

- Attending conferences and webinars

- Taking continuing education courses

7. What is your experience with handling difficult customers?

I have experience with handling difficult customers by:

- Remaining calm and professional

- Listening to the customer’s concerns

- Empathizing with the customer’s situation

- Resolving the issue to the customer’s satisfaction

8. What is your understanding of the insurance industry’s current trends?

The insurance industry is currently experiencing the following trends:

- Increased use of technology

- Growth of the sharing economy

- Aging population

- Increased regulation

9. What are your career goals and how does this position fit into those goals?

My career goals are to become an Underwriter and eventually a Manager. This position is a stepping stone towards achieving my goals because it will provide me with the necessary experience and knowledge.

10. Do you have any questions for me?

I do have a few questions:

- What is the company’s culture like?

- What are the opportunities for advancement?

- What is the training program like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Clerks play a crucial role in the insurance industry, handling various administrative and clerical tasks. Their responsibilities include:

1. Policy Issuance and Maintenance

Process and issue new insurance policies accurately and timely.

- Collect and verify applicant information.

- Create and maintain policy records, such as certificates of insurance.

2. Premium Processing

Handle premium payments efficiently and promptly.

- Generate invoices and collect payments.

- Process refunds and adjustments.

- Issue receipts and handle late payments.

3. Claims Administration

Assist in claims management by gathering information and providing support.

- Receive and document claims reports.

- Collect and organize supporting documentation.

- Provide updates on claim status to policyholders and adjusters.

4. Customer Service

Respond promptly to customer inquiries and requests.

- Answer questions about policies, coverage, and claims.

- Provide guidance on premium payments and policy changes.

- Resolve customer disputes and complaints.

Interview Tips

To ace your interview for an Insurance Clerk position, consider the following tips:

1. Research the Company and Industry

Get familiar with the insurance industry and the specific company you’re applying to.

- Review the company website and recent news articles.

- Understand the types of insurance offered and target industries.

2. Highlight Your Skills and Experience

Emphasize your relevant skills, such as data entry, customer service, and attention to detail.

- Quantify your accomplishments using specific examples.

- Explain how your previous experience aligns with the job responsibilities.

3. Demonstrate Your Commitment to Accuracy

Stress your commitment to accuracy and attention to detail.

- Describe past experiences where you effectively managed data, processed transactions, or resolved errors.

- Mention any certifications or training in accuracy-related areas.

4. Showcase Your Customer Service Skills

Highlight your ability to interact professionally and empathetically with customers.

- Share examples of how you resolved difficult customer inquiries or handled complaints.

- Demonstrate your ability to communicate clearly and understand customer perspectives.

5. Prepare Industry-Specific Questions

Prepare questions to ask the interviewer that demonstrate your knowledge and interest in the industry.

- Inquire about the company’s approach to claims handling.

- Ask about any recent industry trends or regulations.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!